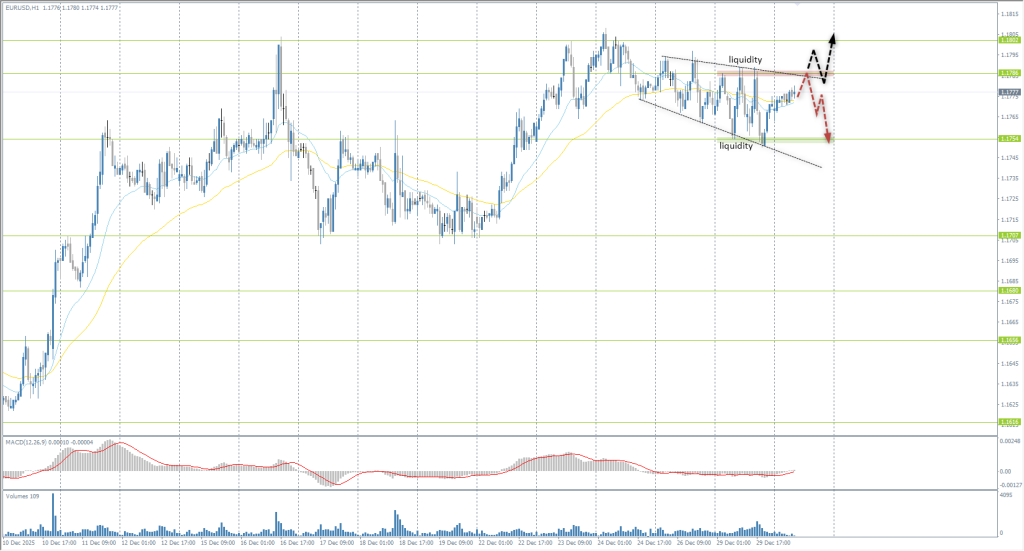

The EUR/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.1766

- Prev. Cerrar: 1.1771

- % cambio. en el último día: +0.06%

By the end of 2025, the euro’s appreciation against the dollar could reach approximately 15%. This trend reflects a divergence in the approaches of the ECB and the Fed: in December, the European regulator kept rates unchanged and signaled no rush to adjust policy, with Christine Lagarde highlighting high uncertainty in prognosing future steps. In the US, conversely, market attention is focused on the prospects of a change in Fed leadership and the continuation of the easing cycle. In December, the rate was cut by 25 bps to 3.50-3.75%, concluding a cumulative reduction of 75 bps in 2025; expectations for two more cuts next year continue to pressure the dollar. Against this backdrop, the euro receives additional support and maintains positive medium-term momentum.

Recomendaciones de trading

- Niveles de soporte: 1.1754, 1.1707, 1.1680, 1.1656, 1.1590, 1.1555, 1.1503

- Niveles de resistencia: 1.1786, 1.1802, 1.1833

A flat accumulation is forming on the euro with boundaries at 1.1754-1.1786. Currently, the price is heading for a test of the upper consolidation limit, where it is important to evaluate the price action. A breakout above 1.1786 would clear the path toward 1.1802 and higher. If sellers react at 1.1786, intraday sales down to the lower consolidation level of 1.1754 can be considered.

Escenario alternativo:- Trend: Up

- Sup: 1.1754

- Res: 1.1786

- Note: Considering buy deals after a price breakout above 1.1786. If sellers show a reaction at 1.1786, intraday sales can be considered.

Noticias para: 2025.12.30

- US Chicago PMI (m/m) at 16:45 (GMT+2); – USD (MED)

- US FOMC Meeting Minutes at 21:00 (GMT+2). – USD (MED)

The GBP/USD currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 1.3486

- Prev. Cerrar: 1.3509

- % cambio. en el último día: +0.17 %

On Monday, the GBP/USD pair consolidated near 1.3490, retreating slightly from previous levels amid lower liquidity and cautious sentiment ahead of the year-end and holiday period. Support for the British currency from monetary expectations remains limited. UK inflation, despite slowing to 3.2% in November, still significantly exceeds the Bank of England’s target, forcing the regulator to act cautiously. The recent rate cut to 3.75% was passed with a minimal majority, and Andrew Bailey’s statements point to a gradual and data-dependent nature of further easing, amid weak economic dynamics and expectations of nearly zero GDP growth at year-end.

Recomendaciones de trading

- Niveles de soporte: 1.3473, 1.3445, 1.3347, 1.3354, 1.3292, 1.3268, 1.3156

- Niveles de resistencia: 1.3526, 1.3586

The situation for the British pound is virtually unchanged compared to yesterday. The pound continues to trade in the 1.3473-1.3526 range. It is important for traders to gauge the price reaction at the upper boundary of 1.3526. A breakout of this level will open the road to 1.3586. If sellers react at 1.3526, intraday sales toward the EMA lines or the lower consolidation level of 1.3473 can be considered.

Escenario alternativo:Trend: Up

Sup: 1.3473

Res: 1.3526

Note: Looking for buy trades after a breakout of 1.3526. If sellers react at 1.3526, intraday sales can be considered.

