The EUR/USD currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 1.1725

- الإغلاق السابق: 1.1714

- تغيُّر بنسبة% خلال اليوم الماضي: -0.09 %

The seasonally adjusted Eurozone unemployment rate rose to 6.3% in August 2025 from a record low of 6.2% in July, defying expectations for it to remain unchanged. The number of unemployed increased by 11,000 compared to the previous month, totaling 10.842 million people. Meanwhile, the youth unemployment rate, which reflects joblessness among those under 25 seeking work, stood at 14% in August, the lowest since March 2023, and matched the revised July figure. Among the bloc’s largest economies, the highest unemployment rates are still seen in Spain (10.3%), France (7.5%), and Italy (6%), while the lowest are in Germany (3.7%) and the Netherlands (3.9%). The unemployment rate was the same (6.3%) a year ago.

توصيات التداول

- مستويات الدعم: 1.1661, 1.1634

- مستويات المقاومة: 1.1717, 1.1754, 1.1786, 1.1819

The EUR/USD currency pair’s hourly trend is downward. After three days of consolidation, the price impulsively settled lower. This opens up opportunities for selling from the resistance level of 1.1717 or from the EMA lines. The profit target is to break the weekly low of 1.1683. If the price sharply and impulsively returns above 1.1717, this scenario would form a locked balance, and the intraday bias should shift to buying with a target of 1.1754 and higher.

السيناريو البديل:if the price breaks through the resistance level of 1.1819 and consolidates above it, the uptrend will likely resume.

موجز أخبار: 2025.10.03

- German Services PMI (m/m) at 10:55 (GMT+3);

- Eurozone Services PMI (m/m) at 11:00 (GMT+3);

- Eurozone Producer Price Index (m/m) at 12:00 (GMT+3);

- Eurozone ECB President Lagarde Speaks at 12:40 (GMT+3);

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3) (tentative);

- US Unemployment Rate (m/m) at 15:30 (GMT+3) (tentative);

- US ISM Services PMI (m/m) at 17:00 (GMT+3).

The GBP/USD currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 1.3474

- الإغلاق السابق: 1.3438

- تغيُّر بنسبة% خلال اليوم الماضي: -0.27 %

Messages from the Bank of England (BoE) continue to support the pound. Policymaker Catherine Mann warned that inflation remains sticky despite a series of previous rate hikes, emphasizing that the BoE should not prematurely ease policy. The Deputy Governor backed the cautious stance, noting that inflationary shocks cannot be viewed as transitory. Nevertheless, the central bank acknowledged the risk of inflation eventually falling short of the 2% target. Currently, UK inflation stood at around 4% in September, outside the BoE’s comfort zone. This balancing act – a bias toward tightening without overdoing it – has lent relative strength to the pound against the dollar.

توصيات التداول

- مستويات الدعم: 1.3415, 1.3388, 1.3332, 1.3315

- مستويات المقاومة: 1.3463, 1.3522, 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD is a downtrend. The British pound formed a locked balance above 1.3464, and the area above this level is now a strong resistance zone. Intraday, traders can consider selling from the EMA lines or the resistance level of 1.3464. Profit targets are 1.3415 and 1.3388. For buying, an impulsive return of the price above 1.3464 is necessary.

السيناريو البديل:if the price breaks through the resistance level of 1.3532 and consolidates above it, the uptrend will likely resume.

موجز أخبار: 2025.10.03

- UK Services PMI (m/m) at 11:30 (GMT+3);

- UK BOE Gov Bailey Speaks at 16:20 (GMT+3).

The USD/JPY currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 147.03

- الإغلاق السابق: 147.25

- تغيُّر بنسبة% خلال اليوم الماضي: +0.15 %

The Japanese yen slipped to around 147.5 per dollar on Friday, retreating from a two-week high, as investors awaited a pivotal ruling party leadership election this weekend that will determine the next Prime Minister and the direction of fiscal and monetary policy. The Liberal Democratic Party (LDP) is set to choose a successor to former Prime Minister Shigeru Ishiba, who resigned last month, with debates focusing on measures to support households and fiscal discipline. On the data front, Japan’s unemployment rate rose to 2.6% in August, the highest in 13 months and above market expectations of 2.4%. Uncertainty also persists regarding the timing of further rate hikes by the Bank of Japan (BoJ) amid mixed economic signals and global trade pressure. BoJ Governor Kazuo Ueda confirmed on Friday that rates would be raised if growth and inflation develop in line with projections.

