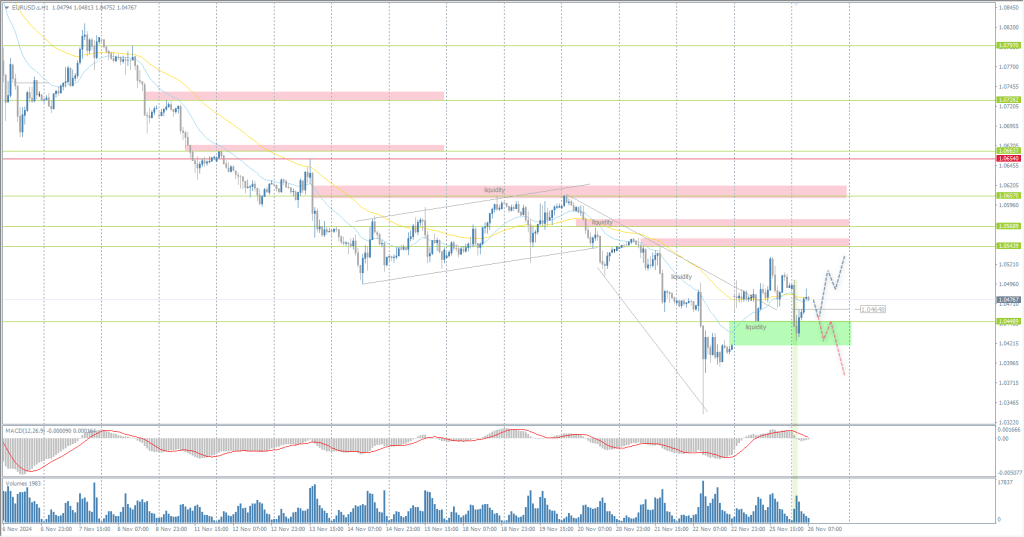

The EUR/USD currency pair

通貨ペアの技術指標:

- 前回開設: 1.0481

- 前回終了: 1.0490

- 前日に%変動: +0.09 %

The euro strengthened and approached $1.05, helped by the weakening dollar after Donald Trump announced his intention to nominate hedge fund manager Scott Bessent as Treasury Secretary. The decision brought investors some relief and a sense of stability as Bessent is expected to prioritize political stability and reduce tariff concerns. Despite this boost, the single currency remains near two-year lows, exacerbated by growing concerns over downside risks to the Eurozone economy.

取引のお薦め

- サポートレベル: 1.0465, 1.0449, 1.0233

- 抵抗レベル: 1.0497, 1.0515, 1.0568, 1.0568, 1.0607, 1.0654, 1.0714

The EUR/USD currency pair’s hourly trend is bearish. Today, at the opening of the Asian session, the price tested the liquidity below 1.0449, where buyers showed a reaction. Currently, buyers need to keep the price above this level, or better, above 1.0465. This allows the price to lean on the new demand zone and continue upward to 1.0544. If the price goes below 1.0449, it will trigger a new wave of selling.

別のシナリオ:if the price breaks the resistance level of 1.0654 and consolidates above it, the uptrend will likely resume.

ニュースフィード:: 2024.11.26

- US Building Permits (m/m) at 15:00 (GMT+2);

- US CB Consumer Confidence (m/m) at 17:00 (GMT+2);

- US New Home Sales (m/m) at 17:00 (GMT+2).

