The EUR/USD currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 1.1964

- পূর্ববর্তী বন্ধ: 1.1852

- সর্বশেষ দিন ধরে % chg.: -0.94%

On Friday, the euro weakened against the dollar as the USD strengthened following the nomination of Kevin Warsh as the new Fed Chair and President Trump’s announcement of a preliminary deal with Democrats to prevent a government shutdown. Despite this, Eurozone economic data appeared strong: the unemployment rate unexpectedly dropped to a record low of 6.2%, Q4 GDP grew by 0.3% QoQ and 1.3% YoY, and the German CPI exceeded expectations at 2.1% YoY. ECB 1-year inflation expectations remained at 2.8%, while 3-year expectations unexpectedly rose to a two-year high of 2.6%. Swaps show only a 2% probability of a rate hike at the next ECB meeting on February 5, while the market prices in a 17% chance of a 25-basis-point Fed rate cut in March. The dollar remains under pressure from foreign investor capital outflows, a growing budget deficit, and political polarization in the US.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 1.1835, 1.1805, 1.1754

- প্রতিরোধের মাত্রা: 1.1874, 1.1953, 1.1859, 1.2050, 1.3000

The euro has consolidated below 1.1908 and continued its corrective move. Currently, the price is heading for a liquidity test below 1.1835, where price behavior and market reaction will be key. An impulsive breakout of this zone could trigger a deeper sell-off toward 1.1754, signaling a medium-term trend reversal. If buyers react actively from the 1.1835 area, intraday buys should be considered with initial targets around 1.1874 and higher.

বিকল্প দৃশ্যকল্প:- Trend: Neutral

- Sup: 1.1835

- Res: 1.1874

- Note: An impulsive break of 1.1835 will trigger a sell-off to 1.1754. If buyers react at 1.1835, look for intraday buys targeting 1.1874 and higher.

-এর জন্য নিউজ ফিড: 2026.02.02

- German Retail Sales (m/m) at 09:00 (GMT+2); – EUR (LOW)

- Eurozone Manufacturing PMI (m/m) at 11:00 (GMT+2); – EUR (MED)

- US ISM Manufacturing PMI (m/m) at 17:00 (GMT+2). – USD (MED)

The GBP/USD currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 1.3795

- পূর্ববর্তী বন্ধ: 1.3683

- সর্বশেষ দিন ধরে % chg.: -0.81 %

Last week, sterling sharply strengthened against the dollar, peaking just above 1.3850, its highest level since September 2021, before the pair consolidated just below 1.38. From a fundamental perspective, the GBP/USD outlook remains bullish, and the pair could rise above 1.40 in the coming months – a level not breached since June 2021. While the Fed kept rates at 3.75%, the dollar remains weak due to concerns that hedge funds are reducing us asset exposure or increasing hedge ratios through other assets, including the pound.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 1.3670, 1.3643, 1.3568

- প্রতিরোধের মাত্রা: 1.3730, 1.3787, 1.3871, 1.4000

The pound’s technical picture largely mirrors the euro’s. The pair is in a corrective phase and has already reached the 1.3670 support level. Below lies the next key level at 1.3643, and together they form a demand zone. It is critical for buyers to prevent the price from consolidating below 1.3643, as this would increase the risk of a sharp sell-off and a trend reversal. Consequently, buy scenarios should only be considered if a confident price reaction occurs in the 1.3643-1.3670 zone.

বিকল্প দৃশ্যকল্প:- Trend: Neutral

- Sup: 1.3670

- Res: 1.3730

- Note: Look for buy trades in the 1.3643-1.3670 zone, but with confirmation. A breakout of 1.3670 will trigger a strong sell-off.

-এর জন্য নিউজ ফিড: 2026.02.02

- UK Manufacturing PMI (m/m) at 11:00 (GMT+2). – GBP (MED)

