The EUR/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.1643

- قبلی بستن: 1.1651

- % chg. در طول روز گذشته: +0.07 %

The Dollar Index remained unchanged and fell slightly to 98.2 after the July Fed meeting minutes showed that policymakers remain more concerned about inflation than the labor market, and tariffs deepened divisions within the committee. Most officials felt that inflation risks outweighed the weakness in the job market, keeping markets cautious ahead of Jerome Powell’s speech at the Jackson Hole symposium on Friday, where investors are hoping for clarity on future easing. Political pressure is also a factor, as President Trump has called for Fed member Lisa Cook to resign over alleged mortgage fraud and continues to push for lower rates. With Powell’s term expiring in May, Trump is considering replacements, and Treasury Secretary Scott Bessent recently supported the idea of a more significant half-point rate cut by September.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.1629, 1.1589, 1.1528, 1.1485, 1.1375, 1.1313

- سطوح مقاومت: 1.1687, 1.1710, 1.1770

The EUR/USD currency pair’s hourly trend is bullish. The situation has not changed significantly compared to yesterday. After testing the support level of 1.1629, the price rebounded. If the price consolidates below 1.1629, sales to the priority change level of 1.1590 can be considered. There are no optimal entry points for buying at the moment, as there is no initiative from buyers.

سناریوی جایگزین:if the price breaks the support level of 1.1590 and consolidates below it, the downtrend will likely resume.

خوراک خبری برای: 2025.08.21

- German Manufacturing PMI (m/m) at 10:30 (GMT+3);

- German Services PMI (m/m) at 10:30 (GMT+3);

- Eurozone Manufacturing PMI (m/m) at 11:00 (GMT+3);

- Eurozone Services PMI (m/m) at 11:00 (GMT+3);

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Manufacturing PMI (m/m) at 16:45 (GMT+3);

- US Services PMI (m/m) at 16:45 (GMT+3);

- US Existing Home Sales (m/m) at 17:00 (GMT+3);

- US Natural Gas Storage (w/w) at 17:30 (GMT+3);

- Jackson Hole Symposium (Day 1).

The GBP/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.3485

- قبلی بستن: 1.3456

- % chg. در طول روز گذشته: -0.22 %

The British pound briefly rose to $1.35 after UK inflation came in higher than expected. The July Consumer Price Index rose 3.8% year-on-year, the fastest pace since January 2024 and exceeding economists’ expectations. This data prompted traders to lower their bets on the Bank of England cutting rates this year, and markets now expect only a 10 basis point cut by December, with the probability of another rate cut below 50%. Instead, a quarter-point cut in early 2026 is considered more likely. Given that growth is continuing and inflation is exceeding projections, another rate cut this year may seem too risky.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.3396, 1.3313, 1.3214, 1.3137

- سطوح مقاومت: 1.3462, 1.3522, 1.3586

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. Sellers pushed through the 1.3462 support level, increasing the likelihood of a further decline. The intraday bias remains with sellers as long as the price is in a downward channel. For buy deals, it is important for the price to consolidate above the downward trend line. For sales, the upper border of the corridor can be considered, but with confirmation.

سناریوی جایگزین:if the price breaks through the support level of 1.3396 and consolidates below it, the downtrend will likely resume.

خوراک خبری برای: 2025.08.21

- UK Manufacturing PMI (m/m) at 11:30 (GMT+3);

- UK Services PMI (m/m) at 11:30 (GMT+3).

The USD/JPY currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 147.59

- قبلی بستن: 147.30

- % chg. در طول روز گذشته: -0.20 %

On Thursday, the yen fell to 147.5 per dollar, interrupting a two-day rally amid continued uncertainty over the Bank of Japan’s policy outlook. At its July meeting, the Central Bank raised its inflation expectations and left the door open for a possible rate hike before the end of the year. However, Governor Kazuo Ueda remains cautious, stressing that “core inflation” has not yet reached the 2% target. In terms of data, Japan’s manufacturing sector approached stability in August, while growth in the services sector slowed.

توصیه های معاملاتی

- سطوح پشتیبانی: 147.09, 146.35

- سطوح مقاومت: 148.03, 148.52, 149.18, 150.34

From a technical point of view, the medium-term trend of the USD/JPY is bearish. The Japanese yen is still trading in the price range of 147.09–148.03. Yesterday, the price tested the support level of 147.09, where buyers showed a reaction. Currently, the price is consolidating above the EMA lines and above the downward trend line, which increases the likelihood of growth to 148.03. There are no optimal entry points for selling at the moment.

