The EUR/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.1753

- Prev. Cerrar: 1.1794

- % cambio. en el último día: +0.35%

EUR/USD rose yesterday amid a weakening dollar and supportive comments from ECB officials. Yannis Stournaras emphasized that the bank is in a «good position» but remains flexible for potential policy adjustments. Gediminas Šimkus noted that rates are near neutral levels and that while economic growth remains weak, it has improved. Peter Kažimír added that the ECB is satisfied with current rates but is considering risks, including tariffs and the Russian invasion of Ukraine.

Recomendaciones de trading

- Niveles de soporte: 1.1768, 1.1707, 1.1680, 1.1656, 1.1590, 1.1555, 1.1503

- Niveles de resistencia: 1.1802, 1.1833

The euro reached the 1.1802 resistance level, where profit-taking on previously opened positions is currently observed. It is highly probable that the price will remain flat within the 1.1768–1.1802 range until the end of the year due to reduced volatility during the winter holidays. Trading for the euro will be closed on Thursday and Friday. Intraday sell trades toward 1.1768 can be considered today.

Escenario alternativo:- Trend: Up

- Sup: 1.1768

- Res: 1.1802

- Note: Considering sell deals from 1.1802 with a target of 1.1768.

Noticias para: 2025.12.24

- US Initial Jobless Claims (w/w) at 15:30 (GMT+2). – USD (MED)

The GBP/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.3456

- Prev. Cerrar: 1.3516

- % cambio. en el último día: +0.44 %

GBP/USD is trading near 1.3510, strengthening on expectations of a gradual policy easing by the Bank of England in 2026. Last week, the BoE rate was cut to 3.75%, but the central bank indicated a high threshold for further cuts due to persistent inflation. Markets are pricing in at least one rate cut in the first half of the year, with a second cut at roughly 50% probability. A strong US GDP, growing at 4.3% YoY in Q3, above the 3.3% expectations, may act as a limiting factor for the pound.

Recomendaciones de trading

- Niveles de soporte: 1.3473, 1.3445, 1.3347, 1.3354, 1.3292, 1.3268, 1.3156

- Niveles de resistencia: 1.3526, 1.3586

The British pound has reached the 1.3526 resistance level, where profit-taking is occurring. The price is likely to enter a flat range between 1.3473 and 1.3526 until the end of the year due to low holiday volatility. GBP trading will be closed on Thursday and Friday. Intraday sell trades toward 1.3473 can be considered today.

Escenario alternativo:- Trend: Up

- Sup: 1.3473

- Res: 1.3526

- Note: Looking for sell deals into a correction toward 1.3473.

No hay noticias para hoy

The USD/JPY currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 157.01

- Prev. Cerrar: 156.20

- % cambio. en el último día: -0.52 %

On Wednesday, the yen strengthened to 156.7 per dollar, extending its rally for a third consecutive session amid persistent expectations of potential government intervention. Comments from Finance Minister Katayama regarding Tokyo’s readiness to curb excessive exchange rate fluctuations helped stop the currency’s depreciation, with year-end low liquidity heightening the risk of official measures. Additional support came from the BoJ October meeting minutes, which revealed discussions on further rate hikes toward a neutral level, despite Governor Ueda’s recent post-hike statements being perceived as relatively dovish.

Recomendaciones de trading

- Niveles de soporte: 155.69, 154.92, 154.41, 154.17

- Niveles de resistencia: 156.71, 157.78, 159.47

The Japanese yen is trading near the 155.69 support level. A divergence has formed on the MACD indicator, suggesting a likely upward bounce in the coming days. Intraday buy trades can be considered, but with a tight stop-loss. There are currently no optimal entry points for sells.

Escenario alternativo:- Trend: Neutral

- Sup: 155.69

- Res: 156.71

- Note: Considering buys from 155.69 with a tight stop-loss. No optimal entry points for sell deals at this time.

Noticias para: 2025.12.24

- Japan BoJ Monetary Policy Meeting Minutes at 01:50 (GMT+2); – JPY (MED)

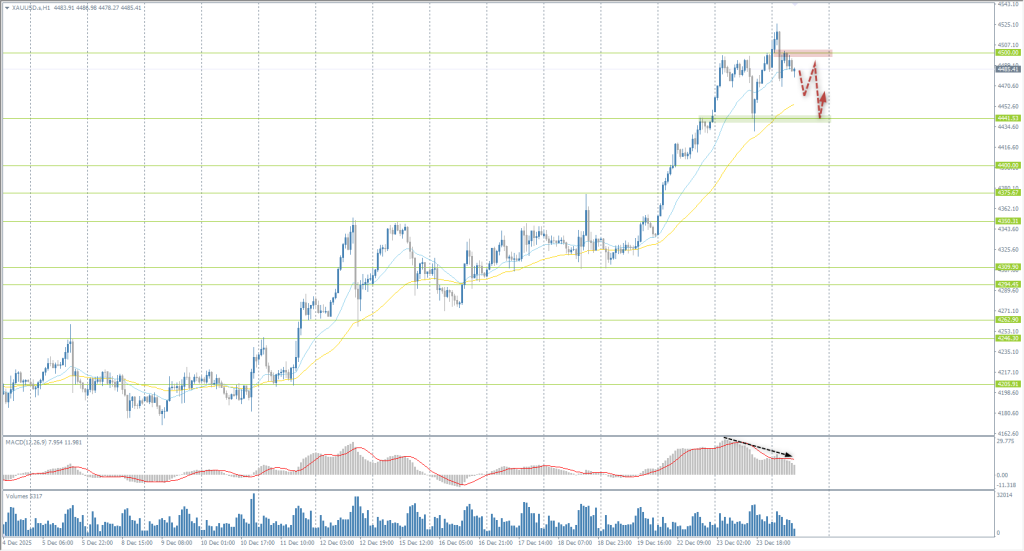

The XAU/USD currency pair (gold)

Indicadores técnicos del par de divisas:

- Prev. Abrir: 4447

- Prev. Cerrar: 4485

- % cambio. en el último día: +0.85%

On Wednesday, the price of gold exceeded $4,500 per ounce, setting a new historical record amid expectations of further Fed easing and rising geopolitical tensions. Markets continue to price in two rate cuts in 2026, despite steady US GDP growth and a gradually cooling labor market. Increased geopolitical risks, including the situation surrounding Venezuela, provided additional support. Gold has appreciated by about 70% year-to-date and is on track for its strongest annual growth since 1979, driven by active central bank buying and ETF inflows.

Recomendaciones de trading

- Niveles de soporte: 4400, 4375, 4350, 4209

- Niveles de resistencia: 4500

Gold has reached the psychological (round) level of 4,500. Profit-taking has begun here ahead of the Christmas holidays. Given the MACD divergence, traders should expect a price correction. Intraday sell deals from 4,500 toward the 4,441 support level can be considered. The price will likely remain within this range until the end of the year. There are currently no optimal entry points for buys.

Escenario alternativo:- Trend: Up

- Sup: 4441

- Res: 4500

- Note: Expecting a price correction to 4441 due to the MACD divergence and the strong option level.

Noticias para: 2025.12.24

- US Initial Jobless Claims (w/w) at 15:30 (GMT+2). – USD (MED)

Este artículo refleja una opinión personal y no debe interpretarse como un consejo de inversión, y/o una oferta, y/o una solicitud persistente para realizar transacciones financieras, y/o una garantía, y/o una previsión de eventos futuros.