The EUR/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.1385

- قبلی بستن: 1.1328

- % chg. در طول روز گذشته: -0.50 %

The euro moved slightly below $1.14 as investors weighed on diverging economic signals from the US and Europe. The US economy unexpectedly contracted 0.3% year-over-year in the first quarter of 2025, largely due to a surge in imports as businesses and consumers decided to preemptively delay purchases ahead of the Trump administration’s expected tariffs. In contrast, the Eurozone economy grew 0.4%, more than expected, driven by robust domestic demand. Among the major economies, Germany grew 0.2%, as projected, while France posted modest growth of 0.1%. As for inflation, headline inflation in Germany eased to 2.1% y/y in April.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.1309, 1.1246, 1.1157, 1.1088, 1.0960

- سطوح مقاومت: 1.1440, 1.1492, 1.1572

The EUR/USD currency pair’s hourly trend is bullish. The euro has corrected to the level of priority shift to the liquidity zone below 1.1309. Here is also the buy-side FVG. Selling in such a place is not recommended. Moreover, on falling candlesticks, there is a decrease in volume, which does not confirm a trend change. Under such market conditions, it can be recommended to look for buying from 1.1309, but only after confirmation in the form of a buyer’s initiative.

سناریوی جایگزین:if the price breaks the support level of 1.1309 and consolidates below it, the downtrend will likely resume.

خوراک خبری برای: 2025.05.01

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US ISM Manufacturing PMI (m/m) at 17:00 (GMT+3);

The GBP/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.3397

- قبلی بستن: 1.3331

- % chg. در طول روز گذشته: -0.49 %

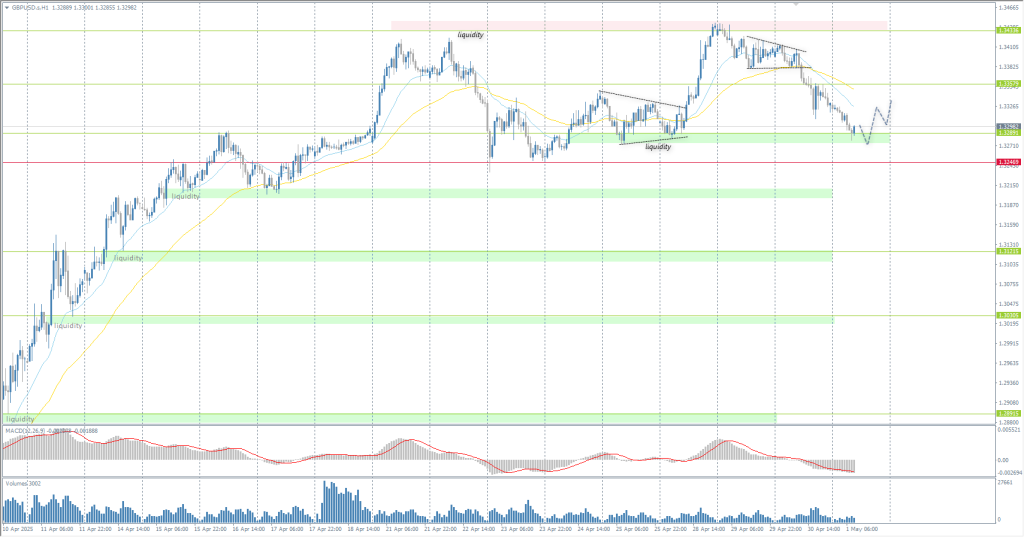

The GBP/USD pair continues its downward trajectory for the third consecutive day, trading near 1.3310. Market participants seem to be taking cautious positions ahead of the release of the UK Manufacturing Purchasing Managers’ Index (PMI) and the US Non-Farm Payrolls report tomorrow. The US dollar is gaining strength thanks to comments made by US President Donald Trump during an interview with NewsNation Town Hall early Thursday. Trump expressed optimism about a possible trade deal with China.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.3289, 1.3246, 1.3121

- سطوح مقاومت: 1.3434

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly time frame is bullish. The British pound corrected to the support level of 1.3289. There is also a bullish FVG here, after the test of which the price has already updated the extremum 2 times. Intraday buying can be considered here with a target up to the EMA lines. There are no optimal entry points for selling now.

