The EUR/USD currency pair

المؤشرات الفنية لأزواج العملات:

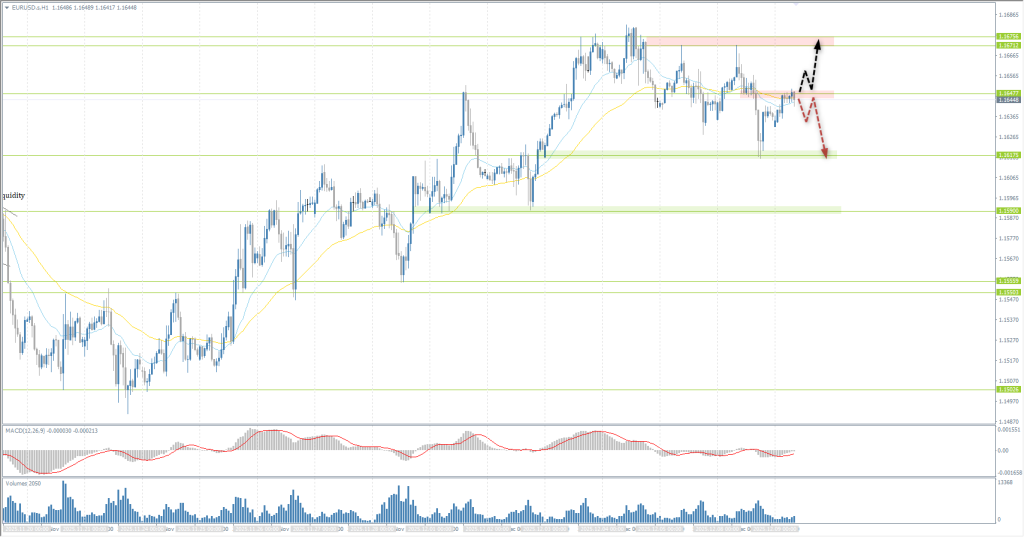

- الافتتاح السابق: 1.1635

- الإغلاق السابق: 1.1637

- تغيُّر بنسبة% خلال اليوم الماضي: +0.02%

The yield on 10‑year German bonds exceeded 2.8% for the first time since March 2025, while 30‑year bonds reached their highest level since 2011 amid hawkish ECB comments and growing concerns about fiscal sustainability. ECB member Isabel Schnabel suggested the possibility of future rate hikes, reinforcing expectations of policy tightening, albeit moderately. Additional pressure came from Germany’s approved 2026 budget, which includes high borrowing and increased government spending, including a controversial pension reform.

توصيات التداول

- مستويات الدعم: 1.1617, 1.1590, 1.1555, 1.1503

- مستويات المقاومة: 1.1647, 1.1728

The euro consolidated below the support level yesterday and reached the 1.1617 level. It is crucial for sellers to hold the price below 1.1647 for a further decline. Therefore, today we evaluate the price’s reaction to this level. If sellers are active, intraday sales down to 1.1617 can be considered. If the price impulsively consolidates above this level, the path to 1.1675 will open.

السيناريو البديل:- Trend: Up

- Sup: 1.1617

- Res: 1.1647

- Note: Сonsidering sales from 1.1647, but with confirmation. Price consolidation above 1.1647 will open the path for the price to 1.1675.

موجز أخبار: 2025.12.09

- US ADP Employment Change (m/m) at 15:15 (GMT+2); – USD, XAU (MED)

- US JOLTS Job Openings (m/m) at 17:00 (GMT+2); – USD, XAU (HIGH)

The GBP/USD currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 1.3316

- الإغلاق السابق: 1.3321

- تغيُّر بنسبة% خلال اليوم الماضي: +0.04 %

The yield on 10-year UK government bonds rose above 4.5% amid data showing an acceleration in wage growth, which complicates the Bank of England’s task of cutting rates. The REC/KPMG survey indicated the fastest growth in starting salaries in five months, despite a weak labor market, which heightens inflationary risks. Nevertheless, market expectations have barely changed: the probability of a BoE rate cut next week remains around 84%, and a second quarter-point cut is almost fully priced in by June.