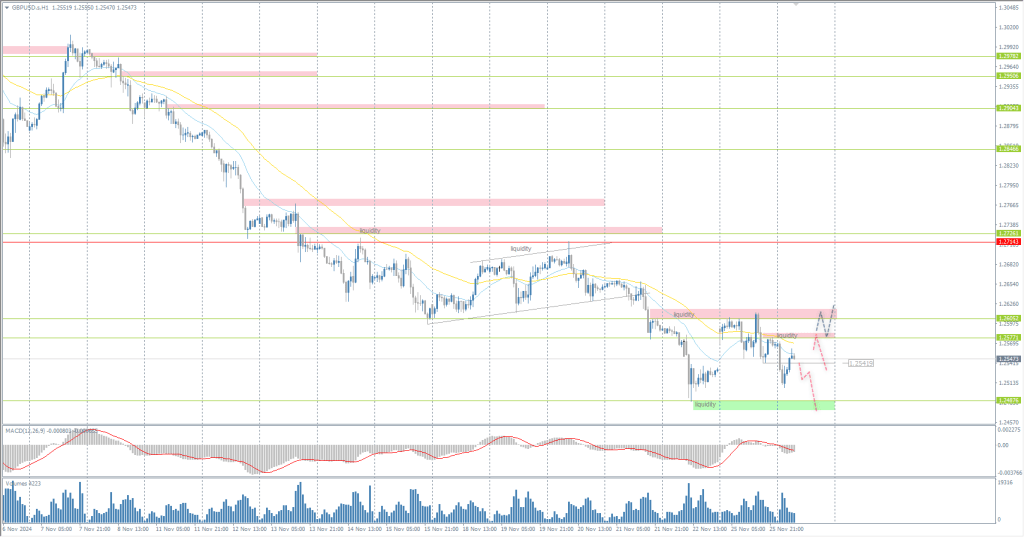

The GBP/USD currency pair

通貨ペアの技術指標:

- 前回開設: 1.2591

- 前回終了: 1.2566

- 前日に%変動: -0.20 %

The British pound sterling strengthened and approached the $1.26 mark, helped by the weakening dollar. However, the Sterling exchange rate remains at a nearly 6-month low as disappointing economic data has raised the stakes for a Bank of England rate cut. Most analysts expect the Bank of England to leave borrowing costs unchanged in December.

取引のお薦め

- サポートレベル: 1.2542, 1.2487

- 抵抗レベル: 1.2577, 1.2605, 1.2714, 1.2766, 1.2878, 1.2905, 1.2982, 1.3023.

From the point of view of technical analysis, the trend on the GBP/USD currency pair is bearish. The situation is very similar to the euro, but here the pressure of sellers is more pronounced. Yesterday, the price tested the liquidity above 1.2605, where sellers took the initiative and formed another level of 1.2577. A price fixing below the intermediate level of 1.2542 will provoke a new wave of sell-offs to 1.2487. A price move above 1.2577 will open the way back to 1.2605.

別のシナリオ:if the price breaks the resistance level at 1.2714 and consolidates above it, the uptrend will likely resume.

ニュースフィード:: 2024.11.26

There is no news feed for today.

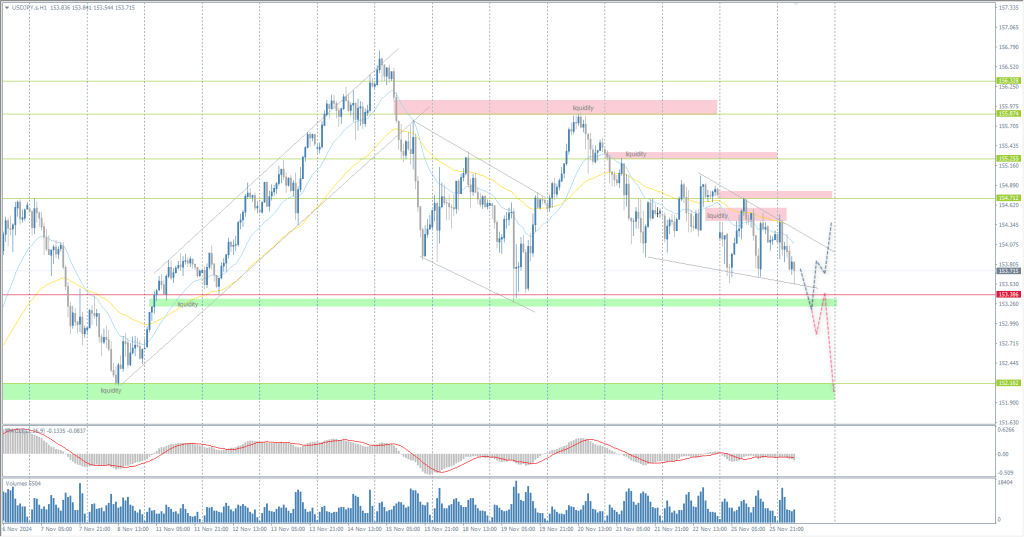

The USD/JPY currency pair

通貨ペアの技術指標:

- 前回開設: 154.16

- 前回終了: 154.22

- 前日に%変動: +0.04 %

The Japanese yen jumped by +0.7% to 153.7 per dollar on Monday, recovering from last week’s losses amid a weaker US dollar. Domestically, investors are keeping a close eye on Tokyo’s inflation data, which is due for release this week, as it is considered a leading indicator of price developments in the country. Last week’s mixed economic data did not provide clear signals on the direction of Japan’s monetary policy. Meanwhile, Bank of Japan Governor Kazuo Ueda suggested the possibility of another interest rate hike as early as December, citing concerns over the recent weakening of the yen.

