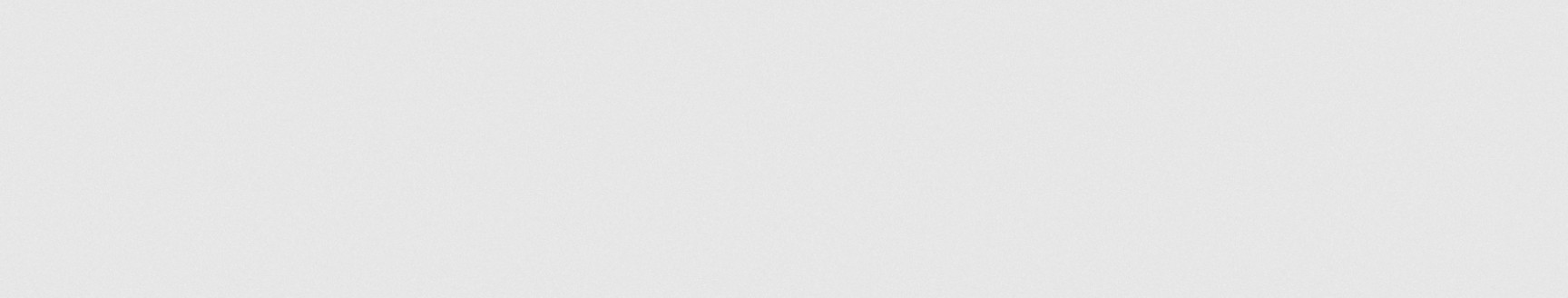

The EUR/USD currency pair

通貨ペアの技術指標:

- 前回開設: 1.1594

- 前回終了: 1.1625

- 前日に%変動: +0.27 %

Friday’s economic news from the Eurozone was negative for the euro after Eurozone construction output in May showed its biggest decline in 2.5 years, and producer prices in Germany in June fell at their sharpest pace in nine months, which is a “dovish” factor for ECB policy. The euro’s gains were also limited on Friday after the Financial Times reported that President Trump is insisting on minimum tariffs of 15–20% in any trade deal with the European Union (EU). Swaps estimate the probability of an ECB rate cut of 25 bps at the July 24 meeting at 1%.

取引のお薦め

- サポートレベル: 1.1615, 1.1561, 1.1518

- 抵抗レベル: 1.1660, 1.1714, 1.1762, 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend is bearish. On Friday, sellers reacted aggressively to the resistance level of 1.1660, after which the price fell to 1.1615. The price will likely fluctuate here until the publication of important economic events or news about negotiations between the US and the EU. Indicators are muted by low volatility. In such market conditions, buy deals should be considered from 1.1615, but with confirmation. For sell deals, you can re-evaluate the price reaction at 1.1660.

別のシナリオ:if the price breaks through the resistance level of 1.1714 and consolidates above it, the uptrend will likely resume.