توصيات التداول

- مستويات الدعم: 1.3315, 1.3268, 1.3156, 1.3111, 1.3080

- مستويات المقاومة: 1.3372

The situation for the British pound has not significantly changed compared to Friday. The price is trading in a wide range with boundaries between 1.3315–1.3365, and liquidity is contracting within a triangle pattern. For buy deals, it is ideal to wait for initiative and an impulsive breakout above the triangle. For sales, a breakout below the triangle can be considered. As long as the price remains within the range, trading should be avoided.

السيناريو البديل:- Trend: Up

- Sup: 1.3315

- Res: 1.3372

- Note: Considering buy deals after the price consolidates above the narrowing triangle.

موجز أخبار: 2025.12.09

- UK Monetary Policy Report Hearings at 16:15 (GMT+2). – GBP (LOW)

The USD/JPY currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 155.14

- الإغلاق السابق: 155.91

- تغيُّر بنسبة% خلال اليوم الماضي: +0.49 %

The Japanese yen stabilized around 155.8 per dollar after brief pressure caused by an earthquake off the northeast coast of the country and a lowered Q3 GDP estimate. These factors increased expectations for additional fiscal support and complicated the Bank of Japan’s decisions, which is still expected to potentially raise the rate next week as part of a gradual policy normalization. The market awaits a speech by BoJ Governor Kazuo Ueda in London, hoping for signals on the future course.

توصيات التداول

- مستويات الدعم: 155.50, 154.91, 154.41, 154.17

- مستويات المقاومة: 156.08, 156.40, 157.11, 157.87

The Japanese currency consolidated above 155.50 and reached the resistance level of 156.08, where traders must evaluate the price action. An impulsive break of this level will open the path to 157.11, so it is crucial for sellers to hold the price below 156.08. If the price reacts bearishly to 156.08, intraday sales with a target down to 155.50 can be considered.

السيناريو البديل:- Trend: Neutral

- Sup: 155.50

- Res: 156.08

- Note: Considering sell trades from 156.08, but with confirmation. A break of this level will open the path for the price to 157.11.

موجز أخبار: 2025.12.09

- Japan BOJ Gov Ueda Speaks at 11:00 (GMT+2). – JPY (LOW)

The XAU/USD currency pair (gold)

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 4202

- الإغلاق السابق: 4192

- تغيُّر بنسبة% خلال اليوم الماضي: -0.24%

Gold is trading around $4,190 per ounce on Tuesday amid anticipation of the Fed’s rate decision. The market almost confidently prices in a 25 basis point cut, but interest is focused on Powell’s expectations regarding the policy trajectory in 2026: two additional cuts are now expected, compared to three a week earlier. Additional support for the metal comes from the continued growth of China’s gold reserves, which is increasing its purchases for the 13th consecutive month.

توصيات التداول

- مستويات الدعم: 4194, 4145, 4108, 4031, 4007, 3966

- مستويات المقاومة: 4194, 4255, 4379

Gold continues to trade in a wide range. The price has now dropped to the lower boundary of the range, where it is important to assess the price action. For buy deals, it is crucial to see initiative and price consolidation above 4194. This will open the path for the price to 4230 and higher. Buyers must prevent the price from consolidating below 4163. Otherwise, it will break the ascending rally and trigger a sell-off to 4108.

السيناريو البديل:- Trend: Up

- Sup: 4163

- Res: 4194

- Note: Looking for buy deals after the price consolidates above 4194. Price consolidation below 4163 may trigger a sell-off to 4108.

موجز أخبار: 2025.12.09

- US ADP Employment Change (m/m) at 15:15 (GMT+2); – USD, XAU (MED)

- US JOLTS Job Openings (m/m) at 17:00 (GMT+2); – USD, XAU (HIGH)

هذه المقالة تُعبِّر عن رأي شخصي ولا ينبغي تفسيرها على أنها نصيحة استثمارية، و/أو عرض، و/أو طلب مُلِح لإجراء معاملات مالية، و/أو ضمان لشيء، و/أو توقع للأحداث المستقبلية.