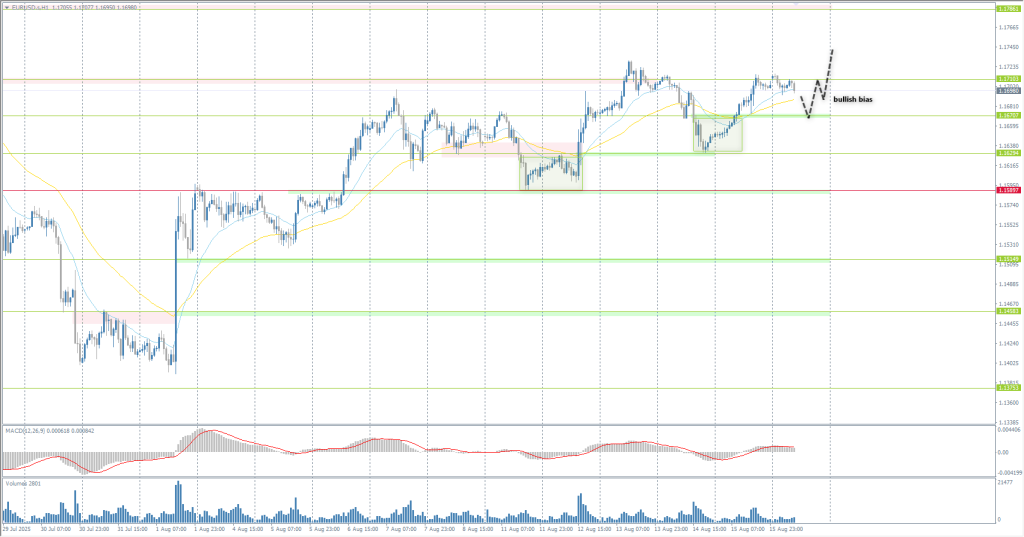

The EUR/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.1648

- 폐장 전: 1.1704

- 전날 대비 # % 변동: +0.48 %

In the US, expectations of an imminent Fed rate cut have intensified, especially after weak wage data and a lower ISM services PMI Index. Meanwhile, the ECB ended its current easing cycle in July after eight cuts over the past year, bringing borrowing costs to their lowest level since November 2022. However, some market participants believe that another ECB rate cut is possible before the end of the year. Such a monetary policy differential will support the euro against the dollar in the medium term.

거래 권고

- 지원 레벨: 1.1670, 1.1629, 1.1589, 1.1528, 1.1485, 1.1375, 1.1313

- 저항 레벨: 1.1710, 1.1770

The EUR/USD currency pair’s hourly trend is bullish. The euro has consolidated above 1.1670, forming another locked balance below the level. It is important for buyers not to let the price cancel this balance, i.e., fall below 1.1670. Intraday, you can look for buys from the EMA lines or from the 1.1670 support level. There are no optimal entry points for sell deals at the moment.

대체 시나리오:if the price breaks the support level of 1.1590 and consolidates below it, the downtrend will likely resume.

@ 뉴스피드: 2025.08.18

- Eurozone Trade Balance (m/m) at 12:00 (GMT+3).

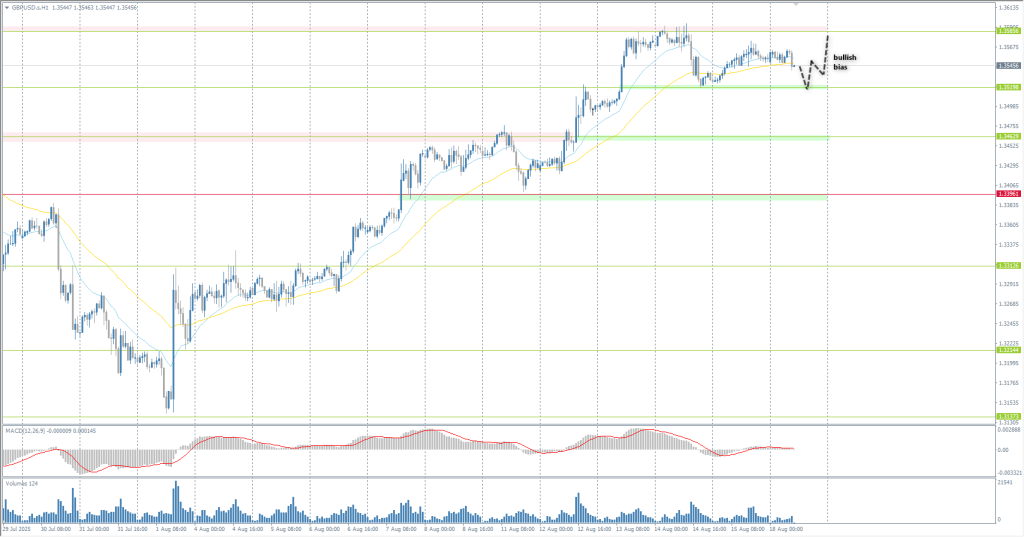

The GBP/USD currency pair

통화 쌍의 기술적 지표:

