The EUR/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.1674

- Prev. Cerrar: 1.1705

- % cambio. en el último día: +0.26 %

The euro gained momentum, rising above $1.171, its highest level in nearly three weeks, and continued its second session of growth amid the dollar’s weakening to its lowest level since late July. US inflation data fueled expectations that the Federal Reserve may cut rates in September, which supported risk sentiment around the world. In Europe, the ECB ended its easing cycle in July after eight cuts over the past year, bringing borrowing costs to their lowest level since November 2022, although some believe another cut is possible before the end of the year. However, trade risks remain, as the EU faces 15% tariffs on many exports to the US.

Recomendaciones de trading

- Niveles de soporte: 1.1692, 1.1629, 1.1589, 1.1528, 1.1485, 1.1375, 1.1313

- Niveles de resistencia: 1.1719, 1.1770

The EUR/USD currency pair’s hourly trend is bullish. The euro continues to rally. Yesterday, buyers broke through the resistance level of 1.1692, and now the price is forming a narrow flat with boundaries of 1.1692–1.1719. There is a partial fixation of previously opened purchases, which is confirmed by the MACD divergence. It is important for traders to assess the price action at the support level of 1.1692. If buyers react here, you can consider buying trades. Consolidation below 1.1692 could trigger a corrective wave to 1.1637.

Escenario alternativo:if the price breaks the support level of 1.1590 and consolidates below it, the downtrend will likely resume.

Noticias para: 2025.08.14

- Eurozone Employment Change (m/m) at 12:00 (GMT+3);

- Eurozone Industrial Production (m/m) at 12:00 (GMT+3);

- Eurozone GDP (q/q) at 12:00 (GMT+3);

- US Producer Price Index (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3).

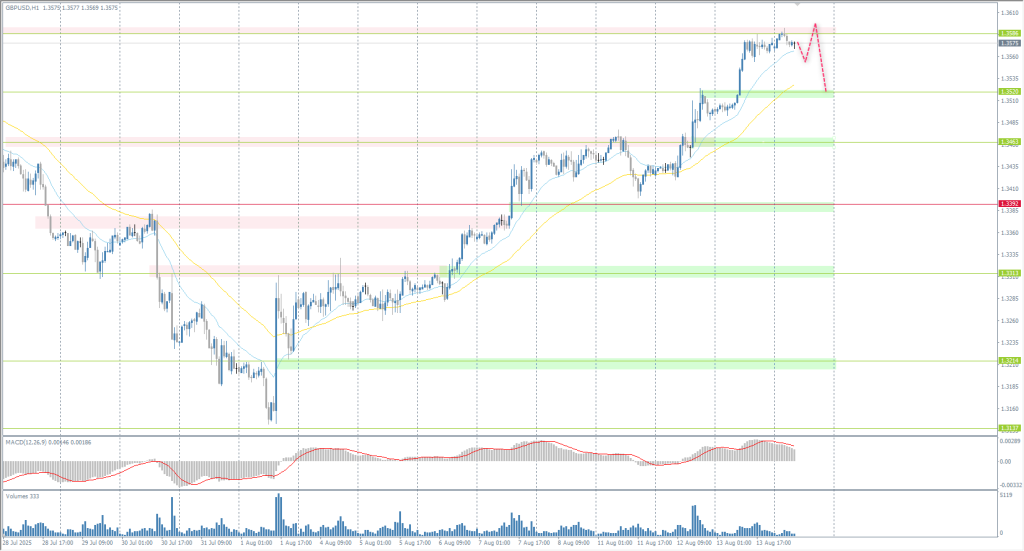

The GBP/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.3500

- Prev. Cerrar: 1.3575

- % cambio. en el último día: +0.55 %

The British pound rose to $1.3580, hitting a three-week high, after UK employment data showed a smaller-than-expected decline in jobs in July, easing concerns about the state of the economy. The number of jobs fell by only 8,000, well below expectations of 20,000, and data for previous months was revised downward, suggesting that the labor market is holding up. Investors are now focusing on the second-quarter GDP, which is expected to show growth of 0.1%.

Recomendaciones de trading

- Niveles de soporte: 1.3520, 1.3462, 1.3390, 1.3313, 1.3214, 1.3137

- Niveles de resistencia: 1.3586

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. The British pound, like the euro, continues to strengthen against the US dollar. The price has reached the resistance level of 1.3586, where we are again seeing partial fixation of previously opened purchases. Given the MACD divergence, a correction may begin here. It is worth being very cautious with buy deals. Intraday, sales up to 1.3520 can be considered.

Escenario alternativo:if the price breaks through the support level of 1.3392 and consolidates below it, the downward trend will likely resume.

Noticias para: 2025.08.14

- UK GDP (q/q) at 09:00 (GMT+3);

- UK Industrial Production (m/m) at 09:00 (GMT+3);

- UK Manufacturing Production (m/m) at 09:00 (GMT+3);

- UK Trade Balance (m/m) at 09:00 (GMT+3).

