The EUR/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.1758

- पिछला क्लोज: 1.1707

- अंतिम दिन की तुलना में % परिवर्तन: -0.43 %

After French Prime Minister François Bayrou was removed from power during a parliamentary vote of confidence on the budget, the euro remained above $1.17, close to its strongest level since the end of July. The defeat led to the collapse of his minority government and deepened the political crisis in France. Now, President Emmanuel Macron must appoint his third prime minister in just one year. Markets are also awaiting Thursday’s European Central Bank meeting, where policymakers are expected to leave rates unchanged for the second time in a row amid ongoing trade uncertainty and stable inflation in the Eurozone, which has remained at its target level for three consecutive months.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.1704, 1.1680, 1.1642, 1.1629, 1.1584, 1.1528

- प्रतिरोध स्तर: 1.1756, 1.1786

The EUR/USD currency pair’s hourly trend is bullish. The price formed a locked balance above 1.1756, after which a correction began. At the moment, the price has tested the liquidity pool below 1.1704, where a new locked balance was formed after the reaction of buyers. This increases the likelihood of price growth from the balance, as the captured liquidity must be distributed above the resistance levels. Intraday, you can look for buys up to the EMA lines. It is important for buyers not to let the price settle below 1.1680.

वैकल्पिक परिदृश्य:if the price breaks the support level of 1.1629 and consolidates below it, the downtrend will likely resume.

समाचार फ़ीड: 2025.09.10

- US Producer Price Index (m/m) at 15:30 (GMT+3).

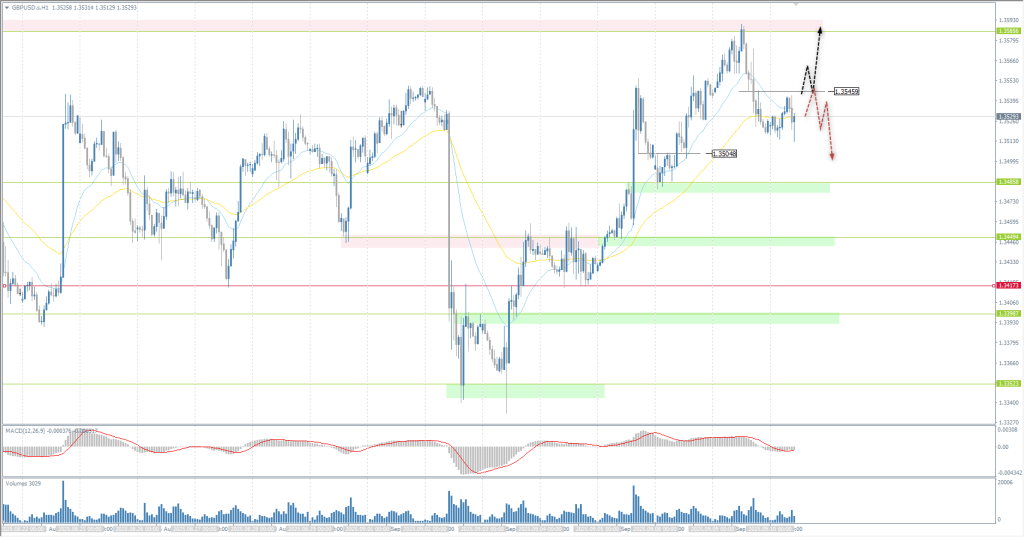

The GBP/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.3545

- पिछला क्लोज: 1.3526

- अंतिम दिन की तुलना में % परिवर्तन: -0.14 %

The GBP/USD pair is trading around 1.3540, down slightly after testing the daily high of 1.3590, as traders digest the revision of US payroll data, which showed that the economy created 911,000 fewer jobs in the year to March. Despite the weak labor picture, the dollar held steady as markets still expect the Federal Reserve to cut rates by only 25 basis points in September, with the probability of a more significant half-point cut at only 9%. The dollar’s resilience held back the pound’s gains, even though data from the UK showed consumer spending rose in August. Given that UK inflation already reached 3.8% in July, the highest level in 18 months, and expectations point to a peak of 4%, the Bank of England has little room for easing.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.3545, 1.3485, 1.3449, 1.3398, 1.3312, 1.3281

- प्रतिरोध स्तर: 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. After testing liquidity above 1.3585, the British currency corrected to the EMA lines and is now forming a flat accumulation below the intermediate level of 1.3545. A consolidation of the price above 1.3585 will open up opportunities for buy deals with a target of 1.3585. If sellers react to 1.3545, it is worth considering intraday sales, but with short targets, as these will be counter-trend trades.

वैकल्पिक परिदृश्य:if the price breaks through the support level of 1.3417 and settles below it, the downtrend will likely resume.

