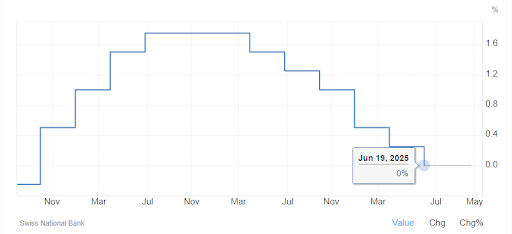

Last week, the Swiss National Bank (SNB) lowered its key interest rate once again, now standing at 0%. What does this mean?

Contrary to popular belief, a zero interest rate does not mean free loans or generosity on the part of the central bank. It is a signal. A signal that the economy is slowing down, inflation is weakening, and consumer activity is insufficient.

For Switzerland, with its stable but export- and capital-dependent economy, this decision is not spontaneous. It is a strategic move aimed at supporting demand, preventing the franc from strengthening and combating the risks of deflation.

What Is a Zero Interest Rate, and Why Is It Needed?

The key interest rate is the rate at which the central bank lends money. It determines the interest rate at which commercial banks can borrow and deposit money with the central bank. Mortgages, loans, bond yields, and the national currency exchange rate all depend on it.

When the rate drops to 0%, it means:

- It becomes cheaper for borrowers to borrow money (loans, mortgages);

- Deposit rates tend toward zero (and sometimes even become negative);

- It is unprofitable for investors to keep money in a “safe” — they are forced to seek returns by investing in the economy;

- The national currency weakens, which makes exports more competitive;

- However, this is also a sign of economic weakness: the SNB is lowering the rate because inflation is insufficient and domestic demand is not growing.

What Happens When Interest Rates Are Negative?

Switzerland is one of the few countries that have experienced negative rates since 2015. The SNB kept the rate at -0.75% at that time. What did we see?

- Banks lost profitability: deposit margins narrowed, forcing banks to charge customers fees.

- The franc remained strong despite sub-zero rates, as it was considered a “safe haven” for investors.

- Real estate and stocks rose: cheap money flowed into assets, causing prices to rise;

- Inflation was suppressed: despite the stimulus policy, Switzerland remained in the “low inflation” zone.

The paradox is that even negative interest rates do not always lead to inflation. If consumers and companies are pessimistic, they do not start spending and investing more; instead, they start saving, even with zero or negative returns.

So, What Is the Optimal Interest Rate?

There is no universal answer. However, there is the concept of a “neutral rate” — a level at which the economy grows steadily and inflation is close to the target level (in Switzerland, 2%).

Under normal conditions:

- The neutral rate in a developed economy is around 1.0–2.5%;

- If inflation falls, the rate should be lowered;

- If inflation rises, it should be raised.

In the case of Switzerland, which is already experiencing the risks of deflation (a slowdown in price growth), a zero rate is an attempt to “shake up” the economy. However, maintaining the rate at this level for an extended period is risky — it can lead to asset market bubbles and destabilize the financial system.

What Next? Are Negative Rates Possible Again?

If inflation continues to decline in the coming months and the global economy weakens, the SNB may return to negative rates. This would be an extremely cautious decision but entirely possible, especially if the franc starts to strengthen again.

Ideally, however, Switzerland wants to return the rate to positive territory. That is, to a level of at least 0.5–1.0%, provided that inflation is stable and growth is moderate.

Why Did Credit Suisse Go Bankrupt? Was It Due to Interest Rates or Something Else?

Credit Suisse did not officially go bankrupt in the traditional sense (like Lehman Brothers in 2008), but it was on the verge of collapse in May 2023 and was acquired by UBS in June 2023 with the support of the Swiss authorities. The reasons for this were much deeper and more complex than the impact of interest rates alone.

1. The main reason — systemic management errors and strategy

- Risky transactions. The bank repeatedly lost billions on high-profile failed projects:

- Participation in the collapse of the Archegos Capital hedge fund (2021): a loss of over $5.5 billion.

- Participation in the financing of the troubled company Greensill Capital, which went bankrupt (2021).

- The risk management culture was weak. Credit Suisse failed to identify and manage these risks in a timely manner despite previous warning signs and scandals.

- Scandals and loss of trust. The bank made headlines due to allegations of money laundering, support for sanctioned regimes, and data leaks (e.g., SwissLeaks). All of this undermined the trust of investors and clients.

2. Customer outflow and crisis of confidence

After a series of scandals:

- Major customers began to withdraw their deposits and assets.

- In late 2022 and early 2023, the bank lost tens of billions of francs under management in a matter of weeks.

- This caused a cascade effect: the greater the outflow, the greater the panic among customers and markets.

3. The role of interest rates

Interest rates played an indirect role:

- In 2022–2023, a cycle of sharp interest rate hikes began around the world (including Switzerland), leading to a fall in bond prices and other problems for banks with large securities portfolios.

- However, Credit Suisse did not fall directly victim to rising rates, unlike Silicon Valley Bank in the US.

- Credit Suisse’s main problems were not interest rates but a loss of confidence and management errors.

- Interest rates may have complicated the situation amid general stress in the banking system, but they were not the root cause.

4. The role of interest rates

Why did UBS and the authorities intervene?

- Credit Suisse was a systemically important bank (too big to fail).

- Its collapse could have caused a chain reaction in the financial markets.

- The Swiss government organized an emergency deal to sell Credit Suisse to UBS to stabilize the system and prevent chaos.

What Zero Rate Means?

A zero interest rate is not a gift but a measure of desperation. It is designed to support demand, ease currency pressure, and avoid a deflationary spiral. But it is also a worrying sign: the economy needs a stimulus, and traditional tools are losing their effectiveness.

Credit Suisse collapsed not because of interest rates, but due to years of accumulated mistakes in risk management, scandals, failed investments, and a loss of trust among customers and markets.