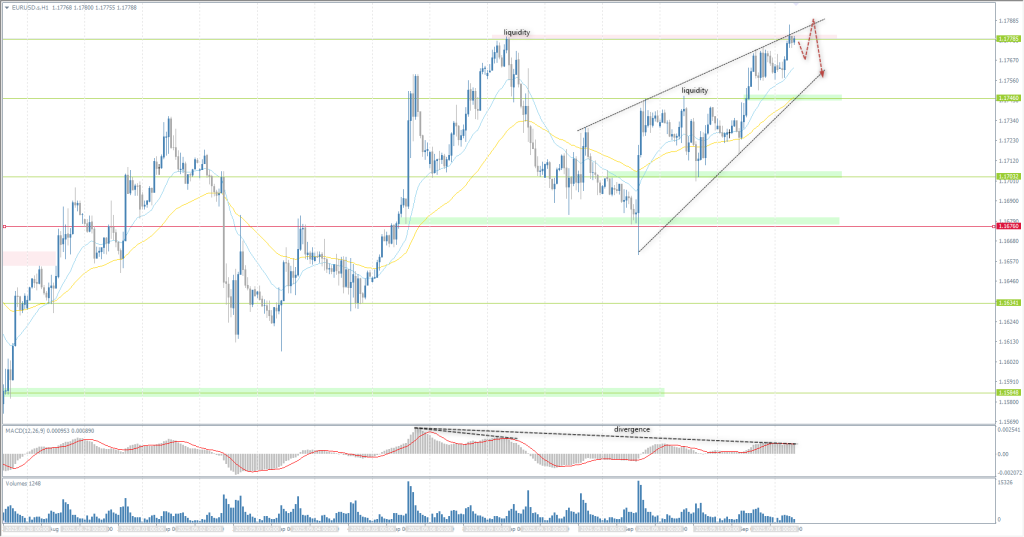

The EUR/USD currency pair

通貨ペアの技術指標:

- 前回開設: 1.1729

- 前回終了: 1.1761

- 前日に%変動: +0.27 %

Fitch Ratings has downgraded France’s credit rating to A+ from AA-, the lowest rating in its history. The agency cites political instability and rising debt as the newly appointed Prime Minister Sébastien Lecornu begins budget negotiations. Attention will now shift to a busy week of Central Bank meetings. The US Federal Reserve is expected to cut rates by at least 25 basis points on Wednesday amid concerns about its independence, as officials weigh a cooling labor market and inflationary pressures caused by tariffs. Meanwhile, the European Central Bank signaled last week that its cycle of rate cuts may be coming to an end. President Christine Lagarde said that growth risks are now more balanced, suggesting that policymakers are shifting to a more hawkish stance after months of easing.

取引のお薦め

- サポートレベル: 1.1746, 1.1717, 1.1703, 1.1677, 1.1642, 1.1629, 1.1584, 1.1528

- 抵抗レベル: 1.1778

The EUR/USD currency pair’s hourly trend is bullish. After forming a two-day balance, the price jumped impulsively and reached the resistance level of 1.1778. It is worth being cautious with buy deals here, as several factors indicate the presence of counter-sales. For purchases, it is best to consider the support level of 1.1746 or the EMA line, but with confirmation.

別のシナリオ:if the price breaks the support level of 1.1676 and consolidates below it, the downtrend will likely resume.

ニュースフィード:: 2025.09.16

- Eurozone Trade Balance (m/m) at 12:00 (GMT+3);

- Eurozone ECB President Lagarde Speaks (m/m) at 21:10 (GMT+3).

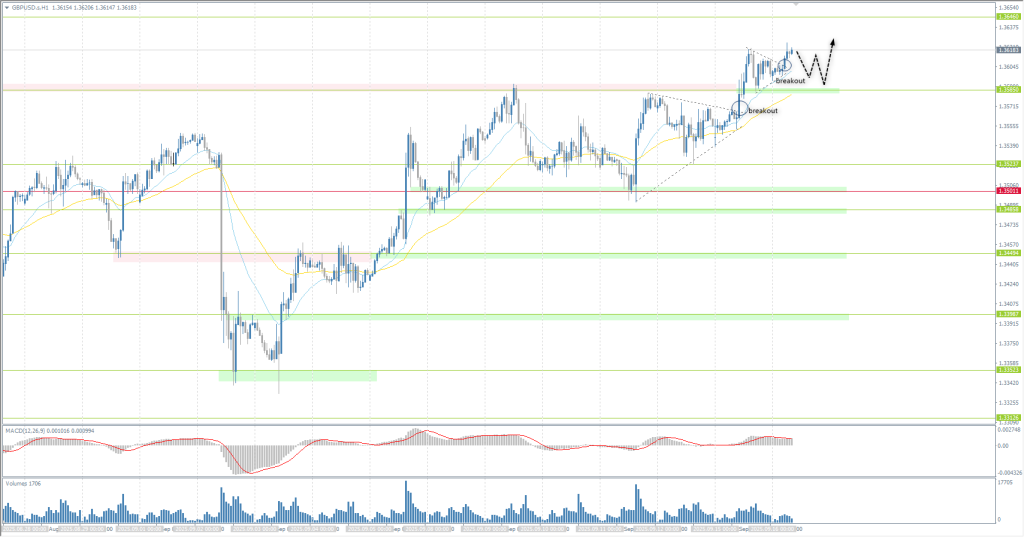

The GBP/USD currency pair

通貨ペアの技術指標:

