The EUR/USD currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 1.1313

- পূর্ববর্তী বন্ধ: 1.1389

- সর্বশেষ দিন ধরে % chg.: +0.67 %

Germany’s Ifo Business Climate Indicator for April 2025 rose to 86.9 from 86.7 in the previous month, the highest reading since July, and well above market expectations that had expected the conditions index to soften to 86.9. The improvement in the indicator was supported by a policy of aggressively increasing government spending on infrastructure, defense, and business to generate some growth momentum amid tariff threats from the United States. But despite this, the German government lowered its economic growth forecast for 2025, predicting stagnation instead of growth of 0.3%

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 1.1309, 1.1246, 1.1157, 1.1088, 1.0960

- প্রতিরোধের মাত্রা: 1.1397, 1.1440, 1.1492, 1.1572

The EUR/USD currency pair’s hourly trend is bullish. The euro is testing the priority change level for the third time, and each price bounce is weaker than the previous one, increasing the probability of a trend change. As long as the support level of 1.1309 is not broken, it is worth staying away from selling. We can return to buying when the price breaks through and consolidates above the downtrend line.

বিকল্প দৃশ্যকল্প:if the price breaks the support level of 1.1309 and consolidates below it, the downtrend will likely resume.

-এর জন্য নিউজ ফিড: 2025.04.25

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+3).

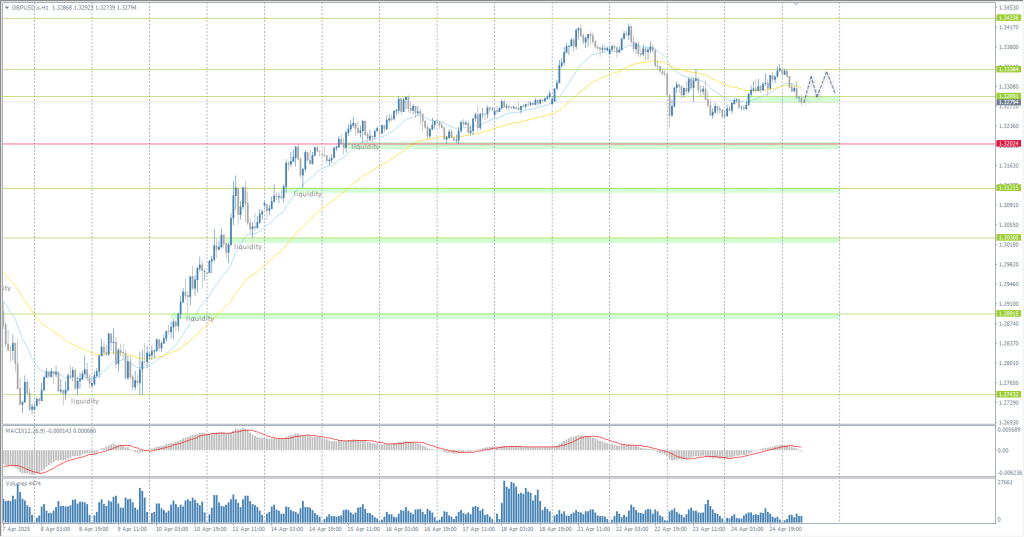

The GBP/USD currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 1.3255

- পূর্ববর্তী বন্ধ: 1.3341

- সর্বশেষ দিন ধরে % chg.: +0.65 %

The GfK UK April 2025 Consumer Confidence Index fell 4 points to 23, hitting its lowest level since November 2023 amid growing concerns over the rising cost of living and escalating global trade tensions. According to an index compiled by the Confederation of British Industry, sentiment in the UK manufacturing sector fell to 33 in April 2025, continuing the deterioration to 47 from the previous quarter, marking the fourth consecutive quarter of pessimism. Manufacturing output also declined (-2 vs. -18 in January), and the trend is likely to continue.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 1.3289, 1.3202, 1.3121, 1.3030, 1.2891, 1.2743

- প্রতিরোধের মাত্রা: 1.3357, 1.3434

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly time frame is bullish. The British pound, following the euro, also corrected on the growth of the US dollar index. However, the pound, unlike the euro, did not reach the support level. This is called SMT divergence between instruments, and it is usually a harbinger of a reversal. For buying, it is best to consider the intraday support level of 1.3289. A breakdown of this level will open the way for the price to 1.3202.

বিকল্প দৃশ্যকল্প:if the price breaks the resistance level of 1.3202 and consolidates above it, the uptrend will likely resume.

