The EUR/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.1662

- قبلی بستن: 1.1641

- % chg. در طول روز گذشته: -0.18 %

On Friday, the euro posted modest losses and continued to struggle amid concerns that President Trump’s tariff policies will curb economic growth in the Eurozone. The euro’s losses were limited by hopes for a ceasefire between Russia and Ukraine after reports that Trump and Putin have scheduled a meeting this week. As for monetary policy, swaps are pricing in a 9% chance of a 25 bps rate cut by the ECB at its September 11 meeting, while the probability of a US Fed rate cut is 89%. This probability differential is a positive factor for a stronger EUR/USD pair.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.1589, 1.1528, 1.1485, 1.1375, 1.1313

- سطوح مقاومت: 1.1678, 1.1710, 1.1770

The EUR/USD currency pair’s hourly trend is bullish. The price has been consolidating near the 1.1677 resistance level, forming a narrowing triangle, which indicates an impending impulsive breakout. Under these market conditions, buy trades should be considered after a breakout of 1.1677. Sell trades should be considered if the price impulsively breaks the lower boundary of the triangle.

سناریوی جایگزین:if the price breaks the support level of 1.1528 and consolidates below it, the downtrend will likely resume.

برای امروز خبری نیست

The GBP/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.3441

- قبلی بستن: 1.3448

- % chg. در طول روز گذشته: +0.05 %

Following last week’s rate cut but cautious expectations, market speculation about a Q4 rate cut has eased from 100% to 70%. The pound remains sensitive to broader dollar movements. The inverse correlation with changes in the Dollar Index remains at negative 0.70 over the last 30 sessions and negative 0.80 over the last 60 sessions. A new labor market report will be released on Tuesday, and Q2 GDP (with June data) will be released on Thursday. Before the next BoE meeting on September 18, two monthly CPI reports, another labor market report, and July GDP will be published. The bar for further rate cuts appears high.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.3390, 1.3313, 1.3214, 1.3137

- سطوح مقاومت: 1.3462, 1.3586

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. The price is currently consolidating near the 1.3463 resistance level. Here, it is important to assess price action. A breakout and hold above this level will open the way to 1.3520. If the price starts to fall from here due to profit-taking and holds below the uptrend line, a sell-off to 1.3390 could occur.

سناریوی جایگزین:if the price breaks through the support level of 1.3280 and consolidates below it, the downward trend will likely resume.

برای امروز خبری نیست

The USD/JPY currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 147.07

- قبلی بستن: 147.73

- % chg. در طول روز گذشته: +0.45 %

On Monday, the Japanese yen traded around 147.7 against the dollar, holding in a narrow range for about a week as investors continued to assess the outlook for the Bank of Japan’s monetary policy. The minutes from the BoJ’s July meeting showed that board members remained of the opinion that further interest rate hikes were appropriate despite heightened uncertainty surrounding tariffs. The minutes also indicated that Japan’s economic growth is expected to be moderate, and any improvement in underlying inflation is likely to be temporarily sluggish. Today is a bank holiday in Japan.

توصیه های معاملاتی

- سطوح پشتیبانی: 147.45, 146.62, 146.34

- سطوح مقاومت: 147.98, 148.54, 149.18, 150.34

From a technical point of view, the medium-term trend of the USD/JPY is bearish. The Japanese yen is forming a wide sideways accumulation with boundaries of 146.62–147.98. Within this range, buyers have formed an intermediate support level at 147.45. Given the lack of news triggers and the bank holiday in Japan, the price is likely to trade in a narrow range of 147.45–147.91. It is recommended to refrain from trading this currency pair today.

سناریوی جایگزین:if the price breaks through the support level of 150.91 and consolidates below it, the downtrend will likely resume.

برای امروز خبری نیست

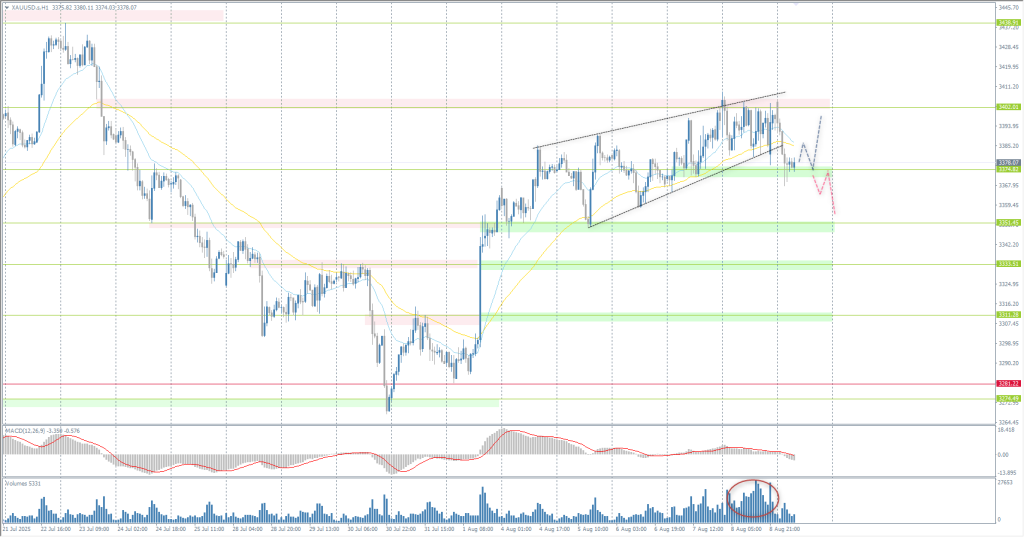

The XAU/USD currency pair (gold)

شاخص های فنی جفت ارز:

- قبلی باز کن: 3403

- قبلی بستن: 3397

- % chg. در طول روز گذشته: -0.17 %

On Monday, gold prices fell below the $3380 per ounce mark as investors awaited clarification from the Trump administration on tariff policy regarding gold bullion. The uncertainty arose after reports on Friday that a US Customs and Border Protection ruling would impose tariffs on 1 kg and 100 oz gold bars, which contradicts traders’ expectations that precious metals would be exempt from duties. Meanwhile, Trump and Russian President Vladimir Putin will meet on August 15 in Alaska to negotiate a ceasefire in Ukraine. This week, investors will also be watching for key US economic data, including the Consumer Price Index, Producer Price Index, and retail sales, for new clues for the Fed on the future path of rates.

توصیه های معاملاتی

- سطوح پشتیبانی: 3374, 3351, 3333, 3311, 3281

- سطوح مقاومت: 3402, 3433

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold is experiencing profit-taking. Since the market opened on Monday, gold has been actively sold off, and the price has now reached the 3374 support level. It is very important for buyers to hold this level; otherwise, a break below could trigger an even larger sell-off to 3351. If buyers react at 3374, intraday buying opportunities can be sought up to 3402 within the wide sideways range.

سناریوی جایگزین:if the price breaks the support level of 3281 and consolidates below it, the downtrend will likely resume.

برای امروز خبری نیست

این مقاله منعکس کننده یک نظر شخصی است و نباید به عنوان یک توصیه سرمایه گذاری و/یا پیشنهاد و/یا درخواست مداوم برای انجام معاملات مالی و/یا تضمین و/یا پیش بینی رویدادهای آتی تفسیر شود.