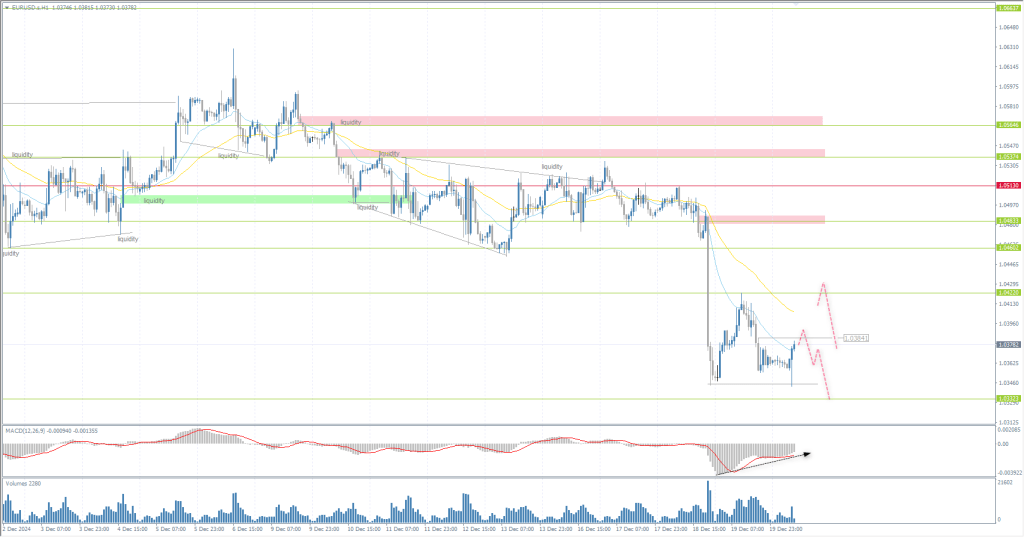

The EUR/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.0363

- 폐장 전: 1.0427

- 전날 대비 # % 변동: +0.61 %

The European Central Bank (ECB) will continue to reduce the cost of borrowing in 2025, said Boris Vujčić, the representative of the Governing Council. Last week, the ECB cut its deposit rate by a quarter point to 3%, the fourth such move since June. Officials said other steps would follow, although opinions differ on how many would be needed. One uncertainty weighing on the outlook is the threat of tariffs once Donald Trump returns to the White House next month. If a trade war breaks out, it would be bad for growth in Europe and the rest of the world.

거래 권고

- 지원 레벨: 1.0422,1.0332, 1.0482, 1.0460, 1.0425

- 저항 레벨: 1.0460, 1.0483, 1.0537, 1.0565, 1.0615

The EUR/USD currency pair’s hourly trend is bearish. On Friday, the euro corrected on the background of the Dollar Index growth. The price even consolidated above the moving averages. However, the downside potential remains, as the price didn’t reach the targets. Under such market conditions, it is recommended to buy (if the price reacts) to the zone below 1.0422. If this zone is broken, we should expect a further price decline.

대체 시나리오:if the price breaks the resistance level of 1.0513 and consolidates above it, the uptrend will likely resume.

@ 뉴스피드: 2024.12.23

- US CB Consumer Confidence (m/m) at 17:00 (GMT+2).