- 前回開設: 1.3546

- 前回終了: 1.3598

- 前日に%変動: +0.38 %

The British pound rose above $1.36, close to a 10-week high, as markets await a busy week of Central Bank decisions and UK data. The Bank of England is expected to keep its benchmark interest rate at 4% on Thursday and slow the pace of its £100 billion annual bond-buying program. UK inflation for August is expected to be 3.8% year-on-year, matching July’s 18-month high. Later in the week, employment and retail sales reports will be released. Markets currently see a one-in-three chance of the Bank of England cutting rates by December. Meanwhile, the US Federal Reserve is expected to cut rates by 25 basis points on Wednesday, and traders are expecting at least two more cuts before the end of 2025.

取引のお薦め

- サポートレベル: 1.3523, 1.3503, 1.3485, 1.3449, 1.3417

- 抵抗レベル: 1.3585

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. The British currency is growing steadily, breaking through impulsively upwards after each accumulation. There are no prerequisites for a reversal at the moment. For buy deals, traders can consider the EMA lines or the support level of 1.3585. The profit target is 1.3646. There are no optimal entry points for sales at the moment.

別のシナリオ:if the price breaks through the support level of 1.3501 and settles below it, the downtrend will likely resume.

本日のニュースはありません

The USD/JPY currency pair

通貨ペアの技術指標:

- 前回開設: 147.49

- 前回終了: 147.36

- 前日に%変動: -0.09 %

On Tuesday, the yen strengthened to 147 per dollar, extending its gains for the second session in a row, as the dollar weakened ahead of an expected rate cut by the Federal Reserve. Domestically, the Bank of Japan will set its policy this week and is widely expected to leave rates unchanged at 0.5% as officials assess the impact of US tariffs on Japan’s export-oriented economy. Traders are also awaiting new data, with exports and imports expected to remain weak and the Core Consumer Price Index projected to slow to 2.7%, the lowest since November 2024.

取引のお薦め

- サポートレベル: 147.32, 146.82, 146.74

- 抵抗レベル: 147.48, 148.07, 148.24, 148.77

From a technical point of view, the medium-term trend of the USD/JPY is bullish, but the intraday bias is bearish. Yesterday, the price failed to consolidate above 147.88, after which there was a breakdown on the impulse of the 147.25 support level. For the price to grow, it is necessary to form a locked balance below the support level. Until this happens, intraday sales from 147.25 should be considered with a target of 146.82, which is the priority change level and the boundary of the previous locked balance.

別のシナリオ:if the price breaks through the support level of 147.09 and consolidates below it, the downtrend will likely resume.

本日のニュースはありません

The XAU/USD currency pair (gold)

通貨ペアの技術指標:

- 前回開設: 3644

- 前回終了: 3681

- 前日に%変動: +1.06 %

On Monday, gold prices hit a record high of $3,680 per ounce as the weakening US dollar and falling Treasury yields boosted demand for the metal. Markets are bracing for a crucial Federal Reserve meeting this week. Policymakers are expected to cut interest rates for the first time since December on Wednesday by at least 25 basis points. The decision comes as officials balance a cooling labor market and tariff-driven inflation pressures amid lingering concerns about the Fed’s independence. The FOMC’s updated prognoses are also expected to signal one or two additional cuts before the end of the year. Meanwhile, US-China trade talks in Madrid, which began on Sunday, remain in focus as global trade tensions continue to weigh on market sentiment.

取引のお薦め

- サポートレベル: 3667, 3655, 3615, 3600

- 抵抗レベル: 3700

From the point of view of technical analysis, the trend on the XAU/USD is bullish. Gold continued its rally. After forming a four-day accumulation, the price rose impulsively. At the moment, the target for gold is the psychological mark of 3700. For buy deals, you can consider the support levels of 3667 and 3655. It is very important for buyers not to let the price fall below 3655, since in this scenario, a locked balance will form above the resistance levels, which could trigger a strong sell-off.

別のシナリオ:if the price breaks the support level of 3615 and consolidates below it, the downtrend will likely resume.

本日のニュースはありません

この記事は個人の意見を反映しており、投資アドバイスや申し出、金融取引実行の持続的なリクエスト、保証、今後のイベントの予測として解釈しないでください。