The EUR/USD currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 1.1850

- Tutup sebelumnya: 1.1790

- % perubahan selama sehari terakhir: -0.51%

On Monday, the euro remained under pressure from a strengthening US dollar. In early February, the EUR/USD rate declined toward the 1.1800 level. However, the single currency received moderate support from updated Eurozone macro data: the Manufacturing PMI for January was revised upward to 49.5 from the previously reported 49.4, slightly improving the industrial outlook. Additional support came from German Retail Sales for December, which grew in line with market expectations, partially offsetting the negative currency headwinds.

Rekomendasi trading

- Level support: 1.1754

- Level resistance: 1.1835, 1.1874, 1.1953, 1.1859, 1.2050, 1.3000

The euro has consolidated below 1.1835 and is trading firmly below the EMA lines. Buyer reaction remains weak, and the lack of divergence on the MACD indicator further suggests a continuation of the decline. In these trading conditions, the priority remains on short positions, ideally from the 1.1835 or 1.1874 resistance levels. The downside target remains the 1.1754 support level. Buying at this stage appears suboptimal, as no confirmed signals from bulls have emerged.

Skenario alternatif:- Trend: Down

- Sup: 1.1754

- Res: 1.1835

- Note: For sell deals, look to resistance levels at 1.1835 or 1.1874, but wait for confirmation. There are currently no optimal entry points for buys.

Umpan berita untuk: 2026.02.03

- US JOLTs Job Openings (m/m) at 17:00 (GMT+2). – USD (MED)

The GBP/USD currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 1.3690

- Tutup sebelumnya: 1.3663

- % perubahan selama sehari terakhir: -0.20 %

The British pound weakened to the 1.367 area as investors adopted a “wait-and-see” approach ahead of the Bank of England’s monetary policy meeting. Markets generally expect the regulator to hold interest rates at 3.75%, while expectations for rate cuts have significantly diminished: the probability of more than one cut this year is now priced at less than 50%. This reflects the resilience of UK macroeconomic data and persistent inflationary pressures. UK inflation remains the highest among G7 nations, and recent Manufacturing PMI data showed business activity reaching its highest level since August 2024, strengthening the case for a more patient and cautious approach from the BoE.

Rekomendasi trading

- Level support: 1.3643, 1.3568

- Level resistance: 1.3710, 1.3737, 1.3787, 1.3871, 1.4000

The British pound appears notably stronger than the euro. The price tested the 1.3643 support level, where buyers showed moderate initiative, and a MACD divergence formed, leading to a bounce. Today, the focus shifts to resistance levels at 1.3710 and 1.3737. If sellers react in these zones, short positions could be considered. A decisive breakout and consolidation above 1.3737 would signal a resumption of the uptrend.

Skenario alternatif:- Trend: Neutral

- Sup: 1.3643

- Res: 1.3710

- Note: Look for sell trades in the 1.3710-1.3737 zone, but with confirmation. A break above 1.3737 will signal the resumption of the uptrend.

Tidak ada berita untuk hari ini

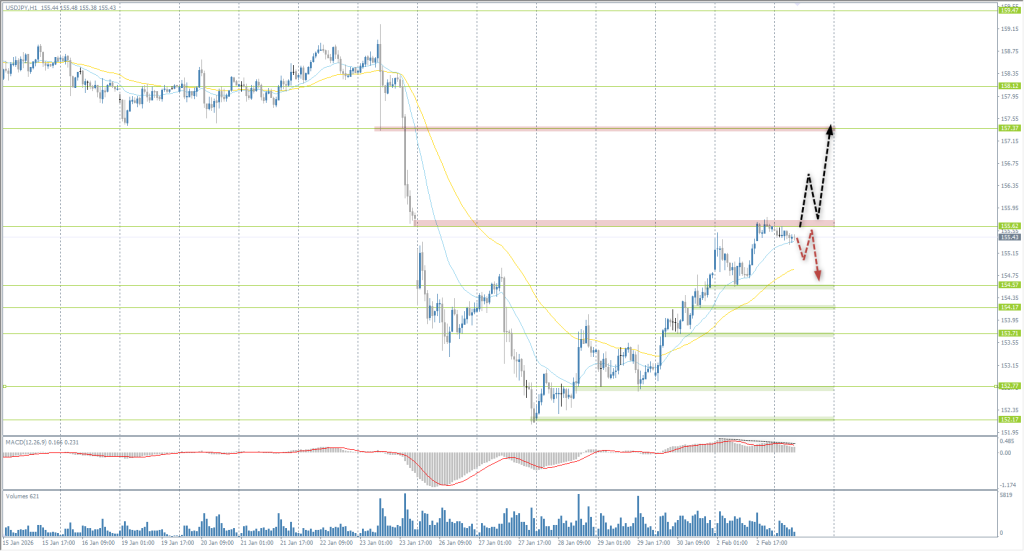

The USD/JPY currency pair

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 154.86

- Tutup sebelumnya: 155.62

- % perubahan selama sehari terakhir: +0.49 %

The Japanese yen traded near 155.5 per dollar on Tuesday following two consecutive sessions of declines, as strong US macro data and the nomination of a policy hawk as Fed Chair continued to support the Greenback. Additional pressure came from Prime Minister Sanae Takaichi, who over the weekend described a weak currency as a potential opportunity for export-oriented industries, signaling a higher tolerance for yen depreciation. Pressure is also mounting ahead of the snap Lower House elections on February 8, where Takaichi’s ruling party is expected to strengthen its position and continue pushing for expansionary fiscal policy.

