The EUR/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.1349

- Prev. Cerrar: 1.1441

- % cambio. en el último día: +0.81 %

Activity in the US manufacturing sector declined more than expected in May, reflecting the negative impact of ongoing trade uncertainty under the Trump administration. Trade problems intensified after Trump threatened to double tariffs on steel imports to 50%, drawing sharp criticism from major trading partners. Despite these obstacles, the dollar strengthened, especially against the yen, the Australian dollar, and the euro. On Tuesday, investors are awaiting fresh economic data, including job openings, durable goods orders, and factory orders, to gain further insight into the state of the US economy.

Recomendaciones de trading

- Niveles de soporte: 1.1390, 1.1324, 1.1296, 1.1269, 1.1220, 1.1200

- Niveles de resistencia: 1.1456, 1.1483

The EUR/USD currency pair’s hourly trend has changed to upward. The price has consolidated above the priority level change and reached the resistance level of 1.1456. The MACD divergence indicates a technical correction. For buy deals, traders can consider the EMA lines or the demand zone near the support level of 1.1390. There are currently no optimal entry points for sales.

Escenario alternativo:if the price breaks through the support level of 1.1323 and consolidates below it, the downward trend will likely resume.

Noticias para: 2025.06.03

- Eurozone Consumer Price Index (m/m) at 12:00 (GMT+3);

- Eurozone Unemployment Rate (m/m) at 12:00 (GMT+3);

- US JOLTs Job Openings (m/m) at 17:00 (GMT+3).

The GBP/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.3461

- Prev. Cerrar: 1.3545

- % cambio. en el último día: +0.62 %

The British pound rose to $1.355, approaching a three-year high since May 26, as investors welcomed stronger UK economic data and a new defense plan. In addition, the dollar weakened after President Trump announced plans to double tariffs on steel and aluminum, and China responded to trade accusations. In terms of data, the UK manufacturing sector contracted less than expected in May, and house prices rose 3.5% year-on-year, helped by buyers rushing to take advantage of tax changes. Investors now expect only a small chance of further interest rate cuts by the Bank of England this year.

Recomendaciones de trading

- Niveles de soporte: 1.3512, 1.3454, 1.3435, 1.3390, 1.3333, 1.3291, 1.3121

- Niveles de resistencia: 1.3556, 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly is bullish. The British pound has reached the resistance level of 1.3556, where there has been some closing of previously opened positions. There are currently no prerequisites for a reversal of the movement. For buy deals, the support level of 1.3512 can be considered, but with confirmation. It is very important for buyers to hold this level, as an impulsive breakdown of this level could trigger a sharp sell-off to 1.3454.

Escenario alternativo:if the price breaks the support level of 1.3390 and consolidates below it, the downtrend will likely resume.

No hay noticias para hoy

The USD/JPY currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 143.83

- Prev. Cerrar: 142.70

- % cambio. en el último día: -0.79 %

The Japanese yen weakened to 143 per dollar on Tuesday, interrupting a three-day winning streak, despite Bank of Japan Governor Kazuo Ueda saying he was ready to raise interest rates if economic and price dynamics accelerated. Ueda emphasized that Japan’s economy is undergoing a moderate recovery, supported by steady business sentiment and improving corporate profits, despite some pockets of weakness.

Recomendaciones de trading

- Niveles de soporte: 142.62, 142.19

- Niveles de resistencia: 143.64, 144.44, 145.45, 146.27, 146.85, 148.28

From a technical point of view, the medium-term trend of the USD/JPY has changed to downward. The Japanese yen has consolidated below the priority change level. However, buyers reacted sharply to the support level of 142.62. Given the MACD divergence, the price may correct to 143.64. However, even in this scenario, it is better to consider sell trades in line with the trend.

Escenario alternativo:if the price breaks through the resistance level of 144.44 and consolidates above it, the uptrend will likely resume.

No hay noticias para hoy

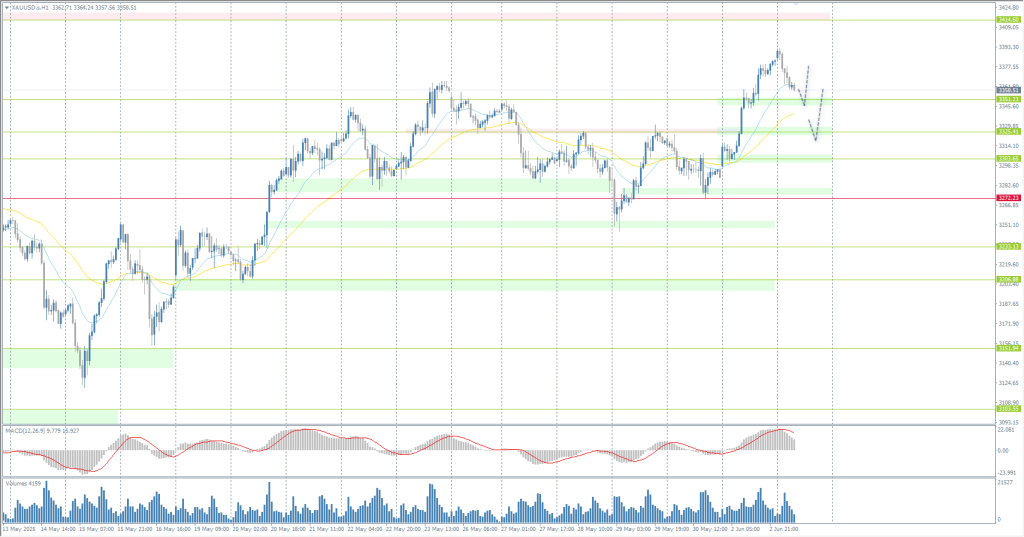

The XAU/USD currency pair (gold)

Indicadores técnicos del par de divisas:

- Prev. Abrir: 3298

- Prev. Cerrar: 3382

- % cambio. en el último día: +2.54 %

On Monday, the price of bullion rose by 2.8%, the strongest one-day gain since May 6, as investors reacted to escalating trade and geopolitical tensions. US President Donald Trump threatened to double tariffs on steel and aluminum starting Wednesday, further exacerbating relations with trading partners. At the same time, tensions between Washington and Beijing intensified after Trump said China had violated its trade agreement with the US. Meanwhile, Russia and Ukraine held a second round of direct peace talks on Monday after a significant escalation of hostilities, but failed to make significant progress.

Recomendaciones de trading

- Niveles de soporte: 3351, 3325, 3303, 3276, 3248

- Niveles de resistencia: 3414

From the point of view of technical analysis, the trend on the XAU/USD is bullish. There are no signs of a reversal. Any pullback should be used to find optimal entry points for buying. Support levels 3351 and 3325 are best suited for longs.

Escenario alternativo:if the price breaks and consolidates below the support level of 3272, the downtrend will likely resume.

Noticias para: 2025.06.03

- US JOLTs Job Openings (m/m) at 17:00 (GMT+3).

Este artículo refleja una opinión personal y no debe interpretarse como un consejo de inversión, y/o una oferta, y/o una solicitud persistente para realizar transacciones financieras, y/o una garantía, y/o una previsión de eventos futuros.