The EUR/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.0797

- पिछला क्लोज: 1.0829

- अंतिम दिन की तुलना में % परिवर्तन: +0.29 %

Median inflation expectations in the Eurozone for the next 12 months in February 2025 remained unchanged at 2.6%, the same as in January, while inflation expectations for the three years ahead also remained unchanged at 2.4%. Uncertainty about inflation expectations for the next 12 months declined slightly to the lowest level since January 2022. The data increases the likelihood of an ECB rate cut at the next meeting. The narrative is not in favor of strengthening the euro.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.0805, 1.0755, 1.0677, 1.0602, 1.0561, 1.0466

- प्रतिरोध स्तर: 1.0858, 1.0918, 1.0947, 1.0979

The EUR/USD currency pair’s hourly trend is bearish. The price is trying to test the level of priority change at 1.0858. Up to this level intraday, traders can look for buying from the EMA lines. Traders can also consider the support level of 1.0805 for buying. When testing 1.0858, it is important to evaluate the price reaction. If sellers take the initiative here, it will open up selling opportunities.

वैकल्पिक परिदृश्य:if the price breaks the resistance level of 1.0858 and consolidates above it, the uptrend will likely resume.

समाचार फ़ीड: 2025.03.31

- German Retail Sales (m/m) at 09:00 (GMT+3);

- German Consumer Price Index (m/m) at 15:00 (GMT+3);

- US Chicago PMI (m/m) at 16:45 (GMT+3).

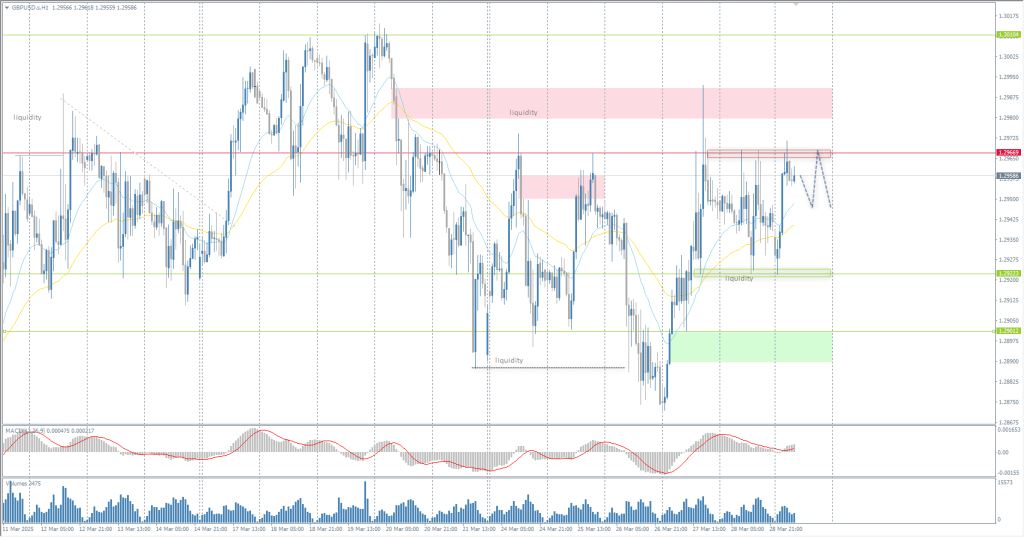

The GBP/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.2945

- पिछला क्लोज: 1.2942

- अंतिम दिन की तुलना में % परिवर्तन: -0.02 %

The British pound slipped below $1.29, hitting its lowest level in nearly two weeks, as traders reacted to weaker-than-expected inflation data for February and the Spring Statement. The UK Finance Minister Reeves said UK inflation will average 3.2% in 2025, down from the 2.6% projection in October. Meanwhile, the economic growth expectation for 2025 has been cut to 1% from 2%, and projected public sector net borrowing is set to fall from £137.3bn (4.8% of GDP) this year to £74.0bn (2.1% of GDP) by 2029-30.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.2922, 1.2873, 1.288, 1.2933, 1.2911, 1.2866, 1.2811

- प्रतिरोध स्तर: 1.2966, 1.3010

From the point of view of technical analysis, the trend on the GBP/USD currency is bullish, but close to change. Over the last 3 trading days, the pound sterling has already tested the priority changes level three times and liquidity above this level. Currently, the sellers are holding the zone, but the probability of a breakout is increasing. Now, the price is trading in a broadly volatile flat at 1.2922-1.2966. There is a reaction to the upper boundary, so intraday you can look for selling, but with a short stop loss. There are no optimal entry points for buying right now.

वैकल्पिक परिदृश्य:if the price breaks through the resistance level of 1.2966 and consolidates above it, the uptrend will likely resume.

