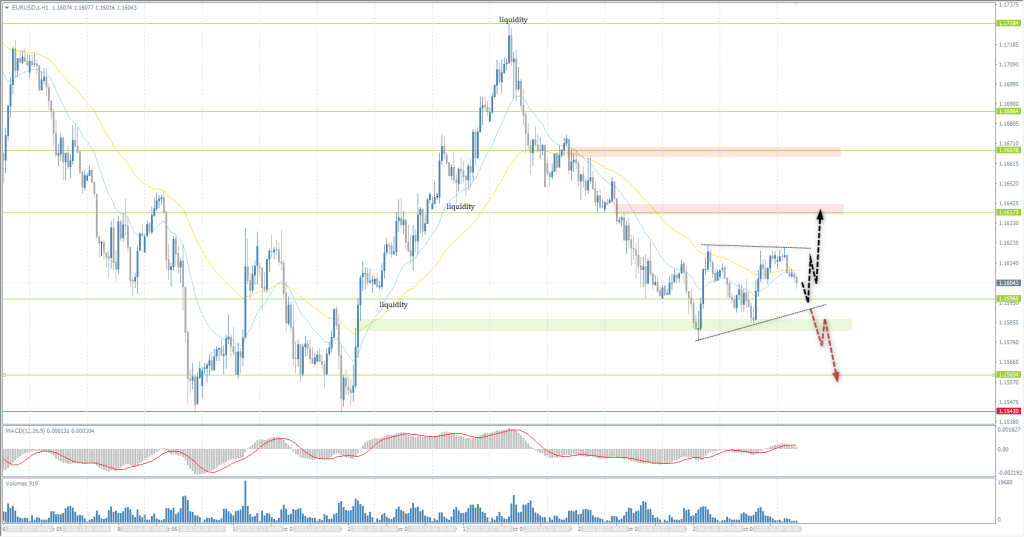

The EUR/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.1608

- पिछला क्लोज: 1.1617

- अंतिम दिन की तुलना में % परिवर्तन: +0.08 %

The EUR/USD pair rose slightly on Thursday, recovering from overnight losses, as the Eurozone Consumer Confidence Index for October unexpectedly reached an 8-month high. The euro also received support from diverging central bank policies: investors expect the Fed to continue its cycle of rate cuts, while the ECB is likely close to ending its cycle. Swap markets estimate the probability of a 25 bp ECB rate cut at its October 30 meeting at only 1%, while the probability of a rate cut at the next FOMC meeting on October 28-29 is 99%. However, the euro’s gains were held back by the strengthening of the dollar and political instability in France, where the government is facing difficulties in passing the budget.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.1600, 1.1543

- प्रतिरोध स्तर: 1.1638, 1.1667, 1.1686, 1.1728

The hourly trend for EUR/USD is bullish. Over the last two trading days, the situation has remained virtually unchanged. The price has been trading near the support level of 1.1600. The intraday bias is in favor of buyers, so intraday trades can be sought with a target of 1.1637 and above. A sell scenario is possible if the price consolidates below the flat accumulation.

वैकल्पिक परिदृश्य:if the price breaks below the 1.1543 support and consolidates, a bearish trend will likely resume.

समाचार फ़ीड: 2025.10.24

- German Manufacturing PMI (m/m) at 10:30 (GMT+3);

- German Services PMI (m/m) at 10:30 (GMT+3);

- Eurozone Manufacturing PMI (m/m) at 11:00 (GMT+3);

- Eurozone Services PMI (m/m) at 11:00 (GMT+3);

- US Consumer Price Index (m/m) at 15:30 (GMT+3), (Tentative);

- US Manufacturing PMI (m/m) at 16:45 (GMT+3), (Tentative);

- US Services PMI (m/m) at 16:45 (GMT+3), (Tentative);

- US New Home Sales (m/m) at 17:00 (GMT+3), (Tentative);

- US Michigan Inflation Expectations (m/m) at 17:00 (GMT+3).

