The EUR/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.0792

- 前一收盤價: 1.0738

- 過去一天的變化%: -0.50 %

St. Louis Fed President Musalem said there is no certainty that the tariffs’ inflationary effect will be temporary, and secondary effects may prompt the Fed to hold interest rates steady for longer. Such a scenario would support the dollar, putting pressure on risky currencies such as the euro and the British pound. Yesterday, dovish comments from ECB Governing Council representative Villeroy de Galhau put negative pressure on the Euro exchange rate when he said that the ECB could still cut interest rates as it has almost achieved its goal of bringing inflation back to the 2% target. Swaps rate the odds of a 25 bp ECB rate cut at the April 17 meeting at 76%.

交易建議

- 支撐價位: 1.0766, 1.0677, 1.0602, 1.0561, 1.0466

- 阻力價位: 1.0802, 1.0830, 1.0858, 1.0918, 1.0947, 1.0979.

The EUR/USD currency pair’s hourly trend is bearish. Yesterday, the price tested the liquidity below 1.0766, where the buyers reacted, bringing the price back above the level. Currently, the price has hit a downtrend line, which, together with the EMA lines, may become a stumbling block for buyers. Here, we can look for sell deals, but with a short-stop loss. A breakout of the descending channel will open up buying opportunities to 1.0802 or 1.0830.

選擇場景:if the price breaks the resistance level of 1.0858 and consolidates above it, the uptrend is likely to be resumed.

新聞動態: 2025.03.27

- US GDP (q/q) at 14:30 (GMT+2);

- US Initial Jobless Claims (w/w) at 14:30 (GMT+2);

- US Pending Home Sales (m/m) at 16:00 (GMT+2).

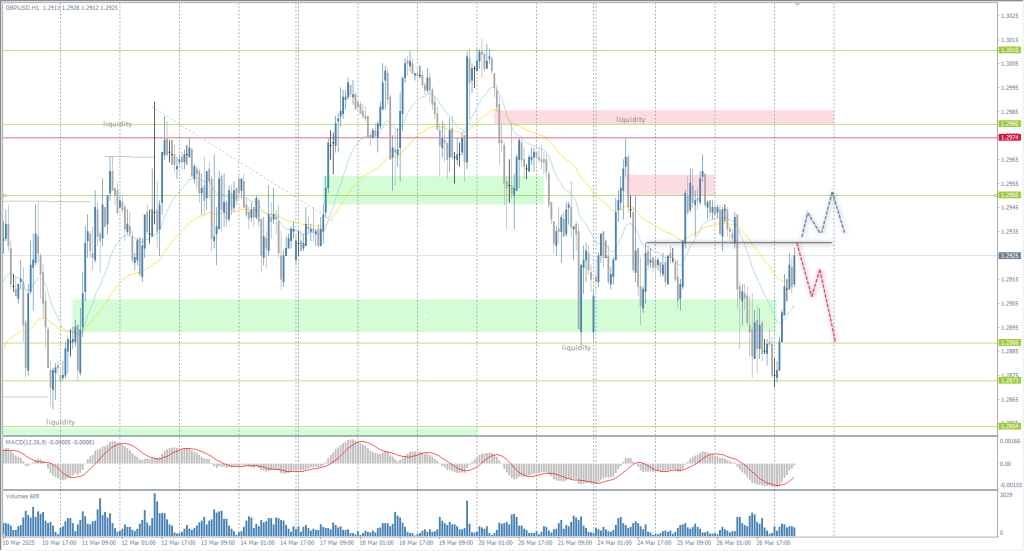

The GBP/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.2945

- 前一收盤價: 1.2875

- 過去一天的變化%: -0.54 %

The British pound slipped below $1.29, hitting its lowest level in nearly two weeks, as traders reacted to weaker-than-expected inflation data for February and the Spring Statement. The UK Finance Minister Reeves said UK inflation will average 3.2% in 2025, down from the 2.6% forecast in October. Meanwhile, the economic growth forecast for 2025 has been cut to 1% from 2% and projected public sector net borrowing is set to fall from £137.3bn (4.8% of GDP) this year to £74.0bn (2.1% of GDP) by 2029-30.

交易建議

- 支撐價位: 1.2873, 1.288, 1.2933, 1.2911, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- 阻力價位: 1.2930, 1.2974, 1.3010

From the technical analysis point of view, the GBP/USD currency trend has changed to a downtrend. The negative fundamental background did its job. Sterling dropped to 1.2873, simultaneously testing the liquidity below 1.2888. The price has now approached the resistance level of 1.2930, above which there are “locked” buyers. This level can be considered for selling. A breakout of this level will open the price to 1.2950 and higher.