आज के लिए कोई खबर नहीं

The USD/JPY currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 147.44

- पिछला क्लोज: 147.40

- अंतिम दिन की तुलना में % परिवर्तन: -0.03 %

On Wednesday, the Japanese yen held steady at around 147.3 per dollar after sharp fluctuations earlier in the week, as traders awaited key US inflation reports that could influence the Federal Reserve’s decision next week. In Japan, a private survey showed that manufacturer sentiment rose to its highest level in more than three years in September, helped by easing trade uncertainty after a tariff agreement with the US. On the political front, markets assessed the fallout from Prime Minister Shigeru Ishiba’s resignation, which followed a deepening rift in the ruling party and mounting pressure after his defeat in national elections late last year.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 147.09, 146.74

- प्रतिरोध स्तर: 147.54, 147.87, 148.26

From a technical point of view, the medium-term trend of the USD/JPY is still bullish. Yesterday, the price attempted to consolidate below the priority level, but after forming a balance, the price impulsively returned above the level, which led to the formation of a locked balance below 146.82. Currently, the price has reached the resistance level of 147.54, where sales are possible, but for a full reversal, it is necessary to form a similar balance above the resistance level, so intraday, the bias remains with buyers.

वैकल्पिक परिदृश्य:if the price breaks through the support level of 147.09 and consolidates below it, the downtrend will likely resume.

आज के लिए कोई खबर नहीं

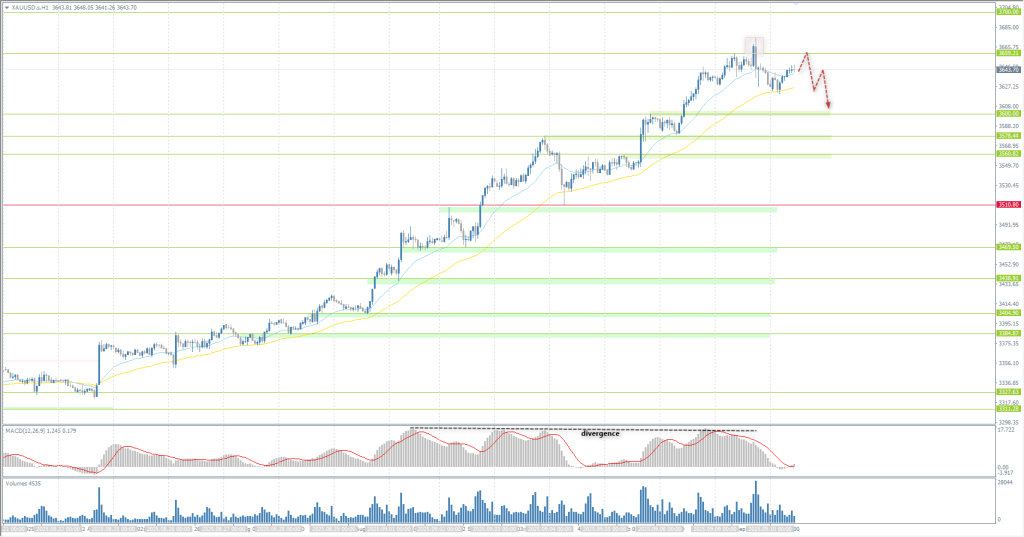

The XAU/USD currency pair (gold)

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 3636

- पिछला क्लोज: 3629

- अंतिम दिन की तुलना में % परिवर्तन: -0.19 %

On Wednesday, the price of gold rose to around $3,640 per ounce, approaching the record high reached in the previous session, thanks to expectations of a softening of US monetary policy and general uncertainty. Investors are now waiting for inflation data at the end of this week for further guidance. On the trade front, US President Donald Trump called on the European Union to impose tariffs of up to 100% on China and India to put pressure on Russian President Vladimir Putin to end the war in Ukraine. Growing unrest in the Middle East is also increasing geopolitical risks.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 3600, 3575, 3560, 3500, 3469, 3438, 3402, 3383, 3374

- प्रतिरोध स्तर: 3660, 3700

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Yesterday, the price formed a locked balance above 3660, which will act as a resistance area today and may trigger a corrective wave. If sellers react to 3660, intraday sales with a target of 3600 can be considered. A buying scenario is possible after the price consolidates above 3660.

वैकल्पिक परिदृश्य:if the price breaks the support level of 3511 and consolidates below it, the downtrend will likely resume.

समाचार फ़ीड: 2025.09.10

- US Producer Price Index (m/m) at 15:30 (GMT+3).

यह लेख एक व्यक्तिगत राय दर्शाता है और इसे निवेश के लिए सलाह, और/या प्रस्ताव, और/या वित्तीय लेनदेन के लिए निरंतर निवेदन, और/या गारंटी, और/या भविष्य की घटनाओं का पूर्वानुमान नहीं समझना चाहिए।