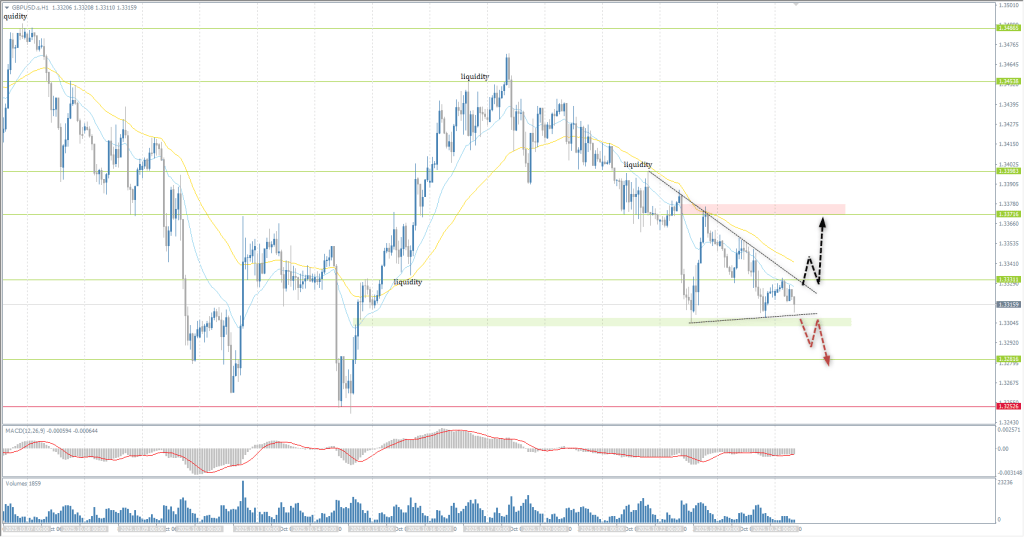

The GBP/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.3354

- पिछला क्लोज: 1.3324

- अंतिम दिन की तुलना में % परिवर्तन: -0.22 %

Monetary Policy Committee representative (MPC) Swati Dhingra said that new US tariffs could put downward pressure on prices in the UK economy. These comments reinforced expectations of further monetary policy easing by the Bank of England. Traders adjusted their projections, increasing the likelihood of a rate cut before the end of the year. Interest rate futures now price in a 78% chance that the Bank of England will cut its base rate by 25 basis points to 3.75% by the end of 2025, up from 46% at the start of Wednesday.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.3281

- प्रतिरोध स्तर: 1.3335, 1.3371, 1.3398, 1.3453, 1.3486

Technically, the trend remains bullish. However, fundamental conditions are putting pressure on prices. For buy deals, it is important for the price to re-establish itself above the 1.3335 level. Without this, the price may slowly slide down to 1.3282.

वैकल्पिक परिदृश्य:if the price breaks through the support level of 1.3253 and consolidates below it, the downtrend will likely resume.

समाचार फ़ीड: 2025.10.24

- UK Retail Sales (m/m) at 09:00 (GMT+3);

- UK Manufacturing PMI (m/m) at 11:30 (GMT+3);

- UK Services PMI (m/m) at 11:30 (GMT+3).

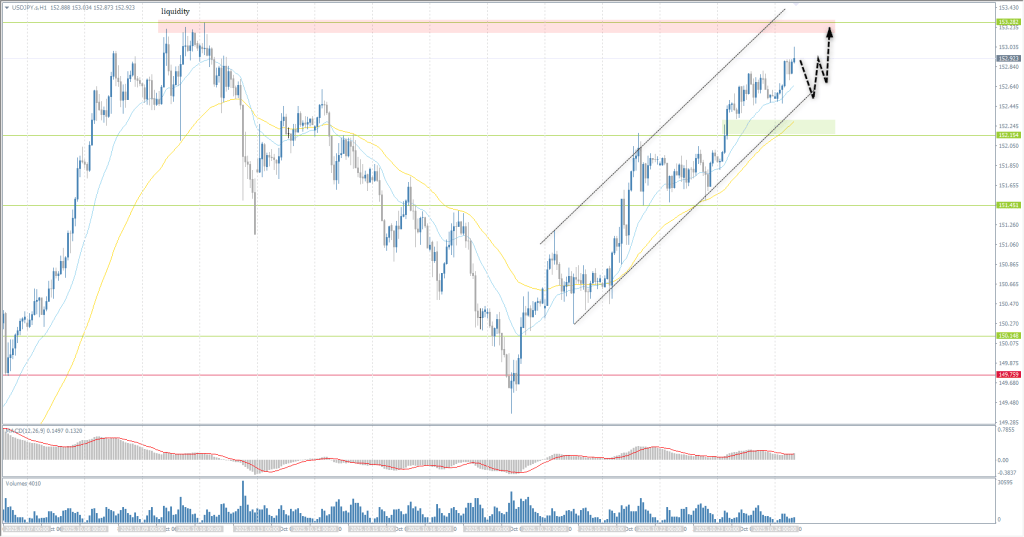

The USD/JPY currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 151.94

- पिछला क्लोज: 152.54

- अंतिम दिन की तुलना में % परिवर्तन: +0.39 %

Despite stronger inflation data, the Japanese yen weakened to 153 per dollar on Friday, approaching its lowest level in eight months. Core inflation in Japan accelerated in September for the first time since May, rising to 2.9% from 2.7% in August. The reason is that expectations are growing that the new Prime Minister Sanae Takaichi will present a large-scale stimulus package as early as next month. Market participants have postponed expectations for the next rate hike by the Bank of Japan until early 2026.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 151.45, 150.15, 149.75

- प्रतिरोध स्तर: 152.15, 153.28, 154.80

The medium-term trend is bullish. The price is trying to test liquidity above the resistance level of 153.28. It is important for buyers not to let the price settle below 152.15. A breakout of the trend line and consolidation below 152.15 could trigger a sharp sell-off. However, a scenario with a new monthly high is more likely.