選擇場景:if the price breaks through the resistance level of 1.2974 and consolidates above it, the uptrend will likely resume.

今天沒有新聞

The USD/JPY currency pair

貨幣對的技術指標:

- 前一開盤價: 149.91

- 前一收盤價: 150.53

- 過去一天的變化%: +0.41 %

The Japanese yen rose to 150 per dollar on Thursday, recovering some losses from the previous session as the dollar retreated after President Donald Trump announced 25% tariffs on auto imports and said that the upcoming retaliatory tariffs would be permanent throughout his second term. Trump’s escalating tariffs have raised fears of retaliatory tariffs and broader economic repercussions, leading to increased volatility in currency markets.

交易建議

- 支撐價位: 149.51, 148.95, 148.58, 148.25

- 阻力價位: 151.32, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish. The situation has not changed for the last few days. The yen seeks to test liquidity above 151.32. There are no strong counterresistances up to this level, so intraday traders should look for buy trades from EMA lines or the uptrend line. There are no optimal entry points for selling right now.

選擇場景:if the price breaks through the support level at 149.51 and consolidates below it, the downtrend is likely to be resumed.

今天沒有新聞

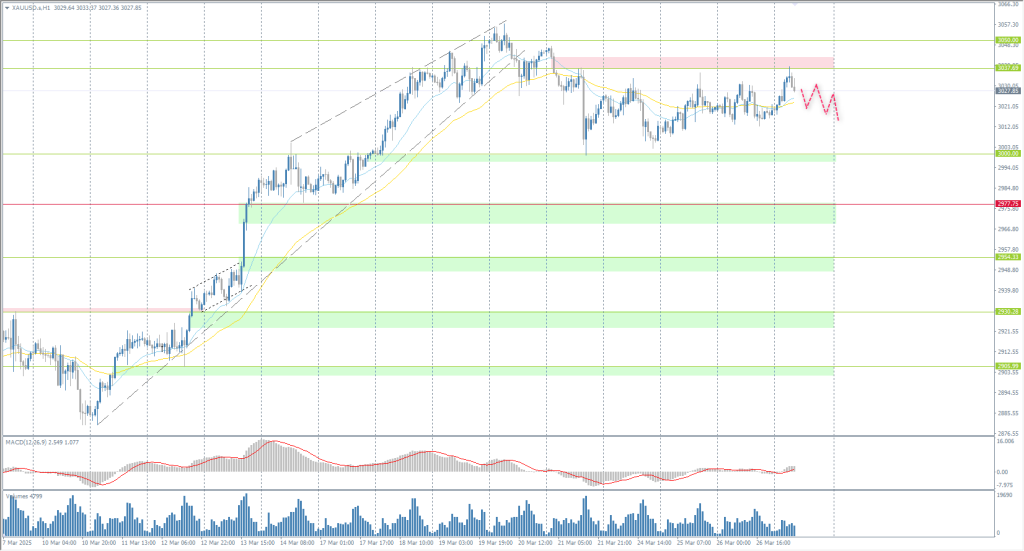

The XAU/USD currency pair (gold)

貨幣對的技術指標:

- 前一開盤價: 3019

- 前一收盤價: 3019

- 過去一天的變化%: 0.0 %

FRB Minneapolis President Kashkari acknowledged progress on inflation but emphasized the need for further action, echoing Chairman Powell’s stance that a rate cut is not imminent. Investors await Friday’s PCE report, the Fed’s preferred inflation gauge, for further policy guidance.

交易建議

- 支撐價位: 3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- 阻力價位: 3037, 3050, 3100

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold is trading in a broadly volatile flat with boundaries of 3000-3037, with the price now reaching the upper boundary. There is a seller’s reaction, so intraday, we can consider selling with a target to the EMA lines or the flat’s lower boundary. Sellers need to keep the resistance level 3037 in force. Otherwise, the uptrend will resume with renewed vigor. But until that happens, the price will be flat in the corridor.

選擇場景:if the price breaks below the support level 2906, the downtrend is likely to resume.

新聞動態: 2025.03.27

- US GDP (q/q) at 14:30 (GMT+2);

- US Initial Jobless Claims (w/w) at 14:30 (GMT+2);

- US Pending Home Sales (m/m) at 16:00 (GMT+2).

本文僅反映個人觀點,不應被視為投資建議和/或要約和/或進行金融交易的持續要求和/或擔保和/或對未來事件的預測。