The EUR/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.0946

- पिछला क्लोज: 1.0905

- अंतिम दिन की तुलना में % परिवर्तन: -0.37 %

Eurozone consumer price inflation fell to 2.3% in February 2025, slightly below the preliminary estimate of 2.4% and below the six-month high of 2.5% in January. Despite the decline, inflation remains above the European Central Bank’s 2% target. Meanwhile, core inflation, which excludes volatile food and energy prices, fell to 2.6%, the lowest level since January 2022. Swaps rate the odds of a 25bp ECB rate cut at the April 17 meeting at 54%.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.0866, 1.0803, 1.0677, 1.0602, 1.0561, 1.0466

- प्रतिरोध स्तर: 1.0911, 1.0947, 1.0979

The EUR/USD currency pair’s hourly trend is bullish. After falling to the support level of 1.0866, buyers were able to push the price back to 1.0911. Currently, this resistance level is a real stumbling block for further growth. In addition, the price has consolidated below the ascending channel. Under such market conditions, the corrective movement may deepen. Inside the day we can look for sales with the target of 1.0866 or even 1.0830. We should return to considering buy deals only after the price consolidates above 1.0911.

वैकल्पिक परिदृश्य:if the price breaks through the support level of 1.0830 and consolidates below it, the downtrend will likely resume.

समाचार फ़ीड: 2025.03.20

- US Initial Jobless Claims (w/w) at 14:30 (GMT+2);

- US Existing Home Sales (m/m) at 16:00 (GMT+2).

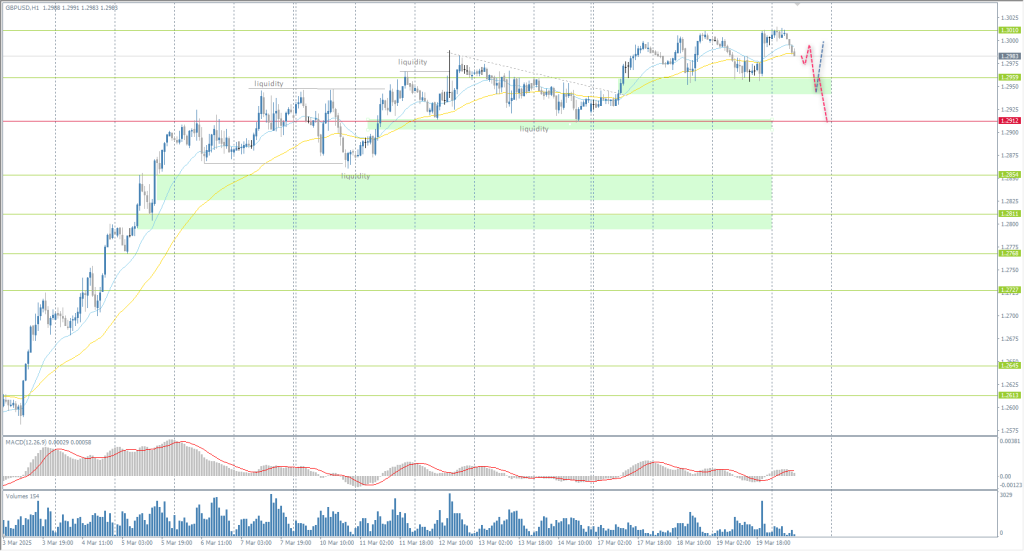

The GBP/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.3001

- पिछला क्लोज: 1.3003

- अंतिम दिन की तुलना में % परिवर्तन: +0.02 %

The Bank of England is expected to maintain its monetary policy settings today and leave the rate at 4.5%. UK inflation slowed to 3.2% annualized in February 2025, down from 3.5% in January. Core inflation also eased to 3.6% y/y, reflecting easing price pressures in key sectors. Nevertheless, wage growth remains strong and services inflation remains resilient, posing challenges for the Bank of England. Market participants will be closely watching the MPC’s vote allocation. If the Bank of England shows a propensity to ease at its next meetings, the pound could weaken as markets expect a rate cut. The probability of a rate cut in May is almost 80% in the swap market. The market is fully discounting two rate cuts between now and the end of the year.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.2959, 1.2912, 1.2866, 1.2811, 1.2768, 1.2704, 1.2645

