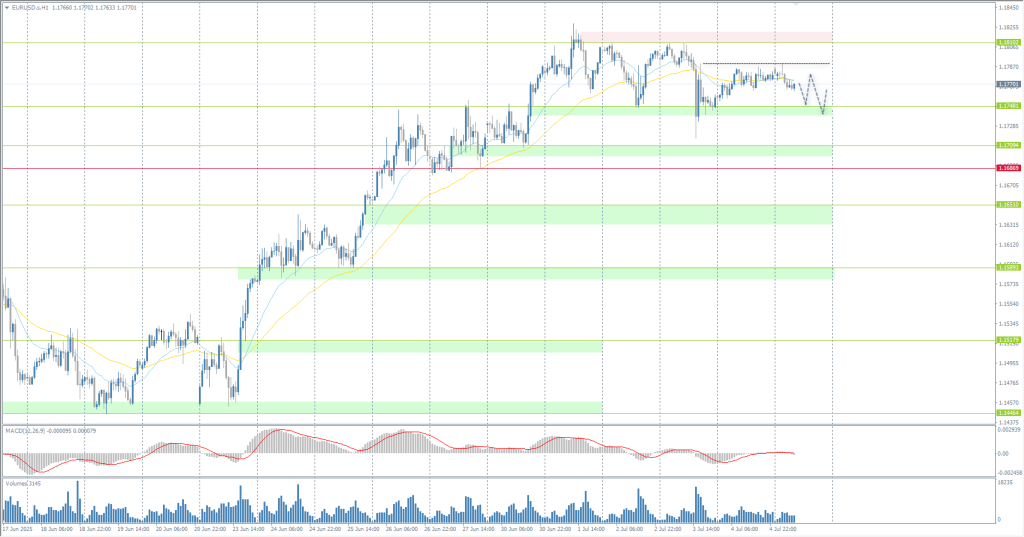

The EUR/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.1758

- 폐장 전: 1.1778

- 전날 대비 # % 변동: -0.17 %

The euro remained just below the $1.18 mark, close to its strongest level since August 2021, as investors turned their attention to trade events and new signals from ECB policymakers. US President Trump announced that Washington would begin sending official notifications to trading partners detailing tariff rates on exports to the US, signaling a departure from previous promises to conclude several bilateral deals before the July 9 deadline, when tariffs are set to rise. The EU has signaled its readiness to conclude a deal, but is also preparing for the possibility of no agreement. As for monetary policy, markets expect another ECB rate cut this year.

거래 권고

- 지원 레벨: 1.1748, 1.1709, 1.1666, 1.1642, 1.1581, 1.1518

- 저항 레벨: 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend is bullish. The euro is trading in the range of 1.1748 to 1.1810. As the intraday bias remains with the buyers, traders can look for buy deals intraday from the EMA lines or the 1.1748 level with a target of 1.1810. There are no optimal entry points for sell deals at this time.

대체 시나리오:if the price breaks through the support level of 1.1686 and consolidates below it, the downward trend is likely to resume.

@ 뉴스피드: 2025.07.07

Eurozone Producer Price Index (m/m) at 12:00 (GMT+3).

