The EUR/USD currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 1.1440

- Tutup sebelumnya: 1.1373

- % perubahan selama sehari terakhir: -0.58 %

The yield on German 10-year bonds fell to 2.5%, reaching its lowest level since May 7, after Eurozone inflation data came in worse than expected, strengthening bets on a 25 basis point cut by the ECB later this week and fueling speculation about further easing. Eurozone consumer price inflation fell to 1.9% in May from 2.2% in April and was below the expected 2.0%, marking the first time inflation has fallen below the ECB’s target since September 2024. In addition, inflation in the services sector fell to its lowest level since March 2022, while core inflation reached its lowest level since January 2022.

Rekomendasi trading

- Level support: 1.1367, 1.1312, 1.1296, 1.1269, 1.1220, 1.1200

- Level resistance: 1.1389, 1.1431, 1.1456, 1.1483

The EUR/USD currency pair’s hourly trend is bearish. Yesterday, the euro reached the resistance level of 1.1456, where previously opened buy trades began to be closed. Currently, the price has corrected to the support level of 1.1367, where it is important to assess the price action. If buyers react here, buy deals to 1.1389 and 1.1431 can be considered. If the price manages to consolidate below 1.1367, this will trigger a sell-off to 1.1312.

Skenario alternatif:if the price breaks through the support level of 1.1323 and consolidates below it, the downward trend will likely resume.

Umpan berita untuk: 2025.06.04

- German Services PMI (m/m) at 10:55 (GMT+3);

- Eurozone Services PMI (m/m) at 11:00 (GMT+3);

- US ADP Nonfarm Employment Change (m/m) at 15:15 (GMT+3);

- US ISM Services PMI (m/m) at 17:00 (GMT+3).

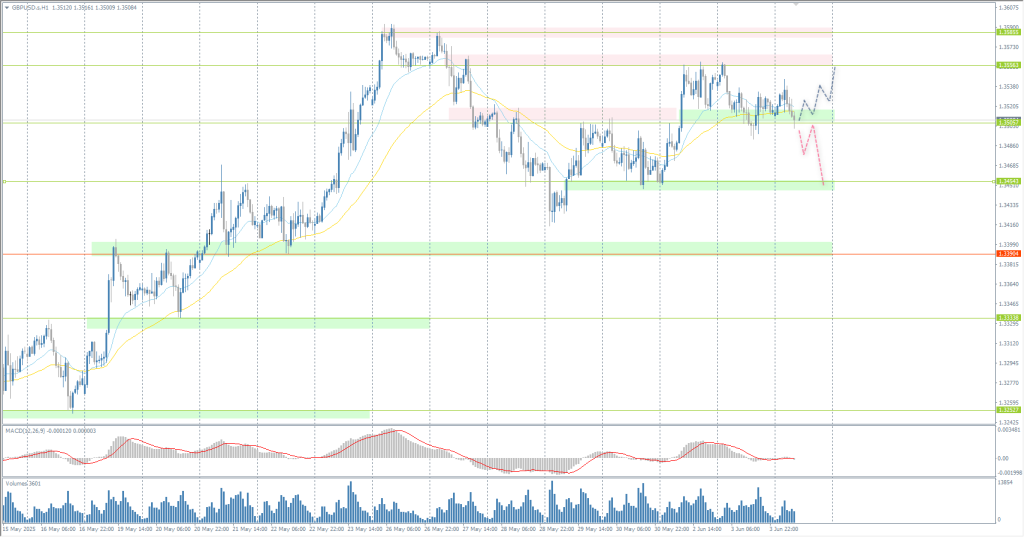

The GBP/USD currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 1.3538

- Tutup sebelumnya: 1.3517

- % perubahan selama sehari terakhir: -0.16 %

Bank of England policymaker Catherine Mann highlighted the contradiction between rate cuts and the Bank’s bond-selling program, warning that asset sales affect long-term yields differently than interest rates. She suggested reviewing the pace of gilt sales. Meanwhile, the OECD lowered its UK economic growth expectations to 1.3% for 2025 and 1.0% for 2026 due to Trump’s trade tariffs, tight government budgets, and persistent inflation. The report warns that weak consumer confidence and fragile public finances make the UK vulnerable to shocks.

