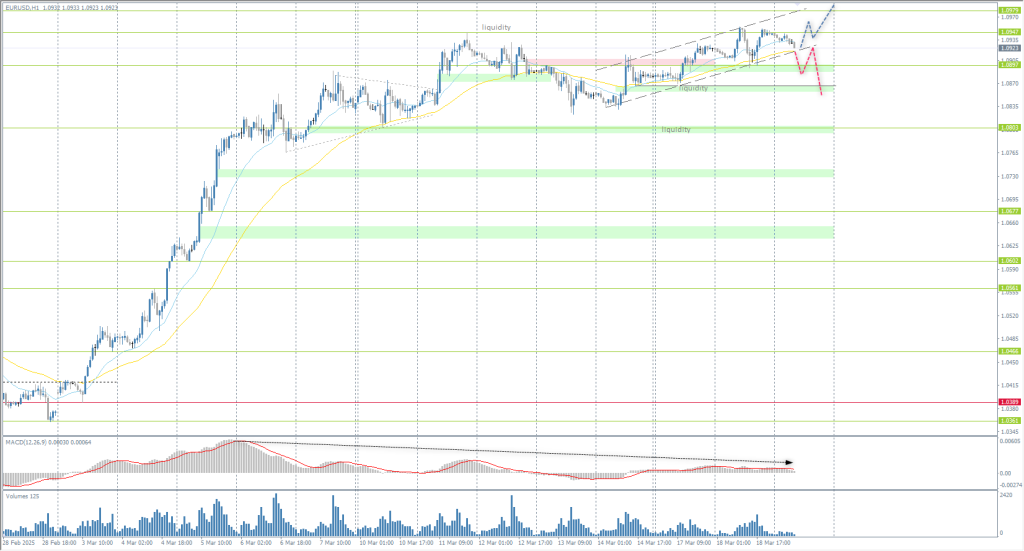

The EUR/USD currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 1.0922

- الإغلاق السابق: 1.0945

- تغيُّر بنسبة% خلال اليوم الماضي: +0.21 %

The EUR/USD rose on Tuesday after expectations for economic growth in Germany rose more than expected in the ZEW survey and reached a 3-year-high. The euro extended gains after the German parliament passed a spending program that will usher in a more expansive fiscal policy and boost economic growth. The plan frees defense spending from the debt brake and creates a 500 billion euro ($546 billion) fund to invest in Germany’s infrastructure, which allows for more expansive fiscal policy and boosts economic growth. Swaps discount the odds of a 25 bps ECB rate cut at the April 17 meeting at 55%.

توصيات التداول

- مستويات الدعم: 1.0897, 1.0803, 1.0677, 1.0602, 1.0561, 1.0466

- مستويات المقاومة: 1.0947, 1.0979

The EUR/USD currency pair’s hourly trend is bullish. The euro has reached the resistance level of 1.0947, where the profit-taking is observed. Currently, the price starts to form a flat accumulation in the range of 1.0897-1.0947. According to the rules of the balance phase, buying is best to look for from the lower boundary, but with confirmation. For selling, it is best to wait for a breakdown of the uptrend channel.

السيناريو البديل:if the price breaks through the support level of 1.0830 and consolidates below it, the downtrend will likely resume.

موجز أخبار: 2025.03.19

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+2);

- US FOMC Federal Funds Rate at 20:00 (GMT+2);

- US FOMC Statement at 20:00 (GMT+2);

- US FOMC Economic Projections at 20:00 (GMT+2);

- US FOMC Press Conference at 20:30 (GMT+2).

The GBP/USD currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 1.2989

- الإغلاق السابق: 1.3001

- تغيُّر بنسبة% خلال اليوم الماضي: +0.09 %

The British pound surpassed $1.30 on Tuesday, marking its highest level in four months, amid expectations that UK interest rates will rise for longer. The Bank of England is set to keep rates on hold at 4.5% this week, with traders estimating a slower pace of rate cuts than the Federal Reserve. Markets expect the Bank of England to cut rates by just 51 basis points by the end of the year, while the Fed expects a 60 basis point cut. Although last week’s data showed an unexpected contraction in the UK economy, hopes remain that planned infrastructure investment will support growth.

توصيات التداول

- مستويات الدعم: 1.2963, 1.2912, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- مستويات المقاومة: 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish. The price reached the resistance level of 1.3010, where the profit-taking started. Now, the price is correcting to the support level of 1.2958, where we can look for buy trades, provided buyers react. But MACD divergence of higher timeframes indicates that sterling may correct deeper, up to 1.2912.

السيناريو البديل:if the price breaks the support level of 1.2912 and consolidates below it, the downtrend will likely resume.

