The EUR/USD currency pair

貨幣對的技術指標:

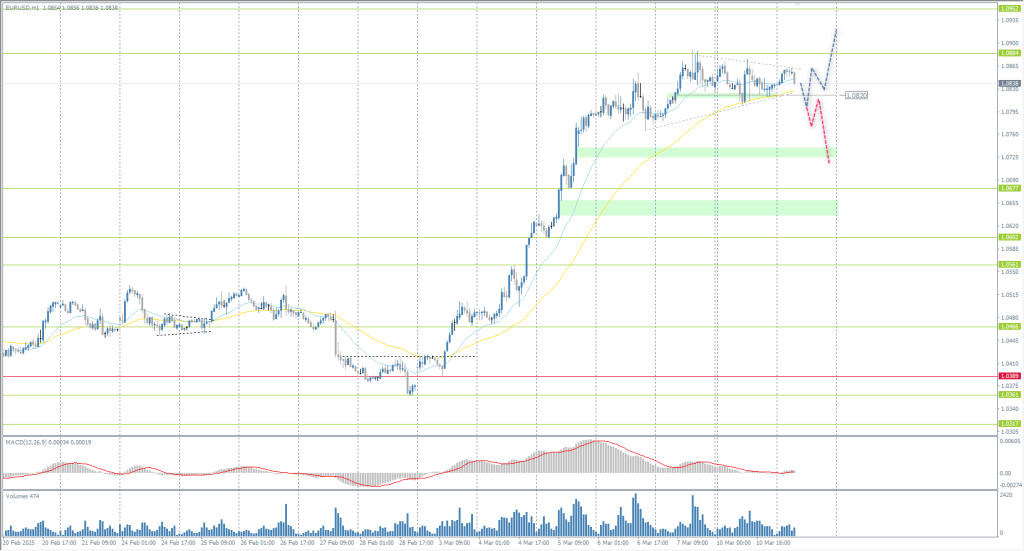

- 前一開盤價: 1.0832

- 前一收盤價: 1.0835

- 過去一天的變化%: +0.03 %

The euro stabilized around $1.08, the strongest level since early November, as investors took a breather after last week’s surge triggered by dramatic changes in German fiscal policy. The single currency rose the most in 16 years in the first week of March after Germany’s main political parties unveiled plans to reform the country’s debt system and create a 500 billion-euro infrastructure fund aimed at boosting economic growth. In addition, European leaders agreed on Thursday to significantly increase defense spending to bolster the region’s defense industry and military capabilities. On the monetary policy front, the European Central Bank delivered a widely expected 25bp rate cut and acknowledged that policy is becoming less tight, hinting at a possible pause in further cuts. Traders are now expecting one or two more 25bp rate cuts this year.

交易建議

- 支撐價位: 1.0820, 1.0677, 1.0602, 1.0561, 1.0466

- 阻力價位: 1.0884

The EUR/USD currency pair’s hourly trend is bullish. The euro has reached the resistance level of 1.0884, where there is a partial fixation of previously opened purchases. Currently, it is important to evaluate the price reaction to the support level of 1.0820. If buyers react here, the price may retest to 1.0884 and rally to 1.0952. If buyers do not react here and the price consolidates below, the probability of a deeper correction increases sharply.

選擇場景:if the price breaks through the support level of 1.0389 and consolidates below it, the downtrend will likely resume.

新聞動態: 2025.03.11

- US JOLTS Job Openings (m/m) at 16:00 (GMT+2).

The GBP/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.2918

- 前一收盤價: 1.2878

- 過去一天的變化%: -0.31 %

The British pound traded near $1.29, near four-month highs, helped by a weaker dollar amid concerns over the state of the US economy and the potential impact of upcoming tariffs. Sterling is also gaining strength on expectations that UK interest rates will remain elevated for longer, with traders cutting bets on a Bank of England rate cut to 52bp for 2025. Investors will be keeping a close eye on this week’s monthly GDP data this week for an insight into the UK’s economic performance in January.

交易建議

- 支撐價位: 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- 阻力價位: 1.2932, 1.3008

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish. The British pound reached the resistance level of 1.2932, after which the price went into correction. Currently, it is important to evaluate the price reaction to the intermediate level of 1.2866. For buy deals, it is best to consider a false breakdown of this level. However, if the price consolidates below, a deeper correction to 1.2811 may occur.

選擇場景:if the price breaks the support level of 1.2582 and consolidates below it, the downtrend will likely resume.

今天沒有新聞

The USD/JPY currency pair

貨幣對的技術指標:

- 前一開盤價: 147.94

- 前一收盤價: 147.17

- 過去一天的變化%: -0.52 %

The Japanese yen strengthened to 147 per dollar on Tuesday, hitting its highest level in five months, as growing fears of a US recession fueled demand for safe-haven assets. US President Donald Trump has recently refused to rule out the possibility of a recession, and his trade policies and government reshuffles are unsettling markets. In Japan, sentiment was further dampened by revised fourth-quarter GDP data that showed annualized growth slowed to 2.2% from the previous estimate of 2.8% due to weak private consumption. Despite economic concerns, the Bank of Japan is expected to leave interest rates unchanged at its March meeting, although further rate hikes are likely later this year as part of a broader normalization of monetary policy.

交易建議

- 支撐價位: 146.00

- 阻力價位: 147.32, 148.40, 149.24, 150.16, 151.29, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The price is forming a wedge pattern, which indicates liquidity contraction and impending momentum. Traders need to gauge the price reaction here. A price consolidation above 147.32 could trigger a rise in price to 148.40, which is very likely with MACD divergence. If the price fails to consolidate above 147.32, the yen could strengthen to 146.00

選擇場景:if the price breaks above the resistance at 151.29, the uptrend will likely resume.

新聞動態: 2025.03.11

- Japan GDP (q/q) at 01:50 (GMT+2).

The XAU/USD currency pair (gold)

貨幣對的技術指標:

- 前一開盤價: 2912

- 前一收盤價: 2889

- 過去一天的變化%: -0.79 %

Gold rose near the $2,900 per ounce mark on Tuesday on the back of a weaker US dollar and safe-haven inflows due to growing concerns over the US economic outlook amid escalating trade tensions. Concerns about a possible slowdown in economic growth intensified after President Donald Trump said in an interview with Fox News on Sunday that the US economy is going through a “transition period,” while refusing to rule out the possibility that his policies would lead to a recession. Investors are now looking forward to US inflation data, which will be released later this week and could influence the Fed’s stance on monetary policy.

交易建議

- 支撐價位: 2859, 2833

- 阻力價位: 2896, 2930, 2940, 2944

From the point of view of technical analysis, the trend on the XAU/USD is bearish. Gold impulsively consolidated below 2896, i.e. below the boundary of the wide-volatility corridor. This may trigger a further sell-off to 2859. However, if the price forms a false breakdown and the price holds above 2896, we may see a sharp impulse to 2930. Therefore, now it is important to evaluate price action to 2896.

選擇場景:if the price breaks and consolidates above the resistance at 2945, the uptrend will likely resume.

新聞動態: 2025.03.11

- US JOLTS Job Openings (m/m) at 16:00 (GMT+2).

本文僅反映個人觀點,不應被視為投資建議和/或要約和/或進行金融交易的持續要求和/或擔保和/或對未來事件的預測。