The EUR/USD currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 1.1281

- পূর্ববর্তী বন্ধ: 1.1398

- সর্বশেষ দিন ধরে % chg.: +1.04 %

The euro held just below $1.14, remaining near its strongest level since late January 2022, driven by heightened global trade tensions and growing uncertainty over US tariff policy, which have renewed recession fears and undermined investor confidence in US assets. However, further prospects for the European currency are in question, as the ECB is expected to cut the rate by 0.25% today and point to additional cuts at subsequent meetings.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 1.1246, 1.1157, 1.1088, 1.0960

- প্রতিরোধের মাত্রা: 1.1496

The EUR/USD currency pair’s hourly trend is bullish. The euro is trading in a sideways phase at the level of EMA lines. The bias remains for the bulls, as the price has not reached an important liquidity pool and has not formed a liquidity grab before the reversal. Therefore, you can look for buy trades intraday. The minimum profit target is to renew Monday’s high. The maximum profit target is to reach the resistance level of 1.1496. There are no optimal entry points for selling right now.

বিকল্প দৃশ্যকল্প:if the price breaks the support level of 1.0960 and consolidates below it, the downtrend will likely resume.

-এর জন্য নিউজ ফিড: 2025.04.17

- Eurozone ECB Rate Statement at 15:15 (GMT+3);

- Eurozone ECB Monetary Policy Report at 15:15 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Philadelphia Fed Manufacturing Index (m/m) at 15:30 (GMT+3);

- US Building Permits (m/m) at 15:30 (GMT+3);

- Eurozone ECB Press Conference at 15:45 (GMT+3).

The GBP/USD currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 1.3224

- পূর্ববর্তী বন্ধ: 1.3244

- সর্বশেষ দিন ধরে % chg.: +0.15 %

The British pound sterling rose for the seventh consecutive day to $1.327, reaching its longest winning streak since July, mainly due to a weaker US dollar, even after weaker-than-expected Consumer Price Index data. Inflation fell more than expected, with core CPI falling to 2.6% year-on-year and services inflation falling to 4.7%, easing pressure on the Bank of England. This has led traders to slightly increase bets on a rate cut and now estimate a rate easing of 86 basis points by the end of the year.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 1.3207, 1.3121, 1.3030, 1.2891, 1.2743

- প্রতিরোধের মাত্রা: 1.3305, 1.3290

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly time frame is bullish. Sterling failed to reach the resistance zone above 1.3305 and has now corrected to the support level of 1.3207. Given that an important liquidity level has not been reached, buying may be considered here. Given the MACD divergence, the upside potential is limited to the resistance level at 1.3305. There are no optimal entry points for selling right now.

বিকল্প দৃশ্যকল্প:if the price breaks the resistance level of 1.3114 and consolidates above it, the uptrend will likely resume.

আজকের জন্য কোন খবর নেই

The USD/JPY currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 143.18

- পূর্ববর্তী বন্ধ: 141.85

- সর্বশেষ দিন ধরে % chg.: -0.94 %

Growing economic uncertainty may force the Bank of Japan to suspend or slow down the pace of interest rate hikes. The US trade policy poses a serious risk to Japan’s economic outlook, Junko Nakagawa of the Bank of Japan (BoJ) said in a speech. She also warned that higher US tariffs could have a direct impact on Japanese companies, affecting exports, production, capital expenditures, sales, and profits.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 142.21, 141.61, 140.45

- প্রতিরোধের মাত্রা: 144.08, 145.14, 147.14

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The yen reached an important support level at 141.61, where the buyers took the initiative. This indicates a liquidity grab, and now the price will seek to distribute this liquidity higher. Ideally, this is the resistance level at 144.08. Therefore, intraday buying from the EMA lines can be sought. There are no optimal entry points for selling now.

বিকল্প দৃশ্যকল্প:if the price breaks through the resistance level at 147.14 and consolidates above it, the uptrend will likely resume.

