The EUR/USD currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 1.1442

- Tutup sebelumnya: 1.1394

- % perubahan selama sehari terakhir: -0.42 %

On Friday, the euro fell below $1.14, retreating from its six-week high of $1.149 reached on Thursday, as a stronger-than-expected US employment report supported the US dollar. The US added 137,000 jobs in May, slightly above the forecast of 130,000, the unemployment rate remained unchanged at 4.2%, and wage growth accelerated to 0.4%, exceeding expectations of 0.3%. In Europe, ECB representative Yannis Stournaras said that the Eurozone had achieved a soft landing and that most rate cuts were probably behind us. However, uncertainty remains, particularly regarding the potential impact of new tariffs.

Rekomendasi trading

- Level support: 1.1386, 1.1356, 1.1312, 1.1296, 1.1269, 1.1220, 1.1200

- Level resistance: 1.1431, 1.1456, 1.1483

The EUR/USD currency pair’s hourly trend is bearish. On Friday, the euro fell to the support level of 1.1386, where buyers became active. The latest surge in volume also points to buyers, as the effort-result rule suggests that the price began to grow after the volume increased. Currently, the price has approached resistance levels, so intraday sales from 1.1432 or 1.1455 can be considered, but only with confirmation.

Skenario alternatif:if the price breaks through the support level of 1.1356 and consolidates below it, the downward trend is likely to resume.

Tidak ada berita untuk hari ini

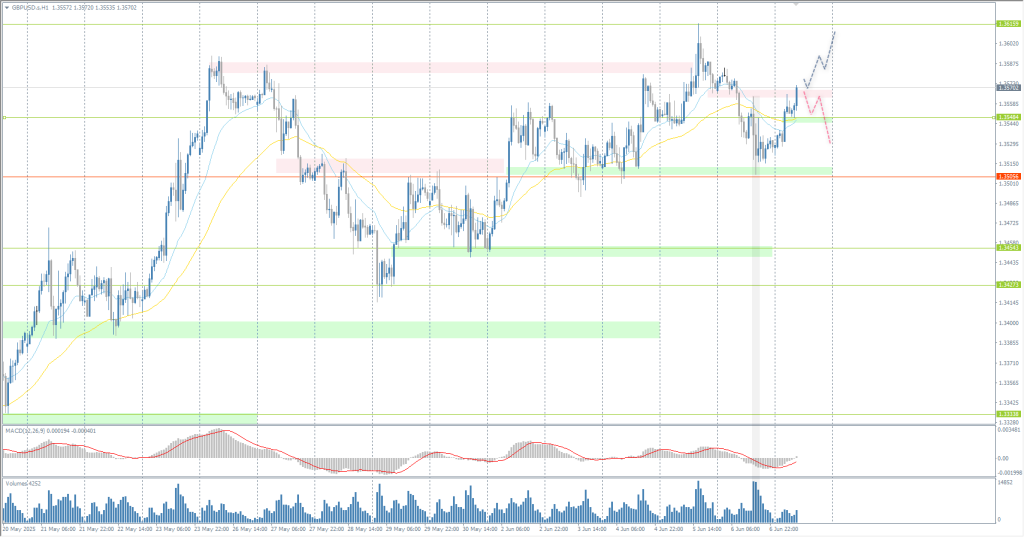

The GBP/USD currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 1.3568

- Tutup sebelumnya: 1.3527

- % perubahan selama sehari terakhir: -0.30 %

Two factors appear to be contributing to the rise in the pound. First, the market has backed away from the aggressiveness with which it discounted the Bank of England’s monetary policy. The year-end rate reflected in the swap market has risen by more than 30 basis points over the past month. Second, there is broad weakness in the dollar. The inverse correlation between changes in the pound sterling and the dollar index is about 0.90.

Rekomendasi trading

- Level support: 1.3548, 1.3505, 1.3454, 1.3435, 1.3390, 1.3333, 1.3291, 1.3121

- Level resistance: 1.3570, 1.3616

In terms of technical analysis, the trend on the currency pair GBP/USD on the hourly chart is bullish. On Friday, the British pound briefly reached the key change level of 1.3505, at which point buyers took the initiative. The surge in volume and the subsequent reaction are also bullish. The price is now facing a resistance zone. A breakout of this zone will trigger a rise to 1.3616. If the price fails to consolidate above 1.3570, the price will likely fall and correct to 1.3550.

Skenario alternatif:if the price breaks through the support level of 1.3505 and consolidates below it, the downtrend is likely to resume.

Tidak ada berita untuk hari ini

The USD/JPY currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 143.46

- Tutup sebelumnya: 144.84

- % perubahan selama sehari terakhir: +0.96 %

The Japanese yen rose to 144.5 per US dollar on Monday, recovering after two consecutive days of losses, as revised data showed that the country’s GDP remained unchanged in the first quarter, which is better than the previously expected decline of 0.2%. Despite the upward revision, the result still reflects a sharp slowdown compared to the 0.6% growth recorded in the previous quarter. Additionally, Japan’s current account surplus narrowed in April, falling short of market expectations. Last week, Bank of Japan Governor Kazuo Ueda confirmed the central bank’s readiness to raise interest rates if economic and inflation forecasts are met, reinforcing the view of a gradual but steady tightening of policy.

Rekomendasi trading

- Level support: 144.21, 143.45, 142.62, 142.19

- Level resistance: 145.06, 146.27, 146.85, 148.28

From a technical perspective, the medium-term trend of the USD/JPY is bullish. On Friday, the Japanese yen consolidated above the priority change level. The price has now corrected to the support level of 144.21, where intraday buy trades can be sought. An impulsive breakdown of this level will open the way for the price to 143.45. Therefore, the focus is on the price reaction to the level of 144.21.

Skenario alternatif:if the price breaks through the support level of 142.77 and consolidates below it, the downtrend is likely to resume.

Umpan berita untuk: 2025.06.09

- Japan GDP (m/m) at 02:50 (GMT+3).

The XAU/USD currency pair (gold)

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 3353

- Tutup sebelumnya: 3312

- % perubahan selama sehari terakhir: -1.12 %

Gold prices lost ground and fell below $3350 per ounce as a stronger-than-expected US employment report eased fears of a sharp downturn in the labor market amid President Donald Trump’s escalating tariff war. Investors also reacted positively to news that President Trump had held a long-awaited telephone conversation with Chinese President Xi Jinping, during which the two leaders agreed to resume trade negotiations that had previously stalled due to mutual accusations of violating commitments. Despite Friday’s pullback, gold rose about 2% for the week.

Rekomendasi trading

- Level support: 3303, 3325, 3303, 3276, 3248

- Level resistance: 3344, 3365, 3414

From the technical analysis perspective, the trend on the XAU/USD is bullish. On Friday, gold corrected to the support level of $3,400, where buyers stepped in. Currently, the price has a clear path to 3344, so intraday buy trades can be sought. There are currently no optimal entry points for sales.

Skenario alternatif:if the price breaks and consolidates below the support level of 3272, the downtrend will likely resume.

Tidak ada berita untuk hari ini

Artikel ini mencerminkan pendapat pribadi dan tidak boleh ditafsirkan sebagai saran investasi, dan/atau penawaran, dan/atau permintaan berkelanjutan untuk melakukan transaksi finansial, dan/atau jaminan, dan/atau perkiraan peristiwa di masa depan.