The EUR/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.1604

- 前一收盤價: 1.1647

- 過去一天的變化%: +0.37 %

The euro rebounded above $1.16, recovering from a more than two-month low. Investors welcomed signs of political stabilization in France and appreciated growing expectations of interest rate cuts in the US. French Prime Minister Lecornu told parliament that he supports suspending pension reforms until the 2027 presidential election, seeking to secure the support of the Socialists and survive a crucial no-confidence vote on Thursday. In the US, Fed Chairman Powell noted the continuing deterioration in the labor market, which reinforced expectations of another rate cut this month. This dovish outlook contrasts with the ECB’s expectations, which suggest that interest rates are likely to remain unchanged. Meanwhile, tensions in trade relations between the US and China have intensified, as President Trump has made it clear that Washington may sever some trade ties with China.

交易建議

- 支撐價位: 1.1642, 1.1618, 1.1600, 1.1543

- 阻力價位: 1.1681, 1.1730, 1.1754, 1.1786, 1.1819

The EUR/USD currency pair’s hourly trend has changed to upward. The price has consolidated above the priority change level. Currently, the price has moved away from the EMA lines, so it is best to look for buy trades after a correction to 1.1642 or 1.1618. Profit targets are 1.1681 and 1.1730.

選擇場景:if the price breaks through the support level of 1.1543 and consolidates below it, the downtrend will likely resume.

新聞動態: 2025.10.16

- Eurozone Trade Balance (m/m) at 12:00 (GMT+3);

- US Philadelphia Fed Manufacturing Index (m/m) at 15:30 (GMT+3);

- Eurozone ECB President Lagarde Speech at 19:00 (GMT+3).

The GBP/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.3319

- 前一收盤價: 1.3400

- 過去一天的變化%: +0.61 %

The latest UK macroeconomic data points to stagnation in the services sector and a continuing decline in consumer spending. At the same time, the slowdown in wage growth gives the Bank of England the opportunity to take a more dovish stance. Market expectations point to a high probability of a rate cut at one of the bank’s upcoming meetings. Political uncertainty is also putting pressure on the currency. The government’s unstable position in parliament and deepening internal divisions over tax and fiscal policy are increasing the vulnerability of the pound. This is compounded by falling business confidence and declining investment activity, raising concerns about the UK’s economic trajectory in the fourth quarter.

交易建議

- 支撐價位: 1.3390, 1.3373, 1.3335, 1.3281

- 阻力價位: 1.3464, 1.3486

In terms of technical analysis, the trend on the currency pair GBP/USD has shifted to an upward trend. The price has firmly settled above the priority level change. Buy trades can be sought from 1.3391 or 1.3373. EMA lines are also suitable. Profit targets are the resistance level of 1.3464 and above. There are currently no optimal entry points for selling.

選擇場景:if the price breaks through the support level of 1.3253 and consolidates below it, the downtrend will likely resume.

新聞動態: 2025.10.16

- UK GDP (m/m) at 09:00 (GMT+3);

- UK Industrial Production (m/m) at 09:00 (GMT+3);

- UK Trade Balance (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

貨幣對的技術指標:

- 前一開盤價: 151.73

- 前一收盤價: 151.03

- 過去一天的變化%: -0.46 %

On Thursday, the yen strengthened above 151 per dollar, rising for the third day in a row. Traders who had previously opened short positions on the yen in anticipation that Takai would pursue aggressive fiscal policy and continue monetary easing have since changed their positions amid growing political uncertainty. Meanwhile, Bank of Japan board member Naoki Tamura warned against tightening policy too quickly, stressing the need to avoid a return to price and wage stagnation.

交易建議

- 支撐價位: 149.95, 148.83, 147.81

- 阻力價位: 151.18, 151.68, 152.50, 153.28, 154.80

From a technical point of view, the medium-term trend of the USD/JPY is upward, but the price is heading towards the priority change level of 149.95. At the moment, the price has settled below 151.18, and sellers are actively defending this level. If the price settles above 151.18, it will trigger growth to 151.68. However, as long as the price remains below 151.18, intraday sell trades can be sought up to the priority change level.

