The EUR/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.1050

- 前一收盤價: 1.0965

- 過去一天的變化%: -0.77 %

The euro is holding near $1.10, the strongest since early October 2024, as the dollar remains weak and trade war tensions intensify. On Friday, China announced plans to impose 34% tariffs on all US goods starting April 10 in retaliation for sweeping tariffs imposed by President Trump. In Europe, French President Emmanuel Macron urged companies to suspend US investments, and the European Commission said it was preparing its retaliatory measures. In response, markets priced in a more than 90% probability of a 25bp ECB rate cut in April, as well as expectations of a deposit rate cut to 1.8% by December, down from previous projections of 1.9% and the current level of 2.5%.

交易建議

- 支撐價位: 1.0879, 1.0805, 1.0785

- 阻力價位: 1.1088, 1.1136, 1.1201

The EUR/USD currency pair’s hourly trend is bullish. The euro corrected sharply on Friday amid the general sell-off of risky assets. Monday’s open occurred with a gap down, but buyers sharply bought the euro from the support level of 1.0879. Given the ongoing panic in the financial markets and with the ECB set to cut rates further, the euro is likely to continue to decline. The downtrend line can be considered for selling. A breakdown of this line will open the price to 1.1088.

選擇場景:if the price breaks the support level of 1.0805 and consolidates below it, the downtrend will likely resume.

新聞動態: 2025.04.07

- German Industrial Production (m/m) at 09:00 (GMT+3);

- German Trade Balance (m/m) at 09:00 (GMT+3);

- Eurozone Retail Sales (m/m) at 12:00 (GMT+3).

The GBP/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.3099

- 前一收盤價: 1.2895

- 過去一天的變化%: -1.58 %

The British pound fell below $1.29 on Friday, driven by concerns over rising global economic risks following President Trump’s sweeping tariff policy. Although the UK faces a relatively low 10% tariff rate, investors fear that higher duties for other economies such as China and the Eurozone could lead to product dumping, undermining the competitiveness of British exports. Before the tariffs were announced, the UK’s Office for Budget Responsibility warned that such a trade policy could shrink the economy by 1% and undermine the government’s fiscal reserve. Domestically, inflation fears are rising after an increase in employers’ national insurance contributions came into effect this month, adding to pressure on businesses. These developments reinforce expectations that the Bank of England will proceed cautiously with monetary easing.

交易建議

- 支撐價位: 1.2884, 1.2853, 1.2811

- 阻力價位: 1.2953, 1.3050, 1.3176

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish, but it is close to change, as Friday’s sell-off and Monday’s gap opening occurred at the level of priority change. Buyers took a sharp initiative from the demand zone below 1.2853. Currently, the grabbed liquidity will lead the price to 1.2953, which opens up intraday buying opportunities. However, further upside potential is limited by the global sell-off of risky assets, which is the pound sterling.

選擇場景:if the price breaks the support level of 1.2884 and consolidates below it, the downtrend will likely resume.

今天沒有新聞

The USD/JPY currency pair

貨幣對的技術指標:

- 前一開盤價: 146.03

- 前一收盤價: 146.91

- 過去一天的變化%: +0.60 %

The Japanese yen strengthened to 145 per dollar, the highest level since early October, thanks to the global flight to safety and a weaker dollar. Investors remain on edge amid an escalating trade war. On monetary policy, the Bank of Japan is expected to keep raising interest rates this year, although uncertainty over global trade and domestic economic conditions clouds the outlook. Bank of Japan Deputy Governor Shinichi Uchida told parliament that further rate hikes remain on hold if the economy meets expectations, while the Central Bank is keeping a close eye on rate risks.