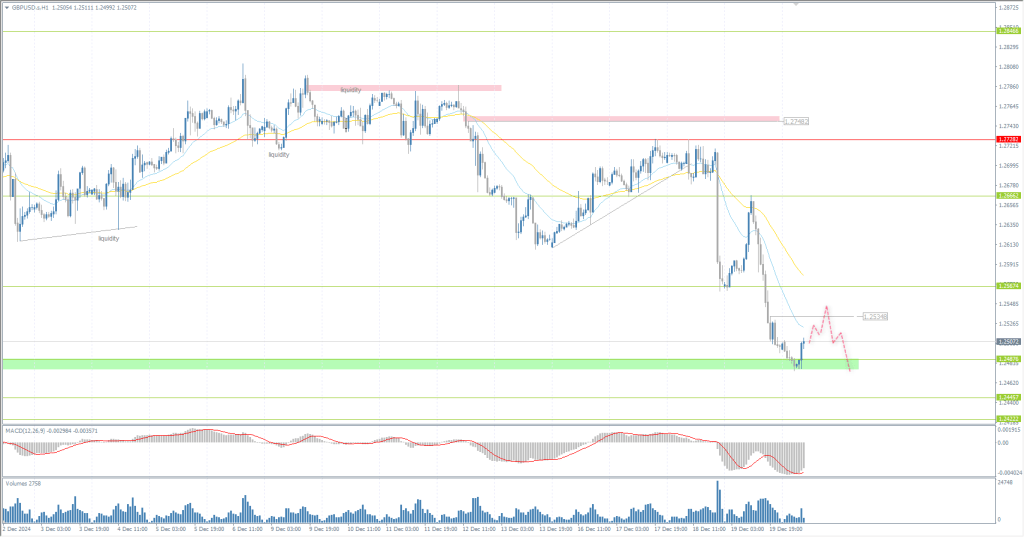

The GBP/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.2498

- 폐장 전: 1.2569

- 전날 대비 # % 변동: +0.56 %

British retailers returned to growth last month despite stores reporting the weakest sales in nearly three years. Economists said this was offset by a stronger month for supermarkets in the run-up to Christmas. Retail sales, which measure the amount of goods bought, rose by 0.2% in November (projection 0.5%) after falling 0.7% in October. However, it was enough to support the pound’s growth on Friday amid temporary weakness in the Dollar Index.

거래 권고

- 지원 레벨: 1.2537, 1.2487, 1.2446

- 저항 레벨: 1.2667, 1.2719, 1.2748, 1.2786, 1.2878

From the point of view of technical analysis, the trend on the GBP/USD currency pair is bearish. The British pound corrected sharply on Friday and consolidated above the moving averages and the level of 1.2560. Buyers also formed a support level of 1.2537 to support the price. With these market conditions, buying can be considered from 1.2537 but with confirmation in the form of initiative. If the price consolidates below 1.2537, a sell-off to 1.2487 is possible.

대체 시나리오:if the price breaks through the resistance level of 1.2667 and consolidates above it, the uptrend will likely resume.

@ 뉴스피드: 2024.12.23

- UK GDP (q/q) at 09:00 (GMT+2).

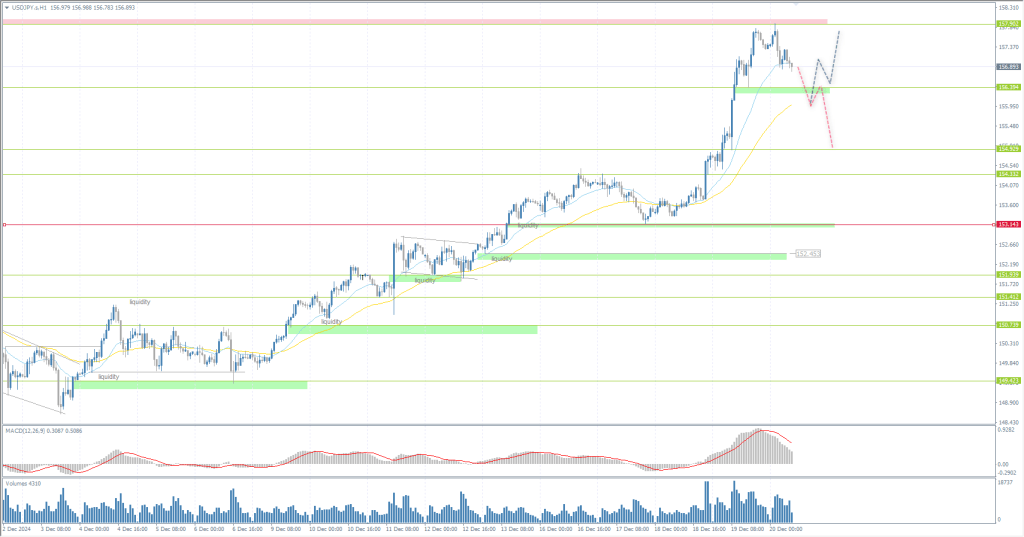

The USD/JPY currency pair

통화 쌍의 기술적 지표:

- 개장 전: 157.39

- 폐장 전: 156.44

- 전날 대비 # % 변동: -0.61 %

Although there was a slight recovery in the yen on Friday, supported by strong inflation data, the yen continued to decline on Monday as uncertainty remains over when the Bank of Japan will next raise interest rates. Last week, the Central Bank decided to leave rates unchanged, citing the need to assess wage dynamics, global economic uncertainty, and the policies of the incoming US administration.