取引のお薦め

- サポートレベル: 153.38, 152.16

- 抵抗レベル: 154.71, 155.25, 155.87, 156.32

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish, but the reversal is very close. The yen aims to test the liquidity below 153.38, and the reaction to this zone will show the bias of the coming days. If the buyers react here and the price impulsively returns above the level, it will open good buying opportunities. An impulsive breakdown of 153.38 will trigger a strong sell-off wave to 152.16.

別のシナリオ:if the price breaks down the support level of 153.38, the downtrend will likely resume.

ニュースフィード:: 2024.11.26

There is no news feed for today.

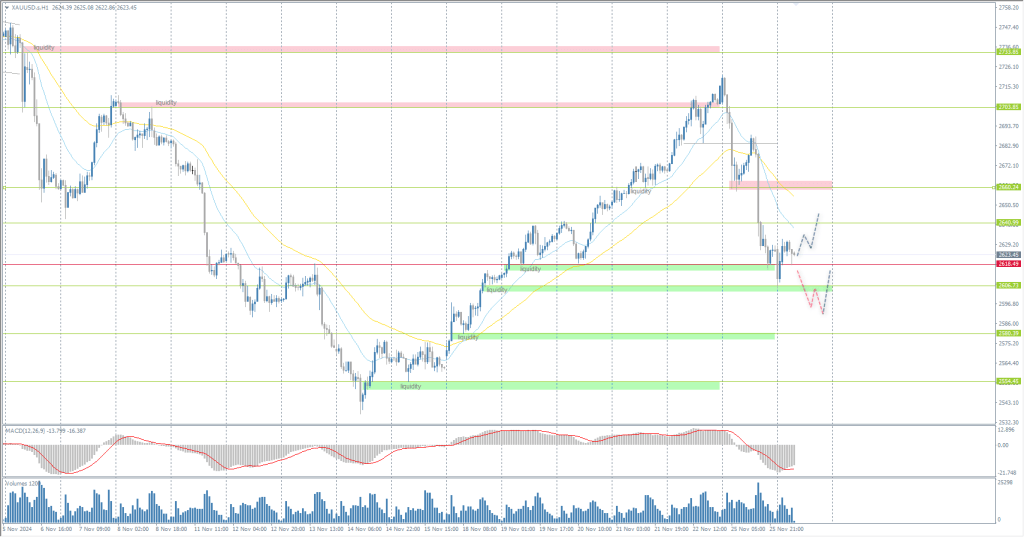

The XAU/USD currency pair (gold)

通貨ペアの技術指標:

- 前回開設: 2706

- 前回終了: 2625

- 前日に%変動: -3.08 %

Gold fell to below $2,630 an ounce on Monday after a five-day rally as investors sought to lock in profits and turned to riskier assets after Donald Trump nominated hedge fund manager Scott Bessent to head the US Treasury. He will focus on delivering on Trump’s promises of tax cuts, spending cuts, and maintaining the dollar’s global reserve status. In addition, reports that Israel is close to reaching a truce with the Hezbollah military group boosted investor confidence.

取引のお薦め

- サポートレベル: 2618, 2580, 2559, 2471

- 抵抗レベル: 2641, 2683, 2704, 2708, 2733, 2749

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Yesterday at the end of the day, gold reached the support level of 2618, where buyers stepped in. After testing below the level, the price came back sharply higher. With these market conditions, today we can consider buying from 2618 with a target of 2641. If the price consolidates below 2618 again, it may trigger a new wave of sell-offs.

別のシナリオ:if the price breaks and consolidates below the support level of 2618, the downtrend will likely resume.

ニュースフィード:: 2024.11.26

- US Building Permits (m/m) at 15:00 (GMT+2);

- US CB Consumer Confidence (m/m) at 17:00 (GMT+2);

- US New Home Sales (m/m) at 17:00 (GMT+2).

この記事は個人の意見を反映しており、投資アドバイスや申し出、金融取引実行の持続的なリクエスト、保証、今後のイベントの予測として解釈しないでください。