The EUR/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.1672

- 폐장 전: 1.1664

- 전날 대비 # % 변동: -0.07 %

On Monday, the euro fell to $1.165, reaching its lowest level in more than two weeks after US President Trump announced the introduction of 30% tariffs on imports from the European Union and Mexico from August 1. This move heightened tensions in global trade and put pressure on the single currency. EU and Mexican officials said they plan to continue talks with the Trump administration this month in an attempt to secure a tariff reduction. European Commission President Ursula von der Leyen also said on Sunday that the EU would postpone retaliatory tariffs that were due to take effect today.

거래 권고

- 지원 레벨: 1.1686, 1.1651, 1.1642, 1.1581, 1.1518

- 저항 레벨: 1.1714, 1.1762, 1.1810, 1.1913

The EUR/USD currency pair’s hourly trend is bullish, but close to a change. The price is close to the priority change level. However, buyers took the initiative yesterday, and the price rose to the upper limit of the narrowing triangle. A consolidation below 1.1686 will open the way for the price to 1.1589. If buyers manage to break above the downward trend line, we can expect growth to 1.1714 and above.

대체 시나리오:if the price breaks through the support level of 1.1668 and consolidates below it, the downward trend will likely resume.

@ 뉴스피드: 2025.07.15

- German ZEW Economic Sentiment (m/m) at 12:00 (GMT+3);

- Eurozone ZEW Economic Sentiment (m/m) at 12:00 (GMT+3);

- Eurozone Industrial Production (m/m) at 12:00 (GMT+3);

- US Consumer Price Index (m/m) at 15:30 (GMT+3);

The GBP/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.3493

- 폐장 전: 1.3427

- 전날 대비 # % 변동: -0.49 %

The British pound is trading at its lowest level in three weeks, as Bank of England Governor Andrew Bailey suggested that the Central Bank could cut interest rates more aggressively if labor market conditions deteriorate further. He noted that economic growth is below potential, creating slack that should help cool inflation, and confirmed that interest rates are on a downward path, although the reduction could be accelerated if economic weakness intensifies. Markets are now focused on upcoming labor and inflation data to be released by the ONS this week.

거래 권고

- 지원 레벨: 1.3410, 1.3388

- 저항 레벨: 1.3471, 1.3532, 1.3619, 1.3680, 1.3712, 1.3752, 1.3770, 1.4000

In terms of technical analysis, the trend on the currency pair GBP/USD is bearish. The British pound has reached a support zone near 1.3410, where some open positions may be closed. If the price reacts, buy deals from 1.3410 with a target of 1.3471 can be considered. Buying is also relevant after consolidation above 1.3471 with a target of 1.3532. There are currently no optimal entry points for sell deals.

대체 시나리오:if the price breaks through the resistance level of 1.3680 and consolidates above it, the uptrend will likely resume.

@ 뉴스피드: 2025.07.15

There is no news feed for today.

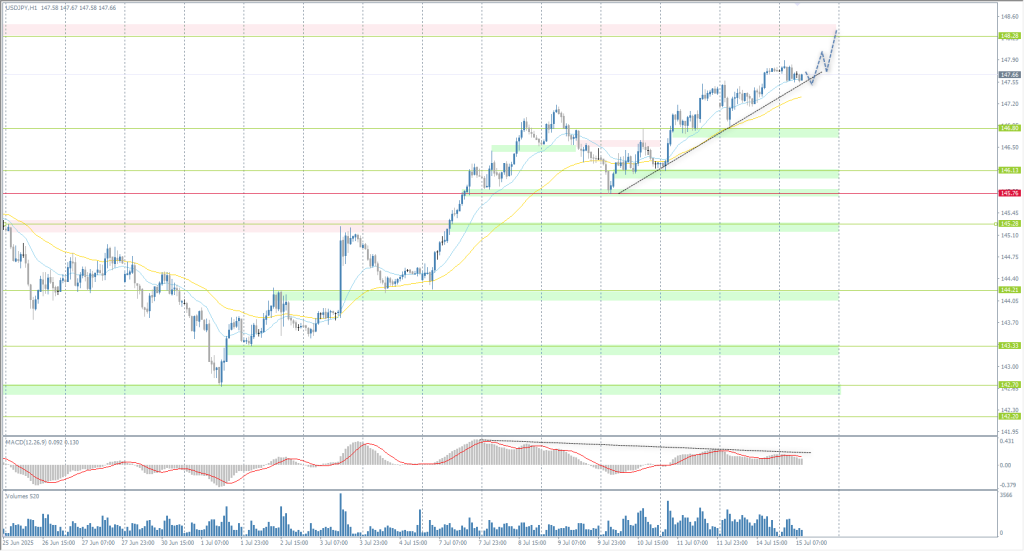

The USD/JPY currency pair

통화 쌍의 기술적 지표:

- 개장 전: 147.21

- 폐장 전: 147.72

- 전날 대비 # % 변동: +0.34 %

On Tuesday, the Japanese yen fluctuated around 147.6 per dollar, close to its lowest level in two months, as ongoing trade tensions weighed on sentiment. Despite Washington’s plans to impose 25% tariffs on Japanese exports, Tokyo has not announced any intention to retaliate. However, trade negotiations between the two countries appear to have reached an impasse. One Japanese official warned that if tariffs are imposed, the country should prepare for potential economic consequences. Investors are currently focused on upcoming trade and inflation data from Japan, which may shed light on the domestic impact of US tariff threats.

