The EUR/USD currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 1.1802

- الإغلاق السابق: 1.1777

- تغيُّر بنسبة% خلال اليوم الماضي: -0.21%

The euro held steady near $1.18, recovering from a slight dip early in the session after the expected ECB decision to keep interest rates unchanged. The regulator reaffirmed its confidence in inflation returning to the 2% target over the medium term and noted the resilience of the Eurozone economy despite ongoing uncertainty related to global trade policies and geopolitical risks. Speaking at the press conference, Christine Lagarde described the inflation outlook as favorable and urged against giving excessive weight to short-term fluctuations in the Euro’s exchange rate or individual indicators.

توصيات التداول

- مستويات الدعم: 1.1777, 1.1754, 1.1726

- مستويات المقاومة: 1.1839, 1.1874, 1.1953, 1.1859, 1.2050, 1.3000

A flat accumulation is forming for the euro within the 1.1777-1.1839 range. During the Asian session, the price swept liquidity below the lower boundary of the sideways range, followed by a noticeable reaction from buyers, confirming the defense of this level. Currently, the market structure indicates a drive toward testing the upper boundary of the range near 1.1839. Intraday priority shifts toward buys, while sell scenarios should only be considered after evaluating price action near resistance.

السيناريو البديل:- Trend: Neutral

- Sup: 1.1777

- Res: 1.1839

- Note: Consider buy deals trades intraday. For sells, evaluate the price reaction at 1.1839.

موجز أخبار: 2026.02.06

- German Trade Balance (m/m) at 09:00 (GMT+2); – EUR (LOW)

- US Michigan Inflation Expectations (m/m) at 17:00 (GMT+2). – USD (MED)

The GBP/USD currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 1.3663

- الإغلاق السابق: 1.3528

- تغيُّر بنسبة% خلال اليوم الماضي: -0.99 %

The British pound fell below $1.36, hitting its lowest levels since late January, following the Bank of England’s decision to maintain the rate at 3.75%, accompanied by a more dovish-than-expected rhetoric. Although the pause was fully priced in, the market reacted negatively to the split within the committee: only a slim majority supported the hold, while several members voted for an immediate cut, citing inflation’s return to target levels as early as this spring. Additional pressure came from the regulator’s comments regarding a shift in the balance of risks toward weakening demand and a cooling labor market, intensifying expectations for imminent policy easing.

توصيات التداول

- مستويات الدعم: 1.3547, 1.3514

- مستويات المقاومة: 1.3615, 1.3674, 1.3732, 1.3787, 1.3871, 1.4000

The British pound saw a significant drop to the 1.3514 area, where buyers began actively returning to the market after liquidity was swept below the level. From the perspective of the current structure, the downward move appears to be a liquidity grab, after which it is vital for the price to move above 1.3615 for redistribution and the formation of a new range. Intraday priority remains with buys from the support zone near 1.3547. Sells only make sense after evaluating the price reaction near 1.3615.

السيناريو البديل:- Trend: Neutral

- Sup: 1.3547

- Res: 1.3615

- Note: It is appropriate to look for intraday buys from the 1.3547 support level. For sells, evaluate the price reaction at 1.3615.

لا يوجد أخبار اليوم

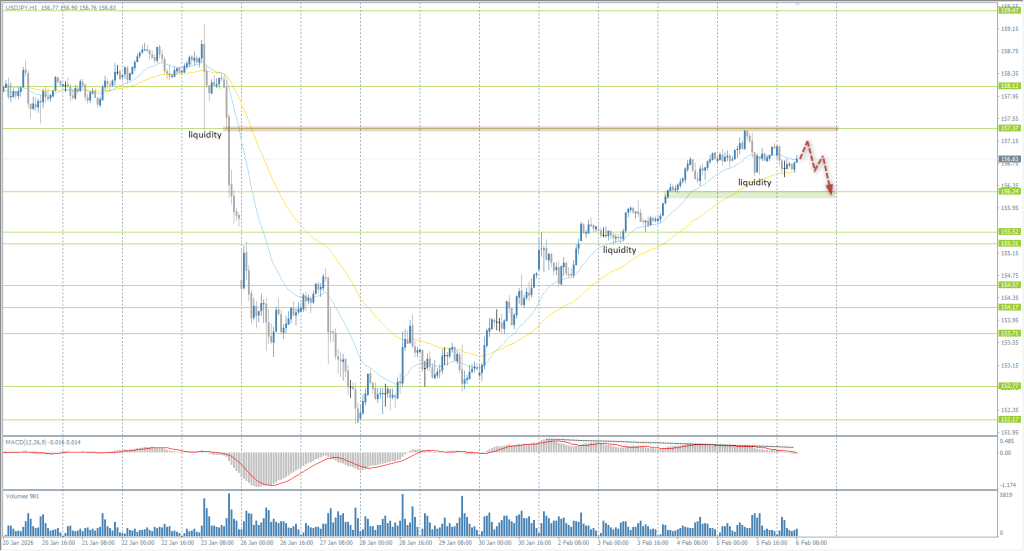

The USD/JPY currency pair

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 156.79

- الإغلاق السابق: 157.02

- تغيُّر بنسبة% خلال اليوم الماضي: +0.15 %

On Friday, the yen held near 156.8 per dollar; however, it remained on track for a weekly decline of more than 1% amid expectations for the Lower House elections. Pressure on the currency is linked to prognoses of a stronger position for Prime Minister Sanae Takaichi and her course toward expanded fiscal spending and possible tax concessions, which has reignited concerns over the sustainability of public finances. Additional uncertainty stems from questions regarding the funding mechanisms for these initiatives, while investors also await Q4 GDP data, which may show an economic recovery.

