The EUR/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.1554

- पिछला क्लोज: 1.1556

- अंतिम दिन की तुलना में % परिवर्तन: +0.02 %

The euro continues to trade around 1.1550. Support for the currency comes from expectations of a swift end to the US government shutdown and increased investor interest in comments from ECB and Fed officials, which may clarify monetary policy prospects. In the Eurozone, the prevailing view is that the ECB will keep rates unchanged for a prolonged period, relying on a relatively resilient economy and inflation approaching the target.

Money markets currently estimate the probability of rate cuts before September 2026 at only around 40%. In the US, by contrast, a series of weak macroeconomic data has once again strengthened expectations of imminent policy easing. Against this backdrop, the market is increasingly pricing in a Fed rate cut as early as December, which pressures the dollar and helps the euro remain elevated.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.1542, 1.1520, 1.1497, 1.1462, 1.1392

- प्रतिरोध स्तर: 1.1579, 1.1605, 1.1634, 1.1667

The hourly trend for EUR/USD is bearish, but market conditions are forming for a reversal. The price has consolidated in a narrowing triangle – a pattern that accumulates liquidity before an impulsive move. Traders should wait to see where the breakout occurs. If the price consolidates above the descending trendline, it will likely jump to 1.1605. A break and consolidation below 1.1542 will open the path to 1.1520 and lower.

वैकल्पिक परिदृश्य:if the price breaks through the resistance level of 1.1666 and consolidates above it, the uptrend will likely resume.

समाचार फ़ीड: 2025.11.11

- Eurozone ECB President Lagarde Speaks at 10:20 (GMT+2);

- German ZEW Economic Sentiment (m/m) at 12:00 (GMT+2);

- Eurozone ZEW Economic Sentiment (m/m) at 12:00 (GMT+2).

The GBP/USD currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 1.3144

- पिछला क्लोज: 1.3172

- अंतिम दिन की तुलना में % परिवर्तन: +0.21 %

Today, UK labor market data will be released. Prognoses suggest unemployment will rise from 4.8% to 4.9%, while wage growth will be around 5%. Despite signs of labor market stabilization, wages remain too high for some Bank of England members. Swap markets currently price in nearly a 70% chance of a December rate cut. Uncertainty around the autumn budget on November 26 also weighs on the pound.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 1.3137, 1.3109, 1.3072

- प्रतिरोध स्तर: 1.3162, 1.3174, 1.3216, 1.3247, 1.3291, 1.3328, 1.3365

Technically, the trend on the GBP/USD currency pair is bearish. After testing resistance at 1.3162, the price consolidated. Profit-taking on earlier longs, combined with MACD divergence, has now led to a decline. The price is aiming to test support at 1.3095. Intraday bias favors sellers, so EMA lines and resistance at 1.3162 can be considered for selling. No optimal entry points for buying at the moment.

वैकल्पिक परिदृश्य:if the price breaks through the resistance level of 1.3365 and consolidates above it, the uptrend will likely resume.

समाचार फ़ीड: 2025.11.11

- UK Average Earnings Index (m/m) at 09:00 (GMT+2);

- UK Claimant Count Change (m/m) at 09:00 (GMT+2);

- UK Unemployment Rate (m/m) at 09:00 (GMT+2).

