The EUR/USD currency pair

通貨ペアの技術指標:

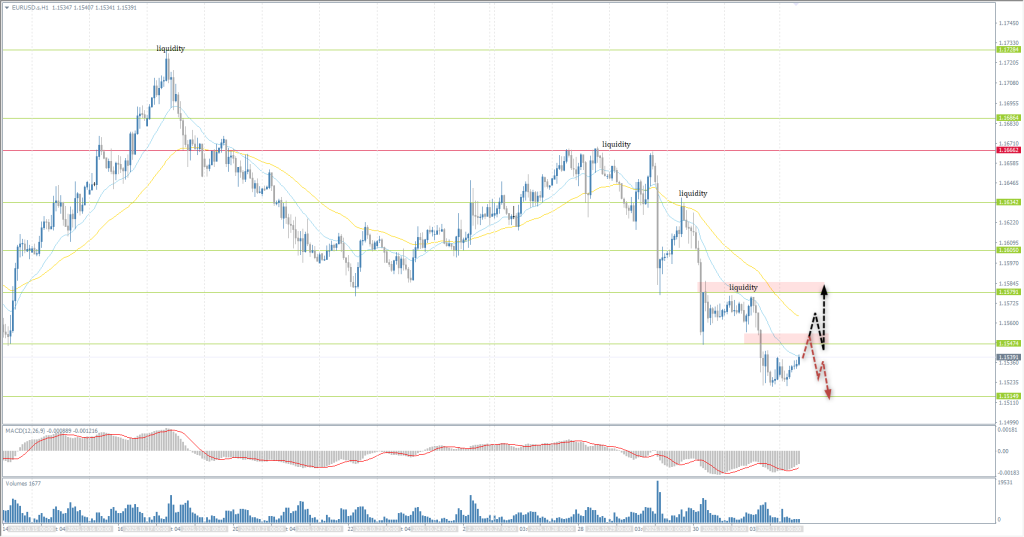

- 前回開設: 1.1567

- 前回終了: 1.1538

- 前日に%変動: -0.25 %

Last week, ECB President Christine Lagarde emphasized the stability of policy, noting that after eight consecutive rate cuts through June, further easing is unlikely. Macro statistics support this view: inflation in the Eurozone fell to just above the ECB’s 2% target, GDP growth in the third quarter exceeded expectations, and October business surveys recorded an improvement in business sentiment. Despite this, the euro has reached its lowest level since the end of July, which contrasts with the macroeconomic situation. Economists believe that against the backdrop of rate cuts by the US Federal Reserve, the euro is now in a more advantageous position against the dollar.

取引のお薦め

- サポートレベル: 1.1515

- 抵抗レベル: 1.1547, 1.1579, 1.1605, 1.1634, 1.1667

The hourly trend for EUR/USD has changed to downward. The intraday bias remains with the sellers. It is highly likely that the price will test liquidity below the support level of 1.1515. For sales, traders can consider the resistance level of 1.1547, but with confirmation. Buy deals can be considered as part of a corrective movement, provided that the price impulsively consolidates above 1.1547.

別のシナリオ:if the price breaks through the resistance level of 1.1666 and consolidates above it, the uptrend will likely resume.

ニュースフィード:: 2025.11.03

- German Manufacturing PMI (m/m) at 10:55 (GMT+2);

- Eurozone Manufacturing PMI (m/m) at 11:00 (GMT+2);

- US ISM Manufacturing PMI (m/m) at 17:00 (GMT+2).

The GBP/USD currency pair

通貨ペアの技術指標:

- 前回開設: 1.3151

- 前回終了: 1.3148

- 前日に%変動: -0.02 %

Last week, the pound sterling was under pressure as market participants slightly increased their bets on interest rate cuts by the Bank of England, and concerns about the potentially negative impact of the November budget on economic growth grew. At the same time, there were reports that the OBR was preparing to lower its UK productivity growth expectations by around 0.3 percentage points, which could lead to a public finance deficit of around £20 billion. Softer inflation data also contributed to expectations of further monetary easing.

取引のお薦め

- サポートレベル: 1.3086

- 抵抗レベル: 1.3174, 1.3216, 1.3247, 1.3291, 1.3328, 1.3365

Technically, the trend on the GBP/USD currency pair is bearish. The British pound is trading in the demand zone and forming a flat accumulation. While the price is in balance, it is not recommended to look for buy or sell trades. An impulsive consolidation above the 1.3174 level could trigger a rise to 1.3216. Given the MACD divergence, the probability of a correction is higher than the probability of a further decline. However, if sellers react at 1.3174, there is a high probability of another wave of decline to 1.3086.

別のシナリオ:if the price breaks through the resistance level of 1.3365 and consolidates above it, the uptrend will likely resume.

ニュースフィード:: 2025.11.03

- UK Manufacturing PMI (m/m) at 11:30 (GMT+2).

The USD/JPY currency pair

通貨ペアの技術指標:

- 前回開設: 154.07

- 前回終了: 153.98

- 前日に%変動: -0.06 %

On Monday, the Japanese yen remained close to 154 per dollar amid low trading volumes due to a public holiday in Japan. Pressure on the currency continues amid the Bank of Japan’s cautious stance on raising interest rates. Last week, the regulator left the rate unchanged again, and its head, Kazuo Ueda, warned of the risks of a slowdown in global trade and a possible decline in corporate profits. Comments by the new finance minister, Satsuki Katayama, also attracted attention, as she distanced herself from her own March statements about a “fair” yen level in the range of 120-130 per dollar.

取引のお薦め

- サポートレベル: 153.26, 151.51, 150.87, 150.15

- 抵抗レベル: 154.80

The medium-term trend is bullish. The price is forming a flat accumulation with signs of narrowing liquidity. It is likely that the price will remain flat until tomorrow due to the public holiday in Japan. Intraday, the bias remains with buyers. The profit target remains around 154.80. Sales are possible if the price impulsively consolidates below the balance.

別のシナリオ:if the price breaks below 151.54 and consolidates lower, a bearish trend will likely resume.

本日のニュースはありません

The XAU/USD currency pair (gold)

通貨ペアの技術指標:

- 前回開設: 4024

- 前回終了: 4001

- 前日に%変動: -0.57%

On Monday, gold stabilized at around $4,000 per ounce. Last week, pressure on the metal intensified amid reduced expectations for further easing of Fed policy and weaker demand for safe-haven assets following the conclusion of a trade agreement between the US and China. On the trade front, US President Donald Trump and Chinese President Xi Jinping agreed to extend the tariff truce, ease export restrictions, and reduce the number of trade barriers.

取引のお薦め

- サポートレベル: 3930, 3896, 3867

- 抵抗レベル: 4050, 4137, 4162, 4184

Technically, the medium-term has shifted downward. Gold is forming a wide-volatility flat. This is a balanced environment where buyers and sellers are fighting each other. While the price is in balance, it is better to refrain from taking positions on gold, as liquidity is currently accumulating. It is worth becoming active when the price impulsively closes above or below the balance.

別のシナリオ:if the price breaks through the resistance level of 4137 and consolidates above it, the downtrend will likely resume.

ニュースフィード:: 2025.11.03

- US ISM Manufacturing PMI (m/m) at 17:00 (GMT+2).

この記事は個人の意見を反映しており、投資アドバイスや申し出、金融取引実行の持続的なリクエスト、保証、今後のイベントの予測として解釈しないでください。