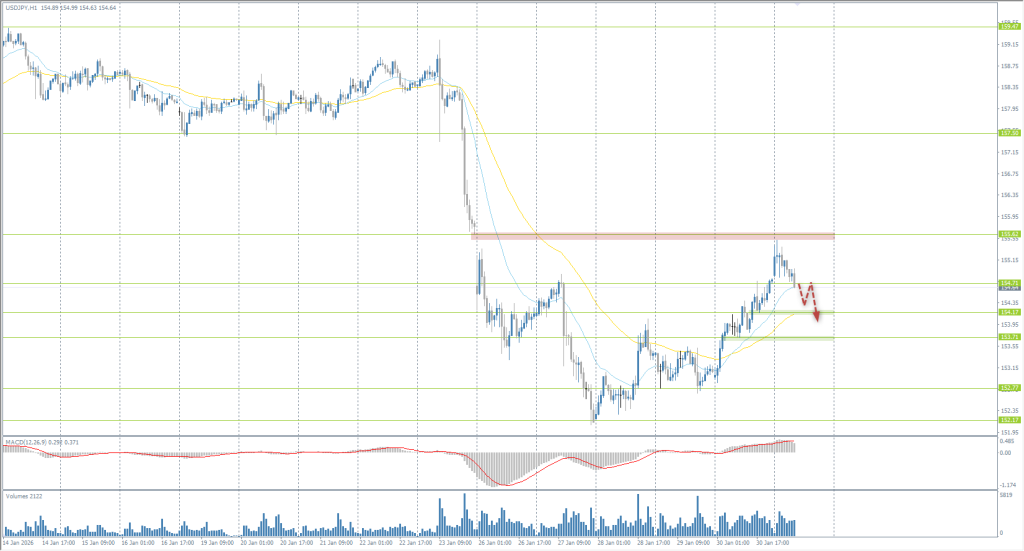

The USD/JPY currency pair

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 152.97

- পূর্ববর্তী বন্ধ: 154.78

- সর্বশেষ দিন ধরে % chg.: +1.18 %

On Monday, the Japanese yen weakened past the 155 per dollar level, extending the sharp decline that began in the previous session. Pressure on the currency intensified following weekend remarks from Prime Minister Sanae Takaichi, who stated that a weak yen could be a significant advantage for export industries. Markets interpreted this as a signal of support for a softer exchange rate. Traders are also pricing in heightened volatility ahead of the snap Lower House elections scheduled for February 8. Market expectations suggest that Takaichi’s ruling party will strengthen its position, paving the way for the promotion of a more expansionary fiscal policy.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 154.17, 153.71, 152.77, 152.17

- প্রতিরোধের মাত্রা: 154.71, 155.62, 157.50

The yen nearly reached the 155.62 resistance level, after which the price reversed sharply, closing last week’s gap, and consolidated back below 154.71. The intraday bias remains in favor of sellers; thus, sell scenarios should be considered from 154.71, targeting 154.17 and lower. Buys are possible only after a reaction at 154.17 or 153.71, and strictly with short-term targets.

বিকল্প দৃশ্যকল্প:- Trend: Neutral

- Sup: 154.17

- Res: 154.71

- Note: Consider sell trades from 154.71 targeting 154.17 and below. For buys, evaluate the reaction at 154.17 and 153.71 with short-term targets only.

-এর জন্য নিউজ ফিড: 2026.02.02

- Japan Manufacturing PMI (m/m) at 02:30 (GMT+2). – JPY (MED)

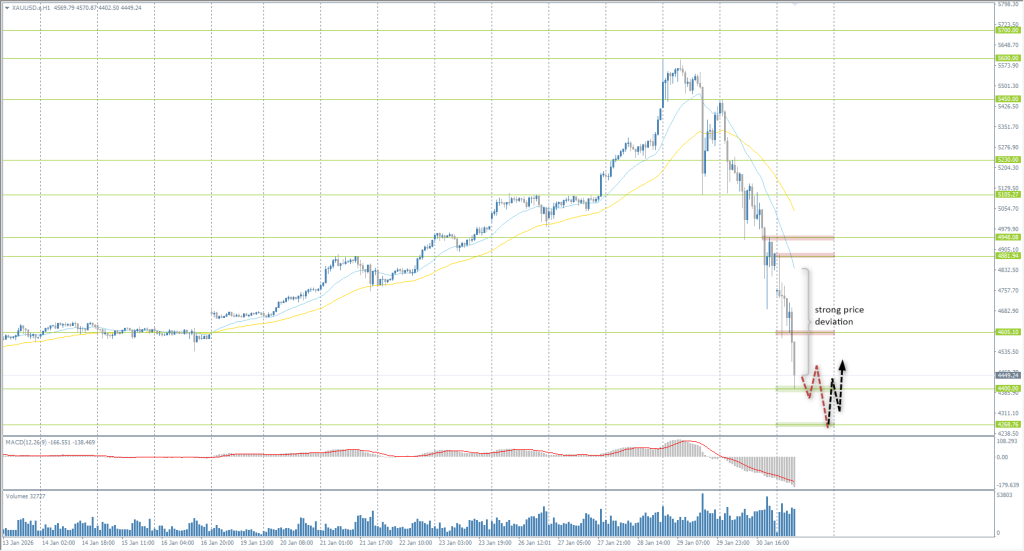

The XAU/USD currency pair (gold)

মুদ্রা জোড়ার প্রযুক্তিগত সূচক:

- পূর্ববর্তী খোলা: 5401

- পূর্ববর্তী বন্ধ: 4890

- সর্বশেষ দিন ধরে % chg.: -10.44 %

On Friday, gold faced a massive sell-off, plummeting over 10% to $4900 per ounce amid large-scale profit-taking. This followed a record high on Thursday. In monetary policy, the nomination of Kevin Warsh as Fed Chair ended months of speculation. Geopolitics remains a major factor: President Trump signed an executive order imposing tariffs on goods from countries supplying oil to Cuba (putting pressure on Mexico), and he has called on Iran for new nuclear negotiations.

ট্রেডিং সুপারিশসমূহ

- সহায়তার মাত্রা: 4400, 4268

- প্রতিরোধের মাত্রা: 4605, 4681, 4948

Gold is under intense selling pressure with no current signs of buyer activity. Attempting to catch “bounces” from the nearest support levels is not recommended until clear bullish signals emerge. Given the significant deviation from average values, a corrective move is likely soon, but due to extreme volatility, it is currently advisable to refrain from trading gold.

বিকল্প দৃশ্যকল্প:- Trend: Down

- Sup: 4400

- Res: 4605

- Note: Given the current volatility, it is best to stay out of gold trades today.

-এর জন্য নিউজ ফিড: 2026.02.02

- US ISM Manufacturing PMI (m/m) at 17:00 (GMT+2). – USD (MED)

এই নিবন্ধটি একটি ব্যক্তিগত মতামত প্রতিফলিত করে এবং এটিকে বিনিয়োগের পরামর্শ, এবং/অথবা অফার, এবং/অথবা আর্থিক লেনদেন করার জন্য একটি ক্রমাগত অনুরোধ, এবং/অথবা একটি গ্যারান্টি, এবং/অথবা ভবিষ্যতের ঘটনাগুলির পূর্বাভাস হিসাবে ব্যাখ্যা করা উচিত নয়।