توصيات التداول

- مستويات الدعم: 147.47, 146.25, 148.85

- مستويات المقاومة: 148.06, 148.47, 148.88, 150.00, 150.73

From a technical point of view, the medium-term trend of the USD/JPY is downward. The Japanese yen formed a locked balance below 147.47, and now it is important for buyers to prevent the price from settling below this level again. Intraday, traders can consider buying from 147.47 with a target of 148.07. An impulsive settlement of the price below 147.47 would cancel the buying scenario.

السيناريو البديل:If the price breaks the resistance level of 148.85 and settles above it, the uptrend will likely resume.

موجز أخبار: 2025.10.03

- Japan Unemployment Rate (m/m) at 02:30 (GMT+3);

- Japan Services PMI (m/m) at 03:30 (GMT+3);

- Japan BoJ Gov Ueda Speaks at 04:05 (GMT+3).

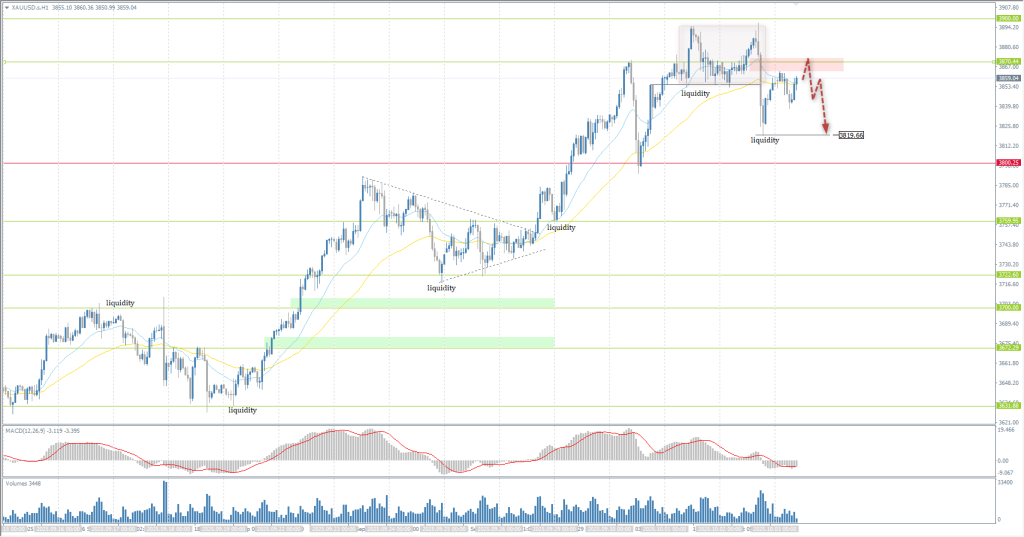

The XAU/USD currency pair (gold)

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 3868

- الإغلاق السابق: 3855

- تغيُّر بنسبة% خلال اليوم الماضي: -0.34%

Gold prices declined to 3840 per ounce on Thursday from a record high of 3895 in the previous session, as investors took profits and assessed how far the rally could go amid safe-haven demand and rate-cut expectations. US Congressional leaders showed no signs of compromise on the ongoing US government shutdown, jeopardizing key economic indicators and amplifying President Trump’s threat that hundreds of thousands of federal employees could be furloughed. Furthermore, the shutdown prevented the publication of key labor data at a time when the private ADP report showed job losses for two consecutive months for the first time since the COVID shock in Q2 2020. Additionally, JOLTS showed a sharp decline in voluntary quits, and the Challenger report indicated a slowdown in hiring, reinforcing bets on two more Fed rate cuts this year despite evidence of stubborn inflation.

توصيات التداول

- مستويات الدعم: 3820, 3800, 3760, 3718

- مستويات المقاومة: 3870, 3900

From the point of view of technical analysis, the trend on the XAU/USD is bullish. However, yesterday’s impulsive move down formed a locked balance above 3870, and this area will now act as a resistance zone. Intraday, traders can consider selling from the EMA lines or 3870, but with confirmation. Profit targets are 3840 and 3820. There are currently no optimal entry points for buying.

السيناريو البديل:if the price breaks the support level of 3800 and consolidates below it, the downtrend will likely resume.

موجز أخبار: 2025.10.03

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3) (tentative);

- US Unemployment Rate (m/m) at 15:30 (GMT+3) (tentative);

- US ISM Services PMI (m/m) at 17:00 (GMT+3).

هذه المقالة تُعبِّر عن رأي شخصي ولا ينبغي تفسيرها على أنها نصيحة استثمارية، و/أو عرض، و/أو طلب مُلِح لإجراء معاملات مالية، و/أو ضمان لشيء، و/أو توقع للأحداث المستقبلية.