The EUR/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.1611

- पिछला क्लोज: 1.1674

- अंतिम दिन की तुलना में % परिवर्तन: +0.54 %

Despite a neutral CPI report, the US dollar came under pressure amid concerns about President Trump’s new attack on Fed Chairman Powell. On Tuesday, Trump said he was considering filing a lawsuit against Mr. Powell related to construction work on Fed buildings. Markets are concerned about inflationary risks associated with the Trump administration’s attempt to oust Mr. Powell from the Fed as a means of artificially lowering interest rates. Federal funds futures prices put the odds of a 25-basis-point rate cut at the September 16–17 FOMC meeting at 96% and at the next meeting on October 28–29 at 58%. The EUR/USD pair rose yesterday thanks to the weakening of the dollar. However, sentiment towards the euro remains cautious due to the negative impact of US tariffs on the European economy. Swaps estimate the probability of an ECB rate cut of 25 bps at the September 11 meeting at only 5%.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.1629, 1.1589, 1.1528, 1.1485, 1.1375, 1.1313

- प्रतिरोध स्तर: 1.1678, 1.1710, 1.1770

The EUR/USD currency pair’s hourly trend is bullish. Yesterday, buyers broke through the 1.1629 resistance level, after which the price rose to 1.1678 as expected. Here, we see partial fixation of previously opened purchases. The price will likely reach 1.1710, where it is important to assess the price action. If sellers take the initiative here, it could lead to a correction or the formation of a flat.

वैकल्पिक परिदृश्य:if the price breaks the support level of 1.1528 and consolidates below it, the downtrend will likely resume.

समाचार फ़ीड: 2025.08.13

- German Consumer Price Index (m/m) at 09:00 (GMT+3).

The GBP/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.3434

- पिछला क्लोज: 1.3499

- अंतिम दिन की तुलना में % परिवर्तन: +0.56 %

The British pound rose to $1.344 after the number of people employed in the UK fell by only 8,000 in July, the smallest decline since January and much better than expectations of a 20,000 decline. The unemployment rate remained at a four-year high of 4.7%, while private sector wage growth slowed slightly to 4.8% from 4.9%, but remains well above the comfortable level set by the Bank of England to achieve its 2% inflation target. Investors are now looking to second-quarter GDP, which is expected to show growth of just 0.1%.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.3462, 1.3390, 1.3313, 1.3214, 1.3137

- प्रतिरोध स्तर: 1.3519, 1.3586

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. An unexpectedly good labor market report pushed the pound higher yesterday. The price reached the resistance level of 1.3520, where there was partial fixation of previously opened purchases. Given the MACD divergence, further growth potential is limited without a correction or the formation of a new flat for liquidity accumulation.

वैकल्पिक परिदृश्य:if the price breaks through the support level of 1.3280 and consolidates below it, the downtrend will likely resume.

आज के लिए कोई खबर नहीं

The USD/JPY currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 148.09

- पिछला क्लोज: 147.83

- अंतिम दिन की तुलना में % परिवर्तन: -0.17 %

The Japanese yen weakened to 148 per dollar on Wednesday, giving up the gains of the previous session, as the rally in global risk assets reduced demand for safe-haven currencies. This came after US inflation data reinforced expectations that the Federal Reserve would cut interest rates next month. In Japan, sentiment among manufacturers improved for the second consecutive month in August after a trade agreement with Washington that reduced US tariffs on cars and other goods to 15% in exchange for a $550 billion package of Japanese investment. Meanwhile, producer price growth slowed to an 11-month low in July, reflecting pressure on local companies from higher US tariffs.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 147.54, 146.62, 146.34

- प्रतिरोध स्तर: 148.52, 149.18, 150.34

From a technical point of view, the medium-term trend of the USD/JPY is bearish. However, the wide-range flat that has been forming for more than 7 trading days may lead to a liquidity imbalance on one side, which in turn will lead to a trend reversal. On intraday time frames, buy trades can be considered from 147.53, but with confirmation. There are currently no optimal entry points for sell trades.

वैकल्पिक परिदृश्य:if the price breaks through the resistance level of 148.52 and consolidates above it, the uptrend will likely resume.

समाचार फ़ीड: 2025.08.13

- Japan Producer Price Index (m/m) at 02:50 (GMT+3).

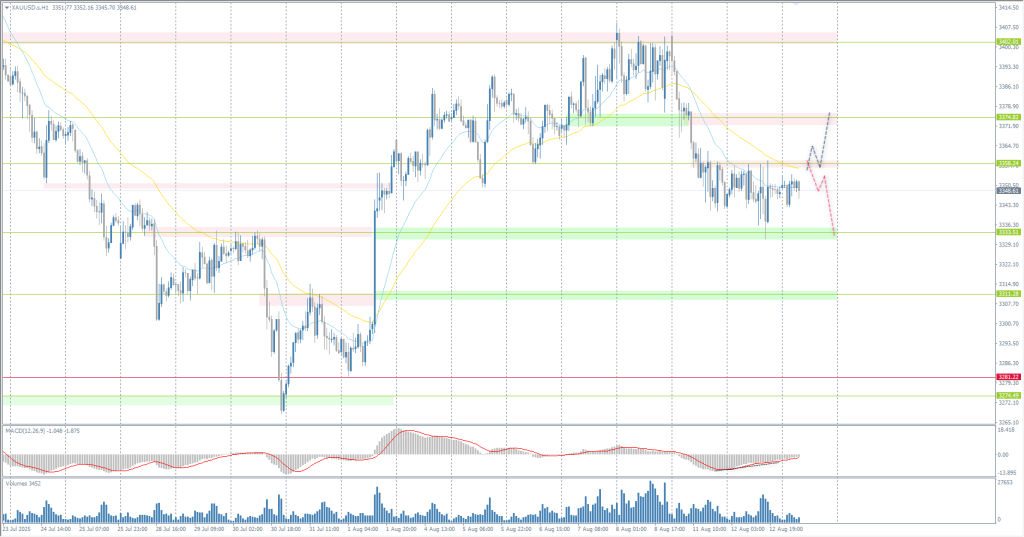

The XAU/USD currency pair (gold)

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 3343

- पिछला क्लोज: 3348

- अंतिम दिन की तुलना में % परिवर्तन: +0.15 %

The latest US Consumer Price Index report has reinforced expectations that the Federal Reserve will cut the federal funds rate next month. Annual inflation in July was 2.7%, below the expectations of 2.8%, while core inflation accelerated more than expected to 3.1%. The data suggest that inflationary pressures related to tariffs remain limited for now, giving the Fed room to cut rates by 25 basis points in September. The odds of a rate cut, which stood at 88% yesterday, have now risen to nearly 93%.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 3333, 3311, 3281

- प्रतिरोध स्तर: 3358, 3374, 3402, 3433

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold corrected to the support level of 3333, where buyers appeared. The price is now forming liquidity accumulation between 3333 and 3358. Traders need to assess the price action at 3358. A breakout and consolidation of the level will open the way for the price to 3374. If sellers react at 3358, the price may sell off again to 3333.

वैकल्पिक परिदृश्य:if the price breaks the support level of 3281 and consolidates below it, the downtrend will likely resume.

आज के लिए कोई खबर नहीं

यह लेख एक व्यक्तिगत राय दर्शाता है और इसे निवेश के लिए सलाह, और/या प्रस्ताव, और/या वित्तीय लेनदेन के लिए निरंतर निवेदन, और/या गारंटी, और/या भविष्य की घटनाओं का पूर्वानुमान नहीं समझना चाहिए।