The EUR/USD currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 1.1612

- Tutup sebelumnya: 1.1568

- % perubahan selama sehari terakhir: -0.38 %

The euro hovered around $1.16, not far from last Thursday’s more than two-month low of $1.154, as investors assessed political uncertainty in France and ongoing trade tensions between the US and China. In France, Sébastien Lecornu, the country’s fifth prime minister in two years, resigned last Monday but was reappointed on Friday. He now faces a narrow path to political survival as he prepares to present a budget bill by Monday’s deadline. To ensure its passage through a divided parliament, Lecornu is trying to persuade the Socialists and center-right Republicans to either abstain or give conditional support when voting on the budget. It is encouraging that the majority of MPs are opposed to dissolving parliament, suggesting that there is a real path to passing the budget.

Rekomendasi trading

- Level support: 1.1560, 1.1515

- Level resistance: 1.1598, 1.1628, 1.1683, 1.1728, 1.1754, 1.1786, 1.1819

The EUR/USD currency pair’s hourly trend is downward. The euro has formed a locked balance below 1.1574, and now this area will act as a support zone. Yesterday, the price fell to the middle of this balance at 1.1598, after which buyers reacted. Today, it is worth considering buying with a target of 1.1628. There are currently no optimal entry points for selling.

Skenario alternatif:if the price breaks through the resistance level of 1.1683 and consolidates above it, the uptrend will likely resume.

Umpan berita untuk: 2025.10.14

- German Inflation Rate (m/m) at 09:00 (GMT+3);

- German ZEW Economic Sentiment (m/m) at 12:00 (GMT+3);

- Eurozone ZEW Economic Sentiment (m/m) at 12:00 (GMT+3);

- US Fed Chair Powell Speech at 19:20 (GMT+3);

The GBP/USD currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 1.3341

- Tutup sebelumnya: 1.3320

- % perubahan selama sehari terakhir: -0.15 %

The British pound fell to $1.333 due to the strengthening US dollar and investor caution ahead of the UK’s November budget. Markets are concerned that potential tax increases aimed at meeting fiscal targets could further distort the fragile UK economy. Chancellor Rachel Reeves is expected to emphasize fiscal discipline in her November 26 budget, possibly through tax increases, after previously raising employer social security contributions by £25 billion. Analysts expect modest economic growth through the end of 2025, with inflation projected to reach 4%, double the Bank of England’s target. Investors are closely watching upcoming UK employment, wage, and GDP data to gauge the outlook for interest rates. The Bank of England’s next meeting is on November 6, and markets expect the rate to remain unchanged, with the first rate cut not coming until March at the earliest.

Rekomendasi trading

- Level support: 1.3315, 1.3282, 1.3214

- Level resistance: 1.3370, 1.3395, 1.3419

In terms of technical analysis, the trend on the currency pair GBP/USD is a downtrend. The British pound is forming a triangle pattern with elements of liquidity compression. Such a formation usually occurs before an impulsive movement. A breakout of the upper border of the triangle on an impulse candle will open the way for growth to 1.3395 and above. It is important for buyers not to let the price settle below 1.3315.

Skenario alternatif:if the price breaks through the resistance level of 1.3419 and consolidates above it, the uptrend will likely resume.

Umpan berita untuk: 2025.10.14

- UK Unemployment Rate (m/m) at 09:00 (GMT+3);

- UK BOE Gov Bailey Speech at 20:00 (GMT+3).

The USD/JPY currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 151.81

- Tutup sebelumnya: 152.25

- % perubahan selama sehari terakhir: +0.29 %

On Tuesday, the Japanese yen fell to 152.3 per dollar as growing political uncertainty dampened investor sentiment. On Friday, Japan’s Komeito party announced its withdrawal from the ruling coalition led by the Liberal Democratic Party, raising doubts about Sanae Takaichi’s political agenda and complicating her path to the prime minister’s office. Meanwhile, Finance Minister Katsunobu Kato said that the current situation in Japan is different from the era of Abenomics expansionary policy, noting that the main problem now is inflation, not deflation. He also warned against unilateral and rapid currency fluctuations, stressing that exchange rates should reflect fundamental economic indicators.