سناریوی جایگزین:if the price breaks the resistance level of 1.3202 and consolidates above it, the uptrend will likely resume.

خوراک خبری برای: 2025.05.01

- UK Manufacturing PMI (m/m) at 11:30 (GMT+3).

The USD/JPY currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 142.27

- قبلی بستن: 143.09

- % chg. در طول روز گذشته: +0.57 %

At the May meeting, the Bank of Japan (BoJ) left the key short-term interest rate unchanged at 0.5%, keeping it at the highest level since 2008 in line with market expectations. The unanimous decision came amid growing concerns that US President Trump’s tariff measures could dampen both US and global economic growth. In its quarterly outlook, the Bank of Japan lowered its GDP growth expectations for fiscal 2025 to 0.5% from 1.0% projected in January, citing trade risks and policy uncertainty. The growth projections for 2026 was also lowered to 0.7% from 1.0%. The BOJ also lowered its FY 2025 core inflation prognosis to 2.2% from 2.7% and expects it to fall further to 1.7% in FY 2026.

توصیه های معاملاتی

- سطوح پشتیبانی: 142.26, 141.96, 140.18, 139.59

- سطوح مقاومت: 143.22, 144.09

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The Japanese yen has reached the liquidity pool above the level of 144.08. There is also FVG on the sellers’ side, but no reaction from the price. It is too late to buy as the price has deviated much from the midlines. It is too early to sell, as there is no initiative on the sellers’ side.

سناریوی جایگزین:if the price breaks the support level of 141.96 and consolidates below it, the downtrend will likely resume.

خوراک خبری برای: 2025.05.01

- Japan Manufacturing PMI (m/m) at 03:30 (GMT+3);

- Japan BoJ Interest Rate Decision at 06:00 (GMT+3);

- Japan BoJ Monetary Policy Statement at 06:00 (GMT+3).

The XAU/USD currency pair (gold)

شاخص های فنی جفت ارز:

- قبلی باز کن: 3317

- قبلی بستن: 3289

- % chg. در طول روز گذشته: -0.85 %

Gold fell to around $3,230 an ounce on Thursday, posting a third straight session of losses and hitting its lowest level in two weeks, as easing trade tensions between the US and its trading partners reduced the metal’s appeal as a safe-haven. President Donald Trump said he has “potential” trade deals with India, South Korea, and Japan as he seeks to convert his tariff policies into trade agreements. On Tuesday, Trump also signed an executive order easing some of his 25% tariffs on cars and auto parts. Investors now await Friday’s Non-Farm Payrolls report to get further insight into the Fed’s policy direction.

توصیه های معاملاتی

- سطوح پشتیبانی: 3194

- سطوح مقاومت: 3267, 3328, 3367, 3385, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold has consolidated below the 3260 priority shift level and is trading below the EMA moving lines. The MACD divergence limits the downside potential, so we should expect a small correction to the EMA lines. The resistance level of 3267 can also be used for selling. The profit target is the support level of 3194.

سناریوی جایگزین:if the price breaks through and consolidates above the resistance level of 3328, the uptrend will likely resume.

خوراک خبری برای: 2025.05.01

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US ISM Manufacturing PMI (m/m) at 17:00 (GMT+3).

این مقاله منعکس کننده یک نظر شخصی است و نباید به عنوان یک توصیه سرمایه گذاری و/یا پیشنهاد و/یا درخواست مداوم برای انجام معاملات مالی و/یا تضمین و/یا پیش بینی رویدادهای آتی تفسیر شود.