交易建議

- 支撐價位: 145.90, 144.22

- 阻力價位: 147.43, 148.41, 149.16, 150.27

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. Last Thursday, the yen reached the daily support level of 145.90, below which there is a large demand zone. Partial fixation of profits was observed here. At the end of Friday and at the market opening on Monday, buyers showed a proactive reaction from this area. Considering the MACD divergence, this opens up intraday buying opportunities within the correction. For buy trades, the 145.92 support level can be considered. For selling, it is best to evaluate the price reaction to the 147.43 resistance level, above which there is new liquidity.

選擇場景:if the price breaks through the resistance level at 150.27 and consolidates above it, the uptrend will likely resume.

今天沒有新聞

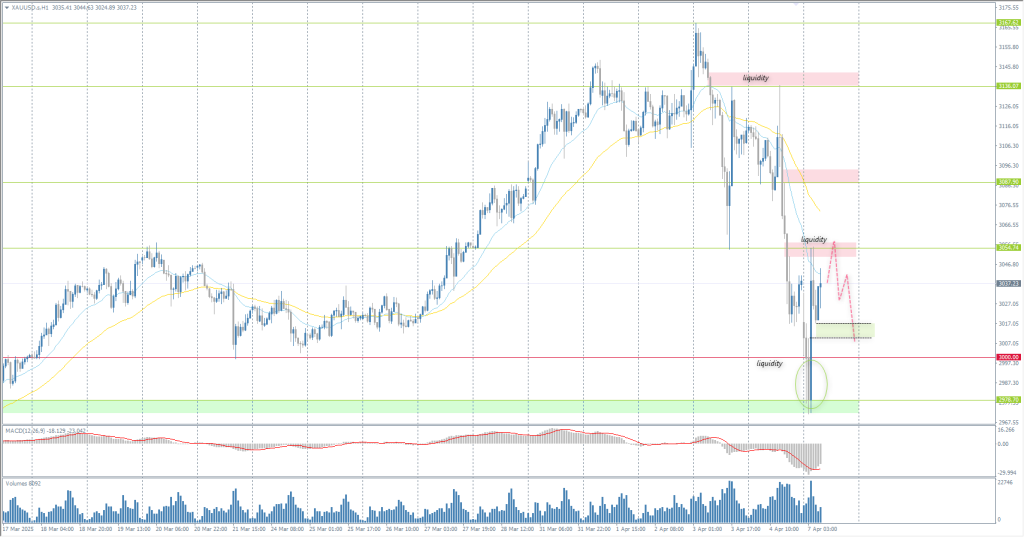

The XAU/USD currency pair (gold)

貨幣對的技術指標:

- 前一開盤價: 3114

- 前一收盤價: 3038

- 過去一天的變化%: -2.50 %

Gold prices reversed gains on Friday and fell 2.5% to $3020 per ounce, hitting a one-week low. Analysts attributed the fall to investors selling gold to cover losses in other asset classes amid margin calls. The stock market saw another sharp sell-off amid escalating trade tensions. China’s announcement to impose 34% tariffs on all US imports in response to President Trump’s duties heightened concerns about the stability of the global economy and inflationary pressures. Meanwhile, gold inventories in COMEX warehouses across the US have risen recently due to concerns that tariffs on imports could disrupt supplies.

交易建議

- 支撐價位: 3017, 3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- 阻力價位: 3054, 3087, 3136, 3167, 3200

From the point of view of technical analysis, the trend on the XAU/USD is bullish, but Friday’s sell-off has sharply increased the probability of a reversal. Gold opened Monday with a price gap below the priority change level, but buyers sharply bought back bullion from 2978. Currently, the price is trading at the level of EMA lines. Traders should return to buying after the price fixes above 3054. There is also a high probability of a bullish reaction at 3017. For sell deals, we can consider the level of 3054, but under the condition of bearish initiative on intraday time frames.

選擇場景:if the price breaks below the support level of 3000, the downtrend will likely resume.

今天沒有新聞

本文僅反映個人觀點,不應被視為投資建議和/或要約和/或進行金融交易的持續要求和/或擔保和/或對未來事件的預測。