The EUR/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.1685

- 前一收盤價: 1.1675

- 過去一天的變化%: -0.08%

Consumer price inflation in December slowed to 2%, returning exactly to the ECB’s target level and reaching a four-month low. Core inflation also decreased to 2.3% against the expected 2.4%, strengthening the arguments for maintaining the regulator’s dovish rhetoric. In the largest economies of the currency bloc, price pressure either weakened or remained stable, confirming a general slowdown in the inflationary impulse. Against this background, money markets have almost completely ruled out an ECB rate hike scenario until December 2026. This reinforces the consensus that interest rates in the Eurozone are likely to remain unchanged in the medium term, limiting the potential for a euro recovery.

交易建議

- 支撐價位: 1.1675, 1.1659, 1.1590, 1.1555, 1.1503

- 阻力價位: 1.1718, 1.1753, 1.1765, 1.1786, 1.1802, 1.1833

The euro price decreased to 1.1675 against the US dollar. The intraday bias favors sellers, which increases the likelihood of a further decline to the support level of 1.1659. However, since the price is directly in front of the support level, it is recommended to open sell trades only after consolidation below it. If buyers show initiative from 1.1680 and the price consolidates above the EMA, this will shift the intraday bias and open opportunities for buys up to 1.1718.

選擇場景:- Trend: Neutral

- Sup: 1.1675

- Res: 1.1718

- Note: Consider selling after the price consolidates below 1.1675. If buyers show initiative from 1.1675, look for buy trades within the day.

新聞動態: 2026.01.08

- Eurozone Producer Price Index (m/m) at 12:00 (GMT+2); – EUR (MED)

- Eurozone Unemployment Rate (m/m) at 12:00 (GMT+2); – EUR (MED)

- US Trade Balance (m/m) at 15:30 (GMT+2); – USD (MED)

- US Initial Jobless Claims (w/w) at 15:30 (GMT+2); – USD (MED)

The GBP/USD currency pair

貨幣對的技術指標:

- 前一開盤價: 1.3498

- 前一收盤價: 1.3457

- 過去一天的變化%: -0.30 %

Investors have increased expectations for Bank of England policy easing in the coming months: markets are pricing in one to two 25-bps rate cuts by the end of the year. In December, the regulator already lowered the rate to 3.75% with a narrow majority, highlighting continued caution amid inflation that has slowed but still exceeds the 2% target. Bank of England Governor Andrew Bailey made it clear that further steps are likely to be gradual rather than sharp. The UK Debt Management Office announced the cancellation of a £607.4 million payment on government bonds maturing in January 2027 due to a targeted donation, reflecting the government’s ongoing efforts to restrain borrowing and manage public debt.

交易建議

- 支撐價位: 1.3437, 1.3402, 1.3347, 1.3354, 1.3292

- 阻力價位: 1.3503, 1.3526, 1.3586

The British pound is also correcting. The price is currently aiming to test the support level of 1.3437. Here, it is important to assess price action: if buyers show initiative, intraday buy trades can be considered with a target up to 1.3503; if sellers can push through the level, there is a high probability of a decline to 1.3402.

選擇場景:- Trend: Neutral

- Sup: 1.3437

- Res: 1.3503

- Note: Consider buys from support at 1.3437, but with confirmation. A breakout of the level will open the way to 1.3402.

今天沒有新聞

The USD/JPY currency pair

貨幣對的技術指標:

- 前一開盤價: 156.56

- 前一收盤價: 156.76

- 過去一天的變化%: +0.10 %

Nominal wage growth in Japan slowed sharply in November 2025 to 0.5% year-on-year, down from 2.5% the previous month and significantly below market expectations. This was the weakest figure in nearly four years, largely due to a 17% plunge in one-off bonus payments. Authorities note that November data is traditionally distorted because a significant portion of winter bonuses has not yet been reflected in the statistics, so the actual income level may be higher. At the same time, real wages, adjusted for inflation, contracted by 2.8% year-on-year – the sharpest drop since January. The widening gap between wages and inflation complicates the task for the Bank of Japan, which has repeatedly emphasized that further monetary tightening is only possible with sustainable and broad-based earnings growth.

