The EUR/USD currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 1.1629

- الإغلاق السابق: 1.1693

- تغيُّر بنسبة% خلال اليوم الماضي: +0.55 %

The euro consolidated above 1.17 USD as investors await the European Central Bank’s decision and keep a close eye on the EU-US trade relations. The ECB is expected to leave interest rates unchanged on Thursday after eight consecutive cuts, with policymakers adopting a wait-and-see stance amid uncertainty over the impact of higher-than-expected US tariffs and a stronger euro on European growth and inflation. Meanwhile, EU envoys are preparing to meet as early as this week to discuss with US President Donald Trump, whose stance on tariffs appears to have hardened ahead of the August 1 deadline.

توصيات التداول

- مستويات الدعم: 1.1659, 1.1615, 1.1561, 1.1518

- مستويات المقاومة: 1.1714, 1.1762, 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend is bearish, but yesterday the price reached the priority change level. Buyers additionally formed the support level at 1.1659. With high probability, the price will retest the resistance level at 1.1714. Buy trades can be considered intraday from EMA lines or from 1.1659. Selling can be considered from 1.1714, subject to sellers’ reaction.

السيناريو البديل:if the price breaks through the resistance level of 1.1714 and consolidates above it, the uptrend will likely resume.

موجز أخبار: 2025.07.22

- US Fed Chair Powell Speaks at 15:30 (GMT+3);

- US Richmond Manufacturing Index (m/m) at 17:00 (GMT+3).

The GBP/USD currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 1.3418

- الإغلاق السابق: 1.3491

- تغيُّر بنسبة% خلال اليوم الماضي: +0.54 %

The British pound rose to $1.35, supported by broad dollar weakness, as market sentiment remained cautious amid growing uncertainty over US tariffs and concerns over the Federal Reserve’s independence. In the UK, attention shifts to key data, with the flash PMI Index expected to show the weakest contraction in manufacturing in six months and the strongest growth in services in almost a year. Retail sales are also expected to rise, helped by hot weather. Meanwhile, the Bank of England may slow or halt sales of long-term bonds due to weak demand from traditional buyers such as pension funds. Traders have slightly lowered expectations for Bank of England policy easing, but still see two rate cuts in 2025.

توصيات التداول

- مستويات الدعم: 1.3374, 1.3334

- مستويات المقاومة: 1.3485, 1.3532, 1.3619, 1.3680, 1.3712

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The British pound has reached the level of priority change at 1.3485, and the reaction of sellers here is weak, which increases the probability of a trend change. Buy trades can be considered from the EMA lines, but also with confirmation. There are no optimal entry points for selling now.

السيناريو البديل:if the price breaks through the resistance level of 1.3485 and consolidates above it, the uptrend will likely resume.

موجز أخبار: 2025.07.22

- UK BoE Gov Bailey Speaks at 12:15 (GMT+3);