سناریوی جایگزین:if the price breaks through the resistance level of 148.53 and consolidates above it, the uptrend will likely resume.

خوراک خبری برای: 2025.08.21

- Japan Manufacturing PMI (m/m) at 03:30 (GMT+3);

- Japan Services PMI (m/m) at 03:30 (GMT+3).

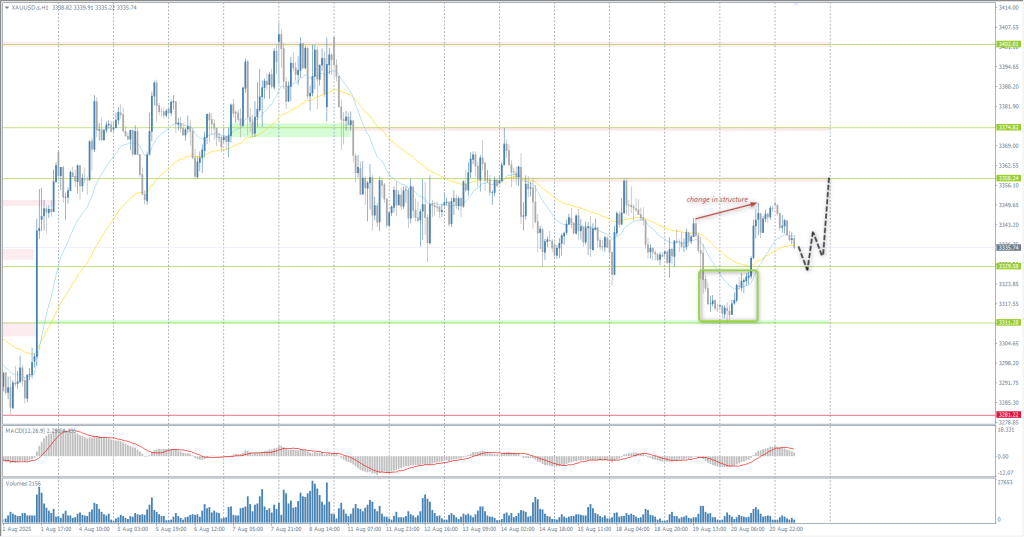

The XAU/USD currency pair (gold)

شاخص های فنی جفت ارز:

- قبلی باز کن: 3316

- قبلی بستن: 3348

- % chg. در طول روز گذشته: +0.96 %

On Thursday, gold prices remained around $3340 per ounce. The market’s attention is focused on Fed Chairman Jerome Powell’s speech at the Jackson Hole symposium in search of hints about the Central Bank’s position on monetary policy. Traders currently estimate the probability of a rate cut in September at 82%. Meanwhile, the latest Fed meeting minutes showed that policymakers remain concerned about inflation and the labor market, with most Fed officials agreeing that it is too early to cut interest rates. On the geopolitical front, Russia said on Wednesday that attempts to resolve security issues related to Ukraine without Moscow’s involvement were a “road to nowhere,” issuing a warning to the West.

توصیه های معاملاتی

- سطوح پشتیبانی: 3333, 3311, 3281

- سطوح مقاومت: 3358, 3374, 3402, 3433

From the point of view of technical analysis, the trend on the XAU/USD is bullish. After testing the support level of 3311, buyers took the initiative with a change in structure on intraday timeframes. This opens up opportunities to buy from the level of 3333 or from the EMA lines. The profit target is 3358. There are currently no optimal entry points for selling.

سناریوی جایگزین:if the price breaks the support level of 3281 and consolidates below it, the downtrend will likely resume.

خوراک خبری برای: 2025.08.21

- US Initial Jobless Claims (w/w) at 15:30 (GMT+3);

- US Manufacturing PMI (m/m) at 16:45 (GMT+3);

- US Services PMI (m/m) at 16:45 (GMT+3);

- US Existing Home Sales (m/m) at 17:00 (GMT+3);

- US Natural Gas Storage (w/w) at 17:30 (GMT+3);

- Jackson Hole Symposium (Day 1).

این مقاله منعکس کننده یک نظر شخصی است و نباید به عنوان یک توصیه سرمایه گذاری و/یا پیشنهاد و/یا درخواست مداوم برای انجام معاملات مالی و/یا تضمین و/یا پیش بینی رویدادهای آتی تفسیر شود.