거래 권고

- 지원 레벨: 146.80, 146.13, 145.88, 145.28, 144.18

- 저항 레벨: 148.28

From a technical point of view, the medium-term trend of the USD/JPY is bullish. The situation has not changed significantly. The Japanese yen continues to depreciate against the dollar. Currently, the price is heading towards the liquidity zone above 148.28. For buy deals, you can consider the EMA lines or the support level of 146.80. However, traders need to be cautious, as the divergence on the MACD is a harbinger of a corrective movement.

대체 시나리오:if the price breaks through the support level of 145.76 and consolidates below it, the downward trend will likely resume.

@ 뉴스피드: 2025.07.15

There is no news feed for today.

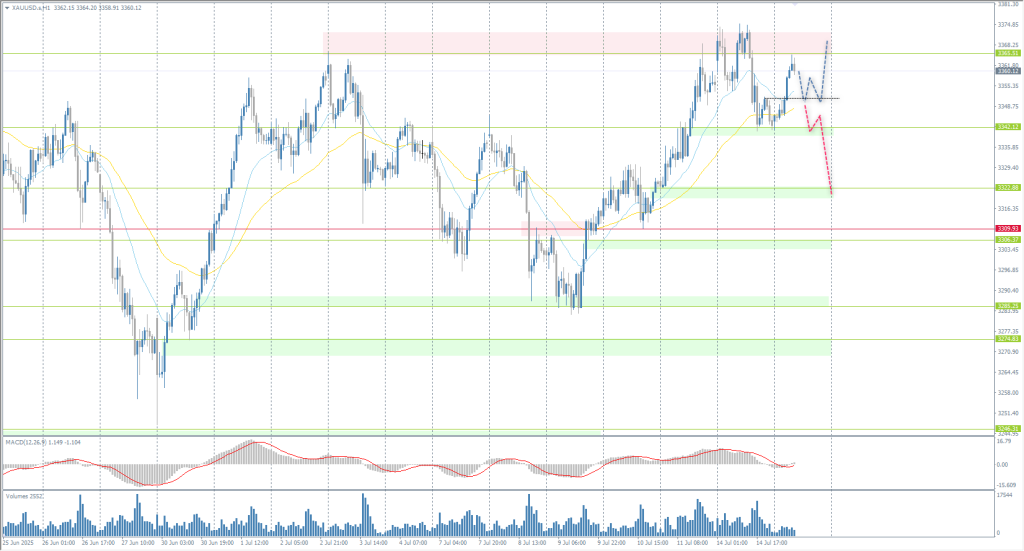

The XAU/USD currency pair (gold)

통화 쌍의 기술적 지표:

- 개장 전: 3363

- 폐장 전: 3343

- 전날 대비 # % 변동: -0.60 %

Gold prices traded unchanged at around $3360 per ounce on Monday as ongoing trade uncertainty continues to weigh on market sentiment. US President Trump announced new 30% tariffs on imports from the European Union and Mexico, which will take effect on August 1. This move follows last week’s broader tariff package targeting more than 20 countries, including Japan, South Korea, Canada, and Brazil, and includes high 50% duties on copper imports. Although some investors believe these tariffs may be softened during negotiations, ongoing trade tensions are adding to overall market volatility.

거래 권고

- 지원 레벨: 3345, 3322, 3309

- 저항 레벨: 3365, 3393, 3405, 3444, 3500

From the point of view of technical analysis, the trend on the XAU/USD is bullish. The price is currently trading near the resistance level of 3365, where sellers previously took the initiative. Here, you can consider countertrend sales, but with a short stop loss and a nearby target. For buy deals, it is best to wait for the price to consolidate above 3365.

대체 시나리오:if the price breaks through the support level of 3322 and consolidates below it, the downtrend will likely resume.

@ 뉴스피드: 2025.07.15

- US Consumer Price Index (m/m) at 15:30 (GMT+3);

이 기사는 개인의 의견이므로 투자 조언 및/또는 제안, 금융 거래 수행에 대한 지속적 요청 및/또는 보증 및/또는 미래 예측으로 해석하시지 마시기 바랍니다.