The EUR/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.1752

- Prev. Cerrar: 1.1588

- % cambio. en el último día: -1.41 %

The euro weakened to $1.16, its lowest level in a week, under pressure from the overall strengthening of the dollar as traders reacted to the recently announced trade agreement between the US and the EU. Some goods, such as aircraft components and certain chemicals, will be exempt from duties, while duties on cars will be reduced to 15%. Many in Europe consider the agreement unfavorable and punitive towards the EU. Meanwhile, attention in the monetary policy arena is shifting to the Federal Reserve’s decision, which is expected in the middle of the week.

Recomendaciones de trading

- Niveles de soporte: 1.1557, 1.1518

- Niveles de resistencia: 1.1612, 1.1710, 1.1770

The EUR/USD currency pair’s hourly trend has changed to downward. On Monday, the euro was sold off amid a rise in the Dollar Index. The price has consolidated below the priority change level and is trading well below the EMA lines. Selling here is not recommended, as there is a deviation from the average values. For sell deals, it is best to wait for a pullback to the resistance level of 1.1612, but with confirmation. At the moment, the price is trying to test liquidity below 1.1557. Consolidation of the price above 1.1612 could trigger a sharp rise in the price.

Escenario alternativo:if the price breaks through the resistance level of 1.1770 and consolidates above it, the uptrend will likely resume.

Noticias para: 2025.07.29

- US CB Consumer Confidence (m/m) at 17:00 (GMT+3);

- US JOLTs Job Openings (m/m) at 17:00 (GMT+3).

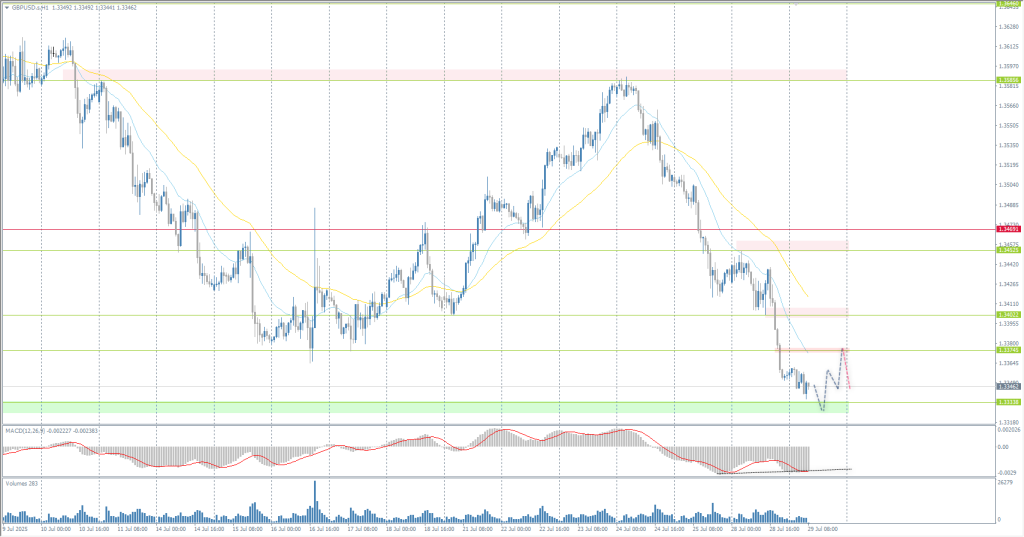

The GBP/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.3428

- Prev. Cerrar: 1.3355

- % cambio. en el último día: -0.54 %

The British pound fell to $1.342, retreating from its recent two-week high, as weak UK data shifted the market’s focus from inflation to slowing growth, while trade optimism supported the US currency. Although warm weather boosted food sales, overall economic momentum remains fragile, and the latest PMI data disappointed. This reinforced expectations that the Bank of England may cut interest rates by 25 basis points in August, with another cut likely by the end of the year as it shifts its focus to supporting growth.

Recomendaciones de trading

- Niveles de soporte: 1.3333, 1.3252

- Niveles de resistencia: 1.3375, 1.3402, 1.3452, 1.3470

In terms of technical analysis, the trend on the currency pair GBP/USD has shifted to downward. As in the case of the euro, the strengthening of the US dollar has also put pressure on the British currency. The price has settled below the priority change level and deviated from the moving averages. For sales, you can consider the EMA lines or the resistance level of 1.3374, but with confirmation. For buy deals, you can consider the liquidity pocket below 1.3333, but also with confirmation in the form of a reaction from buyers.

Escenario alternativo:if the price breaks through the resistance level of 1.3470 and consolidates above it, the uptrend will likely resume.