The USD/JPY currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 147.79

- Prev. Cerrar: 147.37

- % cambio. en el último día: -0.28 %

On Thursday, the Japanese yen strengthened to around 146.5 per dollar, its highest level in three weeks, as growing expectations of a Federal Reserve rate cut this year put pressure on the dollar. Softer US inflation data suggests that President Donald Trump’s tariffs are not adding to price pressures, while signs of a cooling labor market have reinforced expectations of monetary policy easing. On the domestic front, the Bank of Japan is facing pressure to abandon measures to combat inflation linked to domestic demand and wage growth, which are limiting further policy tightening. Governor Kazuo Ueda remains cautious, noting that «core inflation» remains below the Bank of Japan’s 2% target.

Recomendaciones de trading

- Niveles de soporte: 146.35

- Niveles de resistencia: 146.74, 147.51, 148.52, 149.18, 150.34

From a technical point of view, the medium-term trend of the USD/JPY is bearish. The Japanese yen has reached the support level of 146.35. Buyers’ reaction is weak, which increases the likelihood of a further decline. Sell trades can be considered from 146.74, but with confirmation. There are no optimal entry points for buy deals at the moment.

Escenario alternativo:if the price breaks through the resistance level of 148.53 and consolidates above it, the uptrend will likely resume.

No hay noticias para hoy

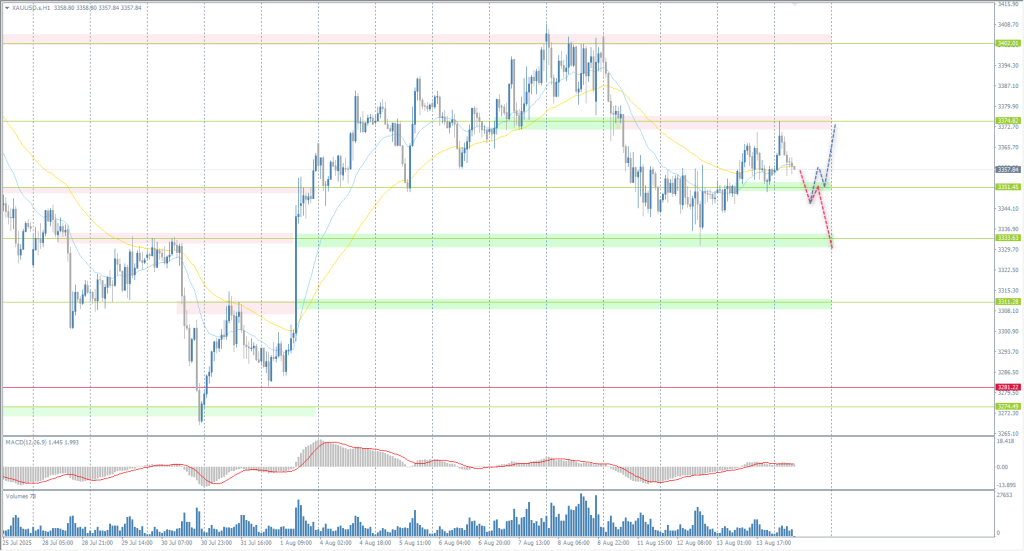

The XAU/USD currency pair (gold)

Indicadores técnicos del par de divisas:

- Prev. Abrir: 3349

- Prev. Cerrar: 3356

- % cambio. en el último día: +0.20 %

On Thursday, gold prices rose to $3,370 per ounce, marking the third consecutive increase, as traders increased their bets on the US Federal Reserve resuming interest rate cuts. The latest US Consumer Price Index report eased concerns about inflation caused by tariffs, while signs of a cooling labor market added to the case for further easing. Markets are almost certain of a 25 basis point cut in September, with some positioning for a more significant 50 basis point cut. Treasury Secretary Scott Bessent also called for several cuts, suggesting the Fed start with a half-percentage point reduction. In addition to rate expectations, gold received support from geopolitical risks ahead of Friday’s meeting between US President Donald Trump and Russian President Vladimir Putin.

Recomendaciones de trading

- Niveles de soporte: 3351, 3333, 3311, 3281

- Niveles de resistencia: 3374, 3402, 3433

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold reached the resistance level of 3374, where sellers reacted. Currently, the price is heading towards the support level of 3351, where it is important to assess the price action. If buyers react here, you can consider buying trades. A breakdown and consolidation below this level could trigger a sell-off to 3333

Escenario alternativo:if the price breaks the support level of 3281 and consolidates below it, the downtrend will likely resume.

Noticias para: 2025.08.14

- US Producer Price Index (m/m) at 15:30 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3).

Este artículo refleja una opinión personal y no debe interpretarse como un consejo de inversión, y/o una oferta, y/o una solicitud persistente para realizar transacciones financieras, y/o una garantía, y/o una previsión de eventos futuros.