- 개장 전: 1.3529

- 폐장 전: 1.3554

- 전날 대비 # % 변동: +0.18 %

The British pound sterling received support last week thanks to the Bank of England’s decision at the beginning of the month to cut interest rates, which was perceived as “hawkish.” As a result of the vote, the base rate was lowered, but inflation projections for the near future were raised, and Bank Governor Bailey announced even more cautious expectations. This was followed in recent days by stronger-than-expected second-quarter GDP, driven by an increase in government spending (up 1.2% for the quarter after a 0.4% decline in the first quarter) and an employment report that was largely better than expected. The year-end rate implied by the swap market is around 3.82%, compared to 3.68% on August 1. This week, inflation data, PMI estimates, and retail sales data are expected to be released.

거래 권고

- 지원 레벨: 1.3520, 1.3462, 1.3396, 1.3313, 1.3214, 1.3137

- 저항 레벨: 1.3586

In terms of technical analysis, the trend on the currency pair GBP/USD is bullish. The British pound is forming a flat accumulation with boundaries of 1.3520–1.3586. The bias remains with buyers, so intraday trades can be considered from 1.3520, but with confirmation. There are currently no optimal entry points for selling.

대체 시나리오:if the price breaks through the support level of 1.3392 and consolidates below it, the downward trend will likely resume.

오늘은 뉴스가 없습니다

The USD/JPY currency pair

통화 쌍의 기술적 지표:

- 개장 전: 147.73

- 폐장 전: 147.17

- 전날 대비 # % 변동: -0.38 %

On Monday, the yen fell to 147.5 per dollar as the dollar rose ahead of a key meeting in Washington between US President Donald Trump and Ukrainian President Volodymyr Zelenskyy aimed at promoting a peace agreement with Russia. Investors are also awaiting the Federal Reserve’s annual symposium in Jackson Hole this week for signals on the outlook for global interest rates. In Japan, data released on Friday showed that the country’s economy grew more than expected in the second quarter, mainly due to net exports, despite pressure from US tariffs. Meanwhile, Japanese officials downplayed comments by US Treasury Secretary Scott Bessent, who said the Bank of Japan was “behind the curve” on policy, in what appeared to be an attempt to pressure the Central Bank to raise rates.

거래 권고

- 지원 레벨: 146.74, 146.35

- 저항 레벨: 147.86, 148.52, 149.18, 150.34

From a technical point of view, the medium-term trend of the USD/JPY is bearish. Currently, the price is stuck in a corridor with boundaries of 146.75–147.54. Given the bearish bias within the day, sales from 146.75 can be considered, as it is very important for sellers to keep this level intact. There are currently no optimal entry points for buy deals.

대체 시나리오:if the price breaks through the resistance level of 148.53 and consolidates above it, the uptrend will likely resume.

오늘은 뉴스가 없습니다

The XAU/USD currency pair (gold)

통화 쌍의 기술적 지표:

- 개장 전: 3337

- 폐장 전: 3335

- 전날 대비 # % 변동: -0.06 %

Gold prices rose to $3,340 per ounce on Monday after hitting a more than two-week low at the start of the session, as investors await a meeting between US President Donald Trump and Ukrainian President Volodymyr Zelenskyy aimed at discussing a peace agreement with Russia. Key European leaders will join Zelenskyy when he meets with Trump today. This comes after a long-awaited summit between Trump and Russian President Vladimir Putin last Friday, which did not result in a breakthrough on a ceasefire, although Putin agreed to allow the US and Europe to provide Ukraine with reliable security guarantees as part of a final deal to end the war.

거래 권고

- 지원 레벨: 3333, 3311, 3281

- 저항 레벨: 3358, 3374, 3402, 3433

From the point of view of technical analysis, the trend on the XAU/USD is bullish. On Friday, gold tested liquidity below 3333, where buyers showed a sharp initiative, forming a locked balance below this level. The price has now reached the resistance level of 3358, but the reaction of sellers here is weak. Intraday, it is worth focusing on buying from the EMA lines, but it is possible that the price will fluctuate until a decision is made on a peace deal for Ukraine.

대체 시나리오:if the price breaks the support level of 3281 and consolidates below it, the downtrend will likely resume.

오늘은 뉴스가 없습니다

이 기사는 개인의 의견이므로 투자 조언 및/또는 제안, 금융 거래 수행에 대한 지속적 요청 및/또는 보증 및/또는 미래 예측으로 해석하시지 마시기 바랍니다.