The EUR/USD currency pair

通貨ペアの技術指標:

- 前回開設: 1.1650

- 前回終了: 1.1634

- 前日に%変動: -0.12%

The euro declined to $1.163, hitting its lowest level since early December due to a reassessment of monetary policy expectations and a series of macroeconomic data releases. In the US, labor market statistics were mixed: weak employment growth was accompanied by a more pronounced decline in unemployment. Together, these confirmed economic resilience and bolstered the market’s view that a Fed rate cut in the near term is unlikely. Against this backdrop, the single currency weakened due to slowing inflation in the Eurozone. Eurostat data showed that consumer price growth approached the ECB’s target level, while core inflation came in below prognoses. This reduced expectations for further tightening by the regulator and increased pressure on the euro.

取引のお薦め

- サポートレベル: 1.1660, 1.1629, 1.1590, 1.1555, 1.1503

- 抵抗レベル: 1.1674, 1.1718, 1.1753, 1.1765, 1.1786

The euro price fell to monthly lows on Friday, reaching the 1.1619 support level. At Monday’s open, buyers sharply took the initiative, pushing the price above 1.1661. Today, it is crucial to evaluate the price reaction to the 1.1674 resistance level. If sellers show activity here, the price could drop sharply again. An impulsive breakout of 1.1674 would change the structure and open the path toward 1.1718.

別のシナリオ:- Trend: Neutral

- Sup: 1.1660

- Res: 1.1671

- Note: Consider short positions if selling activity is observed at the 1.1674 resistance level. An impulsive breakout of 1.1674 opens the way to 1.1718.

本日のニュースはありません

The GBP/USD currency pair

通貨ペアの技術指標:

- 前回開設: 1.3433

- 前回終了: 1.3400

- 前日に%変動: -0.24 %

Until Thursday, the British pound will be fully dependent on the dynamics of the Dollar Index (DXY). On Thursday, attention should turn to a package of economic data from the UK. The primary focus will be on monthly GDP data, manufacturing production, and the trade balance. The UK economy is expected to have flatlined in November after two consecutive months of 0.1% contraction, although improvements are expected in both manufacturing and industrial production.

取引のお薦め

- サポートレベル: 1.3393, 1.3347, 1.3354, 1.3292

- 抵抗レベル: 1.3451, 1.3503, 1.3526, 1.3586

The British pound declined on Friday to the 1.3393 support level, where buyers showed initiative at Monday’s open. The price is currently aiming to test the resistance zone near 1.3393, and it is important to evaluate the price action here. If sellers show activity, intraday short positions can be considered. An impulsive breakout above 1.3393 will shift the structure and open the path to 1.3503.

別のシナリオ:- Trend: Neutral

- Sup: 1.3393

- Res: 1.3451

- Note: Consider sell deals if selling activity is observed at the 1.3451 resistance level. An impulsive breakout of 1.3451 opens the way to 1.3503.

本日のニュースはありません

The USD/JPY currency pair

通貨ペアの技術指標:

- 前回開設: 156.77

- 前回終了: 157.93

- 前日に%変動: +0.74 %

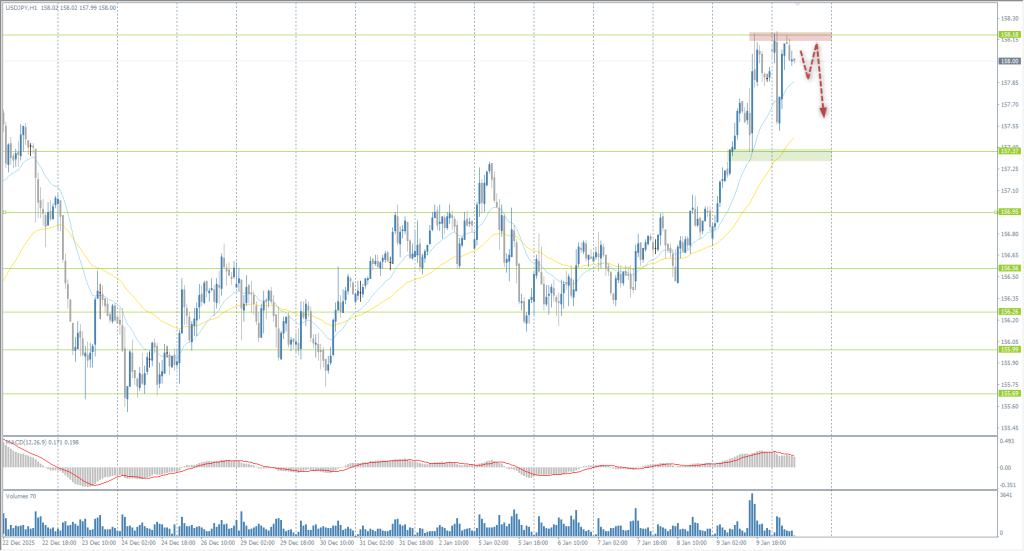

The Japanese yen held near 158 per dollar on Monday, remaining at a yearly low amid thin trading due to a public holiday in Japan. Pressure on the currency was exacerbated by political uncertainty following statements from coalition partners regarding potential snap elections in February, as well as conflicting macroeconomic data complicating the outlook for Bank of Japan (BoJ) tightening. The regulator continues to maintain cautious rhetoric: the BoJ Governor confirmed a readiness to raise rates if economic and price dynamics remain favorable, while avoiding hawkish signals. In the coming days, market attention will focus on key economic indicators that may provide further guidance on future monetary policy steps.

取引のお薦め

- サポートレベル: 157.37, 156.95, 156.56, 156.26

- 抵抗レベル: 158.18, 159.47

The Japanese yen continues to weaken against the dollar, increasing the likelihood of intervention by Japanese authorities. The price reached the 158.18 level, where sellers showed initiative. It is highly probable that the price will now begin to form a flat accumulation range. Intraday short positions can be considered today with a stop loss above 158.18. There are currently no optimal entry points for long positions.

別のシナリオ:- Trend: Up

- Sup: 157.37

- Res: 158.18

- Note: Consider intraday short positions with a stop loss above 158.18. No optimal entry points for buys at this time.

本日のニュースはありません

The XAU/USD currency pair (gold)

通貨ペアの技術指標:

- 前回開設: 4482

- 前回終了: 4507

- 前日に%変動: +0.56 %

Gold prices rose by more than 1% on Monday, hitting a new all-time high amid a surge in demand for safe-haven assets. The market was supported by intensifying geopolitical tensions surrounding Iran following harsh rhetoric from involved parties, as well as investor concerns regarding potential pressure on the independence of the US Federal Reserve. These factors increased interest in gold as a store of value. Additionally, expectations of US monetary policy easing grew following weaker-than-expected December employment data. Investors are now focused on the upcoming inflation data, which could clarify the future path of interest rates.

取引のお薦め

- サポートレベル: 4550, 4517, 4483, 4438, 4400

- 抵抗レベル: 4600, 4650

Gold continues its upward rally. The price reached the psychological milestone of $4600 per ounce. Counter-selling remains very weak, which could lead to further gains for the metal. The price is currently significantly overextended from the EMA average lines, making it difficult to find high-quality entry points for buys. The most optimal support levels are 4550 and 4517. There are currently no market conditions for sell positions.

別のシナリオ:- Trend: Up

- Sup: 4550

- Res: 4600

- Note: For long positions, look for the EMA lines or support levels at 4550 and 4517. There are currently no optimal entry points for sales.

本日のニュースはありません

この記事は個人の意見を反映しており、投資アドバイスや申し出、金融取引実行の持続的なリクエスト、保証、今後のイベントの予測として解釈しないでください。