本日のニュースはありません

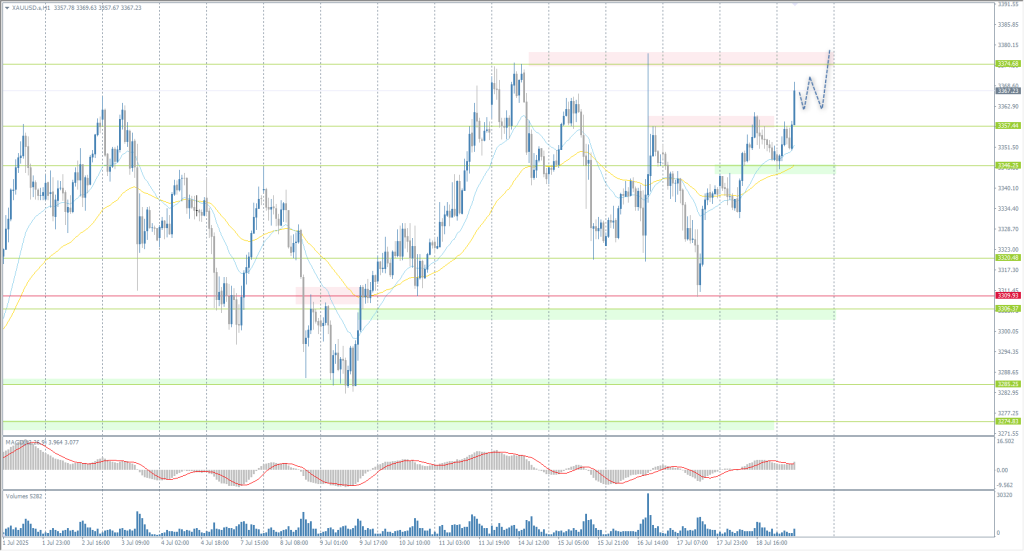

The GBP/USD currency pair

通貨ペアの技術指標:

- 前回開設: 1.3409

- 前回終了: 1.3408

- 前日に%変動: -0.01 %

Over the past few weeks, the British pound has shown that it is also sensitive to looming monetary and fiscal problems. The economy looks weaker than expected. The slowdown in growth from a high of 0.7% in the first quarter was entirely expected, but the labor market is slowing down, manufacturing output has been falling for three consecutive months since May, and the overall Services Activity Index has been slightly better than flat this year. The Bank of England has signaled a gradual approach, and the market expects two rate cuts for the rest of the year. The weaker the growth, the more difficult it will be for the government to fulfill its tax promises and fiscal rule commitments.

取引のお薦め

- サポートレベル: 1.3374, 1.3334

- 抵抗レベル: 1.3485, 1.3532, 1.3619, 1.3680, 1.3712

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The situation has not changed significantly since Friday. The British pound is trading in a wide range 1.3374–1.3485. Intraday, the bias is currently in favor of sellers, so intraday sales from the EMA lines can be considered. For buy deals, it is better to wait for an initiative to test the support level of 1.3374 or 1.3334.

別のシナリオ:if the price breaks through the resistance level of 1.3485 and consolidates above it, the uptrend will likely resume.

本日のニュースはありません

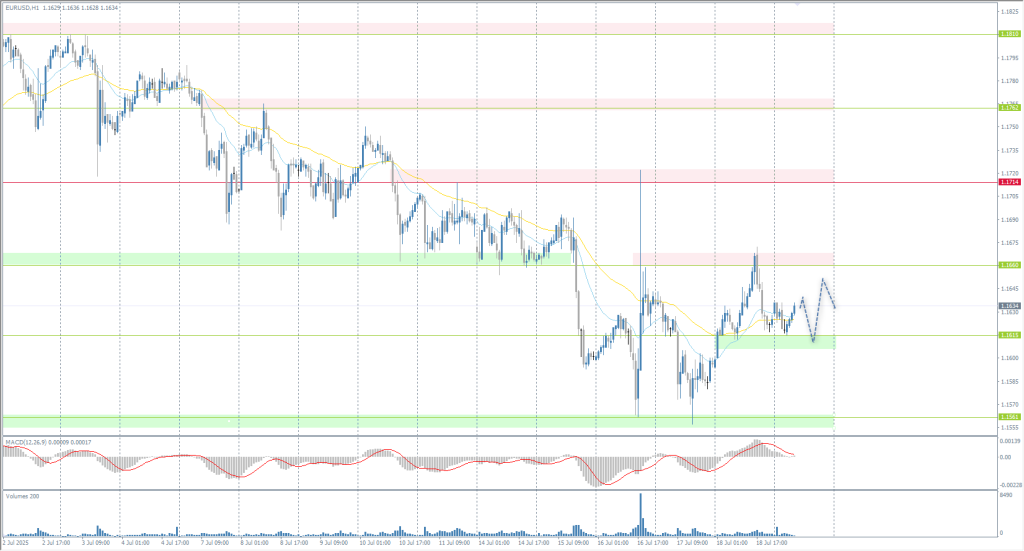

The USD/JPY currency pair

通貨ペアの技術指標:

- 前回開設: 148.59

- 前回終了: 148.84

- 前日に%変動: +0.17 %

The Japanese yen strengthened to 148.5 per dollar on Monday, recovering some of last week’s losses after the ruling coalition lost its majority in the upper house elections. However, the markets largely factored in the election results. Despite the setback, Prime Minister Shigeru Ishiba is expected to remain in office, easing concerns about more serious political turmoil or a possible resignation. The opposition is likely to push for increased government spending and tax cuts, which could affect the yen and push Japanese government bond yields to multi-year highs. The election results come at a time when Tokyo is trying to conclude a trade agreement with Washington.