वैकल्पिक परिदृश्य:if the price breaks below 149.75 and consolidates lower, a bearish trend will likely resume.

समाचार फ़ीड: 2025.10.24

- Japan National Core CPI (m/m) at 02:30 (GMT+3);

- Japan Manufacturing PMI (m/m) at 03:30 (GMT+3);

- Japan Services PMI (m/m) at 03:30 (GMT+3).

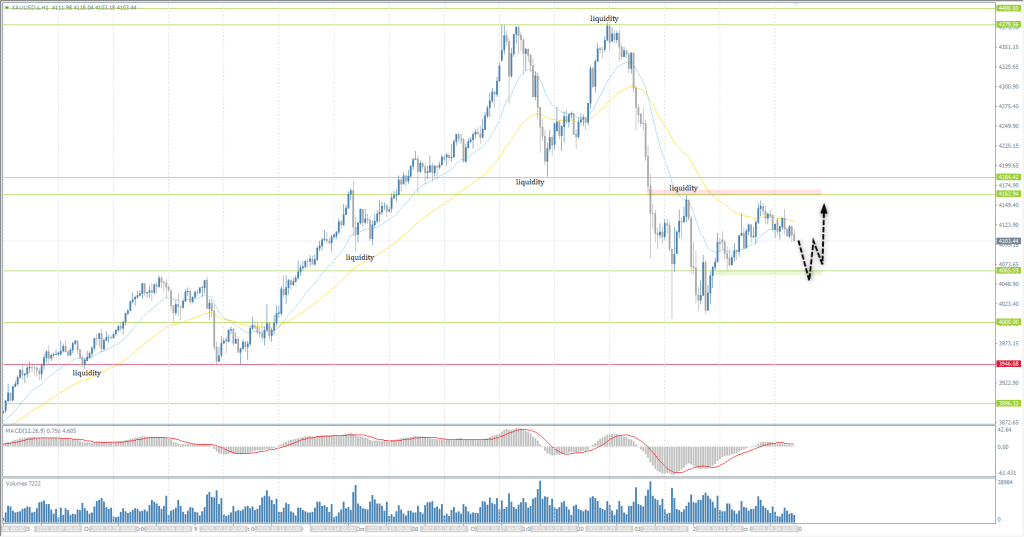

The XAU/USD currency pair (gold)

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 4102

- पिछला क्लोज: 4118

- अंतिम दिन की तुलना में % परिवर्तन: +0.39%

At the end of Wednesday, the US announced sanctions against PJSC Rosneft and PJSC Lukoil, Russia’s largest oil producers, which led to a more than 5% rise in crude oil prices on Thursday, heightened inflation expectations, and increased demand for precious metals as a hedge against inflation. Precious metals continue to receive support as a “safe haven” amid the ongoing US government shutdown, uncertainty over US tariffs, geopolitical risks, central bank purchases, US-China trade tensions, and President Trump’s attempts to undermine the independence of the Federal Reserve.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 4065, 4000, 3946

- प्रतिरोध स्तर: 4162, 4184, 4270, 4379, 4400

Technically, the medium-term trend is bullish. Gold is forming a wide-volatility flat. This is to be expected, especially after Tuesday’s sharp decline. If the US government does not resume its work, gold is likely to remain in the 4065-4162 range. For buy deals, consider the 4065 level, but with confirmation. For sales, we assess the reaction of sellers at 4162.

वैकल्पिक परिदृश्य:if the price breaks below support at 3946 and consolidates, a bearish trend will likely resume.

समाचार फ़ीड: 2025.10.24

- US Consumer Price Index (m/m) at 15:30 (GMT+3), (Tentative);

- US Manufacturing PMI (m/m) at 16:45 (GMT+3), (Tentative);

- US Services PMI (m/m) at 16:45 (GMT+3), (Tentative);

- US New Home Sales (m/m) at 17:00 (GMT+3), (Tentative);

- US Michigan Inflation Expectations (m/m) at 17:00 (GMT+3).

यह लेख एक व्यक्तिगत राय दर्शाता है और इसे निवेश के लिए सलाह, और/या प्रस्ताव, और/या वित्तीय लेनदेन के लिए निरंतर निवेदन, और/या गारंटी, और/या भविष्य की घटनाओं का पूर्वानुमान नहीं समझना चाहिए।