The EUR/USD currency pair

通貨ペアの技術指標:

- 前回開設: 1.2038

- 前回終了: 1.1955

- 前日に%変動: -0.69%

The US Federal Reserve, as expected, held interest rates steady in the 3.50-3.75% range, noting resilient economic activity and signs of labor market stabilization. At the same time, the regulator emphasized that inflation remains elevated and uncertainty regarding the economic outlook is significant. The non-unanimous decision, in which two FOMC members voted for an immediate rate cut, has fueled expectations that monetary easing will return to the agenda in the second half of the year.

取引のお薦め

- サポートレベル: 1.1915, 1.1859, 1.1835, 1.1805, 1.1754

- 抵抗レベル: 1.2050, 1.3000

Following initial profit-taking, the euro pulled back to support near 1.1915, where buyers became active again. This increases the likelihood of the market shifting into a sideways consolidation phase with estimated boundaries of 1.1915-1.2050, as upward momentum has temporarily slowed despite the overall bullish sentiment remaining intact. Under this scenario, priority remains with buys from the support area and nearby EMA lines. Selling should only be considered upon approaching the 1.2050 zone and only if a clear seller reaction appears, targeting a return to the center of the range.

別のシナリオ:- Trend: Up

- Sup: 1.1915

- Res: 1.2049

- Note: For buy deals, consider EMA lines near the support level. For shorts, evaluate price reaction at 1.2050 with targets at the mid-point of the range.

ニュースフィード:: 2026.01.29

- US Trade Balance (m/m) at 15:30 (GMT+2); – USD (MED)

- US Initial Jobless Claims (w/w) at 15:30 (GMT+2). – USD (MED)

The GBP/USD currency pair

通貨ペアの技術指標:

- 前回開設: 1.3829

- 前回終了: 1.3806

- 前日に%変動: -0.16 %

The British pound fluctuated just below the $1.38 mark, close to its highest level since August 2021, supported by US dollar weakness. On Tuesday evening, the dollar fell to a near four-year low after President Trump stated he was satisfied with its recent decline amid concerns over a government shutdown, a weak consumer confidence report, and ongoing political uncertainty in Washington, including renewed tariff threats and criticism of Fed independence. Meanwhile, UK BRC data released on Tuesday pointed to accelerating price pressures, sparking fears of persistent inflation and potentially limiting the Bank of England’s ability to cut rates in the near term.

取引のお薦め

- サポートレベル: 1.3752, 1.3725, 1.3670, 1.3646, 1.3568

- 抵抗レベル: 1.3871, 1.4000

After a corrective move, the price entered a sideways accumulation phase within the 1.3752-1.3871 range. Recent volume spikes were accompanied by a bullish reaction, indicating sustained buyer interest and keeping the intraday bias to the upside. However, the price’s position in the center of the range reduces the attractiveness of trades in terms of risk/reward. It is advisable to consider buys on lower time frames from dynamic EMA lines, targeting the upper boundary of the range near 1.3871. Shorts only make sense upon approaching this resistance and seeing signs of seller reaction, targeting a return to the mid-range.

別のシナリオ:- Trend: Up

- Sup: 1.3752

- Res: 1.3871

- Note: Look for long trades from EMA lines targeting 1.3871. For shorts, evaluate price reaction at 1.3871 with targets at the mid-point of the range.

本日のニュースはありません

The USD/JPY currency pair

通貨ペアの技術指標:

- 前回開設: 152.20

- 前回終了: 153.41

- 前日に%変動: +0.79 %

The Japanese yen weakened below 153.5 per US dollar, retreating from the three-month high of 152.2 reached earlier Wednesday after the US administration denied rumors of potential joint currency intervention with Tokyo to support the yen. Despite Washington’s denial, traders continue to price in the risk of unilateral intervention by Japan, although Bank of Japan data indicate no official market operations at this time. In a broader perspective, the yen has remained relatively strong since early January: US threats to impose tariffs on key trading partners have increased global aversion to the dollar, while expectations that the BoJ will continue its rate hike cycle this year provide structural support to the currency.