No hay noticias para hoy

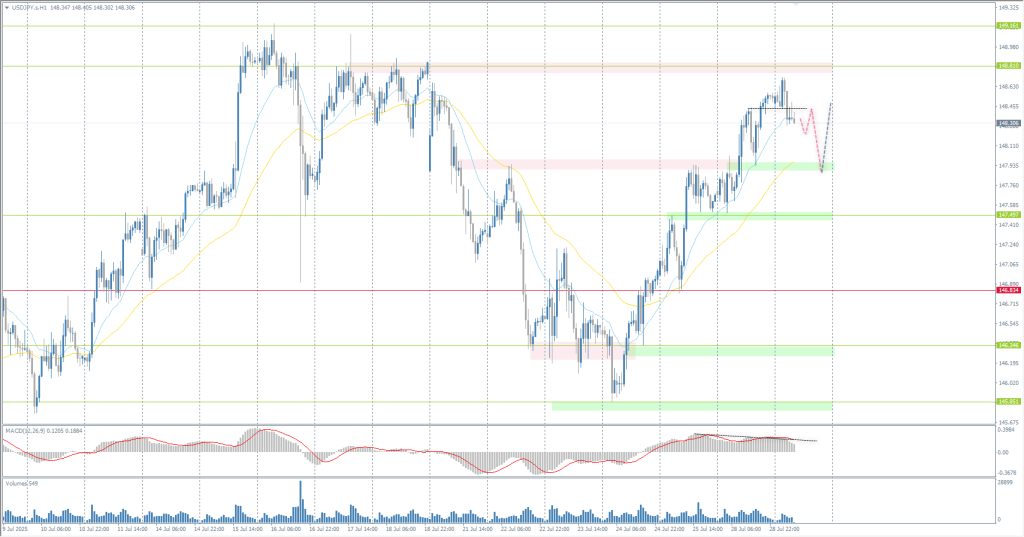

The USD/JPY currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 147.71

- Prev. Cerrar: 148.53

- % cambio. en el último día: +0.55 %

The Japanese yen fluctuated around 148.3 per dollar on Tuesday, remaining close to its weekly low after a sharp three-day decline under pressure from the overall strengthening of the dollar. The US dollar remained supported as recent global trade agreements are seen as disproportionately beneficial to the US economy. US President Donald Trump also reiterated on Monday that countries unwilling to negotiate separate trade agreements could soon face tariffs of 15% to 20%, well above the 10% base rate introduced in April. On the domestic front, the Bank of Japan will announce its latest monetary policy decision this week. Although rates are widely expected to remain unchanged amid ongoing uncertainty over tariffs, the Central Bank is likely to revise its inflation expectations upward in its quarterly review.

Recomendaciones de trading

- Niveles de soporte: 147.94, 147.50, 146.83

- Niveles de resistencia: 148.81, 149.16

From a technical point of view, the medium-term trend of the USD/JPY has changed to upward. The price has firmly consolidated above the priority change level. At the moment, the price is trying to test the liquidity pocket above 148.81. But first, there is a high probability of a corrective wave to 147.95. It is appropriate to look for buys from this level, but with confirmation. Intraday, you can look for sells to 147.95, but with a short stop loss, as this will be a countertrend position.

Escenario alternativo:if the price breaks through the support level of 146.83 and consolidates below it, the downtrend will likely resume.

No hay noticias para hoy

The XAU/USD currency pair (gold)

Indicadores técnicos del par de divisas:

- Prev. Abrir: 3324

- Prev. Cerrar: 3314

- % cambio. en el último día: -0.30 %

On Tuesday, the price of gold fluctuated around $3,310 per ounce, close to a three-week low, as signs of easing trade tensions and a strengthening US dollar reduced the metal’s appeal. Investors are closely watching the ongoing negotiations between the US and China amid expectations of a 90-day extension of the tariff delay, which expires on August 12. Negotiations with other major trading partners, including Canada and South Korea, are still ongoing. Meanwhile, the US Federal Reserve is scheduled to hold a meeting this week and is expected to leave interest rates unchanged, although markets continue to price in a possible rate cut in September.

Recomendaciones de trading

- Niveles de soporte: 3296

- Niveles de resistencia: 3323, 3351, 3374, 3401, 3438

From the point of view of technical analysis, the trend on the XAU/USD has changed to downward. The price has firmly settled below the priority change level. Currently, the price is forming a flat accumulation below the resistance level of 3323. A test plus reaction of sellers to this level will open up opportunities for selling down to 3296. If the price consolidates impulsively above 3323, this will trigger a price increase, as sellers will be locked below 3323 and their positions will be distributed above the resistance levels.

Escenario alternativo:if the price breaks through the resistance level of 1.3374 and consolidates above it, the uptrend will likely resume.

Noticias para: 2025.07.29

- US CB Consumer Confidence (m/m) at 17:00 (GMT+3);

- US JOLTs Job Openings (m/m) at 17:00 (GMT+3).

Este artículo refleja una opinión personal y no debe interpretarse como un consejo de inversión, y/o una oferta, y/o una solicitud persistente para realizar transacciones financieras, y/o una garantía, y/o una previsión de eventos futuros.