交易建議

- 支撐價位: 156.56, 156.26, 155.69, 154.92, 154.41, 154.17

- 阻力價位: 156.95, 157.28, 157.78, 159.47

The Japanese yen has once again consolidated above the 156.56 level. It is important for buyers to hold this level for further growth. Otherwise, a breakout of this level could trigger a sell-off to 156.26. Therefore, today we are evaluating the price reaction to the 156.56 support level.

選擇場景:- Trend: Neutral

- Sup: 156.56

- Res: 156.95

- Note: Look for buys from 156.56, but with confirmation. A breakout of this level will trigger Yen strengthening to 156.26.

新聞動態: 2026.01.08

- Japan Average Cash Earnings (m/m) at 01:30 (GMT+2). – JPY (MED)

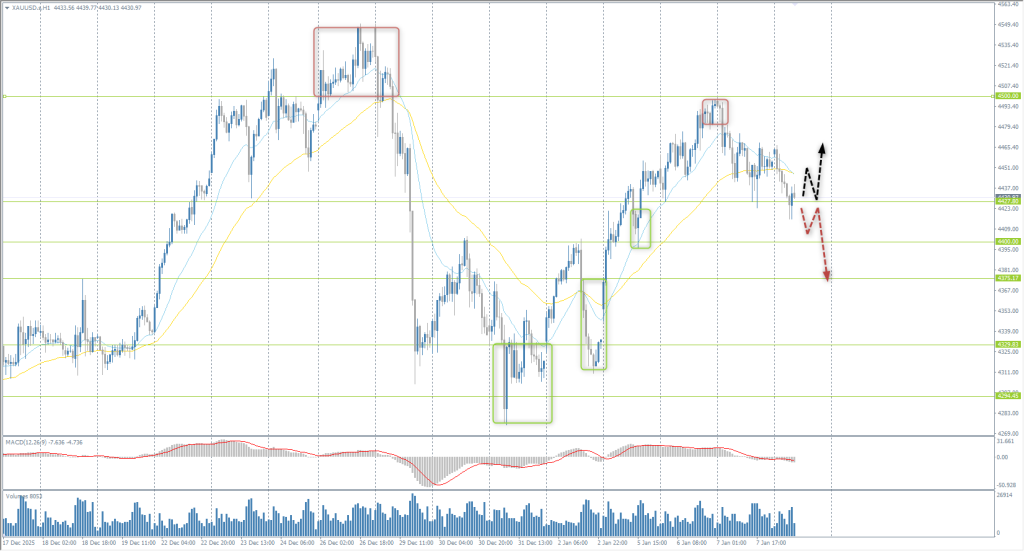

The XAU/USD currency pair (gold)

貨幣對的技術指標:

- 前一開盤價: 4496

- 前一收盤價: 4455

- 過去一天的變化%: -0.92 %

Gold corrected on Wednesday amid profit-taking after a sharp rise and a shift in investor focus from geopolitics to US macroeconomic data. Tensions surrounding Venezuela partially eased following Donald Trump’s statements about possible oil supplies to the US, although the overall geopolitical backdrop remains unstable due to tough rhetoric from Washington, including the topic of Greenland. US macro statistics were mixed: the ADP report showed weaker-than-expected private sector employment growth and a drop in job openings to a one-year low, while the ISM Services PMI unexpectedly showed an acceleration in activity. Market attention is now focused on Friday’s Non-Farm Payrolls report, which could clarify the Fed’s policy outlook. Meanwhile, markets are still pricing in two rate cuts this year, and Fed officials allow for a more dovish scenario if the labor market situation worsens.

交易建議

- 支撐價位: 4427, 4400, 4375, 4329, 4294

- 阻力價位: 4500, 4550

Gold has corrected to the support level of 4427. Here we evaluate the price reaction. If buyers show initiative, intraday buy trades up to 4450 and higher can be considered. If buyers do not show a reaction at 4427, we will likely see a decline to 4400 or even 4375.

選擇場景:- Trend: Up

- Sup: 4427

- Res: 4500

- Note: Buy trades should be sought from the 4427 support level, but with confirmation. A breakout of the level will trigger a sell-off to 4400 or lower.

新聞動態: 2026.01.08

- US Trade Balance (m/m) at 15:30 (GMT+2); – USD (MED)

- US Initial Jobless Claims (w/w) at 15:30 (GMT+2); – USD (MED)

本文僅反映個人觀點,不應被視為投資建議和/或要約和/或進行金融交易的持續要求和/或擔保和/或對未來事件的預測。