لا يوجد أخبار اليوم

The USD/JPY currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 149.19

- الإغلاق السابق: 149.24

- تغيُّر بنسبة% خلال اليوم الماضي: +0.03 %

The Japanese yen slid to 150 per dollar on Wednesday, marking the fourth consecutive day of declines, after the Bank of Japan left interest rates unchanged at 0.5% as expected. The Central Bank maintained its view that Japan’s economy is likely to continue growing above potential but acknowledged some elements of weakness. Policymakers also indicated a cautious stance, preferring to assess how rising global economic risks, particularly tariff hikes in the US, could affect the domestic economy.

توصيات التداول

- مستويات الدعم: 149.06, 148.48, 148.17, 147.61, 146.65, 146.00

- مستويات المقاومة: 150.16, 151.29, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish. The Japanese yen has been showing strong weakness in recent days. It is not combined with fundamental factors, namely the monetary policy of the US Fed and the Bank of Japan. Currently, the price is aiming to test liquidity above 150.15. This level can be considered for selling, but with confirmation. There are no optimal entry points for buying right now.

السيناريو البديل:if the price breaks through the support level at 147.43 and consolidates below it, the downtrend will likely resume.

موجز أخبار: 2025.03.19

- Japan Trade Balance at 01:50 (GMT+2);

- Japan BoJ Policy Rate at 05:00 (GMT+2);

- Japan BoJ Monetary Policy Statement at 05:00 (GMT+2);

- Japan BoJ Press Conference at 06:45 (GMT+2).

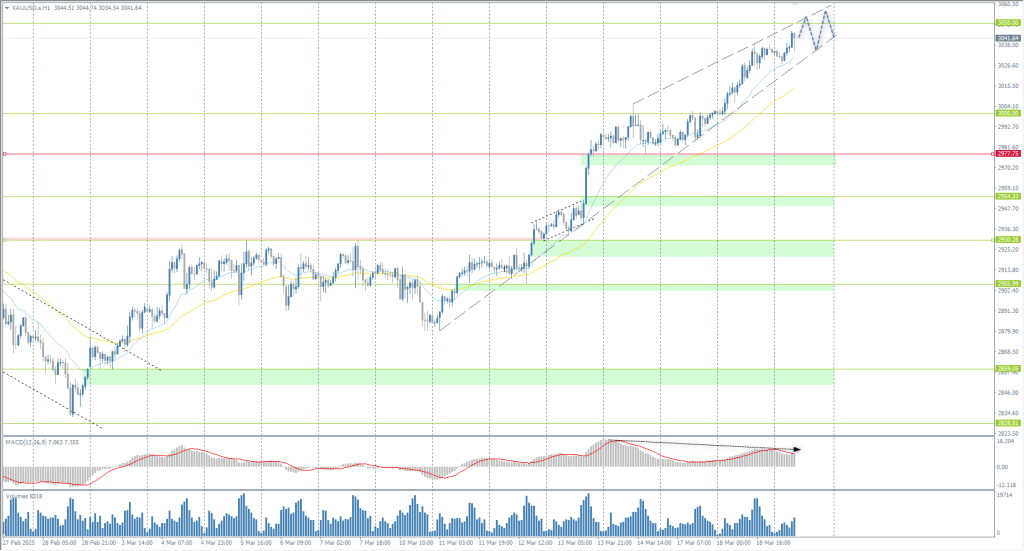

The XAU/USD currency pair (gold)

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 3001

- الإغلاق السابق: 3034

- تغيُّر بنسبة% خلال اليوم الماضي: +1.01 %

Gold surpassed $3,040 per ounce on Wednesday, reaching a new record high, helped by safe-haven demand amid heightened geopolitical tensions and tariff uncertainty. Heightened geopolitical risks in the Middle East prompted buying in precious metals after Israel launched a series of airstrikes on the Gaza Strip, ending a two-month truce with Hamas, and after the US launched strikes against Yemen’s Houthi rebels over the weekend. Tuesday’s decline in the Dollar Index to a 5-month low is also a favorable factor for metals prices. Silver prices also rose to a 4-month-high.

توصيات التداول

- مستويات الدعم: 3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- مستويات المقاومة: 3050, 3100

From the point of view of technical analysis, the trend on the XAU/USD has changed to an uptrend. The price is trading at historical highs. Since there are no counter-resistances now, we can only focus on the psychological levels of 3050, 3100. EMA lines can be considered for buying, but with confirmation. The MACD divergence indicates possible profit-taking near 3050, which will lead to a small correction and a flat formation.

السيناريو البديل:if the price breaks below the support level 2906, the downtrend will likely resume.

موجز أخبار: 2025.03.19

- US FOMC Federal Funds Rate at 20:00 (GMT+2);

- US FOMC Statement at 20:00 (GMT+2);

- US FOMC Economic Projections at 20:00 (GMT+2);

- US FOMC Press Conference at 20:30 (GMT+2).

هذه المقالة تُعبِّر عن رأي شخصي ولا ينبغي تفسيرها على أنها نصيحة استثمارية، و/أو عرض، و/أو طلب مُلِح لإجراء معاملات مالية، و/أو ضمان لشيء، و/أو توقع للأحداث المستقبلية.