The EUR/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.1721

- Prev. Cerrar: 1.1719

- % cambio. en el último día: -0.02 %

Most Fed officials believe that a cut in the federal funds rate would be appropriate at some point this year, noting that upward pressure on inflation from tariffs may be temporary or moderate, as shown by the minutes of the last FOMC meeting in June. However, while some participants suggested lowering the rate at the next meeting, others argued that there should be no reduction this year. Meanwhile, policymakers emphasized that uncertainty about the outlook had increased due to trade policy, other government measures, and geopolitical risks, but overall uncertainty had decreased compared to the previous meeting. The Fed left the federal funds rate unchanged at 4.25-4.50% at its fourth consecutive meeting in June 2025, awaiting greater clarity on the outlook for inflation and economic activity.

Recomendaciones de trading

- Niveles de soporte: 1.1686, 1.1651, 1.1642, 1.1581, 1.1518

- Niveles de resistencia: 1.1762, 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend is bullish. The price tested the priority change level three times, and finally, buyers managed to push the price back and restore the bullish narrative within the day. Currently, the price is heading towards testing liquidity above 1.1762. Intraday, we can look for buy deals from the EMA lines or the intermediate level of 1.1727. For sale deals, you can consider 1.1762, but only with confirmation in the form of a seller’s initiative.

Escenario alternativo:if the price breaks through the support level of 1.1686 and consolidates below it, the downward trend is likely to resume.

Noticias para: 2025.07.10

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3).

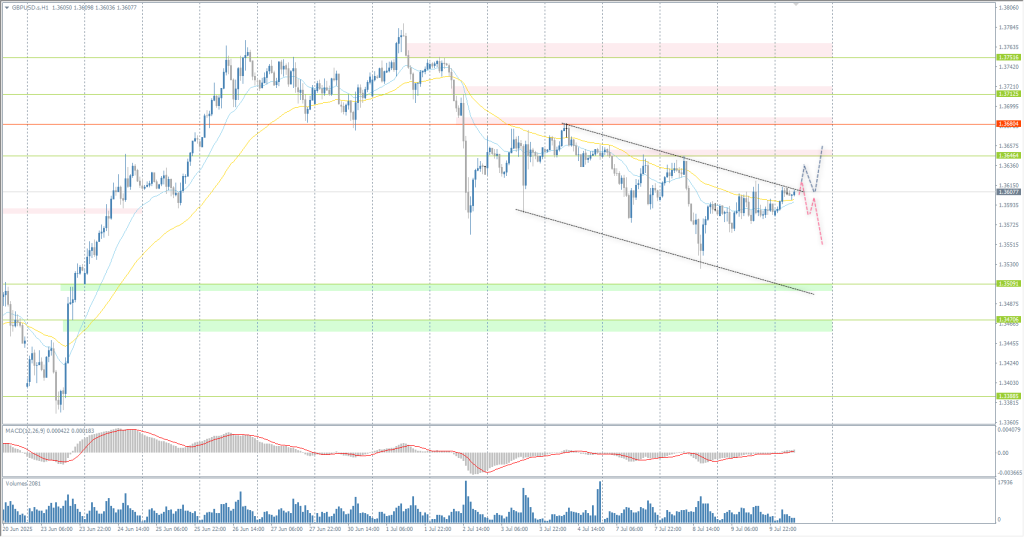

The GBP/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.3588

- Prev. Cerrar: 1.3587

- % cambio. en el último día: -0.01 %

The latest FPC (Financial Policy Committee) minutes revealed that the risks and uncertainties associated with geopolitical tensions, global trade and financial market fragmentation, and pressure on sovereign debt markets remain high. However, UK households and corporate borrowers remain broadly resilient. The UK banking system remains well-positioned to support households and businesses, even if economic, financial, and business conditions deteriorate significantly more than expected.

Recomendaciones de trading

- Niveles de soporte: 1.3509, 1.3471, 1.3450, 1.3388

- Niveles de resistencia: 1.3646, 1.3680, 1.3712, 1.3752, 1.3770, 1.4000

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The price is currently trading near the EMA lines, just above the downward trend line. If sellers react here, traders may consider selling with targets at the weekly low. If the price consolidates above the downward channel, an impulsive rise to the resistance level of 1.3646 is possible.

Escenario alternativo:if the price breaks through the resistance level of 1.3680 and consolidates above it, the uptrend will likely resume.

Noticias para: 2025.07.10

There is no news feed for today.

The USD/JPY currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 146.55

- Prev. Cerrar: 146.32

- % cambio. en el último día: -0.15 %

On Thursday, the Japanese yen strengthened to around 146 per dollar, continuing the rise that began in the previous session amid a weakening US dollar, driven by a sharp decline in Treasury bond yields. Global trade tensions also contributed to market caution, as US President Donald Trump announced a 50% tariff on imports from Brazil starting August 1, citing unfair trade practices. Meanwhile, trade negotiations between the US and Japan have stalled. Trump recently imposed a 25% tariff on Japanese goods, which will also take effect on August 1, and ruled out any extension of the deadline. A local think tank predicts that the new tariffs could reduce Japan’s GDP by 0.8% in 2025 and by 1.9% cumulatively through 2029.

Recomendaciones de trading

- Niveles de soporte: 145.88, 145.28, 144.18

- Niveles de resistencia: 146.51, 147.15, 148.28

From a technical perspective, the medium-term trend of the USD/JPY is bullish. As expected, the Japanese yen corrected to the nearest support levels. Currently, the support level of 145.88 can be considered for buy deals in continuation of the trend. It is crucial for buyers not to allow the price to consolidate below 145.88; otherwise, a sharp sell-off to 145.28 may occur.

Escenario alternativo:if the price breaks through the support level of 144.18 and consolidates below it, the downward trend is likely to resume.

Noticias para: 2025.07.10

- Japan Producer Price Index (m/m) at 02:50 (GMT+3).

The XAU/USD currency pair (gold)

Indicadores técnicos del par de divisas:

- Prev. Abrir: 3303

- Prev. Cerrar: 3314

- % cambio. en el último día: +0.33 %

On Thursday, the price of gold rose to around $3,320 per ounce, continuing the growth that began in the previous session, thanks to the weakening of the dollar. Investors continued to monitor developments in the trade sector and analyze the latest FOMC meeting minutes. Markets remain focused on President Trump’s wave of tariff demands, with Brazil becoming the latest country to face high duties after earlier threats against copper imports and other countries, heightening fears of broader trade turmoil.

Recomendaciones de trading

- Niveles de soporte: 3306, 3291, 3274

- Niveles de resistencia: 3329, 3345, 3357, 3393, 3405, 3444, 3500

From a technical analysis perspective, the trend on the XAU/USD is downward. However, the intraday bias is in favor of buyers. The price is now attempting to test liquidity above the resistance level of 3329, where it is crucial to assess the price action. If sellers take the initiative here, it will open up opportunities for sell trades to the support level of 3306 and below. If the price consolidates above 3329, it will open the way to the next resistance level of 3345.

Escenario alternativo:if the price breaks through and consolidates above the resistance level of 3357, the upward trend will likely resume.

Noticias para: 2025.07.10

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3).

Este artículo refleja una opinión personal y no debe interpretarse como un consejo de inversión, y/o una oferta, y/o una solicitud persistente para realizar transacciones financieras, y/o una garantía, y/o una previsión de eventos futuros.