The EUR/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.1778

- 前一收盤價: 1.1771

- 過去一天的變化%: -0.06%

During the shortened holiday week, the euro held above $1.17 amid divergent expectations regarding ECB and Fed monetary policies. At its last meeting, the ECB left rates unchanged for the fourth time and emphasized they will likely remain at current levels, noting that the Eurozone economy has handled US tariffs better than expected. Recent data prompted the ECB to raise its 2025 growth projections from 1.2% to 1.4%. Simultaneously, soft US inflation data boosted expectations for potential Fed rate cuts next year, providing additional support to the single currency. The combination of stable Eurozone economic dynamics and weak US inflationary pressure creates a positive backdrop for the euro in the short term.

交易建議

- 支撐價位: 1.1758, 1.1707, 1.1680, 1.1656, 1.1590, 1.1555, 1.1503

- 阻力價位: 1.1768, 1.1802, 1.1833

The euro price has dipped below 1.1768; it is now crucial for buyers to prevent the price from consolidating below 1.1758. Otherwise, a sharp sell-off to 1.1707 could occur. Traders should adopt a wait-and-see approach. A price consolidation above 1.1768 will open opportunities for renewed buying.

選擇場景:- Trend: Up

- Sup: 1.1758

- Res: 1.1768

- Note: Looking for buys after the price returns above 1.1768. A price move below 1.1758 could trigger a sell-off.

新聞動態: 2025.12.29

- US Pending Home Sales (m/m) at 17:00 (GMT+2). – USD (MED)

The GBP/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.3523

- 前一收盤價: 1.3497

- 過去一天的變化%: -0.19 %

The British pound rose above $1.35, hitting a three-month high, driven by a weakening US dollar and expectations of at least two Fed rate cuts next year, which reduces the yield advantage of the American currency. Bank of England Governor Andrew Bailey stressed that subsequent rate cuts would be moderate, though the market anticipates more aggressive steps. The UK economy shows moderate growth: Q3 GDP increased by 0.1%, meeting expectations, while the outlook for the final quarter remains neutral. Despite this, the pound has shown impressive momentum, strengthening more than 2% this month and about 8% year-to-date, marking its best annual performance against the dollar since 2017.

交易建議

- 支撐價位: 1.3473, 1.3445, 1.3347, 1.3354, 1.3292, 1.3268, 1.3156

- 阻力價位: 1.3526, 1.3586

As expected, the British pound has trended sideways in the 1.3473-1.3526 range, and it will likely remain in this corridor until the end of the year. It is important for traders to evaluate the price reaction at the lower boundary of 1.3473. If buyers show initiative on lower time frames, this will open buying opportunities. There are currently no optimal entry points for selling.

選擇場景:- Trend: Up

- Sup: 1.3473

- Res: 1.3526

- Note: Looking for buy trades from the 1.3473 support level, but with confirmation.

今天沒有新聞

The USD/JPY currency pair

貨幣對的技術指標:

- 前一開盤價: 155.89

- 前一收盤價: 156.56

- 過去一天的變化%: +0.43 %

On Monday, the Japanese yen strengthened past the 156 mark per dollar. Investors scrutinized the minutes from the December meeting, which show the regulator continues to discuss further policy tightening following the recent rate hike to a multi-decade high. Some committee members noted that monetary policy remains loose in real terms and advocated for gradual rate hikes to mitigate inflationary risks. Others emphasized that excessively low rates contribute to yen weakness and rising long-term yields, whereas timely tightening could stabilize the bond market and anchor inflation expectations.

交易建議

- 支撐價位: 156.07, 155.69, 154.92, 154.41, 154.17

- 阻力價位: 156.71, 157.78, 159.47

After testing the 156.71 resistance, the Japanese yen strengthened to the 156.07 support level. A retest of this level is undesirable for buyers, as it would significantly increase the likelihood of a further decline to 155.69. It is important for traders to gauge the price reaction at 156.07. If buyers show initiative again, short-term buy trades can be considered intraday, but with short targets, as the intraday bias today favors sellers.

選擇場景:- Trend: Neutral

- Sup: 156.07

- Res: 156.71

- Note: Considering buys from 156.07 but with a tight stop-loss. There are currently no optimal entry points for selling.

今天沒有新聞

The XAU/USD currency pair (gold)

貨幣對的技術指標:

- 前一開盤價: 4490

- 前一收盤價: 4531

- 過去一天的變化%: +0.91%

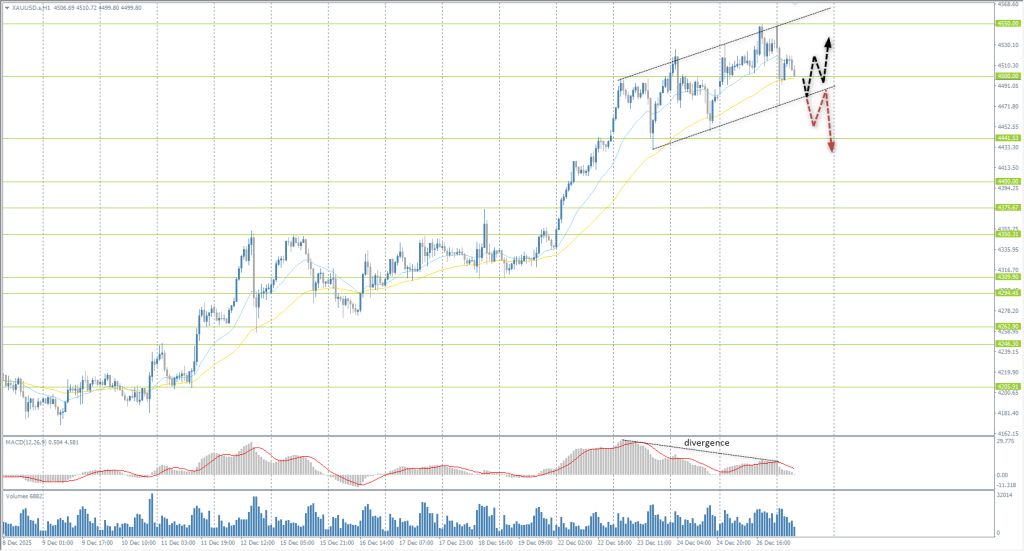

On Monday, gold corrected toward the $4,500 per ounce level but remained near all-time highs amid persistent geopolitical uncertainty and expectations of further US monetary easing. Investors are also focused on the upcoming FOMC minutes, looking for signals regarding the interest rate trajectory, with the market already pricing in two cuts for next year.

交易建議

- 支撐價位: 4500, 4441, 4400, 4375, 4350, 4209

- 阻力價位: 4550

Gold has reached another optional (psychological) level of 4550. This is precisely where buyers began taking profits. A MACD divergence formed since last Wednesday already hinted at a correction. Intraday, buys can be considered from 4500, provided there is a reaction from buyers. A break below the trend line could trigger a wave of selling.

選擇場景:- Trend: Up

- Sup: 4500

- Res: 4550

- Note: Considering buy deals from 4500, but with confirmation. A move lower could trigger a strong sell-off.

新聞動態: 2025.12.29

- US Pending Home Sales (m/m) at 17:00 (GMT+2). – USD (MED)

本文僅反映個人觀點,不應被視為投資建議和/或要約和/或進行金融交易的持續要求和/或擔保和/或對未來事件的預測。