The EUR/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.1737

- 前一收盤價: 1.1665

- 過去一天的變化%: -0.62 %

The dollar’s rally on Thursday put pressure on the euro. The euro’s losses accelerated on Thursday amid heightened tensions between Russia and NATO after European diplomats said they were prepared to shoot down Russian aircraft if new airspace violations were detected. The euro was mainly supported by a stronger-than-expected GfK report on consumer confidence in Germany for October. The euro is also being supported by Central Bank divergence, as markets believe that the ECB has largely completed its rate-cutting cycle, while the Fed is expected to cut rates about two more times before the end of this year. Swaps price in a 1% chance of a 25 bps ECB rate cut at its October 30 meeting.

交易建議

- 支撐價位: 1.1661, 1.1634

- 阻力價位: 1.1702, 1.1754, 1.1786, 1.1819

The EUR/USD currency pair’s hourly trend has changed to downward. The euro sharply fell below 1.1727 and 1.1704 and consolidated below. To change the trend back, we need to see a locked balance, plus an impulse breakout above the resistance level. Until then, it is worth focusing on sales. The most suitable levels are 1.1703 and 1.1727, but with confirmation in the form of a reaction from sellers.

選擇場景:if the price breaks through the resistance level of 1.1819 and consolidates above it, the uptrend will likely resume.

新聞動態: 2025.09.26

- Eurozone ECB President Lagarde Speaks at 12:30 (GMT+3);

- US PCE Price index (m/m) at 15:30 (GMT+3);

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+3).

The GBP/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.3439

- 前一收盤價: 1.3342

- 過去一天的變化%: -0.72 %

The British pound fell below $1.335, approaching a seven-week low, as investors weighed inflation risks and the Bank of England’s policy outlook. Bank of England policymaker Megan Green called for caution on rate cuts, suggesting a pause in November, while Governor Andrew Bailey said more easing was needed. The divergence highlights uncertainty as UK inflation, the highest in the G7, stood at 3.8% in August and is expected to peak at 4% before falling to the target level in 2027.

交易建議

- 支撐價位: 1.3332, 1.3315

- 阻力價位: 1.3392, 1.3434, 1.3463, 1.3491, 1.3532

In terms of technical analysis, the trend on the currency pair GBP/USD is a downtrend. The British pound also fell sharply yesterday amid the strengthening of the US dollar. The price reached the support level of 1.3332, where the first signs of profit-taking are observed. There are no prerequisites for a reversal of the movement. Sell trades are best considered from the EMA lines or from the resistance level of 1.3392.weekly low may occur.

選擇場景:if the price breaks through the resistance level of 1.3532 and consolidates above it, the uptrend will likely resume.

今天沒有新聞

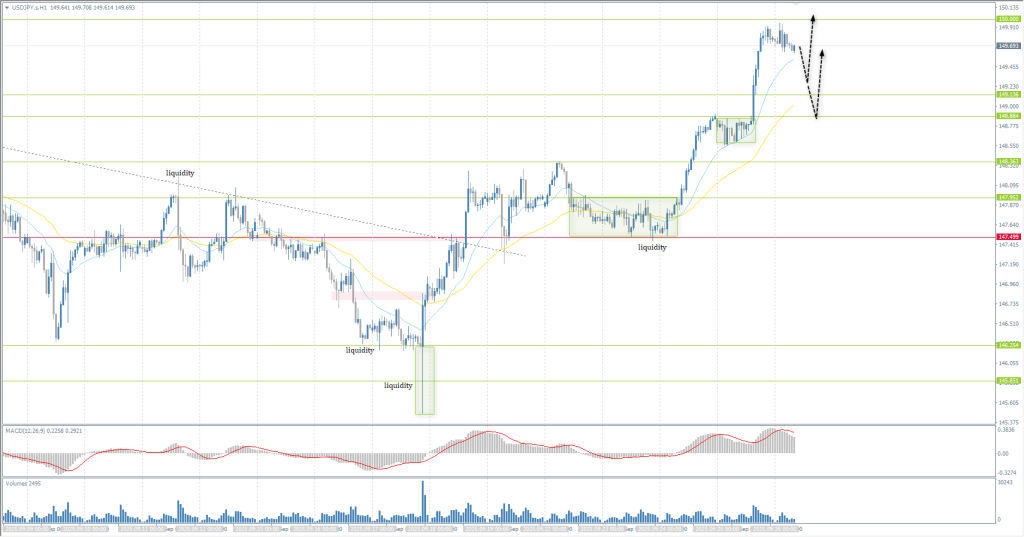

The USD/JPY currency pair

貨幣對的技術指標:

- 前一開盤價: 148.85

- 前一收盤價: 149.80

- 過去一天的變化%: +0.63 %

On Friday, the yen fluctuated around 150 per dollar, its lowest level in nearly two months, under pressure from the overall strengthening of the dollar. In Japan, core inflation in Tokyo rose to 2.5% y/y in September, remaining stable compared to August but below expectations of 2.8% y/y. Minutes from the Bank of Japan’s July meeting showed that policymakers remain inclined to raise rates further if growth and prices develop in line with expectations. At its September meeting, the Bank of Japan left rates unchanged but recorded two dissenting votes, indicating that further policy tightening may be approaching.

交易建議

- 支撐價位: 149.14, 148.84, 148.36, 147.95, 147.50

- 阻力價位: 150.00, 150.73

From a technical point of view, the medium-term trend of the USD/JPY is upward. The price is striving to test the psychological mark of 150 yen per dollar. There are no major sellers at the moment, so it is worth looking for sell trades during the day as the price continues to rise. The EMA lines or support levels of 149.14 or 148.88 are suitable for buying.

選擇場景:if the price breaks through the support level of 147.50 and consolidates below it, the downtrend will likely resume.

新聞動態: 2025.09.26

- Japan Tokyo Core CPI (m/m) at 02:30 (GMT+3).

The XAU/USD currency pair (gold)

貨幣對的技術指標:

- 前一開盤價: 3738

- 前一收盤價: 3746

- 過去一天的變化%: +0.21%

On Friday, gold prices fell to around $3740 per ounce under pressure from a strengthening US dollar after The number of new applications for unemployment benefits declined, and the economy grew faster than initially expected in the second quarter, thanks to strong consumer spending and business investment. Market expectations for a rate cut next month fell from 90% to 85% ahead of the employment data release. Investors are now focused on the PCE Price Index, which will be released today and is the Fed’s preferred inflation indicator, to get further guidance on the direction of policy.

交易建議

- 支撐價位: 3700, 3672

- 阻力價位: 3755, 3800

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold has formed a locked balance above 3750, and this zone now acts as a resistance area. For the bullish rally to resume, we need to see a breakout of 3755 on momentum. Liquidity is now narrowing in the triangle, which increases the likelihood of a quick breakout. Consolidation below the triangle could lead to a sell-off to 3700.

選擇場景:if the price breaks the support level of 3636 and consolidates below it, the downtrend will likely resume.

新聞動態: 2025.09.26

- US PCE Price Index (m/m) at 15:30 (GMT+3);

- US Michigan Consumer Sentiment (m/m) at 17:00 (GMT+3).

本文僅反映個人觀點,不應被視為投資建議和/或要約和/或進行金融交易的持續要求和/或擔保和/或對未來事件的預測。