आज के लिए कोई खबर नहीं

The USD/JPY currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 151.04

- पिछला क्लोज: 149.81

- अंतिम दिन की तुलना में % परिवर्तन: -0.82 %

The Japanese yen strengthened to 149 per dollar on Monday, rising for the second consecutive session as investor concerns over new US tariffs fueled demand for safe-haven assets. Hawkish signals from the Bank of Japan also supported the yen. The latest composite opinion survey showed the central bank will continue to raise interest rates if its economic and inflation expectations hold up. Policymakers emphasized that rising wage growth and increased consumer spending are supporting price growth, reinforcing the case for further normalization of monetary policy.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 148.60, 148.25

- प्रतिरोध स्तर: 149.15, 149.55, 151.32, 152.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish, but close to a shift. The yen has almost reached the priority change level of 148.60. Inside the day, sellers prevail: the price is confidently trading below the EMA lines, while the buyers’ reaction to the support levels is weak. Sell trades can be considered from the resistance level at 149.15 or from 149.55. There are no optimal entry points for buying now.

वैकल्पिक परिदृश्य:if the price breaks through the support level at 149.60 and consolidates below it, the downtrend will likely resume.

समाचार फ़ीड: 2025.03.31

- Japan Industrial Production (m/m) at 02:50 (GMT+3);

- Japan Retail Sales (m/m) at 02:50 (GMT+3).

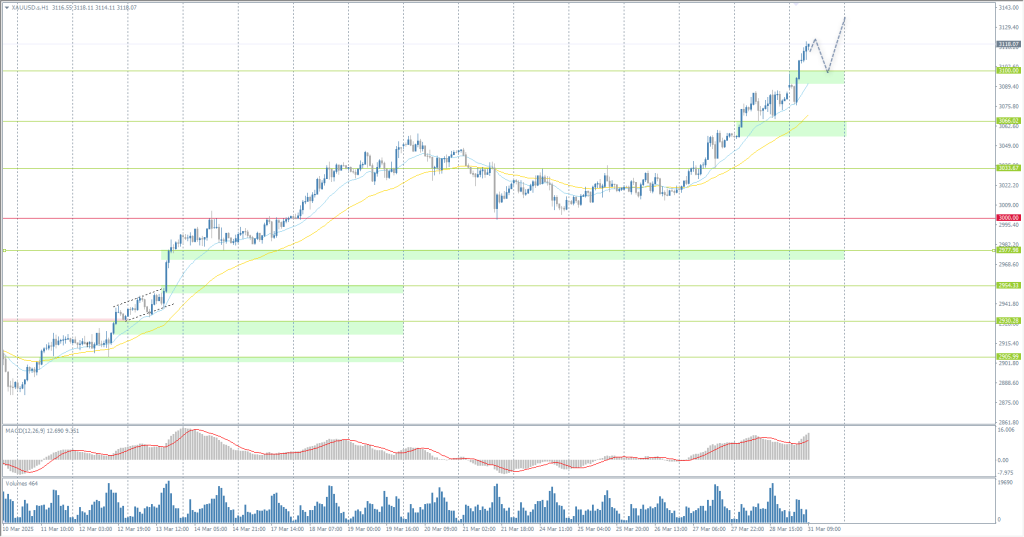

The XAU/USD currency pair (gold)

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 3055

- पिछला क्लोज: 3084

- अंतिम दिन की तुलना में % परिवर्तन: +0.94 %

Gold prices soared above $3120 an ounce on Monday, hitting a record high, as investors seek safe havens amid fears of a global trade war triggered by US President Trump’s new tariffs. Gold rose nearly 2% last week, marking the fourth consecutive weekly gain, driven by concerns over tariffs, trade disputes, and geopolitical risks. In addition, the February PCE Price Index rose by 0.4%, beating expectations. Trump’s upcoming retaliatory tariff plans on April 2 are adding to inflationary concerns and trade tensions. In addition, on Sunday, Trump warned of imposing 25-50% secondary tariffs on Russian oil if Moscow blocks his efforts to end the war in Ukraine, and threatened Iran with additional tariffs and bombing if Tehran fails to reach a nuclear agreement.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 3100, 3057, 3037,3000, 2976, 2954, 2930, 2906, 2896, 2859, 2833

- प्रतिरोध स्तर: 3200

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold is just crazy and is flying upwards non-stop. The price is already above all bank expectations, and the fundamental picture continues to favor the strengthening of the yellow metal. Selling here is like trying to stop a locomotive with bare hands. You can consider buy deals from the EMA lines or from the support level of 3100.

वैकल्पिक परिदृश्य:if the price breaks below the support level 3000, the downtrend will likely resume.

समाचार फ़ीड: 2025.03.31

- US Chicago PMI (m/m) at 16:45 (GMT+3).

यह लेख एक व्यक्तिगत राय दर्शाता है और इसे निवेश के लिए सलाह, और/या प्रस्ताव, और/या वित्तीय लेनदेन के लिए निरंतर निवेदन, और/या गारंटी, और/या भविष्य की घटनाओं का पूर्वानुमान नहीं समझना चाहिए।