The EUR/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.1700

- पिछला क्लोज: 1.1690

- अंतिम दिन की तुलना में % परिवर्तन: -0.08 %

The euro fell below the $1.17 mark, retreating from the 2021 highs reached last month, as growing trade tensions continue to weaken investor sentiment. The US president said that the European Union would soon receive a letter specifying the specific tariffs it would face, suggesting that the EU’s efforts to conclude a trade deal by the August 1 deadline are failing. He also announced plans to impose broad tariffs of 15% to 20% on most trading partners, calling into question previous expectations of a base rate of 10%. On the monetary policy front, the ECB is expected to leave interest rates unchanged this month, but markets are still expecting another rate cut this year.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.1686, 1.1651, 1.1642, 1.1581, 1.1518

- प्रतिरोध स्तर: 1.1714, 1.1762, 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend is bullish, but close to a change. The intraday bias is in favor of sellers, and each rebound from the priority change level is weaker than the previous one, which increases the likelihood of a downward breakout. Traders should now take a wait-and-see position as liquidity narrows in the triangle. Consolidation below 1.1686 will open the way for the price to 1.1589. If buyers manage to seize the initiative and consolidate above the downtrend line, we can expect growth to 1.1714 and above.

वैकल्पिक परिदृश्य:if the price breaks through the support level of 1.1668 and consolidates below it, the downward trend will likely resume.

आज के लिए कोई खबर नहीं

The GBP/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.3571

- पिछला क्लोज: 1.3490

- अंतिम दिन की तुलना में % परिवर्तन: -0.60 %

The British pound fell to its lowest level in two weeks after the UK economy contracted for the second month in a row. GDP contracted by 0.1% in May, falling short of expectations for 0.1% growth, after falling by 0.3% in April. The consecutive decline raises concerns about a contraction in the economy in the second quarter. Manufacturing output weakened significantly, while tax increases and global trade tensions exacerbated the situation. The Bank of England, which has cut rates from 5.25% to 4.25% over the past year, is now almost certain to ease them again in August, even with inflation above 3%. Governor Bailey announced a gradual reduction in rates, but did not say that this would happen in August.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.3509, 1.3471, 1.3450, 1.3388

- प्रतिरोध स्तर: 1.3646, 1.3680, 1.3712, 1.3752, 1.3770, 1.4000

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The British pound has been falling for three consecutive trading sessions. The price has now reached the support zone near 1.3471, where some open positions may be closed. If the price reacts, consider buying deals from 1.3471 with a target of 1.3532. There are currently no optimal entry points for sales.

वैकल्पिक परिदृश्य:if the price breaks through the resistance level of 1.3680 and consolidates above it, the uptrend will likely resume.

आज के लिए कोई खबर नहीं

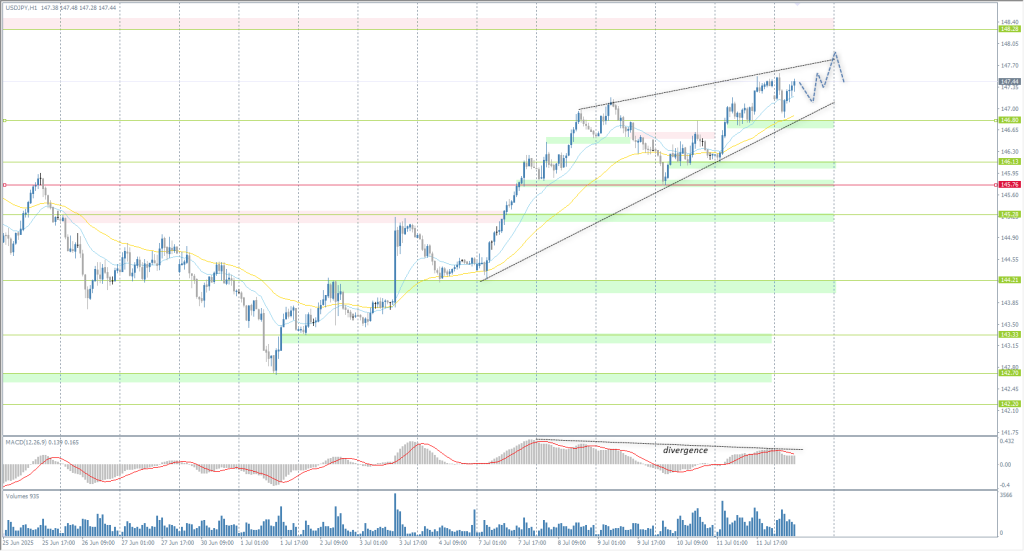

The USD/JPY currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 146.24

- पिछला क्लोज: 147.44

- अंतिम दिन की तुलना में % परिवर्तन: +0.82 %

On Monday, the Japanese yen rose to 147 per dollar, recouping some of last week’s losses as investors reacted to renewed concerns about global trade. This came after President Donald Trump announced the imposition of 30% tariffs on imports from the European Union and Mexico, which will take effect on August 1. On the domestic front in Japan, orders for major equipment in May fell 0.6% from the previous month to ¥913.5 billion. Although the figure is still in negative territory, it is a marked improvement from April’s sharp 9.1% decline.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 146.80, 146.13, 145.88, 145.28, 144.18