Rekomendasi trading

- Level support: 1.3505, 1.3454, 1.3435, 1.3390, 1.3333, 1.3291, 1.3121

- Level resistance: 1.3556, 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly is bullish. The British pound is forming a flat accumulation. The price is currently trading near the demand zone, where it is important to assess price action. If buyers react here, buy deals up to 1.3556 can be considered. If the price manages to consolidate below 1.3505, this will trigger a sell-off to 1.3454.

Skenario alternatif:if the price breaks the support level of 1.3390 and consolidates below it, the downtrend will likely resume.

Umpan berita untuk: 2025.06.04

- UK Services PMI (m/m) at 11:30 (GMT+3).

The USD/JPY currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 142.67

- Tutup sebelumnya: 143.96

- % perubahan selama sehari terakhir: +0.90 %

On Wednesday, the Japanese yen remained at 143.9 per dollar after falling nearly 1% in the previous session, as the decline in the US dollar helped stabilize the currency. Traders remained cautious ahead of key US labor market reports that could influence Federal Reserve policy. Meanwhile, Bank of Japan Governor Kazuo Ueda confirmed on Tuesday that the Central Bank is ready to raise interest rates again if economic and inflation expectations are met, reinforcing prognoses of a slow and measured normalization of policy.

Rekomendasi trading

- Level support: 143.64, 143.27, 142.62, 142.19

- Level resistance: 144.44, 145.45, 146.27, 146.85, 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bullish, but currently the yen has once again approached the priority level. If sellers react here, you can look for sell trades with a target of 143.64. It is very important for sellers not to let the price consolidate above 144.44. There are no optimal entry points for buying at the moment.

Skenario alternatif:if the price breaks through the resistance level of 144.44 and consolidates above it, the uptrend will likely resume.

Umpan berita untuk: 2025.06.04

- Japan Services PMI (m/m) at 03:30 (GMT+3).

The XAU/USD currency pair (gold)

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 3385

- Tutup sebelumnya: 3352

- % perubahan selama sehari terakhir: -0.98 %

On Wednesday, gold rose to $3370 per ounce, recouping some losses from the previous session, as growing geopolitical and economic risks increased its appeal as a safe source of income. On Tuesday, the OECD lowered its global growth expectations, citing growing pressure on the US economy due to escalating trade tensions. This was exacerbated by weak data on US factory orders, which, however, was offset by signs of labor market resilience. Meanwhile, President Trump’s tariffs on steel and aluminum took effect on Wednesday, further exacerbating global trade relations.

Rekomendasi trading

- Level support: 3343, 3325, 3303, 3276, 3248

- Level resistance: 3370, 3414

From the point of view of technical analysis, the trend on the XAU/USD is bullish. There are no signs of a reversal. Any pullback should be used to find optimal entry points for buying. Support levels 3343 and 3325 are best suited for longs. With high probability, until the US labor market report on Friday, the price will fluctuate in the range of 3343-3370.

Skenario alternatif:if the price breaks and consolidates below the support level of 3272, the downtrend will likely resume.

Umpan berita untuk: 2025.06.04

- US ADP Nonfarm Employment Change (m/m) at 15:15 (GMT+3);

- US ISM Services PMI (m/m) at 17:00 (GMT+3).

Artikel ini mencerminkan pendapat pribadi dan tidak boleh ditafsirkan sebagai saran investasi, dan/atau penawaran, dan/atau permintaan berkelanjutan untuk melakukan transaksi finansial, dan/atau jaminan, dan/atau perkiraan peristiwa di masa depan.