No hay noticias para hoy

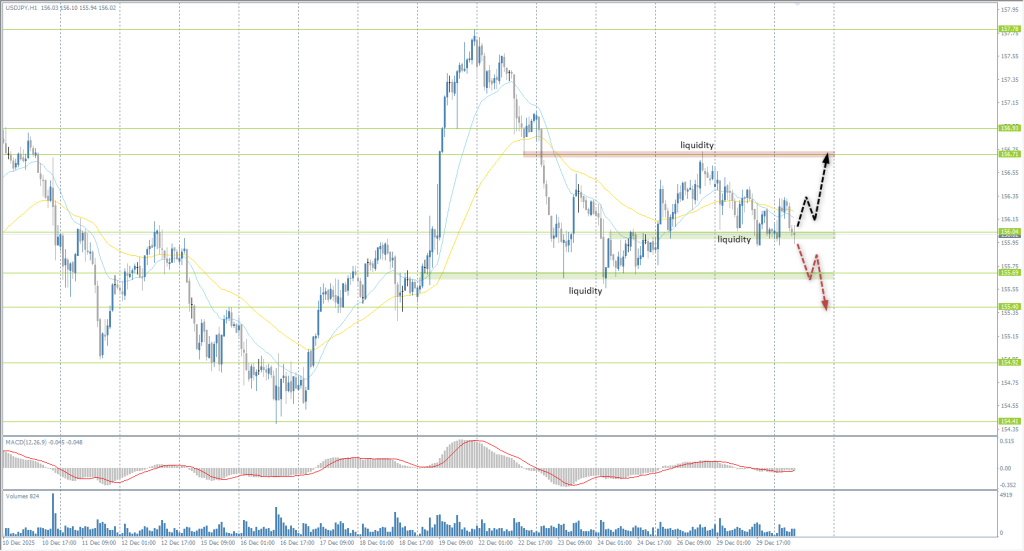

The USD/JPY currency pair

Indicadores técnicos del par de divisas:

- Prev. Abrir: 156.43

- Prev. Cerrar: 156.05

- % cambio. en el último día: -0.24 %

The Japanese yen weakened to around 156 per dollar, correcting the previous session’s gains amid low holiday liquidity and investors’ reassessment of the country’s fiscal outlook. Pressure on the currency came from the approval of a record 122.3 trillion yen budget, aimed at combining massive government spending with debt control by limiting new bond issuance; however, the total public debt, exceeding twice the size of the economy, continues to concern markets. The yen’s decline was partially capped by signals of the authorities’ readiness for currency intervention following statements from the Finance Minister regarding the possibility of countering excessive exchange rate fluctuations.

Recomendaciones de trading

- Niveles de soporte: 156.04, 155.69, 154.92, 154.41, 154.17

- Niveles de resistencia: 156.71, 157.78, 159.47

The Japanese yen declined to the 156.04 support level, where price action must be assessed. Notably, this is the third test of this level, which increases the probability of a breakout. A consolidation below 156.04 would lead to a decline toward 155.69 and lower. Buys should only be considered upon a bullish price reaction from the level with a consolidation above the EMA lines.

Escenario alternativo:- Trend: Neutral

- Sup: 156.07

- Res: 156.71

- Note: Looking for sales below 156.04. Buy deals should only be considered if there is a bullish reaction from the level with consolidation above the EMA lines.

No hay noticias para hoy

The XAU/USD currency pair (gold)

Indicadores técnicos del par de divisas:

- Prev. Abrir: 4547

- Prev. Cerrar: 4331

- % cambio. en el último día: -4.98%

On Monday, gold fell by nearly 5%, dropping below $4,350 per ounce, amid active profit-taking after a series of all-time highs and a decline in demand for safe-haven assets. The catalyst for the correction was reports of preliminary progress in peace talks between the US and Ukraine, although parties admit that key issues, including territorial disputes, remain unresolved and a final agreement may take time. Despite the sharp pullback, the metal still shows impressive performance, gaining more than 70% since the start of the year and heading for its strongest annual growth since 1979, driven by central bank buying, steady ETF inflows, and expectations of further Fed easing.

Recomendaciones de trading

- Niveles de soporte: 4309, 4294

- Niveles de resistencia: 4375, 4400, 4441, 4500, 4550

Gold plummeted yesterday due to profit-taking. The price reached the 4309 support level, where buyers began to show activity. Following such a sell-off, there is no need to rush into buys, especially before the holidays. Intraday, sales from the EMA lines or the 4375 resistance level can be considered, but with confirmation. There are currently no optimal entry points for buying.

Escenario alternativo:- Trend: Neutral

- Sup: 4309

- Res: 4375

- Note: Considering sales from the EMA lines or the 4375 resistance level, but with confirmation. There are currently no optimal entry points for buying.

Noticias para: 2025.12.30

- US Chicago PMI (m/m) at 16:45 (GMT+2); – USD (MED)

- US FOMC Meeting Minutes at 21:00 (GMT+2). – USD (MED)

Este artículo refleja una opinión personal y no debe interpretarse como un consejo de inversión, y/o una oferta, y/o una solicitud persistente para realizar transacciones financieras, y/o una garantía, y/o una previsión de eventos futuros.