The EUR/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.0959

- 前一收盤價: 1.0950

- 過去一天的變化%: -0.08 %

Investors familiarized themselves with the latest FOMC meeting minutes. Fed officials expect tariffs to push inflation higher this year, but noted uncertainty about how strong or lasting their impact will be. In Germany, the CDU/CSU bloc and SPD reached a coalition agreement, ending months of stalemate. The agreement includes measures to curb illegal migration, introduce border controls, and open the door for significant investment in the military and infrastructure. The euro climbed to 1.1090 per dollar, nearing its strongest level since October 2024, as escalating trade tensions and signs of political stability in Europe bolstered the single currency.

交易建議

- 支撐價位: 1.0901, 1.0879, 1.0805, 1.0785

- 阻力價位: 1.0998, 1.1088, 1.1136, 1.1201

The EUR/USD currency pair’s hourly trend is bullish. The euro is expectedly corrected to the breakout point of the trend line, even a little lower. Currently, the price is trading at the EMA levels before the resistance level at 1.0998. A breakout of this level will open the room for the price to 1.1088. If sellers take the initiative from 1.0998, we should expect a decline and the formation of a flat accumulation.

選擇場景:if the price breaks the support level of 1.0805 and consolidates below it, the downtrend will likely resume.

新聞動態: 2025.04.10

- US Consumer Price Index (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3).

The GBP/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.2760

- 前一收盤價: 1.2720

- 過去一天的變化%: -0.31 %

In the UK, Bank of England Deputy Governor Clare Lombardelli warned that tariffs could affect the country’s economic growth, although the impact on inflation is still unclear. In response, traders now see a 50 basis point rate cut in May as more likely, with a total of four rate cuts expected before the end of the year, up from three earlier this week. The market also sees a second rate cut in June as almost certain, with a third fully expected by September.

交易建議

- 支撐價位: 1.2678, 1.2645

- 阻力價位: 1.2864, 1.2934, 1.2953, 1.3050, 1.3176

From the point of view of technical analysis, the trend on the GBP/USD currency is bearish. The price has corrected to the resistance level of 1.2864. Here, we can consider selling if there is a reaction from sellers. The price has not reached the global support level, which increases the probability of further decline. However, if the price breaks 1.2864 and consolidates above, it will open up space to 1.2934.

選擇場景:if the price breaks the resistance level of 1.3114 and consolidates above it, the uptrend will likely resume.

今天沒有新聞

The USD/JPY currency pair

貨幣對的技術指標:

- 前一開盤價: 146.22

- 前一收盤價: 147.73

- 過去一天的變化%: +1.03 %

On Thursday, the Japanese yen exceeded 147 per US dollar, continuing to trade in a volatile range as markets reacted to changes in global trade dynamics. Investor sentiment was influenced by US President Donald Trump’s announcement to suspend retaliatory tariffs for 90 days for countries that have not retaliated, giving Japan some relief in the form of a 10% cut in the base tariff rate. However, trade tensions remain elevated as Trump raised tariffs on Chinese imports to 125% in response to Beijing’s retaliatory measures.

交易建議

- 支撐價位: 145.90, 144.58, 144.83, 144.22

- 阻力價位: 148.16, 149.16, 150.27

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish, but it is close to changing. The yen has reached the level of 148.16, thus confirming the formation of a broadly volatile flat with the boundaries of 144.58–148.16. Currently, the price has corrected to the EMA lines. Considering yesterday’s sharp impulsive growth and taking into account the current slow slide, there are all grounds for further price growth due to the persisting bullish bias. Therefore, buying can be considered from the EMA lines or from 145.90. There are no optimal entry points for selling now.

選擇場景:if the price breaks through the resistance level at 148.16 and consolidates above it, the uptrend will likely resume.

新聞動態: 2025.04.10

- Japan Producer Price Index (m/m) at 02:50 (GMT+3).

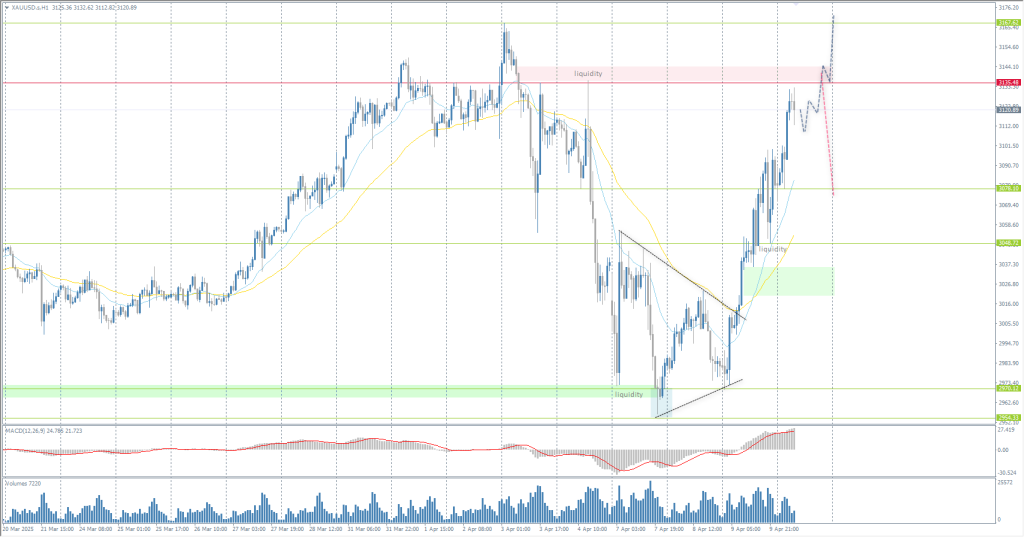

The XAU/USD currency pair (gold)

貨幣對的技術指標:

- 前一開盤價: 2983

- 前一收盤價: 3080

- 過去一天的變化%: +3.25 %

Gold jumped more than 3% to above $3065 an ounce on Wednesday amid escalating trade tensions between the US and China, which is fueling demand for safe-haven gold. Trump announced on the Truth Social website a 90-day pause and a 10% reduction in retaliatory tariffs on all countries except China. In the same message, he said tariffs on Chinese imports would rise to 125%. Treasury Secretary Scott Bessent later clarified that the 10% rate applies during negotiations but excludes China and sectoral tariffs. The move was followed by Beijing’s announcement of new tariffs on US goods to 84% from 34% and the EU’s approval of retaliatory tariffs on 21 billion euros of US imports.

交易建議

- 支撐價位: 3078, 3048, 2970, 2954, 2930, 2906, 2896, 2859, 2833

- 阻力價位: 3135, 3167, 3200

From the point of view of technical analysis, the trend on the XAU/USD is bearish, but close to change. Gold strengthened sharply yesterday and continued to rise in the Asian session on Thursday. Price is looking to test liquidity above the 3135 priority shift level. And further, price action should be evaluated. A break and consolidation above will open the way for a test of liquidity above 3167. If sellers react with initiative from 3125, it will open the door for sell trades up to 3078.

選擇場景:if the price breaks and consolidates above the resistance level of 3135, the uptrend will likely resume.

新聞動態: 2025.04.10

- US Consumer Price Index (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3).

本文僅反映個人觀點,不應被視為投資建議和/或要約和/或進行金融交易的持續要求和/或擔保和/或對未來事件的預測。