The EUR/USD currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 1.0846

- পূর্ববর্তী বন্ধ: 1.1051

- সর্বশেষ দিন ধরে % chg.: +1.89 %

The euro jumped nearly 2% to surpass $1.1130, hitting its highest level since early October 2024, benefiting from the general weakening of the dollar as traders react to the latest batch of tariffs announced by President Trump. More than 20% of European Union exports are sent to the US and Germany will be one of the hardest hit countries. Traders are now pricing in a near 90% chance of a 25bp ECB rate cut in April, and expect the deposit rate to fall to 1.82% by December, down from previous estimates of 1.9% and the current 2.5%.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 1.1015, 1.0952, 1.0879, 1.0805, 1.0785

- প্রতিরোধের মাত্রা: 1.1136, 1.1201

The EUR/USD currency pair’s hourly trend is bullish. The euro reached the resistance level of 1.1136, where partial fixation of profits is observed. Prerequisites for further growth up to 1.1201 remain. However, it is not recommended to buy at current prices, as the price has deviated strongly from the EMA midlines. For buy deals, it is better to focus on the support level of 1.1015.

বিকল্প দৃশ্যকল্প:if the price breaks the support level of 1.0805 and consolidates below it, the downtrend will likely resume.

-এর জন্য নিউজ ফিড: 2025.04.04

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3);

- US Unemployment Rate (m/m) at 15:30 (GMT+3);

- US Fed Chair Powell Speaks at 18:25 (GMT+3).

The GBP/USD currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 1.3002

- পূর্ববর্তী বন্ধ: 1.3099

- সর্বশেষ দিন ধরে % chg.: +0.74 %

The British pound rose to $1.3, the highest level in about six months, helped by a sharp decline in the US dollar. UK imports will be subject to a 10% tariff. The announcement sparked a flight to safety and a shift to risky assets as investors grew increasingly worried about the potential impact on the global economy. Prime Minister Starmer said the UK would respond “with a cool and calm head.” He added that the US President acted in his country’s best interests last night and that he would act in the UK’s best interests today. Markets are now pricing in the likelihood of the Bank of England cutting its benchmark bank rate by around 62bp by December, down from 54bp on Wednesday.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 1.3025, 1.2953, 1.2901, 1.2884

- প্রতিরোধের মাত্রা: 1.3176

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish. Sterling reached the resistance level of 1.3176, where investors started to fix earlier open purchases. The potential for further growth remains, although it is limited. For buying, it is best to consider the EMA lines or the support level at 1.3025. There are no optimal entry points for selling now.

বিকল্প দৃশ্যকল্প:if the price breaks the support level of 1.2884 and consolidates below it, the downtrend will likely resume.

আজকের জন্য কোন খবর নেই

The USD/JPY currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 149.21

- পূর্ববর্তী বন্ধ: 146.06

- সর্বশেষ দিন ধরে % chg.: -2.16 %

The Japanese yen held near the six-month high of 146 per dollar on Friday after rising nearly 2% in the previous session as US President Donald Trump’s sweeping tariffs fueled demand for safe-haven assets. Trump announced base tariffs of 10% on all imports, which will take effect on April 5, as well as stiffer duties on about 60 countries including China (54%), EU (20%), Japan (24%), India (27%), and Vietnam (46%). Markets reacted by assuming higher inflation and weaker global growth, which triggered a broad sell-off and increased demand for safer investments such as the yen.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 145.89, 144.22

- প্রতিরোধের মাত্রা: 146.53, 148.41, 149.16, 150.27

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The yen has reached the daily support level of 145.89. Partial fixation of profits is observed here. There is no proactive reaction of buyers, which increases the probability of further decline. The resistance level of 146.53 can be considered for selling. A breakout of 146.53 will open the way to 148.41.

বিকল্প দৃশ্যকল্প:if the price breaks through the resistance level at 150.27 and consolidates above it, the uptrend will likely resume.