- प्रतिरोध स्तर: 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish. The price reached the resistance level of 1.3010, where the profit-taking started. Now, the price has formed a flat accumulation with the boundaries of 1.2959-1.3010. According to the rules of flat trading, buy deals should be considered from the lower boundary of the flat, but with confirmation. If the price of the impulse breaks the 1.2959 level, we should count in this case on the continuation of the decline to the level of priority change 1.2912.

वैकल्पिक परिदृश्य:if the price breaks the support level of 1.2912 and consolidates below it, the downtrend will likely resume.

समाचार फ़ीड: 2025.03.20

- UK Claimant Count Change (m/m) at 09:00 (GMT+2);

- UK Average Earnings Index (m/m) at 09:00 (GMT+2);

- UK Unemployment Rate (m/m) at 09:00 (GMT+2);

- UK BoE Official Bank Rate at 14:00 (GMT+2);

- UK BoE Monetary Policy Summary at 14:00 (GMT+2);

- UK BoE Press Conference at 14:30 (GMT+2).

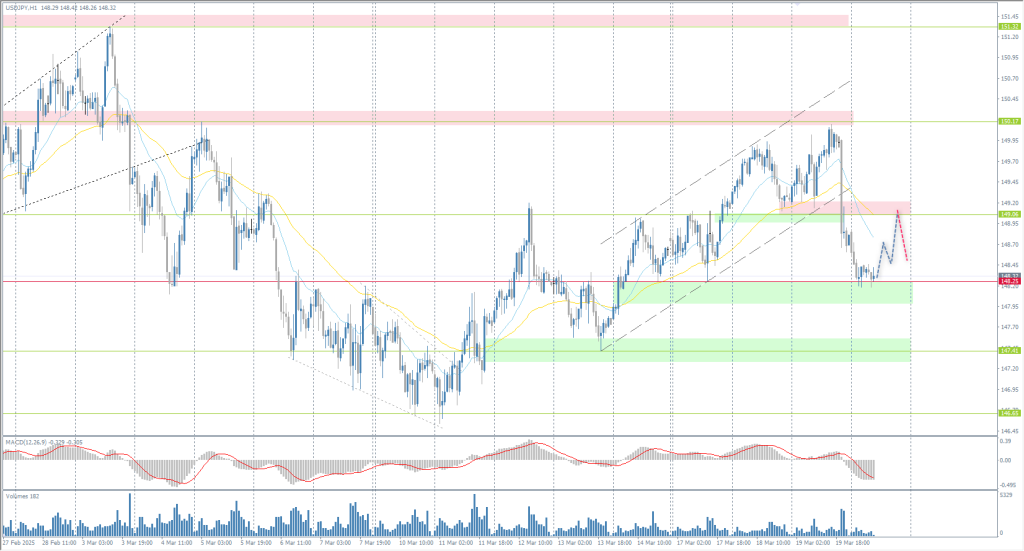

The USD/JPY currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 149.21

- पिछला क्लोज: 148.81

- अंतिम दिन की तुलना में % परिवर्तन: -0.40 %

The Japanese yen exceeded 148.5 per dollar on Thursday, rising for the second consecutive session on the back of a weaker dollar after the US Federal Reserve reiterated its projection for two interest rate cuts this year. Fed Chairman Jerome Powell also downplayed the inflationary impact of President Donald Trump’s tariffs, calling them likely to be short-lived or transitory.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 148.25, 147.41, 146.65, 146.00

- प्रतिरोध स्तर: 149.06, 150.17, 151.29, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish, but close to change. After testing the resistance zone above 150.17, the Japanese yen sharply strengthened and reached the level of 148.25 during the day. Buyers are trying to stop the decline, but the reaction is weak. Under such market conditions, we should expect a technical bounce from this level, after which we should look for sales from EMA lines or from the resistance level at 149.06 with the aim of further yen strengthening.