選擇場景:if the price breaks through the support level of 149.95 and consolidates below it, the downtrend will likely resume.

今天沒有新聞

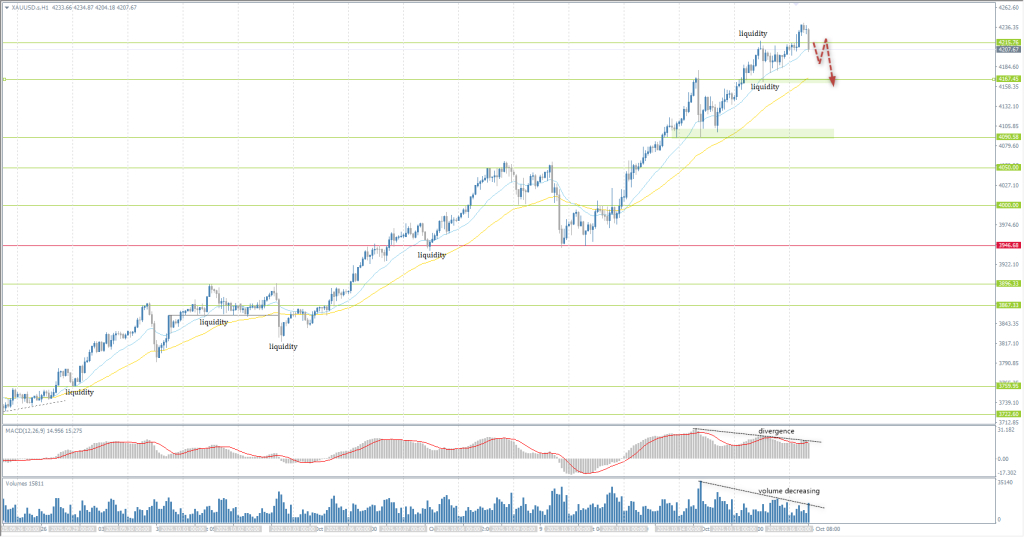

The XAU/USD currency pair (gold)

貨幣對的技術指標:

- 前一開盤價: 4141

- 前一收盤價: 4210

- 過去一天的變化%: +1.67%

On Thursday, gold prices rose above $4230 per ounce, continuing their growth to a new record high, driven by demand for safe-haven assets and growing expectations of monetary policy easing in the US. Recent comments by Fed Chair Jerome Powell, in which he highlighted signs of a weakening labor market, prompted investors to almost fully price in a 25 basis point rate cut at this month’s meeting and another likely cut in December. Such prospects also put pressure on the dollar, making gold more attractive to foreign buyers

On the trade front, US officials on Wednesday condemned China’s tightening of restrictions on rare earth metal exports, warning that it poses risks to global supply chains and hinting at possible US retaliation. Treasury Secretary Scott Bessent said Washington could also impose export restrictions or import duties on Chinese oil from Russia if agreed with European partners. Meanwhile, the prolonged government shutdown continued to pose risks to the US economy and heighten market jitters.

交易建議

- 支撐價位: 4167, 4090, 4050, 4000, 3944, 3896, 3867, 3820, 3800

- 阻力價位: 4215

From the point of view of technical analysis, the trend on the XAU/USD is bullish. However, given the prolonged divergence on the MACD indicator and the decline in volume at highs, all of these point to an impending correction. Gold needs liquidity for a further rally. The nearest liquidity pool is below 4167. Intraday, sales to this level can be considered, but only with confirmation and with short stop losses, as these will be countertrend trades. For buy deals, it is better to wait for a correction to 4167 or 4090, as it is too high.

選擇場景:if the price breaks the support level of 3946 and consolidates below it, the downtrend will likely resume.

新聞動態: 2025.10.16

- US Philadelphia Fed Manufacturing Index (m/m) at 15:30 (GMT+3).

本文僅反映個人觀點,不應被視為投資建議和/或要約和/或進行金融交易的持續要求和/或擔保和/或對未來事件的預測。