আজকের জন্য কোন খবর নেই

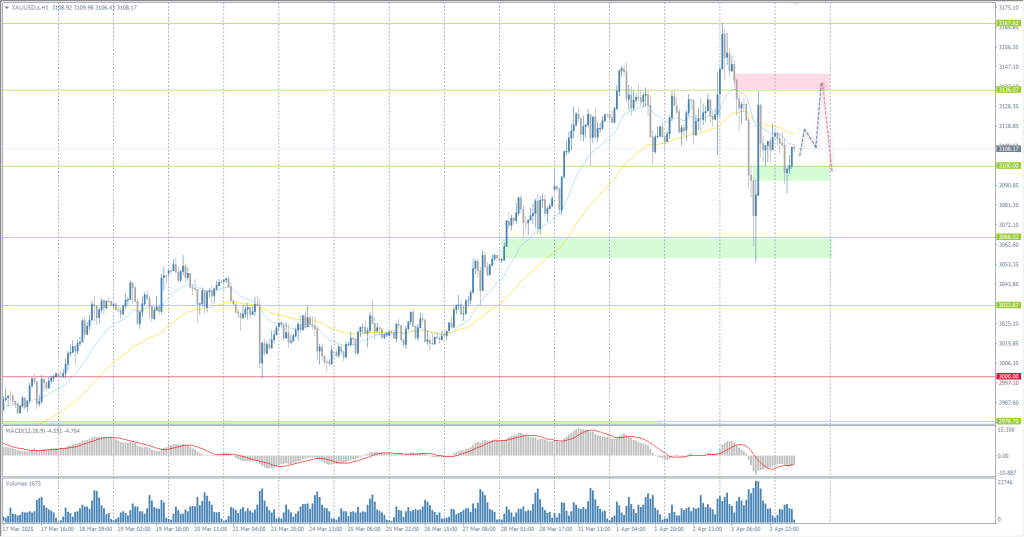

The XAU/USD currency pair (gold)

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 3135

- পূর্ববর্তী বন্ধ: 3113

- সর্বশেষ দিন ধরে % chg.: -0.70 %

Precious metals fell on Thursday, with gold falling to a 1-week low and silver falling to a 1-month low. President Trump’s new retaliatory tariffs hit stock and commodity markets on Thursday, prompting investors to liquidate their lucrative long positions in gold and silver to generate cash to offset losses in other markets. In addition, lower inflation expectations are bearish for gold as it limits demand for gold as an inflation hedge after the US 10-year breakeven inflation rate fell to a 3-week low on Thursday. However, experts say trade war fears continue to fuel demand for precious metals.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 3066, 3100, 3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- প্রতিরোধের মাত্রা: 3136, 3167, 3200

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold corrected sharply yesterday to the support level of 3066, where buyers showed a sharp reaction (price rejection). Currently, the buyers have built another support level of 3100, which can be considered for buying with a target of 3136. However, the resistance level of 3136 may become a stumbling block for the continuation of the trend. Here, we can consider selling, but only with confirmation.

বিকল্প দৃশ্যকল্প:if the price breaks below the support level of 3000, the downtrend will likely resume.

-এর জন্য নিউজ ফিড: 2025.04.04

- US Nonfarm Payrolls (m/m) at 15:30 (GMT+3);

- US Unemployment Rate (m/m) at 15:30 (GMT+3);

- US Fed Chair Powell Speaks at 18:25 (GMT+3).

এই নিবন্ধটি একটি ব্যক্তিগত মতামত প্রতিফলিত করে এবং এটিকে বিনিয়োগের পরামর্শ, এবং/অথবা অফার, এবং/অথবা আর্থিক লেনদেন করার জন্য একটি ক্রমাগত অনুরোধ, এবং/অথবা একটি গ্যারান্টি, এবং/অথবা ভবিষ্যতের ঘটনাগুলির পূর্বাভাস হিসাবে ব্যাখ্যা করা উচিত নয়।