वैकल्पिक परिदृश्य:if the price breaks through the support level at 147.43 and consolidates below it, the downtrend will likely resume.

आज के लिए कोई खबर नहीं

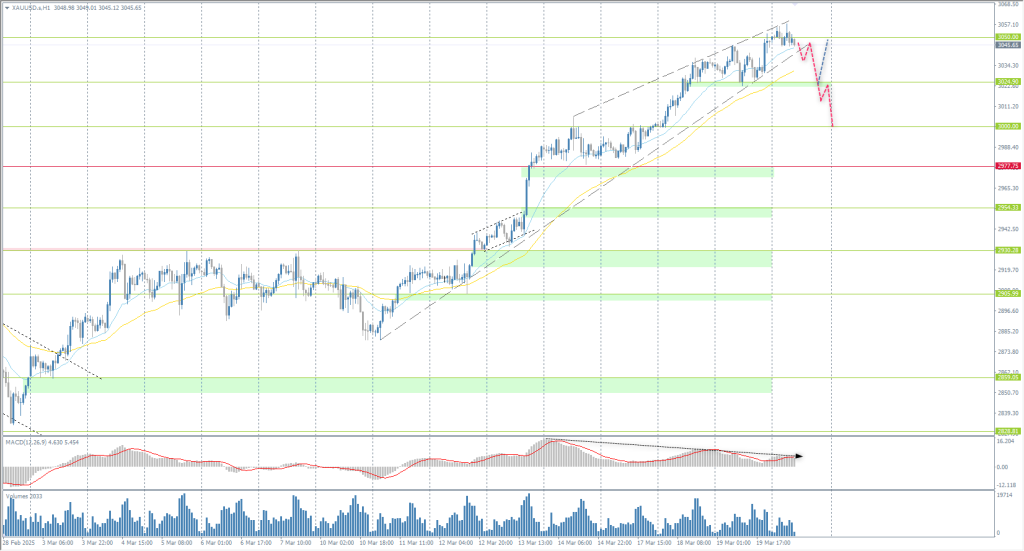

The XAU/USD currency pair (gold)

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 3034

- पिछला क्लोज: 3048

- अंतिम दिन की तुलना में % परिवर्तन: +0.46 %

Gold prices held above $3050 per ounce on Wednesday, near an all-time high, after the US Federal Reserve kept interest rates unchanged at 4.25-4.5%. Uncertainty surrounding President Trump’s tariffs and fiscal policy has led officials to expect two rate cuts before 2025. Earlier, the precious metal briefly hit a new record of $3047, driven by safe-haven demand amid escalating geopolitical tensions and trade uncertainty.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- प्रतिरोध स्तर: 3050, 3100

From the point of view of technical analysis, the trend on the XAU/USD has changed to an uptrend. The price has reached the psychological mark of 3050, where some profit-taking is observed. The MACD divergence has strengthened, which may lead to a small correction and the formation of a flat. Buying should be considered from the support level of 3025 or 3000, but with confirmation. Selling can be looked for after the breakdown of the trend line.

वैकल्पिक परिदृश्य:if the price breaks below the support level 2906, the downtrend will likely resume.

समाचार फ़ीड: 2025.03.20

- US Initial Jobless Claims (w/w) at 14:30 (GMT+2);

- US Existing Home Sales (m/m) at 16:00 (GMT+2).

यह लेख एक व्यक्तिगत राय दर्शाता है और इसे निवेश के लिए सलाह, और/या प्रस्ताव, और/या वित्तीय लेनदेन के लिए निरंतर निवेदन, और/या गारंटी, और/या भविष्य की घटनाओं का पूर्वानुमान नहीं समझना चाहिए।