-এর জন্য নিউজ ফিড: 2025.04.25

- UK Retail Sales (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 143.42

- পূর্ববর্তী বন্ধ: 142.64

- সর্বশেষ দিন ধরে % chg.: -0.54 %

The Japanese yen slipped to 143 per dollar on Friday, reversing gains from the previous session as the dollar strengthened on signs of easing global trade tensions. US President Donald Trump insisted that talks between the US and China are underway, despite denials from Beijing. Further signs of progress in trade talks with Japan and South Korea also supported the dollar. On the domestic front, data showed that Tokyo’s core inflation rate, a leading indicator of price dynamics in the country, jumped to a two-year high of 3.4% in April, increasing the likelihood of a rate hike by the Bank of Japan at its upcoming meetings.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 142.26, 141.52, 140.18, 139.59

- প্রতিরোধের মাত্রা: 144.09

From a technical point of view, the medium-term trend of the USD/JPY currency pair has changed to an upward trend. The Japanese yen has consolidated above the priority change level and aims for liquidity above 144.08. The rising MACD divergence indicates that selling is possible here. There are no optimal entry points for buying now, as the price has deviated strongly from the EMA lines.

বিকল্প দৃশ্যকল্প:if the price breaks the support level of 140.16 and consolidates below it, the downtrend will likely resume.

-এর জন্য নিউজ ফিড: 2025.04.25

- Japan Tokyo Core CPI (m/m) at 02:30 (GMT+3).

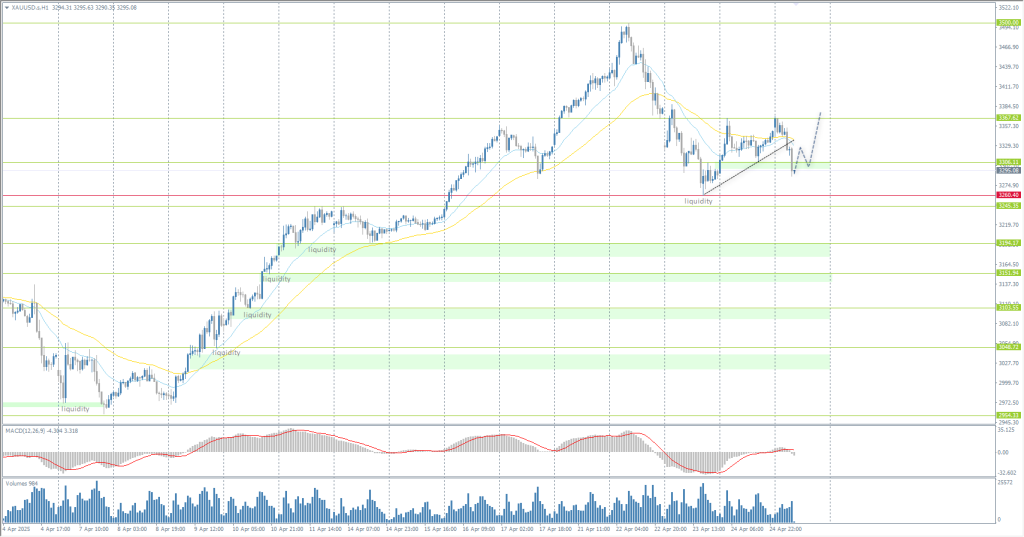

The XAU/USD currency pair (gold)

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 3309

- পূর্ববর্তী বন্ধ: 3350

- সর্বশেষ দিন ধরে % chg.: +1.23 %

Gold rose above $3350 an ounce on Friday, hitting a third weekly high, as skepticism over a trade deal between the US and China continues to support the metal’s safe-haven appeal. The US Treasury Secretary Bessent said that high tariffs between the two countries must be reduced to advance negotiations but emphasized that Trump would not unilaterally reduce tariffs on Chinese imports. Rising military tensions between India and Pakistan also boost gold.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 3260, 3245, 3194

- প্রতিরোধের মাত্রা: 3367, 3385, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold corrected within the framework of profit-taking, but the correction was a bit deeper than initially expected. Once again, The price aims for a priority shift level, which increases the probability of a reversal. It is important to evaluate the price reaction to the 3306 support level. A breakdown and consolidation below this level will trigger a sell-off to 3260. If buyers react to the liquidity zone below 3306, it will open up buying opportunities up to 3367.

বিকল্প দৃশ্যকল্প:if the price breaks and consolidates below the support level of 3260, the downtrend will likely resume.

-এর জন্য নিউজ ফিড: 2025.04.25

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+3).

এই নিবন্ধটি একটি ব্যক্তিগত মতামত প্রতিফলিত করে এবং এটিকে বিনিয়োগের পরামর্শ, এবং/অথবা অফার, এবং/অথবা আর্থিক লেনদেন করার জন্য একটি ক্রমাগত অনুরোধ, এবং/অথবা একটি গ্যারান্টি, এবং/অথবা ভবিষ্যতের ঘটনাগুলির পূর্বাভাস হিসাবে ব্যাখ্যা করা উচিত নয়।