取引のお薦め

- サポートレベル: 148.27, 146.72, 146.13, 145.88, 145.28, 144.18

- 抵抗レベル: 149.16

From a technical point of view, the medium-term trend of the USD/JPY is bullish. On Monday, the price opened with a gap down amid elections to the upper house of parliament. However, buyers took the initiative and brought the price back above the 148.27 level. Currently, it is important for buyers not to let the price settle below this level again. Intraday, consider buying from 148.27. There are no optimal entry points for selling at the moment.

別のシナリオ:if the price breaks through the support level of 146.72 and consolidates below it, the downward trend will likely resume.

本日のニュースはありません

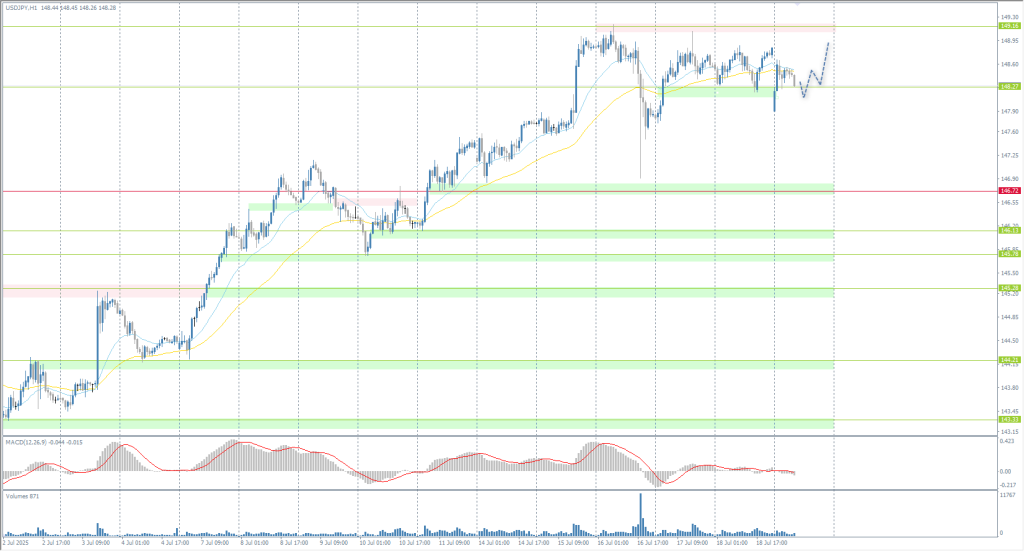

The XAU/USD currency pair (gold)

通貨ペアの技術指標:

- 前回開設: 3340

- 前回終了: 3350

- 前日に%変動: +0.30 %

On Monday, gold prices fluctuated around $3350 per ounce as investors closely monitored the progress of trade negotiations. Although US Trade Representative Howard Lute expressed confidence that an agreement with the EU could be reached, he confirmed that August 1 was a “hard deadline” for tariffs to take effect. He also stressed that the base tariff rate of 10% would “definitely remain” in place during the negotiations. These comments followed Trump’s recent letters to trading partners earlier this month, in which he notified them of the new tariff rates their countries would face if they failed to reach an agreement with him. However, strong US economic data released last week dampened expectations of an imminent interest rate cut by the Federal Reserve, limiting further gains.

取引のお薦め

- サポートレベル: 3320, 3309

- 抵抗レベル: 3344, 3357, 3374, 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Today, during the Asian session, the price broke through and consolidated above the resistance level of 3357, and now the price has a clear path to 3374. Intraday, you can look for buys from the EMA line or from the support level of 3357. For sell deals, it is important to wait for the initiative from sellers at the resistance level of 3374.

別のシナリオ:if the price breaks through the support level of 3309 and consolidates below it, the downtrend will likely resume.

本日のニュースはありません

この記事は個人の意見を反映しており、投資アドバイスや申し出、金融取引実行の持続的なリクエスト、保証、今後のイベントの予測として解釈しないでください。