توصيات التداول

- مستويات الدعم: 156.24, 155.52, 155.31, 154.57, 154.17, 153.71

- مستويات المقاومة: 157.37, 158.12

Technically, the yen reached resistance near 157.37, after which it transitioned into a correction and is now forming a flat accumulation. The 156.24 support presumably acts as the lower boundary of the current range. With the price currently near the middle of the sideways range, finding high-quality entries is less obvious. In these conditions, it is more justifiable to focus on sells following false breakouts to the upside on intraday time frames, using tight stops and targeting the 156.24 area.

السيناريو البديل:- Trend: Up

- Sup: 156.24

- Res: 157.37

- Note: On intraday time frames, it is best to focus on sells after false breakouts to the upside with tight stops and a target of 156.24.

لا يوجد أخبار اليوم

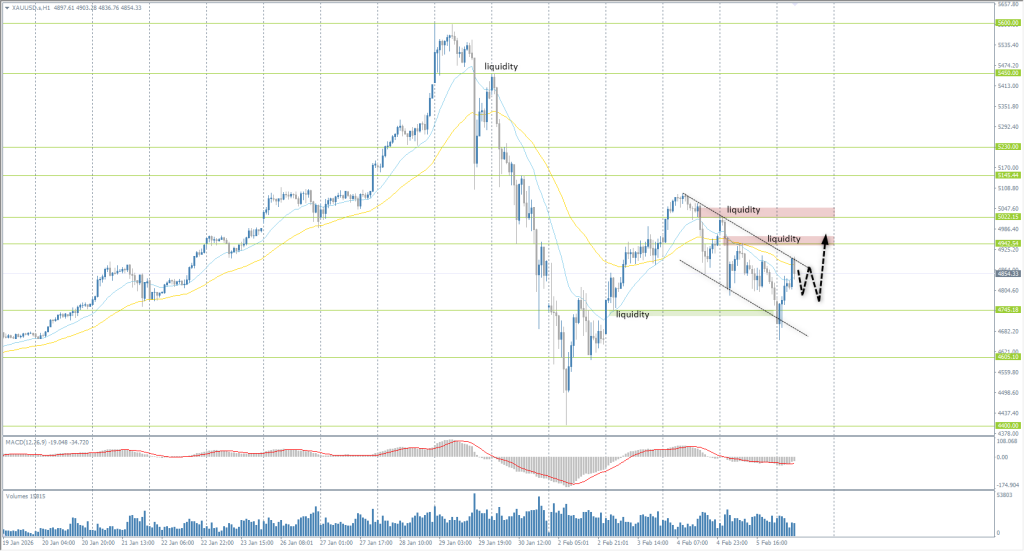

The XAU/USD currency pair (gold)

المؤشرات الفنية لأزواج العملات:

- الافتتاح السابق: 4980

- الإغلاق السابق: 4776

- تغيُّر بنسبة% خلال اليوم الماضي: -4.27 %

On Friday, gold recovered to a level near $4,870 per ounce, partially recouping previous losses amid ongoing high volatility. The sharp fluctuations that began late last week have significantly corrected the year-to-date gains following a series of all-time highs in January, as profit-taking intensified pressure on quotes. The market was supported by weak signals from the US labor market, including a sharp rise in corporate layoffs and an increase in unemployment claims, which strengthened expectations for the first Fed rate cut in the summer.

توصيات التداول

- مستويات الدعم: 4745, 4605, 4400

- مستويات المقاومة: 4942, 5022, 4948, 5145, 5230

Yesterday, gold dropped sharply, forming another false breakout of support near 4745, after which the market likely entered a redistribution phase of the captured liquidity. This structure shifts priority upward toward the zones above 4942 and 5022, which now serve as key targets for a price recovery. Current intraday dynamics allow for seeking buy opportunities, while it is more logical to return to sells only after evaluating the reaction near and above 4942. Given the ongoing high volatility, it is sensible to reduce position sizes and set wider stop-loss orders.

السيناريو البديل:- Trend: Neutral

- Sup: 4745

- Res: 4942

- Note: Look for intraday buys targeting 4942. Sells should only be considered after evaluating the price reaction to liquidity above 4942 or 5022.

موجز أخبار: 2026.02.06

- US Michigan Inflation Expectations (m/m) at 17:00 (GMT+2). – USD (MED)

هذه المقالة تُعبِّر عن رأي شخصي ولا ينبغي تفسيرها على أنها نصيحة استثمارية، و/أو عرض، و/أو طلب مُلِح لإجراء معاملات مالية، و/أو ضمان لشيء، و/أو توقع للأحداث المستقبلية.