Rekomendasi trading

- Level support: 154.57, 154.17, 153.71, 152.77, 152.17

- Level resistance: 155.62, 157.50

The yen is retesting the 155.62 level, where evaluating the price reaction is crucial. An impulsive break of this level could open the path toward 157.37; therefore, sellers will likely defend this key frontier. Should a bearish reaction form, a correction toward 154.70 and lower is possible. Look for confirmation on intraday time frames, paying close attention to movement structure and momentum.

Skenario alternatif:- Trend: Neutral

- Sup: 155.62

- Res: 154.57

- Note: Consider sell trades from 155.62 with confirmation. Buys are appropriate only after a confident breakout of 155.62.

Tidak ada berita untuk hari ini

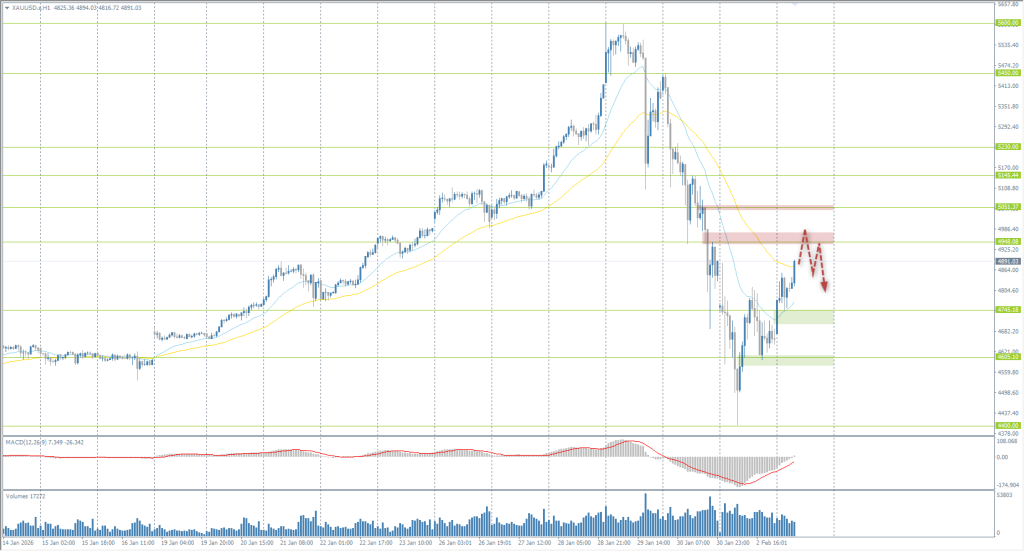

The XAU/USD currency pair (gold)

Indikator teknis pasangan mata uang:

- Buka sebelumnya: 4754

- Tutup sebelumnya: 4658

- % perubahan selama sehari terakhir: -2.06 %

Gold prices declined approximately 4% on the first trading day of February, falling below $4700 per ounce following a 10% plunge during the Asian session and a nearly 9% drop on Friday. The sharp retreat was triggered by President Trump’s nomination of Kevin Warsh, viewed by markets as a more “hawkish” candidate, as Fed Chair. This bolstered the US dollar and pressured gold. Active profit-taking after a prolonged rally, which saw gold hit record highs, also contributed to the slide. The previous rally was supported by central bank demand and the “debasement trade” as investors shifted funds into physical assets amid rising government debt concerns.

Rekomendasi trading

- Level support: 4745, 4605, 4400

- Level resistance: 4948, 5051, 5145, 5230

Gold found support around 4400, triggering a bounce. The price has managed to consolidate above 4745, opening a path toward 4948. The resistance zones at 4948 and 5051 remain critical, as they marked the start of the previous secondary downward impulse. Intraday buys targeting 4948 can be considered, while for sells, monitor the price reaction in the liquidity zone above that level.

Skenario alternatif:- Trend: Down

- Sup: 4745

- Res: 4948

- Note: Look for intraday buys targeting 4948. For sells, evaluate the price reaction in the 4948–5051 zone.

Umpan berita untuk: 2026.02.03

- US JOLTs Job Openings (m/m) at 17:00 (GMT+2). – USD (MED)

Artikel ini mencerminkan pendapat pribadi dan tidak boleh ditafsirkan sebagai saran investasi, dan/atau penawaran, dan/atau permintaan berkelanjutan untuk melakukan transaksi finansial, dan/atau jaminan, dan/atau perkiraan peristiwa di masa depan.