The EUR/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.1552

- قبلی بستن: 1.1622

- % chg. در طول روز گذشته: +0.61 %

The dollar’s decline accelerated on Friday after escalating trade tensions between the US and China, which could negatively affect economic growth, following President Trump’s threat of a “massive increase” in tariffs on Chinese goods. But the European currency benefited from this situation. In addition, the euro was supported by hawkish comments from ECB Governing Council members Nagel and Kazaks, who said that the ECB’s current interest rates are adequate. Political uncertainty in France is holding back the euro’s growth. However, President Macron has said he will appoint a new prime minister soon, which could avoid the need for early elections. Swaps estimate the probability of a 25 basis point cut in the ECB rate at its October 30 policy meeting at 2%.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.1598, 1.1574, 1.1515

- سطوح مقاومت: 1.1648, 1.1683, 1.1728, 1.1754, 1.1786, 1.1819

The EUR/USD currency pair’s hourly trend is downward. The euro has formed a locked balance below 1.1574, and now this area will act as a strong support zone. Today, intraday buy deals should be considered from 1.1598 or 1.1574 with a target of 1.1648. There are no optimal entry points for selling at this time.

سناریوی جایگزین:if the price breaks through the resistance level of 1.1683 and consolidates above it, the upward trend is likely to resume.

برای امروز خبری نیست

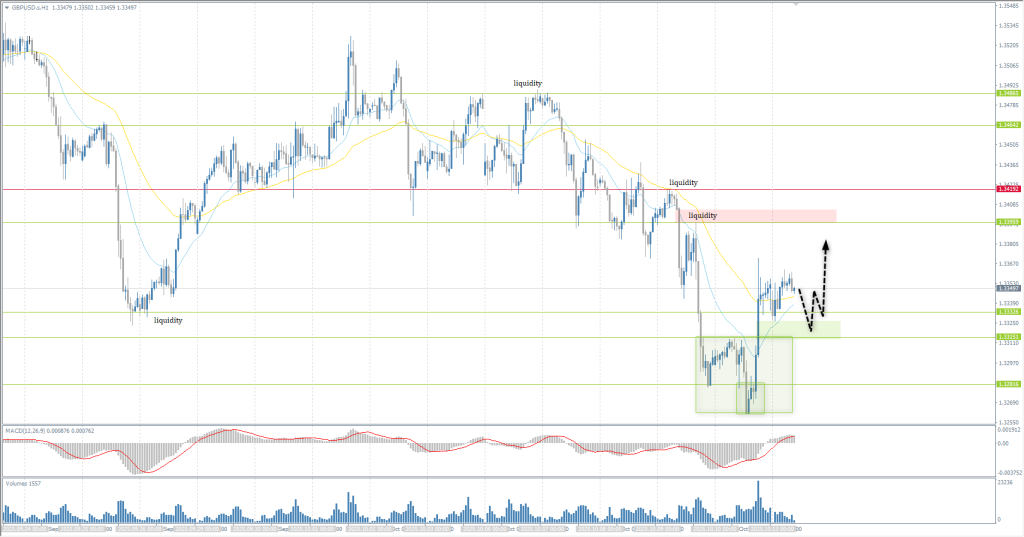

The GBP/USD currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 1.3296

- قبلی بستن: 1.3352

- % chg. در طول روز گذشته: +0.42 %

The British pound also benefited from the US dollar’s decline on Friday. This week, investors will be watching the latest labor market and GDP figures for August. Signs of a further slowdown in wage growth or another month of stagnant manufacturing could heighten concerns about the UK’s economic trajectory, making it difficult for sterling to recover from recent lows. Conversely, any positive surprises in these reports could provide short-term support for sterling. However, the market is likely to remain cautious as long as financial and global uncertainty dominate sentiment.

توصیه های معاملاتی

- سطوح پشتیبانی: 1.3333, 1.3315, 1.3282, 1.3214

- سطوح مقاومت: 1.3395, 1.3419

In terms of technical analysis, the trend on the currency pair GBP/USD is a downtrend. However, the British pound, like the euro, has formed a locked balance below the support level. Buyers have entered the game, and now the area below 1.3333 will act as a support zone. Intraday, buy deals can be considered from 1.3333 or 1.3315 with a target of 1.3396. There are currently no optimal entry points for sales.

سناریوی جایگزین:if the price breaks through the resistance level of 1.3419 and consolidates above it, the uptrend is likely to resume.

برای امروز خبری نیست

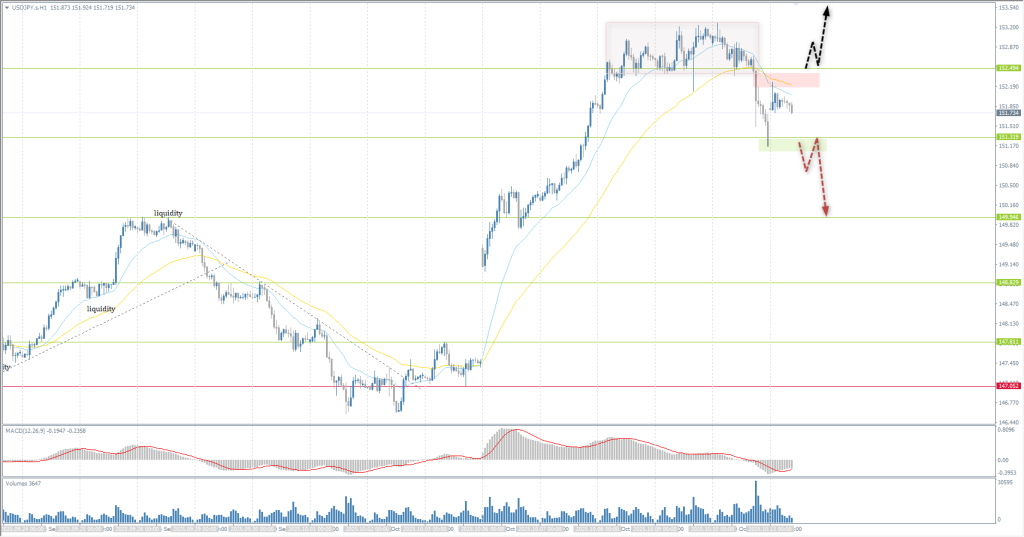

The USD/JPY currency pair

شاخص های فنی جفت ارز:

- قبلی باز کن: 152.94

- قبلی بستن: 151.17

- % chg. در طول روز گذشته: -1.17 %

The Japanese yen weakened to 152 per dollar amid low trading activity on Monday, giving back some of the previous session’s gains. Easing trade tensions between the US and China reduced demand for safe-haven assets, and investors kept an eye on political developments in Tokyo. On Friday, the yen jumped more than 1% after US President Donald Trump threatened to impose additional 100% tariffs on Chinese goods from November 1 in response to Beijing’s new measures to control exports of rare earth minerals. However, Trump later signaled his willingness to negotiate ahead of a possible meeting with President Xi Jinping later this month, saying that trade relations with China “will be fine.” In Japan, markets reassessed the chances of LDP leader Sanae Takaichi becoming prime minister and introducing new fiscal stimulus measures after the Komeito party left the ruling coalition on Friday, ending a partnership of more than 25 years.

توصیه های معاملاتی

- سطوح پشتیبانی: 151.31, 149.95, 148.83, 147.81

- سطوح مقاومت: 152.50, 154.80

From a technical point of view, the medium-term trend of the USD/JPY is bullish. With the Japanese yen, things are not as clear as with the euro and the British pound. The price fell sharply below 152.50 and is now in a zone of uncertainty. To resume buying, it is necessary to wait for consolidation above 152.50. For selling, you can use the breakdown of 151.31. Between these levels, the price is likely to fluctuate, which complicates the search for good entry points.

سناریوی جایگزین:if the price breaks through the support level of 147.05 and consolidates below it, the downtrend is likely to resume.

برای امروز خبری نیست

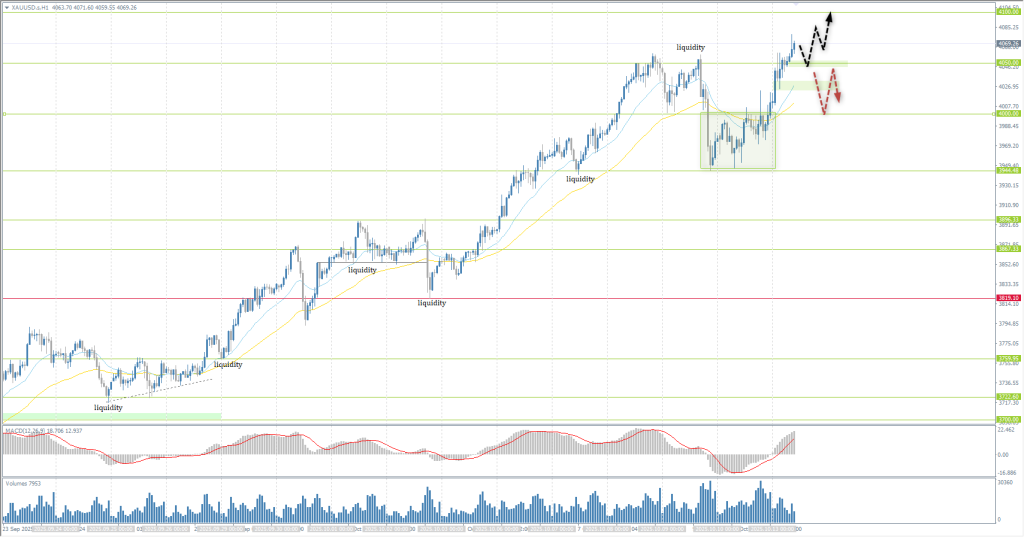

The XAU/USD currency pair (gold)

شاخص های فنی جفت ارز:

- قبلی باز کن: 3973

- قبلی بستن: 4011

- % chg. در طول روز گذشته: +0.95%

On Monday, gold reached a record high of $4070 per ounce as renewed concerns about US-China trade and economic uncertainty stimulated demand for safe-haven assets. On Friday, President Trump threatened to impose additional 100% tariffs on Chinese exports, as well as new export controls on critical software starting on November 1. However, on Sunday, he softened his stance, saying that America wants to help China, not hurt it. The US government shutdown, extended for another week, has caused additional nervousness in the market, depriving investors of key economic data needed to assess the state of the economy.

توصیه های معاملاتی

- سطوح پشتیبانی: 4050, 4000, 3944, 3896, 3867, 3820, 3800

- سطوح مقاومت: 4100

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold resumed its rally amid tariff uncertainty between the US and China and a sharp sell-off in cryptocurrencies on Friday. The price is trading above 4050 again and is heading towards the next psychological level of 4100. Sell deals can only be considered if the price consolidates below 4050 again. Until that happens, we are looking for intraday buys in line with the trend.

سناریوی جایگزین:if the price breaks the support level of 3944 and consolidates below it, the downtrend will likely resume.

برای امروز خبری نیست

این مقاله منعکس کننده یک نظر شخصی است و نباید به عنوان یک توصیه سرمایه گذاری و/یا پیشنهاد و/یا درخواست مداوم برای انجام معاملات مالی و/یا تضمین و/یا پیش بینی رویدادهای آتی تفسیر شود.