- प्रतिरोध स्तर: 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The Japanese yen continues to lose ground. The price is now heading towards the liquidity zone above 148.28. For buy deals, consider the EMA lines or the support level of 146.80. However, traders need to be cautious, as the divergence on the MACD is a harbinger of a corrective movement.

वैकल्पिक परिदृश्य:if the price breaks through the support level of 145.76 and consolidates below it, the downward trend will likely resume.

समाचार फ़ीड: 2025.07.14

- Japan Industrial Production (m/m) at 07:30 (GMT+3).

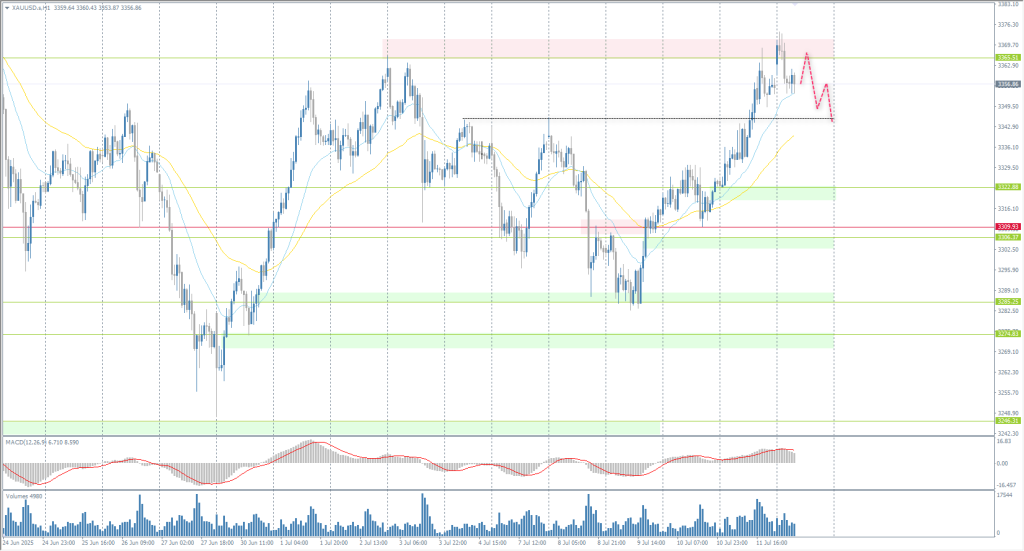

The XAU/USD currency pair (gold)

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 3326

- पिछला क्लोज: 3355

- अंतिम दिन की तुलना में % परिवर्तन: +0.87 %

Gold prices on Monday remained around $3,350 per ounce, close to a three-week high, supported by demand for safe assets after President Donald Trump announced new tariffs. In letters sent to the EU and Mexico, Trump imposed 30% tariffs on both countries, calling their trade deficits with the US a “serious threat” to national security. The EU and Mexico called the tariffs unfair and destructive, with the EU saying it would extend the suspension of countermeasures against US tariffs until early August and continue to seek a settlement through negotiations.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 3345, 3322, 3309

- प्रतिरोध स्तर: 3365, 3393, 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD has changed to bullish. The price has consolidated above the priority change level and is trading confidently above the EMA lines. The price has now reached the resistance level of 3365, where sellers have taken the initiative. This is very similar to early fixation, which often leads to a corrective movement. Intraday, countertrend sales can be considered, but with a short stop loss and a nearby target. For buy deals, it is best to wait for a correction to 3345 or 3322.

वैकल्पिक परिदृश्य:if the price breaks through the support level of 3322 and consolidates below it, the downtrend will likely resume.

आज के लिए कोई खबर नहीं

यह लेख एक व्यक्तिगत राय दर्शाता है और इसे निवेश के लिए सलाह, और/या प्रस्ताव, और/या वित्तीय लेनदेन के लिए निरंतर निवेदन, और/या गारंटी, और/या भविष्य की घटनाओं का पूर्वानुमान नहीं समझना चाहिए।