-এর জন্য নিউজ ফিড: 2025.04.17

- Japan Trade Balance (m/m) at 02:50 (GMT+3).

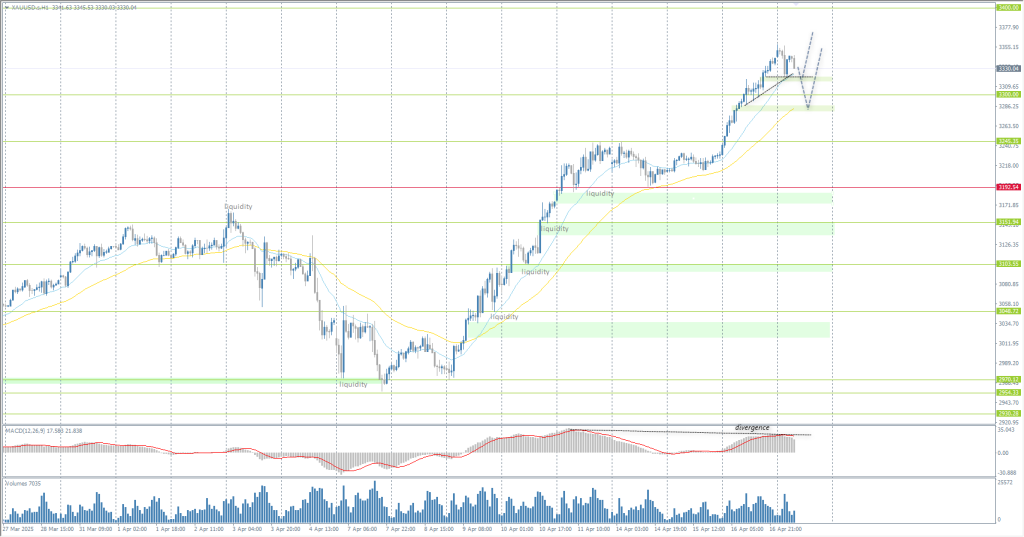

The XAU/USD currency pair (gold)

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 3231

- পূর্ববর্তী বন্ধ: 3341

- সর্বশেষ দিন ধরে % chg.: +3.40 %

Gold prices rose to a record high of $3340 an ounce on Thursday as growing unpredictability in US trade policy and weak demand for the dollar and Treasury securities left gold as one of the main safe haven assets in the market. The US President Trump has launched a probe into new tariffs on crucial minerals, escalating the trade war with China shortly after concessions on cars and electronics. The move expanded current inspections on copper, pharmaceuticals, lumber, and semiconductors, increasing the range of tariffs on key goods whose production in the US is limited.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 3300, 3192, 3152, 3103, 3048, 3035

- প্রতিরোধের মাত্রা: 3400, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold continues its rally. The price has consolidated above the psychological mark of 3300. The MACD divergence is getting stronger, which limits the potential, but without a bearish reaction, selling should not be rushed. EMA lines or the nearest support levels below which there is liquidity can be considered for buying. The 3300 support level would also be good for buy deals.

বিকল্প দৃশ্যকল্প:if the price breaks and consolidates below the support level of 3192, the downtrend will likely resume.

-এর জন্য নিউজ ফিড: 2025.04.17

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Philadelphia Fed Manufacturing Index (m/m) at 15:30 (GMT+3);

- US Building Permits (m/m) at 15:30 (GMT+3).

এই নিবন্ধটি একটি ব্যক্তিগত মতামত প্রতিফলিত করে এবং এটিকে বিনিয়োগের পরামর্শ, এবং/অথবা অফার, এবং/অথবা আর্থিক লেনদেন করার জন্য একটি ক্রমাগত অনুরোধ, এবং/অথবা একটি গ্যারান্টি, এবং/অথবা ভবিষ্যতের ঘটনাগুলির পূর্বাভাস হিসাবে ব্যাখ্যা করা উচিত নয়।