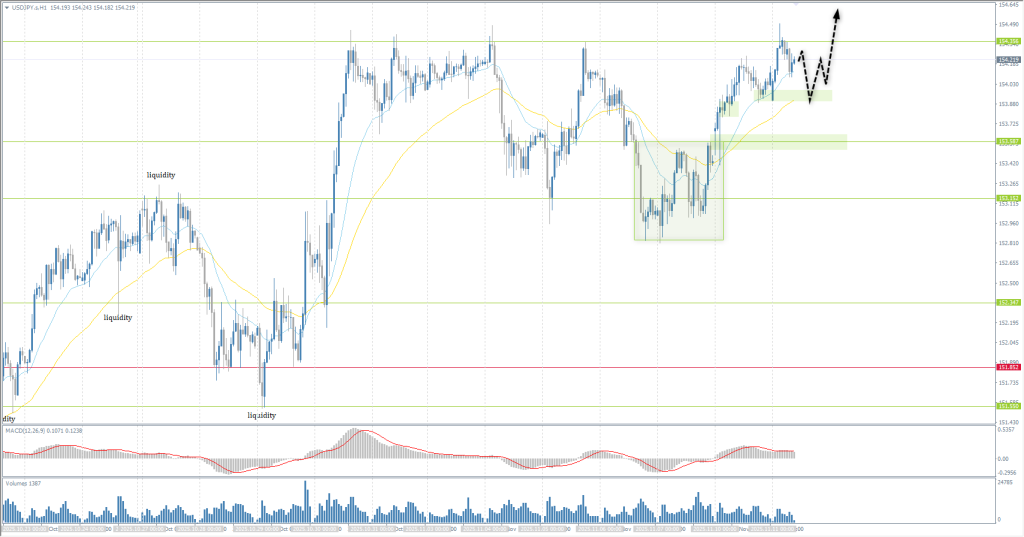

The USD/JPY currency pair

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 153.67

- पिछला क्लोज: 154.12

- अंतिम दिन की तुलना में % परिवर्तन: +0.29 %

On Tuesday, the Japanese yen weakened to 154.5 per dollar, approaching a nine-month low, as improved sentiment over a possible resumption of US government operations reduced demand for safe-haven assets. Economy Revitalization Minister Minoru Kiuchi warned that yen weakness could accelerate consumer price growth through more expensive imports and stressed the need for close monitoring. The Japanese government is preparing to approve Prime Minister Sanae Takaichi’s stimulus package on November 21.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 153.58, 153.15, 151.51, 150.87, 150.15

- प्रतिरोध स्तर: 154.36, 154.79, 156.54

The medium-term trend is bullish. The price has again reached resistance at 154.36, but sellers’ reaction is weak this time. Moreover, buyers are preventing any decline. This increases the likelihood of a breakout above 154.36 and further growth. EMA lines or support at 153.58 can be considered for buying. No confirmation for selling at the moment.

वैकल्पिक परिदृश्य:if the price breaks below 151.85 and consolidates lower, a bearish trend will likely resume.

आज के लिए कोई खबर नहीं

The XAU/USD currency pair (gold)

मुद्रा जोड़ी के तकनीकी संकेतक:

- पिछला ओपन: 4004

- पिछला क्लोज: 4111

- अंतिम दिन की तुलना में % परिवर्तन: +2.67%

On Tuesday, gold rose above $4,130 per ounce, hitting a three-week high. Price growth is supported by uncertainty around the US economy and expectations of imminent Fed easing. Recent data showed job losses in October, especially in government and retail, while consumer sentiment in early November fell to its lowest in 3.5 years. Against this backdrop, markets estimate the probability of a Fed rate cut in December at 25 bps at around 64%.

Hopes for a swift resumption of federal government operations after a 40-day pause, strengthened by Senate progress on the measure, may partially reduce demand for gold as a safe-haven asset. However, structural factors continue to support the bullish scenario: according to JP Morgan Private Bank, gold could exceed $5,000 per ounce next year.

ट्रेडिंग सिफ़ारिशें

- समर्थन स्तर: 4082, 4046, 4019, 3960, 3930, 3896, 3867

- प्रतिरोध स्तर: 4162, 4184

Technically, the medium-term has shifted upward. On Monday, gold impulsively consolidated above the accumulation range of 3930-4046 and resumed its rally. The price has been secured above the priority-shift level. No conditions for selling at the moment. The path to 4162 is open. Buyers should look for trades from EMA lines or nearby support levels.

वैकल्पिक परिदृश्य:if the price breaks support at 3965 and consolidates below, the downtrend will likely resume.

आज के लिए कोई खबर नहीं

यह लेख एक व्यक्तिगत राय दर्शाता है और इसे निवेश के लिए सलाह, और/या प्रस्ताव, और/या वित्तीय लेनदेन के लिए निरंतर निवेदन, और/या गारंटी, और/या भविष्य की घटनाओं का पूर्वानुमान नहीं समझना चाहिए।