The EUR/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.0856

- قبلی بستن: 1.0878

- % chg. در طول روز گذشته: +0.20 %

The euro rose to 1.09 USD, near its strongest level since early November, as investors welcomed the news that Germany agreed on a debt renegotiation and a significant increase in government spending. ECB Governing Council spokesman Holzmann said Eurozone interest rates are already at neutral levels, and he supports the idea of pausing ECB rate cuts next month. He added that the bigger risk is a resurgence in inflation and rising costs in Europe could force the ECB to raise interest rates. Swaps currently estimate the odds of a 25bp ECB rate cut at the April 17 meeting at 53%.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.0803, 1.0677, 1.0602, 1.0561, 1.0466

- سطوح مقاومت: 1.0897, 1.0937, 1.0979

The EUR/USD currency pair’s hourly trend is bullish. The euro is starting to form a flat accumulation. Sellers will seek to lower the price to 1.0803 to test liquidity. Intraday trades can be sought for selling from the resistance level of 1.0897 but with confirmation. Buying should be considered from 1.0803, also subject to a buying reaction.

سناریوی جایگزین:if the price breaks through the support level of 1.0803 and consolidates below it, the downtrend will likely resume.

خوراک خبری برای: 2025.03.17

- US Retail Sales (m/m) at 14:30 (GMT+2).

The GBP/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.2957

- قبلی بستن: 1.2936

- % chg. در طول روز گذشته: -0.16 %

The British pound declined to $1.29 after fresh data showed that the UK economy unexpectedly contracted by 0.1% in January, missing market expectations of 0.1% growth. The decline was mainly due to weakness in the manufacturing sector. Last month, the Bank of England lowered its estimates for economic growth in the first quarter to 0.1%, down from the 0.4% projected in November. Investors will now turn their attention to the Bank of England’s monetary policy decision this week, where interest rates are expected to remain unchanged at 4.5%. In addition, Chancellor Rachel Reeves will set out plans to rein in public spending in her Spring Statement on March 26, which will coincide with the Office for Budget Responsibility’s publication of updated prognoses for the economy and borrowing.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.2914, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- سطوح مقاومت: 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish. The situation has not changed much. Currently, the price is forming a narrowing triangle, a harbinger of an impulsive movement. Inside the triangle, after each bounce, the price presses to the support level, which increases the probability of an impulsive downward movement. For buy deals, it is best to wait for the triangle to break upwards, when the price fixes above the EMA lines. Selling should be looked for from 1.2914, provided the triangle breaks down.

سناریوی جایگزین:if the price breaks the support level of 1.2860 and consolidates below it, the downtrend will likely resume.

برای امروز خبری نیست

The USD/JPY currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 147.80

- قبلی بستن: 148.64

- % chg. در طول روز گذشته: +0.56 %

On Monday, the Japanese yen traded near 148.6 per dollar, near a five-month-high amid strong expectations that the Bank of Japan will continue to raise interest rates this year. However, the Central Bank is widely expected to keep policy steady at its upcoming meeting this week. In the external market, the yen benefited from a general weakening of the dollar as US economic concerns and shifting trade policies put pressure on the dollar. This has prompted traders to move into safe-haven currencies, including the Japanese yen and Swiss franc.

توصیه های معاملاتی

- سطوح پشتیبانی: 148.48, 148.17, 147.61, 146.65, 146.00

- سطوح مقاومت: 149.20, 149.32, 150.16, 151.29, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bearish. The Japanese yen continues to form a broadly volatile flat. Currently, the price is trying to test the liquidity above 149.20 and is close to the level of priority change at 149.32. Here, we can consider selling, but only after the sellers’ reaction. There are no optimal entry points for buying right now.

سناریوی جایگزین:if the price breaks above the resistance at 149.32, the uptrend will likely resume.

برای امروز خبری نیست

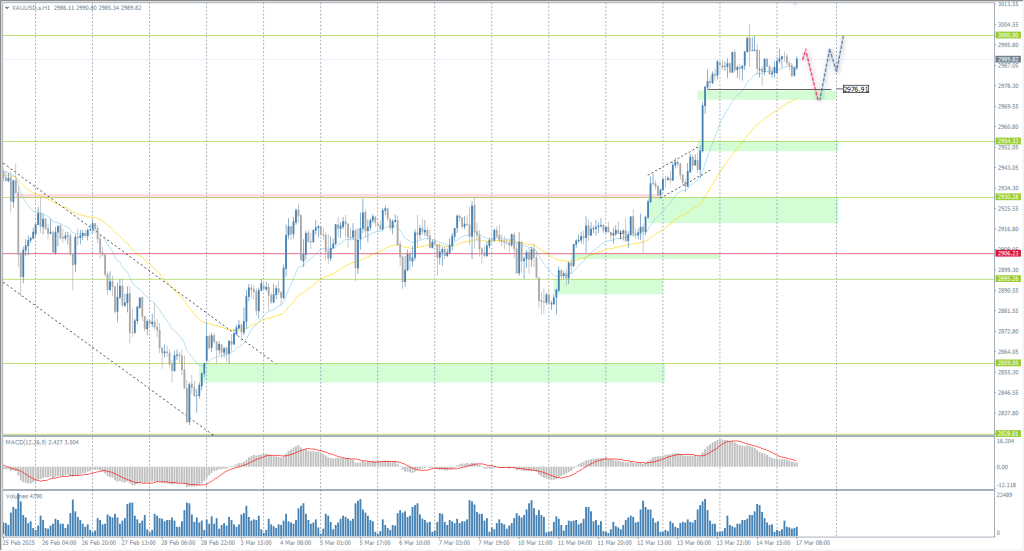

The XAU/USD currency pair (gold)

شاخص های فنی جفت ارز:

- قبلی باز کن: 2988

- قبلی بستن: 2986

- % chg. در طول روز گذشته: -0.07 %

Gold hit $3000 per ounce on Friday, a new record high, driven by risk aversion and rising expectations of a Federal Reserve rate cut. In the latest escalation of US President Donald Trump’s multilateral trade war, he warned of imposing 200% tariffs on European wine and other alcoholic beverages after the EU imposed a 50% tax on US whiskey exports. Meanwhile, the latest PPI and CPI data signaled easing price pressures in February, giving the Fed more room to cut rates and boosting the appeal of non-income gold. Additional support for the metal comes from strong demand for ETFs and continued buying by central banks, with China increasing purchases for the fourth consecutive month.

توصیه های معاملاتی

- سطوح پشتیبانی: 2976, 2954, 2930, 2906, 2896, 2859, 2833

- سطوح مقاومت: 3000

From the point of view of technical analysis, the trend on the XAU/USD has changed to an uptrend. The price is trading at historical highs and reached the psychological mark of 3000 on Friday. Then there was some fixation of previously opened positions, after which the price flattened. EMA lines or 2976 support level can be considered for buying, but with confirmation. Selling can be considered intraday up to 2976, but with a short stop loss and minimal risk as this trade is counter-trend.

سناریوی جایگزین:if the price breaks below the support level 2906, the downtrend will likely resume.

خوراک خبری برای: 2025.03.17

- US Retail Sales (m/m) at 14:30 (GMT+2).

این مقاله منعکس کننده یک نظر شخصی است و نباید به عنوان یک توصیه سرمایه گذاری و/یا پیشنهاد و/یا درخواست مداوم برای انجام معاملات مالی و/یا تضمین و/یا پیش بینی رویدادهای آتی تفسیر شود.