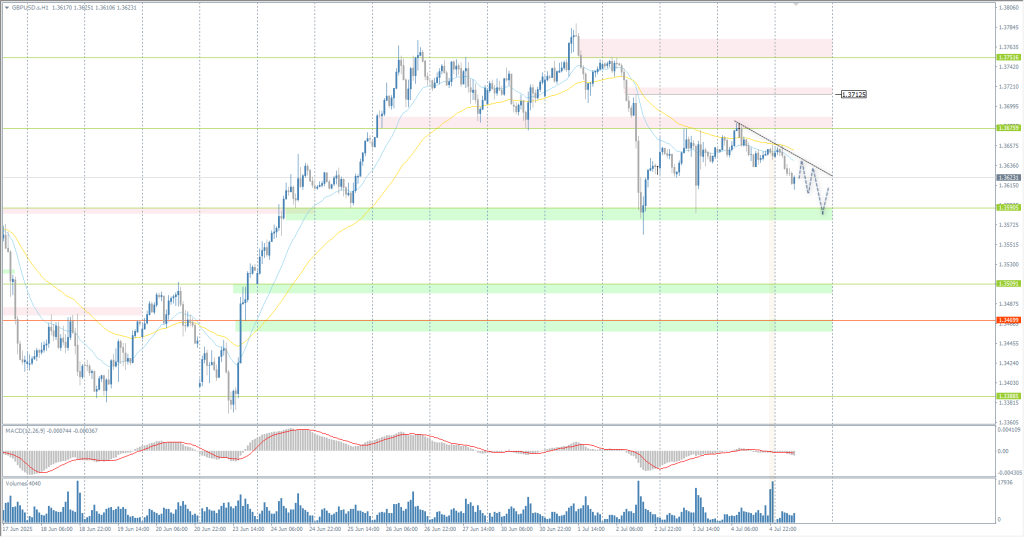

The GBP/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.3654

- 폐장 전: 1.3647

- 전날 대비 # % 변동: -0.07 %

On Monday, the US dollar index rose above 97 after President Donald Trump confirmed on Sunday that his retaliatory tariffs would take effect on August 1. Treasury Secretary Scott Bessent had previously stated that tariffs would return to April 2 levels for countries that had not reached a trade agreement with the US by that time, effectively giving trading partners more time to revise terms. At this point, only China, the UK, and Vietnam have reached an agreement with Washington in one form or another. Last week, the dollar fell to its lowest level in three years under pressure from growing tariff risks, mounting fiscal problems, and expectations of a deeper rate cut by the Federal Reserve.

거래 권고

- 지원 레벨: 1.3591, 1.3509, 1.3471, 1.3450, 1.3388

- 저항 레벨: 1.3675, 1.3712, 1.3752, 1.3770, 1.4000

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. The British pound, like the euro, is forming a flat accumulation. But unlike the euro, the intraday bias here is on the sellers’ side. Therefore, it is highly likely that the price will slide back to the support level of 1.3591, where it will be possible to look for buy trades, but with confirmation. There are no optimal entry points for selling at the moment, as there is little potential for movement.

대체 시나리오:if the price breaks through the support level of 1.3470 and consolidates below it, the downward trend will likely resume.

오늘은 뉴스가 없습니다

The USD/JPY currency pair

통화 쌍의 기술적 지표:

- 개장 전: 144.89

- 폐장 전: 144.49

- 전날 대비 # % 변동: -0.27 %

On Monday, the Japanese yen fell to 145 per dollar, wiping out the gains of the previous session, as disappointing wage data dampened expectations of further rate hikes by the Bank of Japan. Nominal wages rose by only 1% year-on-year in May, below market forecasts of 2.4% and marking the third consecutive month of slowing growth. Real wages, a key indicator of consumer purchasing power, fell 2.9%, the sharpest decline in nearly two years and the fifth consecutive monthly decline. The yen also came under additional pressure after Prime Minister Shigeru Ishiba said on Sunday that he would not make any “easy compromises” in trade negotiations with Washington, as Japan seeks to avoid US tariffs of up to 35% on its exports.

거래 권고

- 지원 레벨: 144.25, 143.33, 142.64

- 저항 레벨: 144.96, 145.95, 146.62, 148.28

From a technical perspective, the medium-term trend of the USD/JPY is bearish, but it is close to a potential reversal. The price has again reached the priority change level of 144.96, and the reaction of sellers is weak. A false breakdown and initiatives from sellers will open up opportunities for selling deals with a target of up to 144.25. A breakout and consolidation above 144.96 will open the way for the price to 145.95.

대체 시나리오:if the price breaks through the resistance level of 144.96 and consolidates above it, the uptrend is likely to resume.

오늘은 뉴스가 없습니다

The XAU/USD currency pair (gold)

통화 쌍의 기술적 지표:

- 개장 전: 3326

- 폐장 전: 3336

- 전날 대비 # % 변동: +0.30 %

On Monday, gold fell to $3,310 per ounce, reaching a weekly low, as demand for safe-haven gold declined after the US reported progress in concluding several trade deals and announced an extension of the tariff delay for some countries. The bearish tone is also supported by the fact that strong employment data last week weakened expectations of a July rate cut by the Federal Reserve. Concerns related to inflation and tariffs have further reduced the odds of Fed policy easing, with markets now pricing in only a two-quarter-point rate cut by the end of the year.

거래 권고

- 지원 레벨: 3327, 3301, 3274, 3246

- 저항 레벨: 3342, 3357, 3393, 3405, 3444, 3500

From the technical analysis perspective, the trend on the XAU/USD is downward. Sellers managed to defend their positions from the 3357 priority change level and formed a new resistance level at 3342. The price is now seeking to test liquidity below 3301. If buyers react here, it will open up opportunities for intraday purchases. There are currently no optimal entry points for sales, despite the intraday bias on the bearish side.

대체 시나리오:if the price breaks through and consolidates above the resistance level of 3357, the upward trend will likely resume.

오늘은 뉴스가 없습니다

이 기사는 개인의 의견이므로 투자 조언 및/또는 제안, 금융 거래 수행에 대한 지속적 요청 및/또는 보증 및/또는 미래 예측으로 해석하시지 마시기 바랍니다.