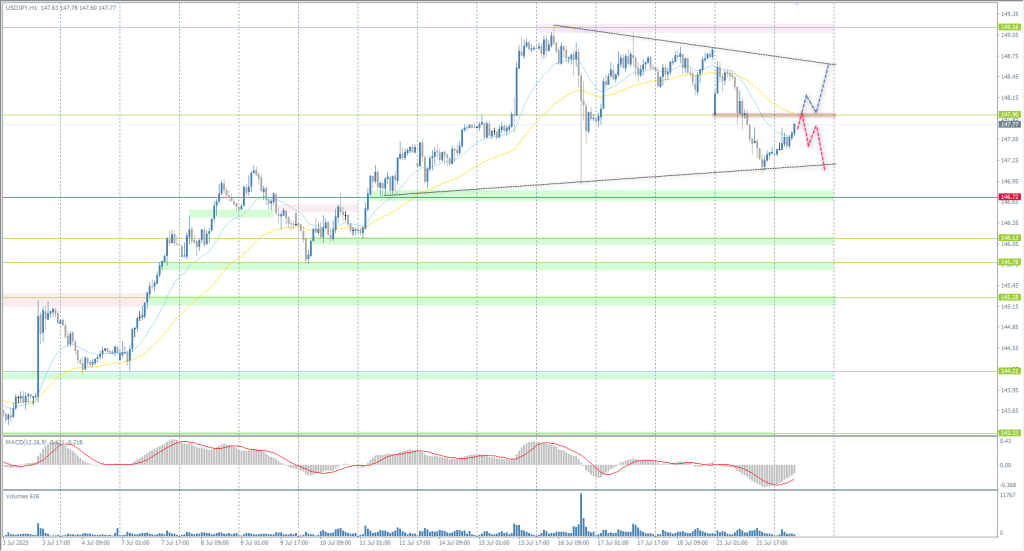

The USD/JPY currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 147.90

- الإغلاق السابق: 147.37

- تغيُّر بنسبة% خلال اليوم الماضي: -0.35 %

The Japanese yen exchange rate hovered around 147.5 per dollar on Tuesday after rising around 1% in the previous session as investors continued to digest the outcome of the weekend’s elections. Although the ruling coalition lost its majority in the upper house of parliament, the result was largely upbeat. Prime Minister Shigeru Ishiba is expected to remain in office, easing fears of political instability or sudden resignation. Ishiba has reiterated his willingness to oversee the ongoing tariff talks with the US and tackle other key policy issues. Meanwhile, opposition parties are expected to push for more fiscal stimulus and tax cuts, which could put pressure on the yen and push government bond yields to multi-year highs.

توصيات التداول

- مستويات الدعم: 146.72, 146.13, 145.88, 145.28, 144.18

- مستويات المقاومة: 147.90, 149.16

From a technical point of view, the medium-term trend of the USD/JPY is bullish. Yesterday, the yen strengthened sharply, with sellers forming a resistance level at 147.90, which could become a stumbling block for buyers. It is now important to assess the price action at 147.90. If sellers react here, we can consider selling with a target of 146.72. If the price consolidates above 147.90, it will open the price path to 149.16.

السيناريو البديل:if the price breaks through the support level of 146.72 and consolidates below it, the downward trend will likely resume.

لا يوجد أخبار اليوم

The XAU/USD currency pair (gold)

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 3349

- الإغلاق السابق: 3397

- تغيُّر بنسبة% خلال اليوم الماضي: +1.43 %

Gold prices surpassed $3,390 an ounce, hitting the highest level since mid-June, as a weaker US dollar and falling Treasury yields boosted safe-haven demand amid mounting trade tensions. The US Commerce Secretary expressed optimism about a deal with the EU, but warned that the August 1 deadline for tariffs is a “hard deadline.” He also emphasized that the 10% base tariff would “definitely stay” during the negotiations. His words came after President Trump sent formal letters to key trading partners earlier this month outlining the tariff rates their countries would face without a deal. Meanwhile, the EU is preparing to retaliate against the US as hopes of a favorable trade agreement with Washington dwindle. As for monetary policy, traders estimate the probability of a Fed rate cut in September at around 60% amid growing speculation about possible changes in the leadership of the Federal Reserve and a broader reorganization of the institution.

توصيات التداول

- مستويات الدعم: 3362, 3345, 3320, 3309

- مستويات المقاومة: 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Yesterday, the bullion price rose sharply. Currently, the price is seeking to test liquidity above 3405. For buying, it is best to consider EMA lines or 3362 support levels, but with confirmation in the form of buyers’ initiative. For selling, there are no optimal entry points right now.

السيناريو البديل:if the price breaks through the support level of 3345 and consolidates below it, the downtrend will likely resume.

لا يوجد أخبار اليوم

هذه المقالة تُعبِّر عن رأي شخصي ولا ينبغي تفسيرها على أنها نصيحة استثمارية، و/أو عرض، و/أو طلب مُلِح لإجراء معاملات مالية، و/أو ضمان لشيء، و/أو توقع للأحداث المستقبلية.