Rekomendasi trading

- Level support: 151.18, 149.95, 148.83, 147.81

- Level resistance: 152.50, 153.28, 154.80

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The Japanese yen tested the resistance level of 152.50, where sellers showed a bearish reaction. Intraday, look for sell trades with the aim of updating this week’s low of 151.18. It is important for sellers not to let the price consolidate above 152.50. In this case, the sell scenario will be canceled.

Skenario alternatif:If the price breaks through the support level of 147.05 and consolidates below it, the downtrend will likely resume.

Tidak ada berita untuk hari ini

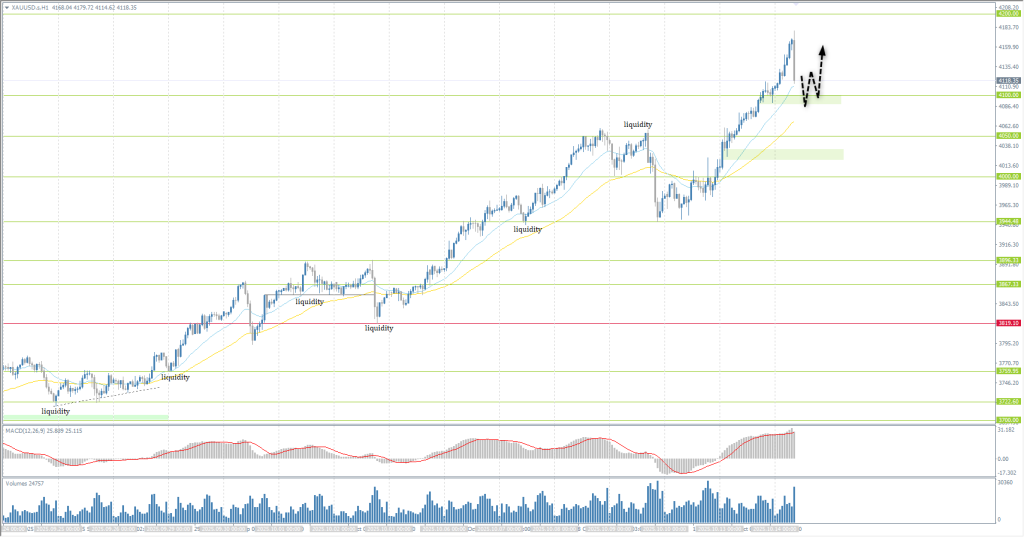

The XAU/USD currency pair (gold)

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 4011

- Tutup sebelumnya: 4102

- % perubahan selama sehari terakhir: +2.27%

On Tuesday, gold prices reached a new record high of $4170 per ounce as investors stepped up purchases of safe-haven assets amid trade tensions between the US and China and increased bets on interest rate cuts in the US. Last week, US President Donald Trump reignited the trade war with China by threatening to impose a new round of tariffs on Chinese goods and introduce export controls. In response, Beijing promised to take retaliatory measures if Trump follows through on his threats. The market also remains concerned about the prolonged US government shutdown, which, according to Treasury Secretary Scott Bessent, is beginning to affect the economy. Meanwhile, investors are awaiting Fed Chairman Jerome Powell’s speech at the annual NABE meeting later today, hoping to gain insight into the US central bank’s plans for rate cuts. Traders currently estimate the probability of a 25 basis point rate cut in October at 97% and in December at 90%.

Rekomendasi trading

- Level support: 4100, 4050, 4000, 3944, 3896, 3867, 3820, 3800

- Level resistance: 4200

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold is skyrocketing high without stopping. Selling during such a strong bullish trend is not recommended, but at any moment, previously opened purchases may begin to be fixed, which could lead to a sharp correction, and this must be taken into account. For buy deals, it is best to consider the EMA lines or the support level of 4100, but with confirmation. There are currently no optimal entry points for sales.

Skenario alternatif:if the price breaks the support level of 3944 and consolidates below it, the downtrend will likely resume.

Umpan berita untuk: 2025.10.14

- US Fed Chair Powell Speech at 19:20 (GMT+3).

Artikel ini mencerminkan pendapat pribadi dan tidak boleh ditafsirkan sebagai saran investasi, dan/atau penawaran, dan/atau permintaan berkelanjutan untuk melakukan transaksi finansial, dan/atau jaminan, dan/atau perkiraan peristiwa di masa depan.