取引のお薦め

- サポートレベル: 151.54

- 抵抗レベル: 153.67, 154.58, 155.62

The Japanese yen reached an intermediate support level at 152.17, where early signs of profit-taking are observed. However, it is premature to talk about a full-fledged reversal. Price reaction to volume indicates the presence of a large seller in the market, maintaining pressure and keeping the downward scenario as the priority. In current conditions, preference should be given to shorts. Optimal zones for short entry include the 153.67 resistance area and pullbacks to dynamic EMA lines. The profit-taking target is the 151.54 support level.

別のシナリオ:- Trend: Down

- Sup: 151.54

- Res: 153.67

- Note: Consider short trades from the 153.67 resistance level or EMA lines, but only with confirmation. Take-profit target is the 151.54 support level.

本日のニュースはありません

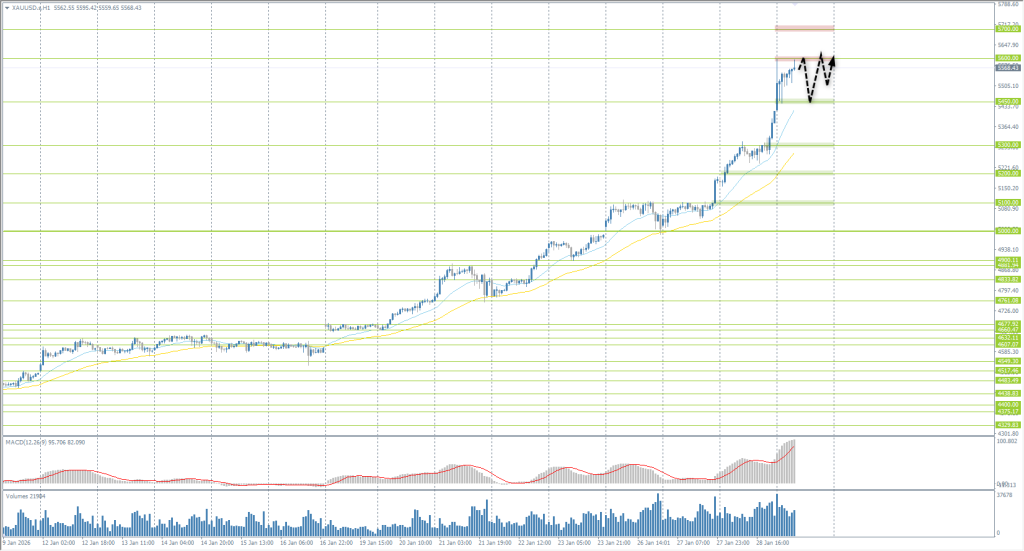

The XAU/USD currency pair (gold)

通貨ペアの技術指標:

- 前回開設: 5175

- 前回終了: 5417

- 前日に%変動: +4.67 %

On Thursday, gold continued to set new all-time highs, consolidating above $5,500 per ounce amid prolonged US dollar weakness and rising economic and geopolitical uncertainty. Momentum intensified following statements from President Trump, who effectively signaled that the administration tolerates further dollar weakening despite tariff rhetoric and renewed pressure on Fed independence. Additional growth drivers include tensions surrounding Iran, fiscal risks, active central bank buying, and steady inflows into ETFs.

取引のお薦め

- サポートレベル: 5450, 5200, 5100, 5000, 4900

- 抵抗レベル: 5600

Gold continues its rapid rally. Following the US Fed meeting, the price accelerated sharply, reaching the $5,600 area. However, an endless vertical ascent is unlikely: given the significant deviation from mean values, the probability of consolidation for liquidity accumulation increases. This does not mean one should look for shorts, but a corrective wave from the 5,600 level cannot be entirely ruled out. The most rational strategy is to look for long trades after a correction: either to dynamic EMA lines or toward the key support at 5450.

別のシナリオ:- Trend: Up

- Sup: 5450

- Res: 5600

- Note: Look for long trades following a correction to EMA lines or the 5450 support level. No optimal entry points for shorts.

ニュースフィード:: 2026.01.29

- US Trade Balance (m/m) at 15:30 (GMT+2); – USD (MED)

- US Initial Jobless Claims (w/w) at 15:30 (GMT+2). – USD (MED)

この記事は個人の意見を反映しており、投資アドバイスや申し出、金融取引実行の持続的なリクエスト、保証、今後のイベントの予測として解釈しないでください。