거래 권고

- 지원 레벨: 156.39, 154.93, 154.34, 153.14, 152.45, 151.94, 151.41

- 저항 레벨: 157.90

From a technical point of view, the medium-term trend of the USD/JPY currency pair is bullish. On Friday, the price reached the resistance zone at 157.90, where the buyers started fixing the previously opened longs, which led to the price correction. The price has now corrected to 156.39, but after a liquidity test below, the price has consolidated above the level. Under such market conditions, intraday buying can be considered with a target up to the nearest supply zone.

대체 시나리오:if the price breaks and consolidates below the 153.14 support, the downtrend will likely resume.

오늘은 뉴스가 없습니다

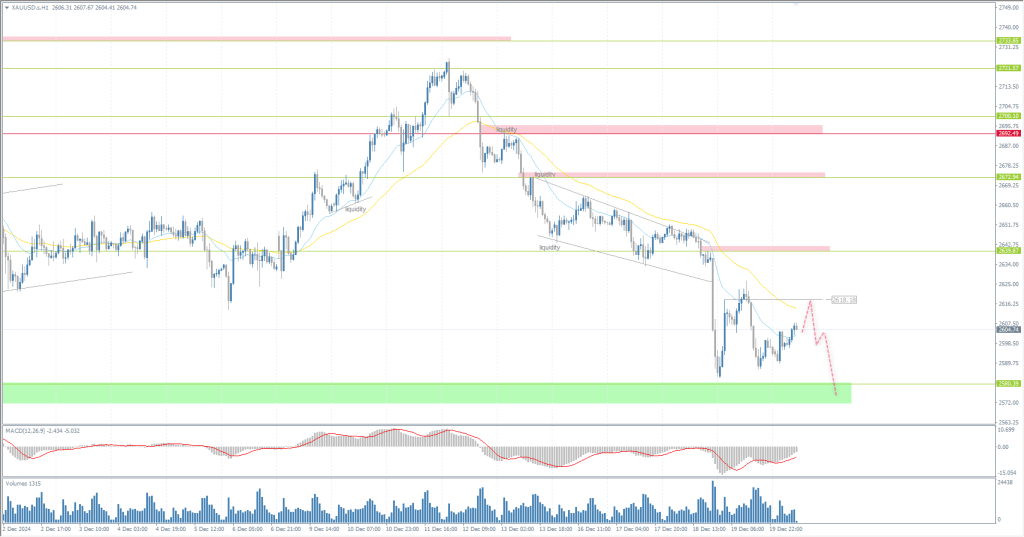

The XAU/USD currency pair (gold)

통화 쌍의 기술적 지표:

- 개장 전: 2597

- 폐장 전: 2623

- 전날 대비 # % 변동: +1.00 %

Gold traded near $2,620 per ounce on Monday, maintaining gains from the previous session, as the US dollar weakened following the release of a favorable PCE inflation report that revived hopes for further monetary easing by the Federal Reserve next year. Meanwhile, gold may face further near-term challenges from weakening physical demand in key consumer India, where government officials expect a sharp decline in gold imports in December.

거래 권고

- 지원 레벨: 2617, 2580, 2559, 2471

- 저항 레벨: 2640, 2673, 2693, 2700, 2721, 2733, 2749

From the point of view of technical analysis, the trend on the XAU/USD is bearish, but intraday, the buyers took the initiative. Currently, the price is trying to test the resistance level of 2640, where we can look for sell deals if sellers react. A breakout of 2640 on the impulse will open the way to 2673, but the probability of such a scenario in a low-volatility holiday week is low. Buying can also be considered from 2617 but with confirmation.

대체 시나리오:if the price breaks above the 2614 resistance level, the uptrend will likely resume.

@ 뉴스피드: 2024.12.23

- US CB Consumer Confidence (m/m) at 17:00 (GMT+2).

이 기사는 개인의 의견이므로 투자 조언 및/또는 제안, 금융 거래 수행에 대한 지속적 요청 및/또는 보증 및/또는 미래 예측으로 해석하시지 마시기 바랍니다.